Summary

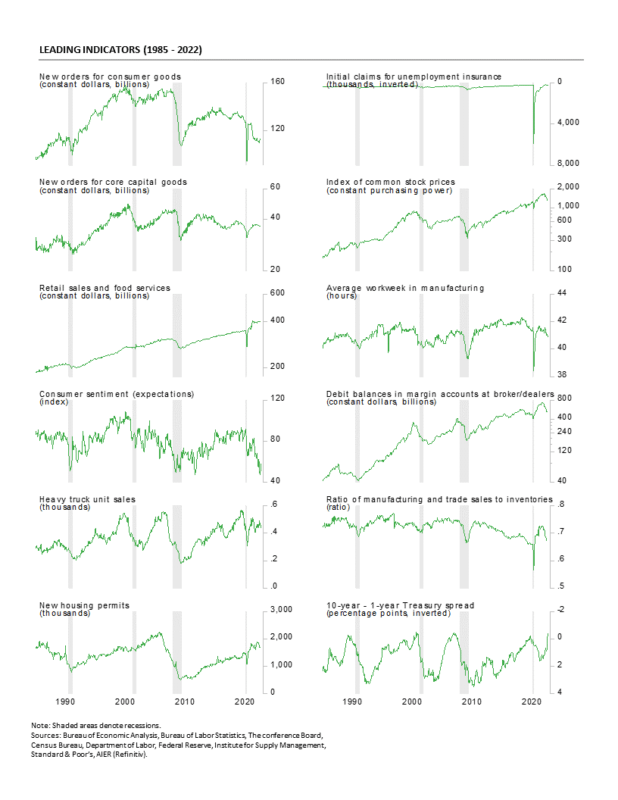

AIER’s Leading Indicators Index held at a cycle low of 29 in August, matching the lowest level since August 2020. The latest result remains well below the neutral 50 threshold and is consistent with broadening weakness in the economy and significantly elevated risks for the outlook.

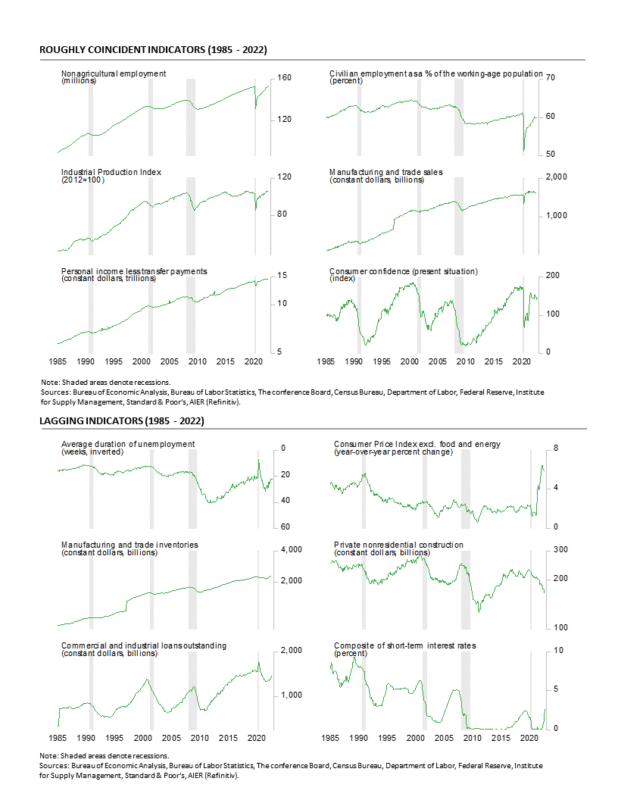

The Roughly Coincident Indicators Index and the Lagging Indicators Index remain solidly above neutral. The labor market and continued growth in broad measures of current economic activity are the key drivers for the Roughly Coincident Indicators Index. The historically tight labor market supports consumer attitudes, income, and spending creating a virtuous cycle for continued economic expansion.

Working against the virtuous cycle are persistently elevated rates of price increases and an aggressive Fed tightening cycle which weigh on consumer attitudes, increase uncertainty, and restrain growth in activity. The longer elevated rates of price increases continue and the extent to which the Fed continues an aggressive tightening cycle, the higher the probability that a vicious cycle of declining economic activity and softening labor market will begin to dominate the virtuous cycle. Overall, the outlook remains highly uncertain. Caution is warranted.

AIER Leading Indicators Index Holds at 29 in August, Signaling Major Risks

The AIER Leading Indicators index held at a cycle low of 29 in the latest update. The August result is down 63 points from the March 2021 high of 92 and matches the lowest level since August 2020 during the recovery from the lockdown recession. In recent business cycles, the Leading Indicators Index has fallen into the twenties-range five times since 1985. In four of those instances, a recession followed within about 12 months. The exception was in 1995, when no recession was declared but real GDP growth slowed significantly. With the latest reading holding well below the neutral 50 threshold, the AIER Leading Indicators Index is signaling broadening economic weakness and significantly elevated outlook risks.

Though the overall index was unchanged for the month, three leading indicators had offsetting changes in August. The initial claims for unemployment insurance indicator changed from a favorable trend to a neutral trend. As noted in previous reports, weekly initial claims had begun a rising (unfavorable) trend in mid-March. Though the last several weeks appear to be leveling off, a change from the favorable trend to a neutral trend was expected. Overall, initial claims remain very low by historical measures. If the overall level of claims continues to be rangebound, the contribution to the composite Leading Indicators Index is likely to remain neutral. A resumption of an upward trend in initial claims will likely turn the indicator to an unfavorable contributor to the Leading Indicators Index.

The total heavy truck unit sales indicator also weakened from a favorable trend to a neutral trend in August. This indicator had been a positive contributor since April. Heavy truck unit sales remain relatively high by historical comparison though they are down from prior peaks. Furthermore, trucking remains a critical component of supply chain logistics supporting goods and services production as well as the delivery of final goods.

Offsetting the weakening in the initial claims for unemployment indicator and the unit heavy truck sales indicator was an improvement in the real new orders for consumer goods indicator, improving from a negative trend to a positive trend. This indicator had been neutral or negative since April 2021, a run of sixteen consecutive months. With the real retail sales and food services indicator currently in a neutral trend, it’s questionable whether the real new orders for consumer goods indicator can continue on a favorable trend.

Among the 12 leading indicators, just two remained in a positive trend in August while seven were trending lower and three were trending flat or neutral.

The Roughly Coincident Indicators index held steady in August, coming in at 67 for the second consecutive month. Prior to July, the indicator posted a 75 in June, 83 in May, and a perfect 100 in April. None of the individual indicators changed signal in August.

In total, four roughly coincident indicators – nonfarm payrolls, employment-to-population ratio, industrial production, and real personal income excluding transfers were trending higher in August while two – the real manufacturing and trade sales indicator and the Conference Board Consumer Confidence in the Present Situation indicator – were in negative trends; none were in a flat or neutral trend. Given the weakening in the AIER Leading Indicators Index, it would not be surprising to see further declines in the Roughly Coincident Index in the coming months.

AIER’s Lagging Indicators index was unchanged for the seventh consecutive month, holding at 83 in August. No individual indicators changed trend for the month. In total, five indicators – duration of unemployment, real manufacturing and trade inventories, commercial and industrial loans, composite short-term interest rates, and the 12-month change in the core Consumer Price Index – were in favorable trends, one indicator, real private nonresidential construction, had an unfavorable trend, and none had a neutral trend.

Overall, the AIER Leading Indicators Index remains well below neutral, signaling broadening economic weakness and sharply elevated levels of risk for the outlook. The virtuous cycle of a tight labor market supporting personal income and consumer spending is facing significant headwinds from elevated rates of price increases and an aggressive Fed tightening cycle. Furthermore, the fallout from the Russian invasion of Ukraine and periodic lockdowns in China continue to disrupt global supply chains. Caution is warranted.

Unemployment Rate Jumps and Job Gains Slow in August

U.S. nonfarm payrolls added 315,000 jobs in August, substantially less than the 526,000 gain in July. The July estimate was revised down by 2,000 from the original estimate of 528,000. June payroll growth was also revised down, now estimated to have increased by 293,000, 105,000 less than the previous estimate of 398,000.

Private payrolls posted a 308,000 gain in August, less than the 477,000 gain in July (revised up by 6,000 from 471,000 while June was revised down by 58,000 to 346,000). August was the smallest gain since April 2021.

Gains in August were broad-based, though smaller than recent prior months. Within the 308,000 gain in private payrolls, private services added 263,000 versus a 3-month average of 325,700 while goods-producing industries added 45,000 versus a 3-month average of 51,300.

Within private service-producing industries, education and health services increased by 68,000 (versus a 93,300 three-month average), business and professional services added 68,000 (versus 80,700), retail employment rose by 44,000 (versus 31,800), leisure and hospitality added 31,000 (versus 56,300), wholesale trade gained 15,100 (versus 13,400), information services gained 7,000 (versus 16,300), and transportation and warehousing added 4,800 jobs (versus an average 15,100).

Within the 45,000 gain in goods-producing industries, durable-goods manufacturing increased by 19,000, construction added 16,000, mining and logging industries increased by 7,000, and nondurable-goods manufacturing added 3,000.

While a few of the services industries dominate actual monthly private payroll gains, monthly percent changes paint a different picture. Mining and logging industries have recently posted strong monthly percentage gains.

Average hourly earnings for all private workers rose 0.3 percent in August, the smallest increase since February. That puts the 12-month gain at 5.2 percent, about steady since October 2021. Average hourly earnings for private, production and nonsupervisory workers rose 0.4 percent for the month and are up 6.1 percent from a year ago, also about in line with results over the last eleven months.

The average workweek for all workers fell to 34.5 hours in August versus 34.6 in July while the average workweek for production and nonsupervisory dropped to 33.9 hours from 34.0 hours in July.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls for all workers gained 0.3 percent in August and is up 9.4 percent from a year ago; the index for production and nonsupervisory workers rose 0.3 percent and is 9.9 percent above the year ago level.

The total number of officially unemployed was 6.014 million in August, a jump of 344,000. The unemployment rate rose a sharp 0.2 percentage points to 3.7 percent from 3.5 percent in July while the underemployed rate, referred to as the U-6 rate, increased by 0.3 percentage points to 7.0 percent in August.

The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 60.1 percent for August, up 0.1 percentage points but still significantly below the 61.2 percent in February 2020.

The labor force participation rate jumped by 0.3 percentage points in August, to 62.4 percent. This important measure has been trending lower in recent months after hitting a pandemic high of 62.4 in March 2022. Despite the August gain, it is still well below the 63.4 percent of February 2020.

The total labor force came in at 164.746 million, up 786,000 from the prior month and the first month above the February 2020 level. If the 63.4 percent participation rate were applied to the current working-age population of 264.184 million, an additional 2.75 million workers would be available.

The August jobs report shows total nonfarm and private payrolls posted slower gains compared to July. There was also a jump in labor force participation contributing to a sharp rise in unemployment. Continued gains in employment are a positive sign though the gains may be slowing. At the same time, more people joined the labor force. If both of these trends continue, wage gains will likely slow.

Consumer Confidence Improved in August, but Risks Remain

The Consumer Confidence Index from The Conference Board rose in August, the first increase following three consecutive monthly declines. The composite index increased by 7.9 points, or 8.3 percent, to 103.2. From a year ago, the index is still down 10.4 percent. Both components gained in August.

The expectations component added 9.5 points, or 14.5 percent, to 75.1 while the present-situation component – one of AIER’s Roughly Coincident Indicators – rose 5.7 points to 145.4. The present situation index is down 2.4 percent over the past year while the expectations index is down 19.1 percent from a year ago. The present situation index remains consistent with economic expansion while the expectations index remains consistent with prior recessions.

Within the expectations index, all three components improved versus July. The index for expectations for higher income gained 0.5 points to 15.8 while the index for expectations for lower income fell 1.0 points, leaving the net (expected higher income – expected lower income) up 1.5 points to 1.3.

The index for expectations for better business conditions rose 3.8 points to 17.5 while the index for expected worse conditions fell 3.9 points, leaving the net (expected business conditions better – expected business conditions worse) up 7.7 points, but still at -4.8.

The outlook for the jobs market improved in August as the expectations for more jobs index increased 2.3 points to 17.4 while the expectations for fewer jobs index fell by 1.8 points to 19.3, putting the net up 4.1 points to -1.9.

Current business conditions improved for the present situation index components, but current employment conditions weakened. The net reading for current business conditions (current business conditions good – current business conditions bad) was -4.0 in August, up from -7.9 in July. Current views for the labor market saw the jobs hard to get index decrease, falling 1.0 point to 11.4 while the jobs plentiful index fell 1.2 points to a still-strong 48.0 resulting in a 0.2-point drop in the net to 36.6.

Inflation expectations eased down to 7.0 percent in August from 7.4 percent in July; expectations were 4.4 percent in January 2020. The sharp rise in expected inflation from The Conference Board survey is consistent with the University of Michigan survey results, though the magnitudes differ. Inflation expectations remain extremely high as prices for many goods and services continue to rise at an elevated pace. The extreme outlook for inflation is a key driver of weaker consumer expectations.

Consumer Sentiment Improved in August but Remains Low

The final August results from the University of Michigan Surveys of Consumers show overall consumer sentiment improved versus the prior month but remains very low by historical comparison. The composite consumer sentiment increased to 58.2 in August, up from 51.5 in July and the record low of 50.0 in June. The increase in August totaled 6.7 points or 13.0 percent. However, the index remains consistent with prior recession levels.

The current-economic-conditions index rose slightly to 58.6 versus 58.1 in July. That is a 0.5-point or 0.9 percent increase for the month. This component is modestly above the record low and remains consistent with prior recessions.

The second component — consumer expectations, one of the AIER leading indicators — gained 10.7 points or 22.6 percent for the month, rising to 58.0. Despite the gain, this component index is also consistent with prior recession levels.

According to the report, “Most of this increase was concentrated in expectations, with a 59% surge in the year-ahead outlook for the economy following two months at its lowest reading since the Great Recession. In addition, personal financial expectations rose 12% since July. The gains in sentiment were seen across age, education, income, region, and political affiliation and can be attributed to the recent deceleration in inflation. Lower-income consumers, who have fewer resources to buffer against inflation, posted particularly large gains on all index components. Their sentiment now even exceeds that of higher-income consumers, when it typically lags higher-income sentiment by over 15 points. Hopefully, this tentative improvement will continue, as overall sentiment remains extremely low by historical standards.”

The one-year inflation expectations fell notably in August, dropping 0.4 percentage points to 4.8 percent. That is the third decline in the last four months since hitting back-to-back readings of 5.4 percent in March and April and the lowest reading since December 2021.

The five-year inflation expectations was unchanged at 2.9 percent in August. That result is well within the 25-year range of 2.2 percent to 3.5 percent.

The report states, “The relative relief felt by consumers reflected in their inflation expectations. The median expected year-ahead inflation rate was 4.8%, down from 5.2% last month and its lowest reading in 8 months.” However, the report adds, “Uncertainty over expectations rose considerably, particularly among lower-educated consumers.”

Nominal and Real Core Retail Sales Increase in July

Total nominal retail sales and food-services spending were unchanged in July following an 0.8 percent increase in June. From a year ago, retail sales are up 10.3 percent and remain well above the pre-pandemic trend.

Nominal retail sales excluding motor vehicle and parts dealers and gasoline stations – or core retail sales – rose 0.7 percent in July, matching the 0.7 percent gain in June. From July 2021 to July 2022, core retail sales are up 9.3 percent. As with total retail sales, core retail sales remain well above the pre-pandemic trend.

However, these data are not adjusted for price changes. In real terms (adjusted using the CPI), real total retail sales were roughly unchanged (up less than 0.1 percent) in July following a 0.5 percent decrease in June and a 0.6 percent decline in May. From a year ago, real total retail sales are up 1.4 percent. As with nominal retail sales, real retail sales remain well above its pre-pandemic trend but since March 2021, real retail sales have been trending essentially flat.

Real core retail sales posted a solid 0.4 percent rise in July after declining less than 0.1 percent in June. Over the last twelve months, real core retail sales are up 2.6 percent. While real total retail sales have been trending flat recently, real core retail sales have been trending slightly higher.

Categories were generally higher in nominal terms for the month, with nine up and four down in July. The gains were led by nonstore retailers, up 2.7 percent for the month, followed by building materials, gardening equipment and supplies (1.5 percent), and miscellaneous retailers (1.5 percent).

Gasoline spending led the decliners with a 1.8 percent drop. However, the average price for a gallon of gasoline was $4.77, down 7.4 percent from $5.15 in June, suggesting price changes more than accounted for the drop. Other declines came in motor vehicles and parts dealers (-1.6 percent), general merchandise retailers (-0.7 percent), and clothing and accessory stores (-0.6 percent).

Overall, nominal total and core retail sales remain well above trend. However, rising prices are still providing a significant boost to the numbers. In real terms, total retail sales were essentially unchanged and have been trending flat since March 2021. Real core retail sales posted a solid gain for the month and appear to have a modest upward trend.

Unit Auto Sales Remained Weak in August

Sales of light vehicles totaled 13.2 million at an annual rate in August, little changed from a 13.3 million pace in July. The August result was a 1.1 percent decrease from the prior month and the third decrease in the last six months. It was the fifteenth consecutive month below the 16 to 18 million range, averaging just 13.56 million over that period. Weak auto sales are largely a result of component shortages that have limited production, resulting in plunging inventory and surging prices.

Breaking down sales by the origin of assembly, sales of domestic vehicles decreased to 10.3 million units versus 10.7 million in July, a decline of 3.9 percent, while imports jumped to a 2.88 million rate, a rise of 10.3 percent. Domestic sales had generally been in the 13 million to 14 million range in the period before the pandemic, averaging 13.3 million for the six years through December 2019. The domestic share came in at 78.1 percent in August versus 80.4 in July.

Within the domestic light-vehicles category, domestic car sales were 1.99 million in August versus 2.05 million in July, a drop of 2.6 percent. Domestic light truck sales were 8.31 million versus 8.67 million in the prior month, a drop of 4.2 percent. That puts the domestic light truck share of total domestic auto sales at 80.6 percent.

Domestic assemblies jumped in July, coming in at 10.72 million at a seasonally adjusted annual rate. That is up 6.9 percent from 10.02 million in June and still slightly below the 10.8 million average pace for the three years through December 2019.

Component shortages, especially computer chips, continue to restrain production for most manufacturers, creating scarcity for many models and leading to lower inventory and higher prices. Ward’s estimate of unit auto inventory came in at 97,000 in July, up from 114,100 in June, and a new all-time low. The Bureau of Economic Analysis estimates that the inventory-to-sales ratio fell to 0.505 in July, down from 0.558 in June but above the February low of 0.368.

The low inventory levels continue to push prices higher, with the average consumer expenditure for a car coming in at $34,962 in July, up 0.8 percent from June to a new record high. The average consumer expenditure on a light truck rose to $50,320 from $50,143 in June, up 0.4 percent for the month and a new record high.

As a share of disposable personal income per capita, average consumer expenditures on a car came in at 62.47 percent versus 62.09 in June and up sharply from 51.8 percent in December 2019. The average consumer expenditure on a light truck as a share of disposable personal income per capita was 89.91 percent versus 89.75 percent in June and 78.78 percent in December 2019.