Market timing is the strategy of making buying or selling decisions of financial assets by attempting to predict future market price movements. By timing the market, the hope is to make a profitable decision at the time of action.

Market timing gets a bad rap partially because it’s difficult to do consistently to profit. However, I mostly believe the act of marketing timing is misunderstood.

In reality, every investment decision you make is market timing. As rational human beings, we are always attempting to make the best decision possible based on the information we have and the situation we are in at the time.

A profitable decision generally means buying at a time before future prices go higher or selling at a time before future prices go lower. But a profitable decision can also mean buying or selling to help improve the quality of your life. After all, the ultimate goal of investing is to provide us returns to live a better life.

Here are some common examples you might not think of as market timing, but in reality, they are.

Examples Of Market Timing

You are timing the market if you are investing a fixed percentage of your paycheck in your 401(k) each month. Why not front load your 401(k) contribution so you’re done by mid-year? Or why not wait to max out your 401(k) with your year-end bonus?

If you decide to replenish your cash hoard until you have 12 months of living expenses before you invest, you are market timing. Why not wait to start investing in stocks once you have three months of living expenses instead?

If you decide to use 100% of your monthly cash flow to pay extra towards your mortgage instead of follow my FS-DAIR framework, you’re market timing. Why not pay down debt and invest at the same time?

If you decide to sell some of your S&P 500 holdings because valuations are 50% above the historical median valuation, you’re timing the market as well. Or are you making a disciplined decision?

If you decide to sell one of your rental properties because you don’t want to manage tenants anymore, you’re timing the market. The decision is based on your inability to endure dealing with tenant issues.

Investing For The Long Term Is Optimal

We all know it’s difficult to consistently buy or sell at the bottom or top of the latest market cycle. You could sell near the top, but then you have to time your purchase near the bottom correctly. Then there are tax implications when buying and selling investments in taxable accounts.

Therefore, when it comes to stocks and real estate, the best holding period is usually for as long as possible. It’s much better to identify long-term investment trends and asset allocate accordingly. Focusing on the minutiae to outperform the broad trend is often a poor return on effort.

However, whenever asset allocation percentages get out of whack you should buy or sell accordingly. Further, whenever you have new capital to deploy, you should always have an opinion about each investment before purchase.

Market Timing The Real Estate Market

In order to write, The Best Time To Upgrade Your Home Is Coming, I had to have a view on where the real estate market was headed. My conclusion was to buy your move-up property roughly 18 months after the latest peak in the real estate cycle to get the best deal possible.

In other words, I was practicing real estate market timing. I don’t want to buy a new primary residence now because I think there will be better deals in the future. Specifically, I think I can buy my move-up home sometime after July 2023.

I currently have the capital to put 20 percent down to buy a nicer property, but I don’t think it’s prudent just yet. The economic landscape has changed since the beginning of the year, hence, I have adjusted my outlook accordingly.

Yes, my decision to wait to buy a new property in one-to-two years might prove to be a suboptimal decision. Prices could zoom higher if inflation suddenly collapses.

However, I’m willing to time the real estate market based on my experience investing in a couple of cycles. Further, I’m governed by our desire to enjoy our forever property for longer since we just purchased it in 2020.

Now that we’re hopefully more accepting of market timing, let me share why I think it’s easier to time the real estate market versus the stock market. The greater ability to time the real estate market is one of the main reasons why I prefer real estate to stocks.

Why Timing The Real Estate Market Is Easier Than Timing The Stock Market

I’ve been investing in stocks since 1995 and bought my first property in 2003. Hence, I’ve had a long-enough period of time to make a lot of mistakes. But I’ve also had a long enough time to be able to hone my investing acumen to make better-than-average decisions.

Timing the real estate market to make more money is easier than timing the stock market for the following reasons.

1) The Real Estate Market Moves Much Slower Than The Stock Market

Largely due to technology and globalization, the stock market corrects and rebounds much quicker than the real estate market. Real estate agents, on the other hand, are still able to charge a 5% commission while stock trading is now free for everyone.

When I published How To Pick The Stock Market Bottom Like Nostradamus on March 18, 2020, I wrote in detail why the bottom of the S&P 500 was around 2,200 – 2,400. At the time, the S&P 500 was trading at 2,304.

I planned on backing up the truck if the S&P 500 got to 2,200. But in three weeks, the S&P 500 had already rebounded to 2,800. As a result, I only ended up investing about 35% of my intended capital instead of 100%. At least I didn’t sell any stocks.

The speed and magnitude of price movements in the stock market is the main reason why market timing stocks is so difficult. It’s much easier to catch a snail than a sparrow.

It’s also much easier for me to play against 4.0 tennis players because fewer opponents have booming serves like many rated 5.0 do.

Real Estate Market Timing Example

Although timing the stock market was difficult in 2020, I was able to time the real estate market well and get 100% of my intended capital invested during that year.

On April 27, 2020, I published the post, Real Estate Buying Strategies During The COVID-19 Pandemic. I had just stumbled upon my dream property two weeks earlier and wanted to write out my thoughts on how to get the best deal possible.

Public showings were canceled during lockdowns. Only private 1X1 showings were available and limited to two people per showing. Many people were too worried to consider buying property during this time.

I didn’t want to miss out on touring the gem I’d stumbled upon. So, I attended a private showing and instantly saw the benefits the property could provide my family.

Slow Motion Real Estate Market

After six weeks of discussions and negotiations, I got into contract in early June 2020. The offer was for six percent below asking and a 30-day close. But out of fear and my desire to get a better deal, we closed 55 days later.

The sellers weren’t happy that I asked for a price concession after getting into contract. But this period of the pandemic still had me quite nervous about our economic future. I had just bought a fixer in 2019 and now I was upgrading to a home 57% more expensive.

Despite all the technology in the world, the real estate market moves at a snail’s pace compared to the stock market. Pricing whiplash is uncommon in real estate. As a result, it’s much easier to make more optimal buying decisions.

Market timing a real estate sale, on the other hand, is more difficult due to the preparation required to sell a home. Moving out, staging, asking your tenants to move out, painting, and fixing things usually takes months.

2) You Can Better Control The Length Of Transaction With Real Estate

When it comes to buying and selling stocks, once you press the button, your transaction is complete. Your stocks or cash will settle in a couple of days. However, when it comes to buying and selling real estate, the average time in escrow is around five weeks. And during this time in escrow, anything can happen.

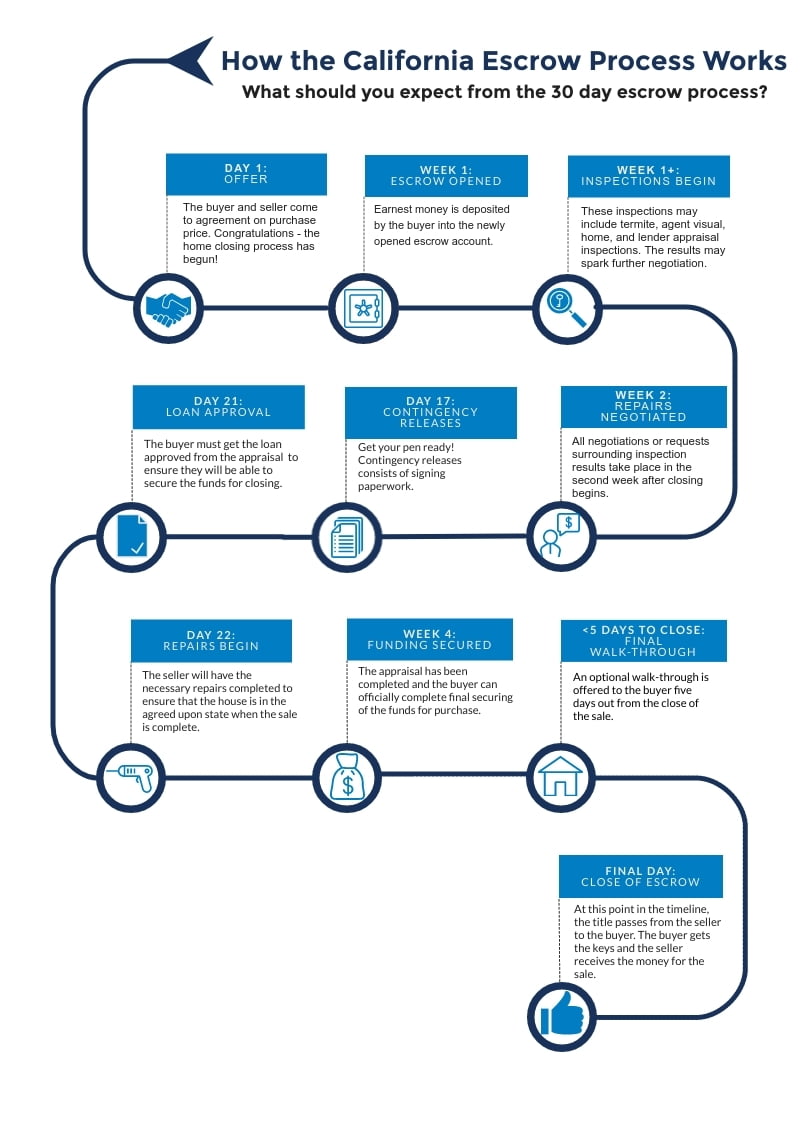

Below is a great graphic that shows the various steps of a escrow process. This process excludes all the time you spent house hunting and getting your offers rejected.

The escrow process can be delayed mainly due to inspection contingencies and financing contingencies. As a buyer, you have the right to delay closing until all inspection issues are fixed or agreed upon. As a seller, you can drag your feet to accommodate the buyer’s wishes or counter.

If you have a financing contingency, as a buyer, you also have the right to delay closing until you can get your financing. Worst case, you can also back out of the deal if you have a financing contingency.

During the escrow period, anything can happen to make you want to back out. Maybe the S&P 500 tanks by 30% during escrow. If so, you have real-time data to help you argue for a lower price.

Conversely, if the S&P 500 zooms higher by 20% during the first half of escrow, you may want to accelerate your close to lock in your price before the seller changes their mind.

Therefore, with real estate, you can better control the timing of the transaction. It’s almost like having the ability to bend time and space. Some escrow periods last six to twelve months!

3) You Can Negotiate Price With Real Estate

Unlike with stocks, you can negotiate your real estate purchase price. There are also many tactics to deploy as well.

Before submitting a written offer, you can tell your agent to tell the listing agent you’re thinking about X price. This whisper price may sway the seller your way. You can also submit low-ball offers across multiple listings to see if any bite.

Once you’re in escrow, you can further negotiate on price based on the inspection and financing contingency. Finally, you can always ask for a pricing concession for whatever reason. A price concession can include having the seller pay for closing costs.

Let’s say you believe the real estate market will decline by 10% over the next 12 months. But given you would rather buy a home today, you craft a real estate love letter to get your foot in the door.

Once you’re in deep discussion then you write a real estate breakup letter to try and get a discount. If you can convince the seller to sell at a 10% discount immediately, then you’ve successfully bent the market to your desires.

As a minority stockholder, you have no say on price whatsoever. But as the potential sole owner of a property, you have tremendous power to get a better deal.

As a real estate investor, you could come up with an all-cash offer and a quick close to entice the seller to get you a deal. Whereas with stocks, you’re almost always paying cash with an instant close so it doesn’t matter.

Thoughts On Properly Timing The Real Estate Market

Timing the real estate market is still not easy. But at least it’s much easier than timing the stock market given how much slower the real estate market moves.

The key is to know where you are in the real estate cycle. Once you have a good idea, you can make an educated guess on how long the current situation will last before making a move.

Below is the classic real estate cycle that is divided into four phases: Recovery, Expansion, Hypersupply, and Recession. Each real estate cycle will be different than the next. Some will have much higher amplitudes than others. Other cycles will be much shorter.

But based on history, real estate tends to move in 7-10-year bull runs followed by 1-3-year bear runs.

Once you make an appropriate estimate of where you are in the cycle based on supply and demand figures, you must estimate how much time is left until the next phase and so forth.

If you get your timing wrong, it’s easier to estimate how much you could lose or gain given the price moves are less dramatic. Historically, real estate prices move up and down any given year by +/- 5%, similar to bonds. Hence, the beta is lower.

The Current Real Estate Cycle

The United States just went through a 10-year real estate bull market (Phase 1 and Phase 2). Supply is still well below the pre-pandemic average, however, demand has declined given a significant rise in rates.

We could say we are at the end of Phase III, despite supply not being in hyper supply. However, what’s more likely going on is that both supply and demand have pulled back.

If you own a property with an attractive mortgage rate, why would you sell and buy a more expensive house with a higher mortgage rate if you don’t have to?

Given the magnitude of price appreciation and the duration of the real estate bull market, a recession could easily occur for two or three years until recovery.

As of now, rich Fed Governors are also emboldened to inflict pain on the middle class to protect their legacy. If so, it’s best to accumulate cash while the recession works itself out.

As a buyer during a recession, your goal is to try and get a discounted price equal to what you believe will be the bottom of the cycle. This way, you won’t have to compete with frenzied buyers during a recovery.

In other words, if you believe the bottom of the real estate cycle is December 2023 down 10%, you want to buy at a purchase price down 10% before December 2023. Because if bidding wars return in March 2024, prices will move far ahead and you might miss out.

Buying when nobody else wants to buy always feels off; it always does. But it often turns out well given real estate always eventually recovers.

Of course, if moral suasion by the Fed changes, so will our market timing forecasts.

Be A Good Negotiator to Better Time The Real Estate Market

Stocks are a great way to invest passively. No effort is involved once you own stocks. However, there’s no way to get a better price at the time of purchase. The only thing you can do with stocks is wait for a better entry point, if it ever occurs.

With real estate, there are so many tactics to deploy to improve your transaction price. If you are an experienced negotiator who can recognize potential, then you should much prefer real estate over stocks.

Eventually, you can amass a large enough physical real estate portfolio and no longer want to do more work. When that time comes, you can then invest in real estate online for 100% passive returns.

Letting a professional time the market and negotiate better terms for a fee becomes more attractive the more valuable your time.

Readers, what are your thoughts on real estate market timing? Do you think it’s easier to do than timing the stock market? If you zoom out far enough, isn’t every investment decision market timing?

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.