While the latest RIA mergers and acquisitions data shows that the pace of deals has slowed slightly, 2022 is still on track to be a record-breaking year. Two active acquirers, Bluespring Wealth Partners and Mariner Wealth Advisors, both say their deal flow hasn’t slowed. But the reasons RIAs are searching for partners has evolved beyond simply monetizing a business and handing off to the next generation.

“Typically, it’s always pegged to succession planning,” said Kevin Corbett, managing director of corporate development and strategy at Mariner Wealth Advisors Succession. “Succession planning is one reason, one driver, perhaps, of why people are looking at a strategic partnership, but it’s not the only one.”

“Sure, we’re in what I would call an ‘M&A age wave,’” said David Canter, who recently left Fidelity Institutional to join Bluespring as president.

But Canter said there’s also a fear among RIAs that they will get left behind.

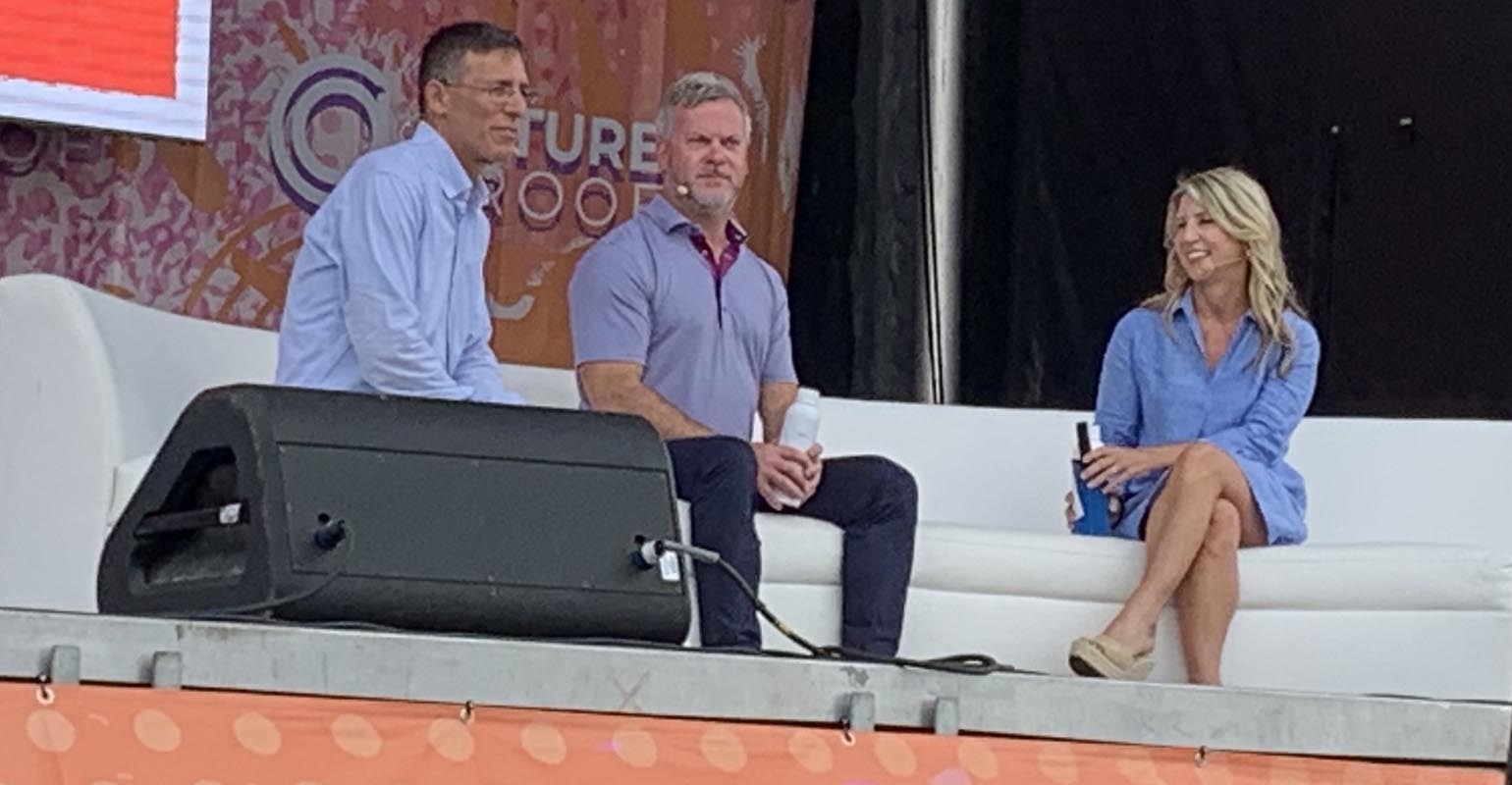

“There are firms like his firm, firms like my firm that are building out platforms that create time machines for the principals and advisors at these firms, so they have more time to focus on clients, more time to grow the business, more time to do the things that they love in terms of developing that next generation,” Canter said, speaking at Advisor Circle’s Future Proof festival in Huntington Beach, Calif.

“A lot of wealth management firms, started as sort of artisan shops—boutiques that crafted their offering to their clients in a very specialized way. But what we’ve seen is these boutiques coming together to create platforms. In a world where boutiques are coming together and forming platforms, it can be harder to compete.”

Canter also pointed out that the wealth management industry is in “a state of self-renewal.” By that, he means that there is a constant slate of new registrants. In fact, the number of registrants has grown 6.7% from 2021 to this year, according to Form ADV data, he said. Yet, year-to-date there have only been 120 M&A transactions representing $160 billion.

“That’s a tiny fraction,” he said. “We may not be in the morning of M&A in the RIA profession, but we’re certainly not at lunchtime. We just had breakfast, I’d say.”

Corbett agreed, saying that they are seeing more opportunity with firms that are just going to market.

“Those of us out there who are participating regularly and perhaps printing more and more of the deals are seeing really unique opportunities coming to market,” he said. Firms are “far more interested in a lot of other capabilities, ability to serve their clients in a deeper, more meaningful way, thinking about their next generation teams. And it’s not just about an owner and operator or founder trying to fill or satisfy his retirement plan.”

More sellers are coming forward to solve problems beyond their own succession, both speakers said.

The ability to better compete in the market is something that the platform-oriented firms can provide, he said. “It allows advisors and these teams to do more to be able to serve the needs of their clients as those clients needs continue to be more complex,” he said.

In addition to a new registrants, he’s noticed a large number of investment bankers coming into the space representing the sellers. Corbett said about 50-60% of Mariner’s deals come from investment bankers now, while 40-50% are self-sourced through referrals and other “centers of influence.”

Such high deal flow means a lot of investment bankers have fully embraced virtual meetings to move the processes along. Some are giving strong “indications of interest” in doing a deal before the acquirers get a chance to speak with the leadership team, Corbett said.

“That’s just not conducive to a good process in my mind,” he said. “That model is rife for disaster from a cultural standpoint until you can really engage with somebody and determine, ‘are we as good a fit as much as they’re a good fit for us?’”