RightCapital scored a spring hit when it introduced its Snapshot feature to advisors back in April. Now, the financial planning application provider has a fall follow-up in the form of Blueprint.

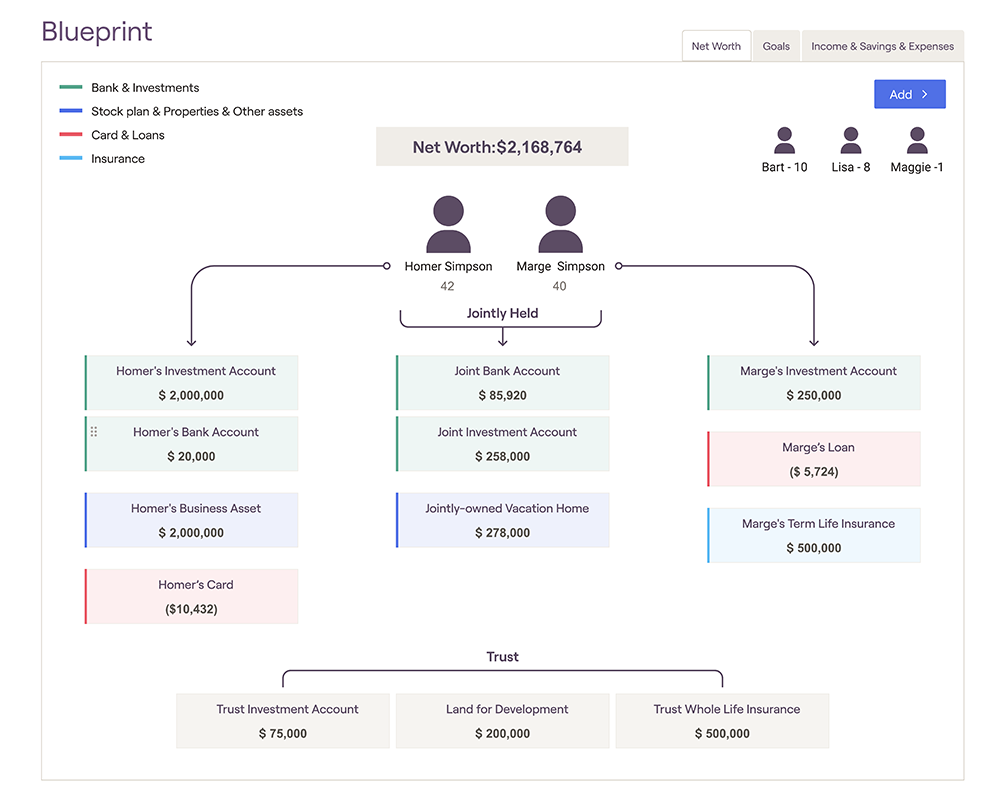

Whereas Snapshot was a customizable, highly visual one-page financial plan that advisors could share with prospects and clients, Blueprint is an interactive and customizable tool for visualizing and organizing a prospect or client’s household financial data, including net worth, goals and income, as well as savings and expenses.

With several distinct default graphical layouts to choose from, Blueprint can help advisors not only present such data in an intuitive and meaningful way but also help both parties identify missing inputs or changes in the client or household’s financial picture.

Data points can be edited and changed directly in the layouts as well, and then are automatically updated in the client’s overall financial plan.

Matt Smith, founder and lead advisor at Concert Financial Planning, said he has been using RightCapital since the summer of 2019.

“They release a lot of new features, occasionally they hit a home run and this is one of them,” said Smith, whose firm, which works with 32 households, focuses on financial planning for lawyers.

He said RightCapital’s timing was perfect to roll out Blueprint as he had already been looking at third-party visualization tools, most leaving him wanting, especially on the integration front, noting that other applications would require either data entry or cutting and pasting of client data.

“Most people are visual thinkers after all and this feature is going to save a lot of prep time and will be really intuitive for the clients,” he said.

Ryan Weiser, president and chief compliance officer of Weiser Financial Planning, said he had already been using mind-mapping software to create visuals for his clients, which looked good but became quickly outdated and required manual updating—not an efficient use of his or his staffers’ time.

“Now, with the Blueprint feature that replaces it—and it takes only a few seconds after logging in for the accounts to update,” said Weiser, who has been using RightCapital for five years now.

Shuang Chen, co-founder and CEO of RightCapital, which launched in 2015, said the company had been investing a lot of time on data visualization over the last couple of years.

“We want to present financial plan output very visually instead of 60 pages of printed or PDF documents,” he said chuckling.

“And a lot of the feedback we got back from advisors was there are a lot of data inputs that we want to be able to show and discuss, from assets to liabilities,” said Chen, adding this was the case whether it was an initial meeting with a prospect or during an annual review with a client.

Blueprint, as with Snapshot and the dynamic retirement spending strategies feature it rolled out in August, is included with the basic RightCapital offering at no additional cost (current pricing is available on RightCapital’s website).

RightCapital has integrations with all three major custodial platforms (including TD Ameritrade Institutional Veo), as well as several large independent broker/dealers, including LPL’s ClientWorks platform and Raymond James, among others.