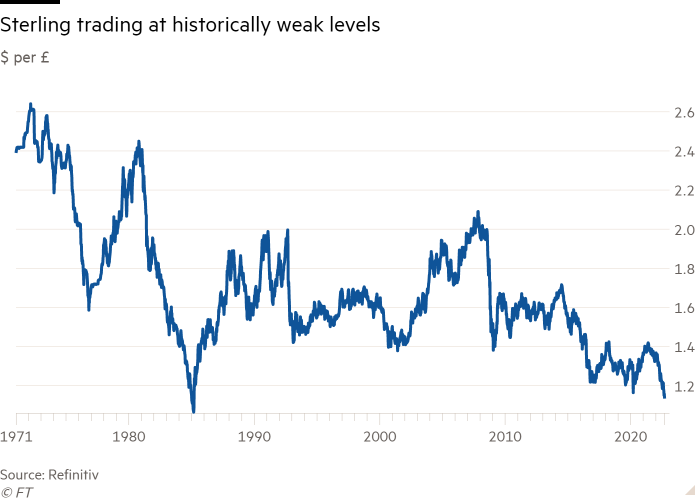

Sterling slid to its lowest level since 1985 against the dollar on Friday after a round of weaker than expected data on UK retail sales amplified concerns that the country was headed for a prolonged recession.

The pound dropped as much as 1 per cent to $1.135, the first time it has breached the $1.14 mark in almost four decades. It rose back to just above $1.14 in New York trading but remains down almost 16 per cent in 2022.

The currency’s sharp decline reflects a broad and powerful rally this year in the dollar, as well as particular concerns over the UK economy. Sterling was off about 0.5 per cent on Friday against the euro at €1.141, leaving it down about 4 per cent this year.

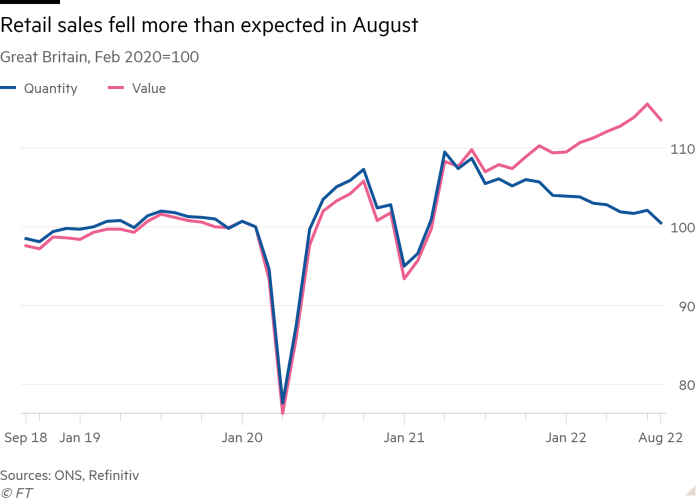

Retail sales fell sharply in August as UK consumers struggled with soaring prices and high energy costs, according to data published on Friday by the Office for National Statistics. The quantity of goods bought in the UK fell 1.6 per cent between July and August, reversing a small expansion in the previous month.

This was a larger drop than the 0.5 per cent contraction forecast by economists polled by Reuters and the largest fall since July 2021, when Covid-19 restrictions on hospitality were lifted.

Olivia Cross, economist at Capital Economics, said the figures suggested “that the downward momentum is gathering speed” and supported her view that “the economy is already in recession”.

The ONS said that rising prices and cost of living pressures were affecting sales volumes, which have continued a downward trend since the summer of 2021, following the reopening of the economy after pandemic lockdowns.

The figures highlighted how high inflation has hit consumers and the wider economy. The government’s £150bn energy support package announced this month is expected to limit the blow from the recent surge in gas prices, but it did not dispel the risk of a recession.

Victoria Scholar, head of investment at Interactive Investor, said the fact that sterling fell against both the dollar and euro on Friday showed “this is not a dollar move . . . but, in fact, it is traders selling the pound amid negative sentiment towards the UK’s economic outlook and investment case”.

Bank of England data also show that the effective sterling exchange rate, a measure that is weighted to take into account its strength against major trading partners, has declined 6.5 per cent since the start of the year. The gauge is still above the historic lows it reached in 2020 and 2016.

The BoE is expected to raise interest rates for the seventh consecutive time at its meeting next week as it deals with an inflation rate almost five times its 2 per cent target.

However, the weak retail sales figures could steer the BoE towards a 0.5 percentage point rate rise when policymakers meet next week, rather than a 0.75 percentage point increase some had expected, said Gabriella Dickens, senior UK economist at Pantheon Macroeconomics.

The US Federal Reserve is widely expected to raise rates by at least 0.75 percentage points next week and a smaller BoE rate rise could further dent the allure of holding the pound.

In a sign of the struggles for the UK economy, the quantity of goods bought by consumers was almost back to pre-pandemic levels, down from a peak of almost 10 per cent above those levels in April 2021.

All main sectors fell over the month, but non-food stores were the biggest driver. This is because of large drops in sales in department stores, down 2.7 per cent, household goods stores, down 1.1 per cent, and clothing stores, down 0.6 per cent.

Notable declines in sports equipment, furniture and lighting gave “an indication of the types of items consumers push to the bottom of their priority list in difficult times”, said Sophie Lund-Yates, analyst at the financial services company Hargreaves Lansdown.

Online sales also fell sharply, by 2.6 per cent, with food being the third biggest component of the monthly decline.

While food sales were particularly affected by the reopening of the hospitality sector, the ONS reported that “in recent months, retailers have highlighted that they are seeing a decline in volumes sold because of increased food prices and cost of living impacts”.

Fuel sales also dropped 1.7 per cent, and were 9 per cent below their pre-pandemic levels, reflecting the impact of soaring prices at the pump on car trips despite some easing in prices in August compared with the previous month.

Lynda Petherick, retail lead at the consultancy Accenture, said that “with a difficult winter to come, it will come as a worry to retailers that shoppers have already reined in their spending despite the hot summer”.