If you find it difficult to save money, then you’ll love the extra motivation that money saving charts will bring you. A recent survey found that 71% of women are stressed about their ability to save money for their goals outside of retirement.

Saving money isn’t always fun, but by tracking how much money you have saved, you might even start looking forward to setting aside extra cash in your savings account.

In this article we will cover:

- what money saving charts are and how they can help motivate you to save more money

- examples of what money saving journeys you can track

- links to money saving charts you will love

What are Money Savings Charts?

A money savings chart is simply a vision board for your savings goals. Vision boards have been scientifically proven to help you achieve your goals with a higher rate of success than people who don’t use them.

By posting the vision board so you can see it daily, it will help you want to hit the goal and mark off your progress along the way.

Examples of What to Track with a Money Savings Chart

The sky is the limit when it comes to tracking your goals with a money savings chart. Below are a few examples to help get you started.

Debt Payoff

One of the most popular things to track on a money savings chart is your debt payoff journey. You can track anything from your mortgage, car loan, credit card, personal loan, student loans, etc.

House Down Payment

Saving for a down payment on a house is a pivotal moment in a person’s life. You can make saving for it easier with a money savings chart.

Emergency Fund

An emergency fund is a crucial step on your journey to becoming debt free. Using a money savings chart to save up for your emergency fund will help you get there faster.

You can save up for your starter emergency fund or your 3-6 months emergency fund on your money saving charts.

Car Fund

You can use a money saving chart for a car fund. Whether you are saving up to buy a new car or pay off your current loan, this is a great way to stay motivated!

Vacation Fund

Whether you’re taking a short weekend trip or going for a weeklong trip to Disney, using one of your money saving charts to help you save for a vacation will help you feel motivated to save for it faster.

House Payoff

Paying off your house normally takes at least a few years. The money saving chart will help you stay motivated to do it faster and you’ll be able to see your progress along the way.

Wedding Savings

A wedding is a huge part of a couple’s life and can get expensive quickly. Using a money saving chart will help you save for it and avoid getting into debt.

Investments (401k, Roth IRA, etc.)

Saving up for your financial future is so important. The earlier you can start to invest in your future, the faster your money will grow. The money savings chart will help you reach your investment goals fast.

27 Money Savings Charts to Print Now

Enjoy these 27 charts that you can print from home today!

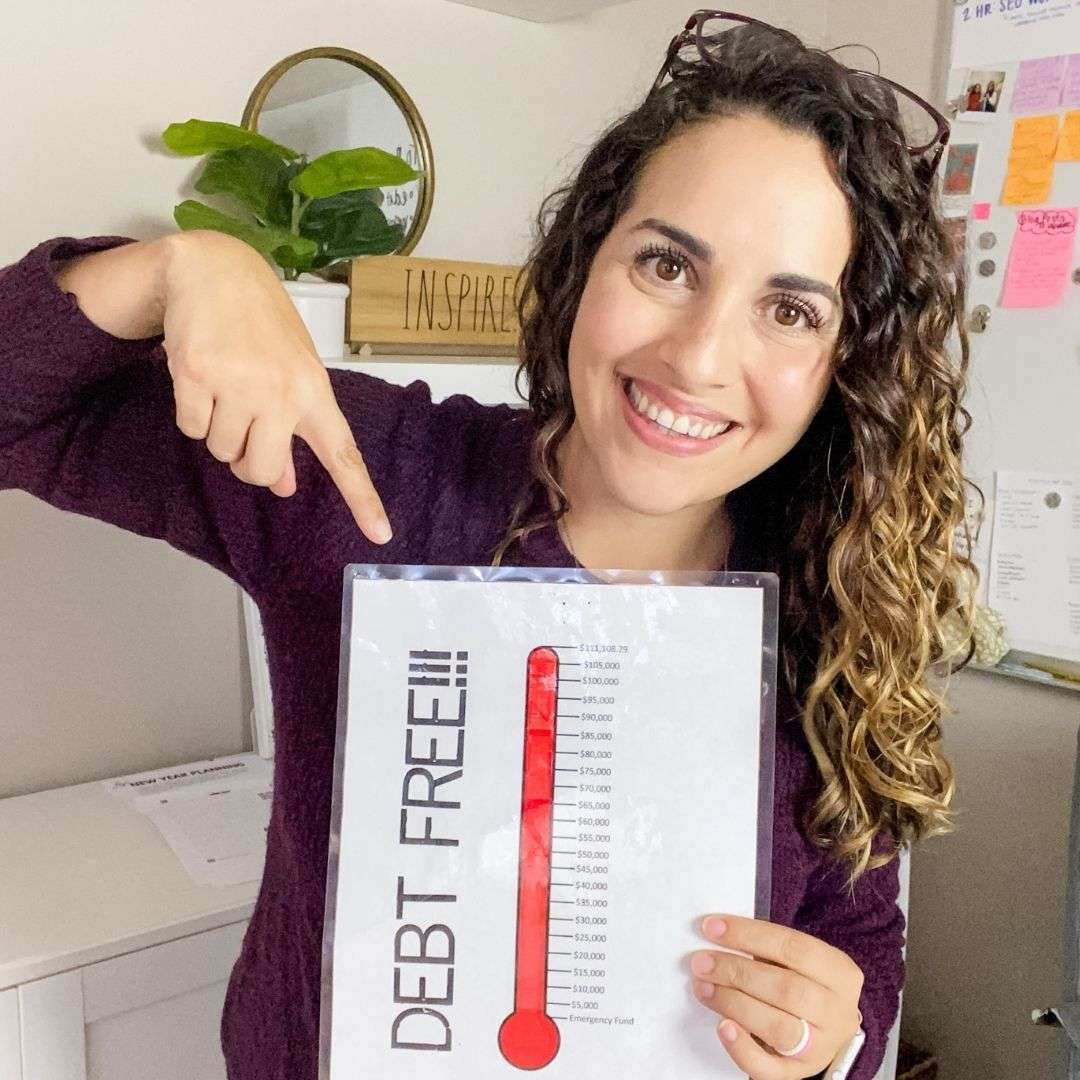

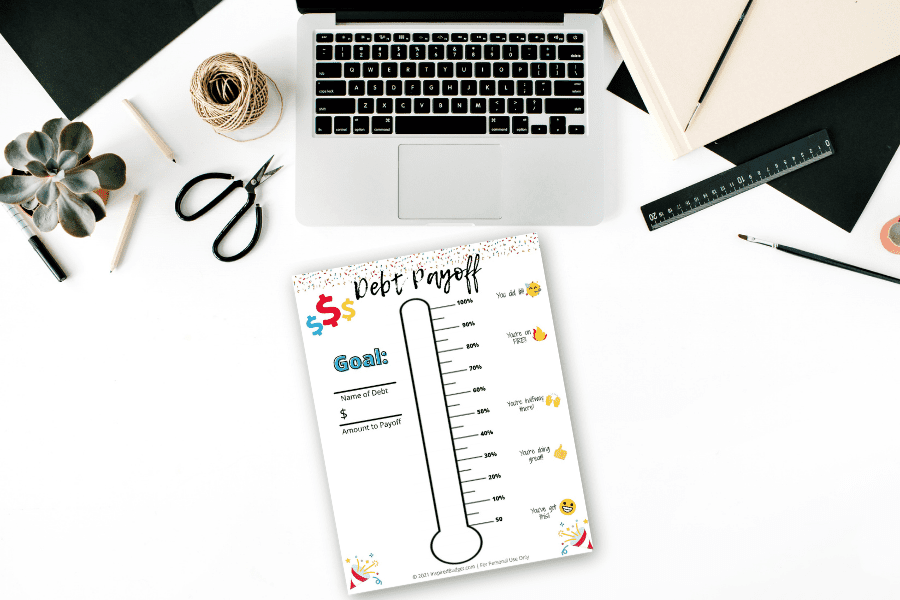

1. Debt Payoff Tracker

This super cute debt payoff tracker will help you set a goal to payoff debt and then crush the goal! You can use this tracker for any debt and any amount.

This chart is free and part of my Free Resource Library. You can grab your free copy when you sign up for the Budgeting Basics Email Course!

2. House Fund Tracker

This house fund tracker will help you meet all of your house savings goals. Get this page for free when you sign up for my Budgeting Basics Email Course.

Ideas to use the house fund tracker for:

- Paying off your house

- Creating a sinking fund for a remodel

- House down payment

- HOA dues

- Maintenance sinking fund

3. Car Fund Tracker

This cute car fund tracker will help you save for anything for your car. Get yours here.

You can use it to:

- Payoff your car loan

- Start a car maintenance sinking fund

- Save for a new car

4. Vacation Fund Tracker

This vacation fund tracker will help you save for anything from a weekend getaway to a splurge weeklong trip to Disney. Get yours for free here.

You can use it to:

- Save for a future vacation

- Payoff debt from a previous vacation

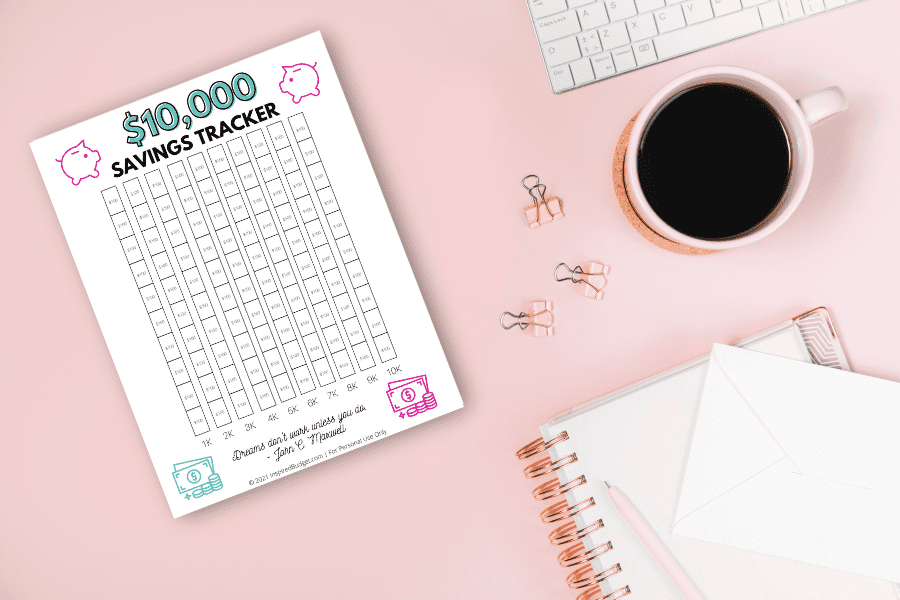

5. $10,000 Savings Fund Tracker

$10,000 is a big savings goal for a family to hit. You can use the money for your 3-6 months emergency fund (as long as it’s enough money) or any other $10,000 savings goal you have. Print yours today.

You can use it to:

- Pay for a wedding

- Pay for any $10,000 savings goal

- Save for college

- Set aside money for a big move

- Save for a new car

6. Student Loan Payoff

This student loan payoff tracker will help you payoff all of your student loans fast!

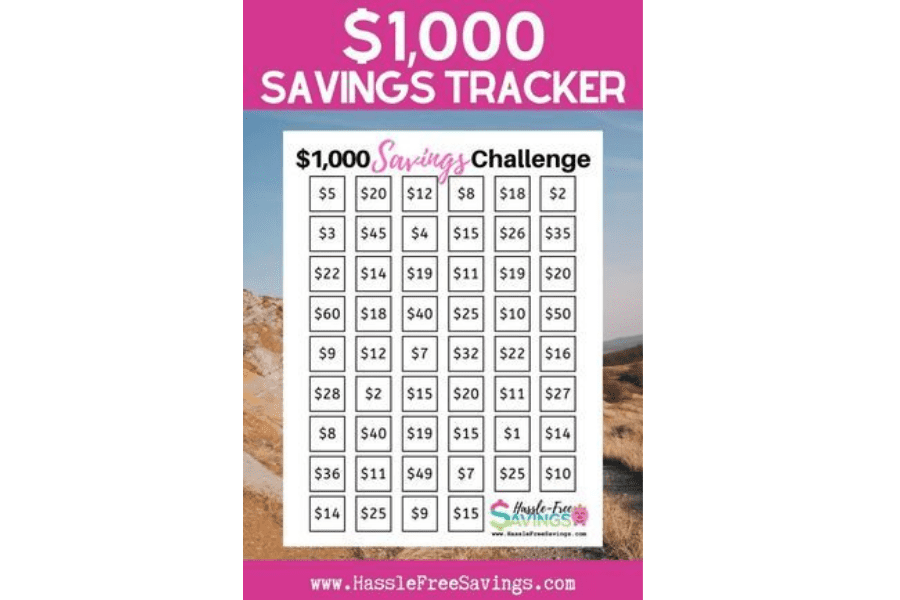

7. $1,000 Savings Fund Tracker

This cute $1,000 savings fund tracker will help you get started on your baby emergency fund or save for any $1,000 goal.

You can use it to:

- Save for a baby starter emergency fund

- New furniture

- Save for a mini weekend getaway

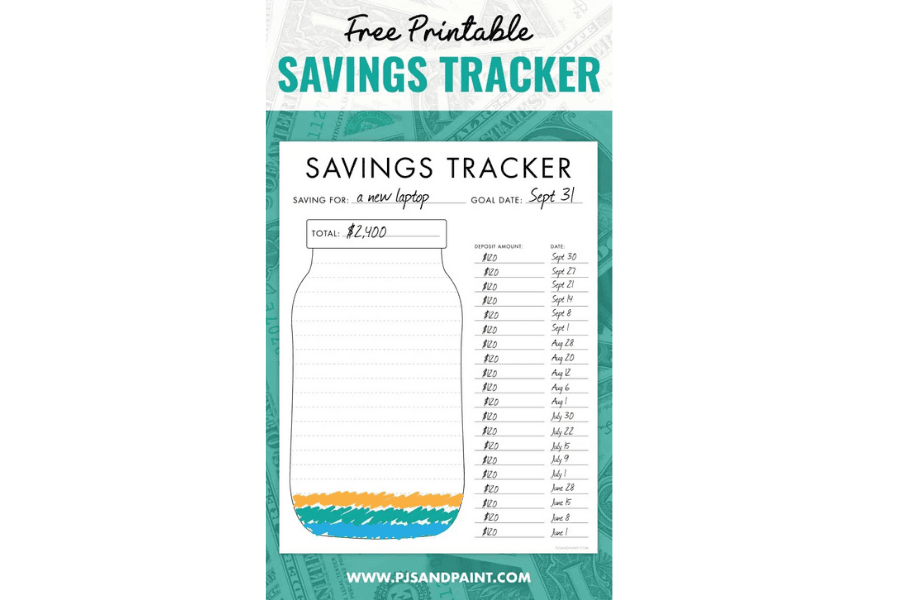

8. Savings Tracker

This customizable savings tracker will help you track all of your savings goals.

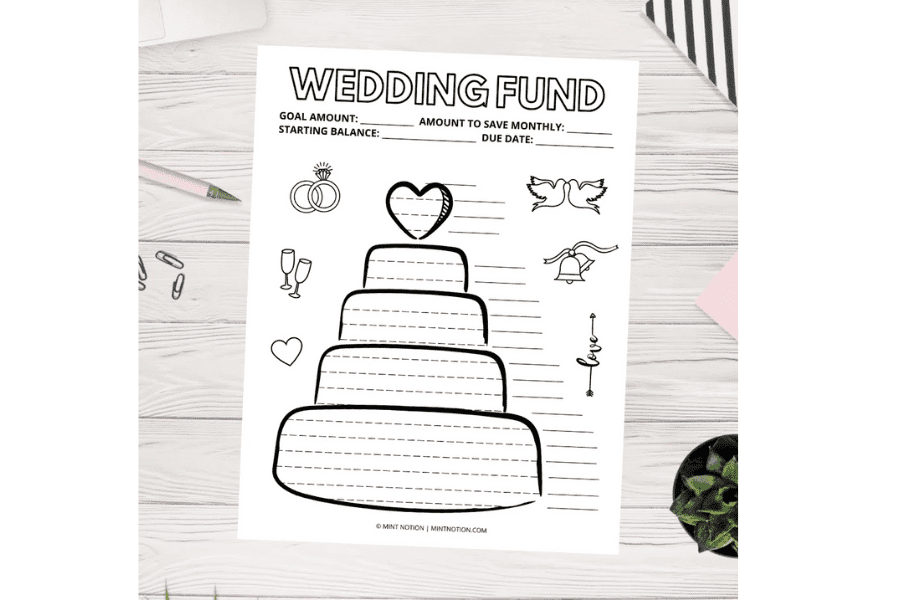

9. Wedding Fund Tracker

This super cute wedding fund tracker will help you save up for your wedding and avoid getting into debt.

10. $1,000 Money Saving Chart

This cute money saving chart will help you save up $1,000 fast.

11. Christmas Savings Printable

So many Americans go into debt each Christmas. This Christmas savings tracker will help you have an amazing debt-free Christmas.

12. Debt Free Charts

These super cute debt free charts will help you payoff any debt you have. She creates beautiful money saving charts for all goals!

13. No Spend Challenge Worksheets

These cute no spend challenge worksheets will help you focus on not spending unnecessary money so you can save more.

14. Disney Savings Printable

This super cute Disney savings printable will help you save for your family trip to Disney without the debt!

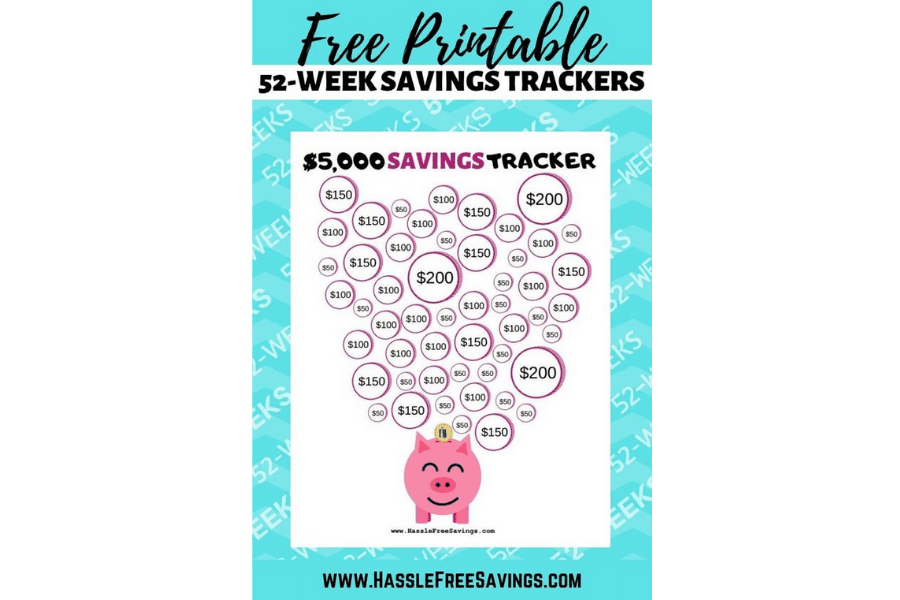

15. $5,000 Savings Challenge

This savings challenge printable will help you save $5,000 in one year!

16. Car Loan Payoff Printable

These car loan payoff printables will help you payoff your car loan fast.

17. Summer Savings Challenge

This super cute summer savings challenge printable will help you save some money in fun savings challenges over the summer or save for a summer getaway.

18. Roth IRA Max Savings Printable

This Roth IRA Max Printable will help you save for your retirement year after year.

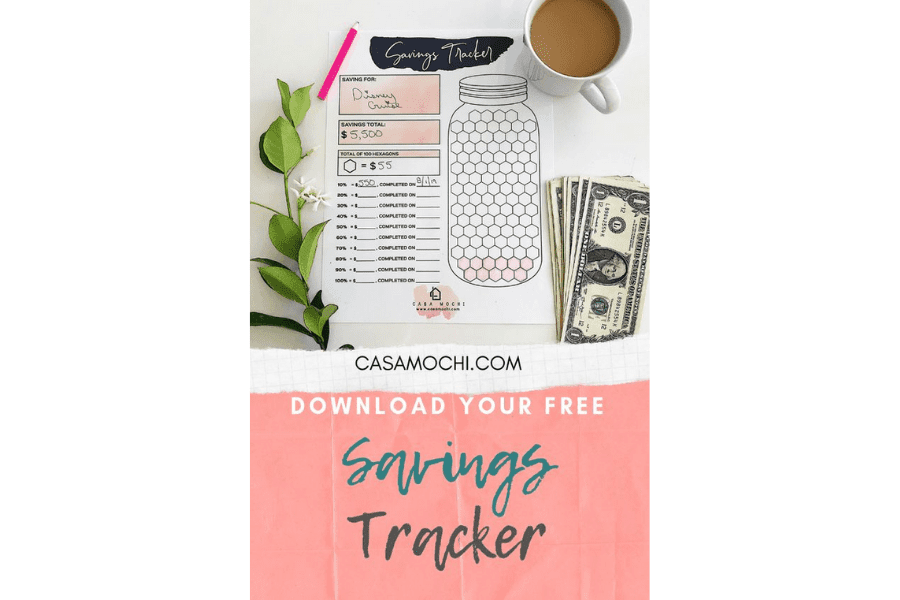

19. Free Savings Tracker

This cute free savings tracker jar will help you reach your savings goals fast.

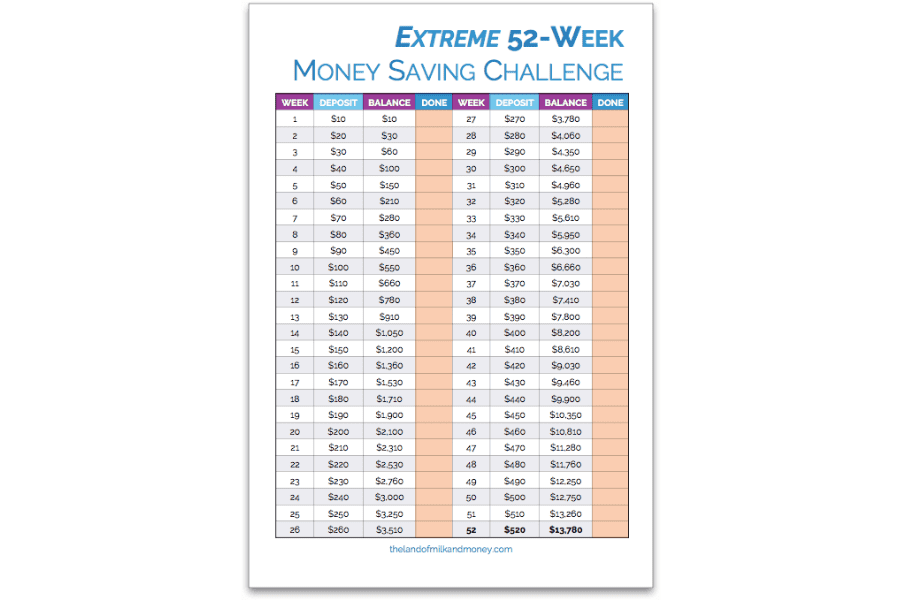

20. Extreme Money Savings Challenge

This extreme money savings challenge will help you save $13,780 in 1 year!!

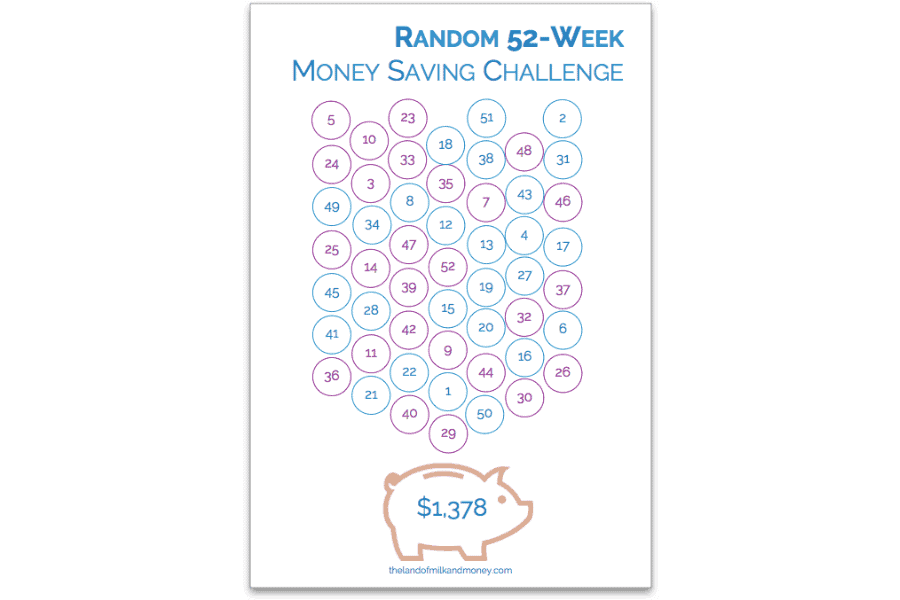

21. Random Money Savings Challenge

This random money savings challenge will help you save $1,378 in 1 year in small bite-sized chunks.

22. Flexible Money Savings Challenge

This flexible money savings challenge will help you save $1,649 in 1 year. You can pick and choose which blocks to fill up on your own.

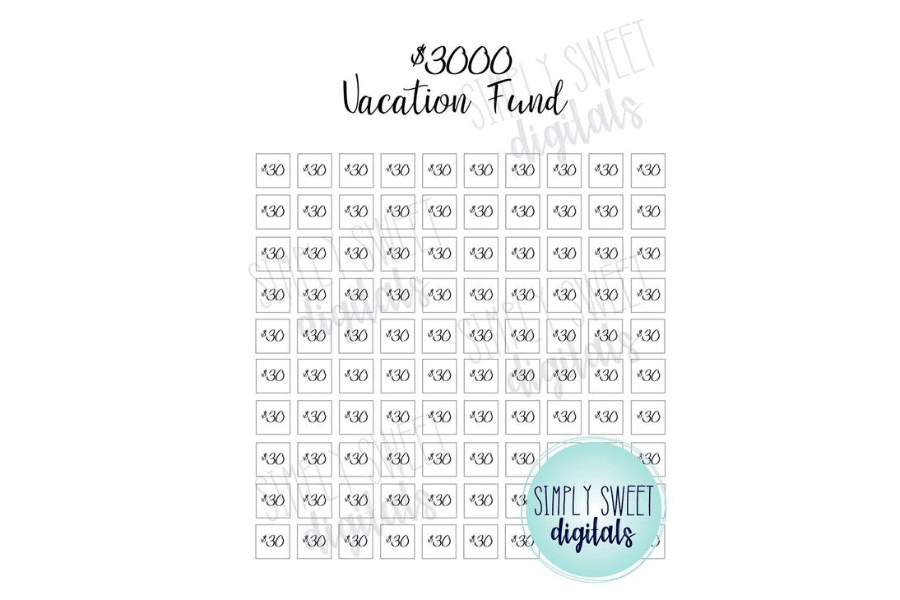

23. $3,000 Vacation Savings Fund

This cute vacation savings fund printable will help you save $3,000 for a vacation.

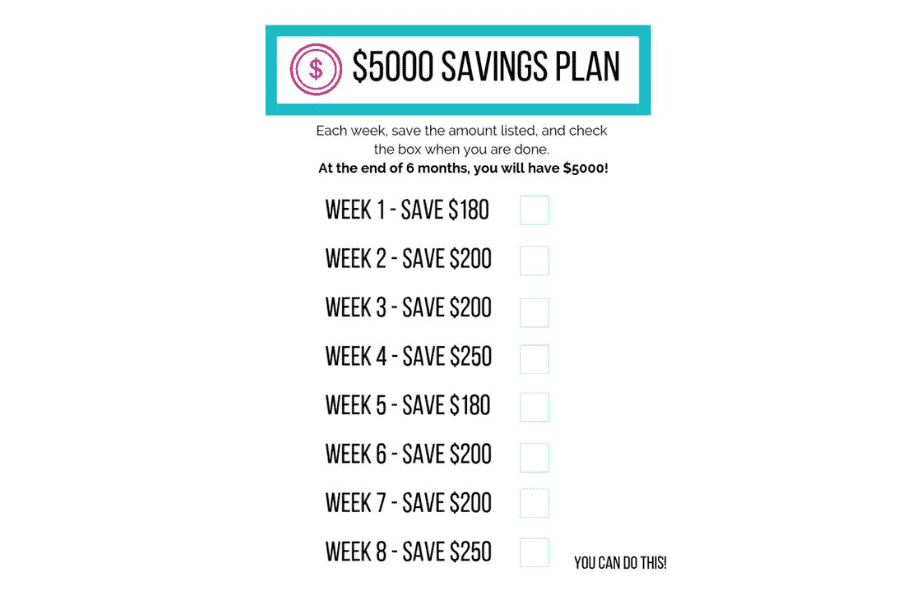

24. Save $5,000 in 8 Weeks Savings Printable

This money savings printable will help you save $5,000 in 8 weeks!

25. Save $1,000 in 30 Days Savings Challenge

This money saving challenge printable will help you save $1,000 in 30 days.

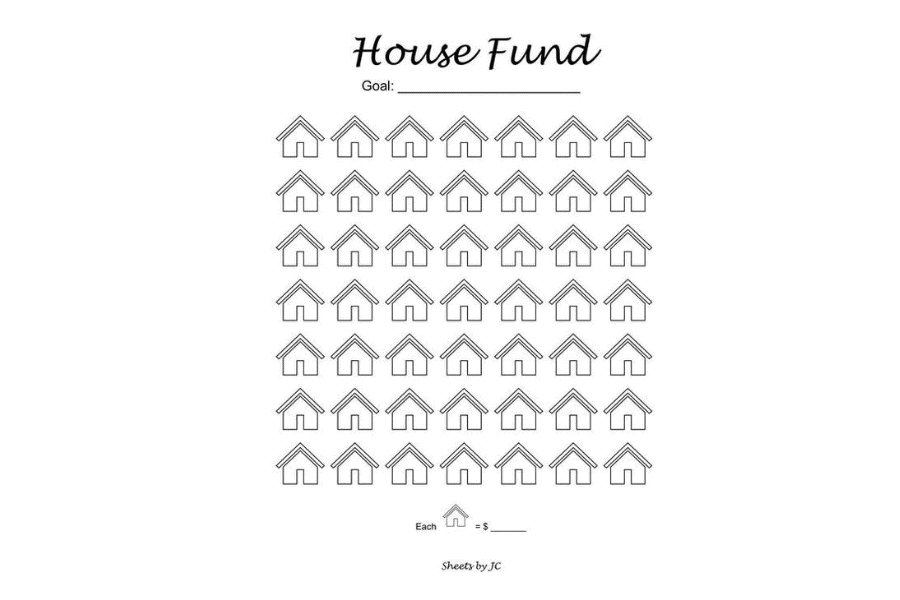

26. House Fund Printable

This house fund printable will help you save for anything on your house. It’s one of many money savings charts that everyone needs.

You can save for:

- House down payment

- House remodeling

- Home repairs

27. Credit Card Debt Payoff

This cute printable will help you pay off your credit card fast.

5 Tips to Help You Save More Money

1. Stick to a budget

Sticking to your budget can be challenging, but with the tips below, you’ll find that sticking to your budget is easier than you think.

7 Quick Tips to Help You Stick to Your Budget:

- Stay out of the stores.

- Check your calendar before you make your budget.

- Revisit your budget often.

- Keep your goals visible.

- Track your spending every day.

- Find yourself a budget buddy.

- Use a budget binder.

We take a deep dive into these steps inside of the post Ways to Stick to Your Budget.

These tips will help it be easier to stick to your budget. This will save you a ton of money. When you create a budget ahead of time, it’s easier to make smarter decisions.

Related Posts:

2. Track Your Expenses

Tracking your expenses may sound like it takes a lot of time, but hear me out. You can work tracking your expenses into your daily money routine and it won’t take that long.

There are a ton of benefits to tracking your expenses. It helps you figure out where you’re money is going. Just because you said you were going to spend $600 on groceries at the beginning of the month, doesn’t mean you did.

It helps you figure out where you need to make changes in your budget. If you’re overspending in a certain category, you need to figure out if you want to increase that category or figure out how to save more money in that area.

It also helps you refine your budget and create a realistic budget you’ll have less problems sticking to. The easier and more realistic your budget is, the easier it is to stick to and keep going.

The easiest way to track your expenses is with Quicken. I’ve been using Quicken for years and love it!! It makes it so easy to track your expenses and see where your money is going. You can even auto connect it to your checking account for even easier tracking.

3. Cut Back on Your Subscriptions

Subscriptions can cost you hundreds every single month. It’s so important to regularly go through your subscriptions and decide if you want to keep them or not.

A lot of people say subscriptions are bad, but it’s all about how you look at it. If you love your subscriptions and can fit them in your budget, keep them. If you don’t like them, cancel them.

4. Increase Your Income

Increasing your income can help out your budget so much. There’s only so much you can cut, right? Increasing your income doesn’t always mean you have to go out and get a second job.

Here are some ways to make more money:

- Declutter and sell stuff on Facebook

- Start a side hustle

- Start a side business

- Take surveys

- Take a picture of your receipts with a free Fetch Rewards app (Use code KP5WK to earn 2,000 points)

- Download the Shopkick app to get free money just scanning items while you’re shopping (Use code Allison to get a free $5 gift card when you earn 60 kicks in the first 7 days)

Related Posts:

5. Stop Spending Money Impulsively

Stop spending money can be challenging. You can have one bad day and then start cruising the isles at Target and then before you know it, you’re the owner of aisle 12.

Stores have marketing experts who layout the stores in a way that tempts you to buy impulsively. Online stores have suggested items pop up before you checkout. They also automatically save your debit/credit card for even easier purchasing.

There are so many things that tempt you to spend, that it can be really easy to get sucked into it and blow your budget.

You can learn to control your impulse spending through changing your habits. This is something I teach in my mini course Stop the Swipe.

Stop the Swipe will help you:

- Take back control of your spending

- Develop better spending habits

- Learn to live within your means

- Figure out the real reason you’re overspending

The Bottom Line

Saving money doesn’t have to be boring. You might even start to enjoy it once you get to color in your money saving charts! Keep them in a binder or displayed in your home for more motivation!