One of the things we know about inflation expectations is that Federal Reserve Chairman Jerome Powell relies heavily on them. He thinks about expectations, gives speeches on them, and uses the data series when enacting Federal Reserve policies to combat inflation.

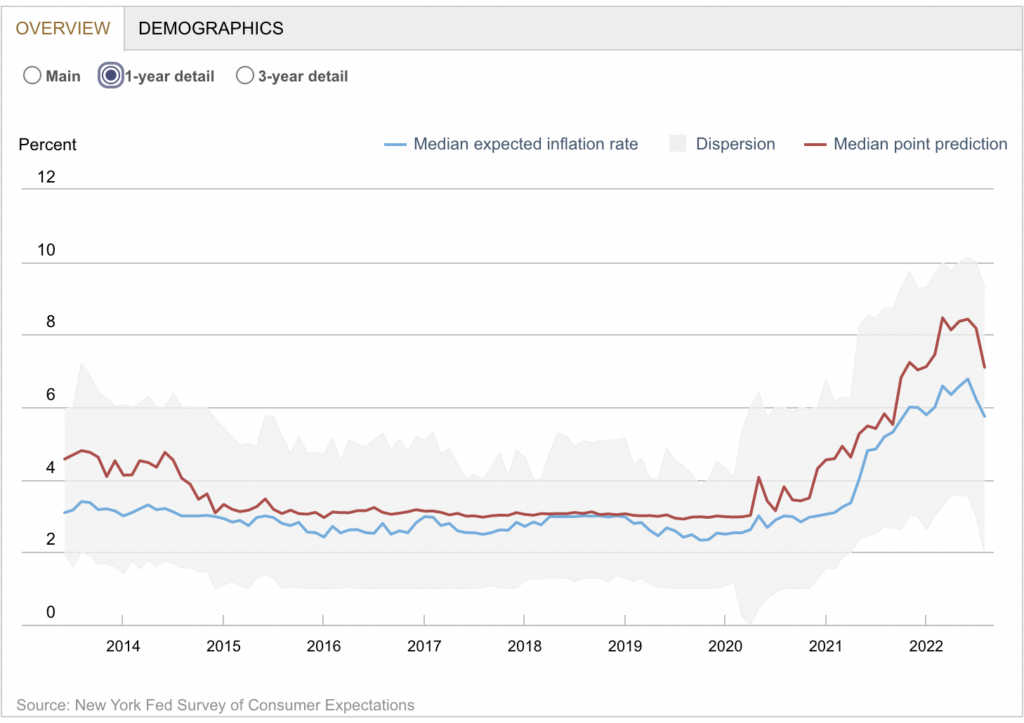

The problem is that all consumer surveys (including inflation expectations) are deeply problematic. At the very least, they are backward-looking, operating on a lag. You can see this on the FRBNY chart of Inflation Expectations above, where the expectations for higher prices over the next 1 and 3 years peaked in June after inflation itself reached new highs.

What just happened always has an outsized impact on what consumers expect will happen in the future. Recency Bias leads investors to make the exact same error, as they are also anchored on what just happened.

Consider: Questioning investors as to their risk tolerance does not typically result in an accurate description of their true tolerance for drawdowns and lower returns; instead, we get a number highly dependent upon the performance of equity markets over the prior three to six months. Ask any investor what their tolerance for risk is in the fourth quarter of 2021 and you will hear a very different answer than asking that same question of that same investor in the second quarter of 2022. Their risk tolerance has not changed, but the short-term market environment has; this is of course irrelevant to their long-term investing needs.

Do you imagine for a moment that the folks queried by the Federal Reserve Bank of New York in its Inflation Expectations survey behave any differently?

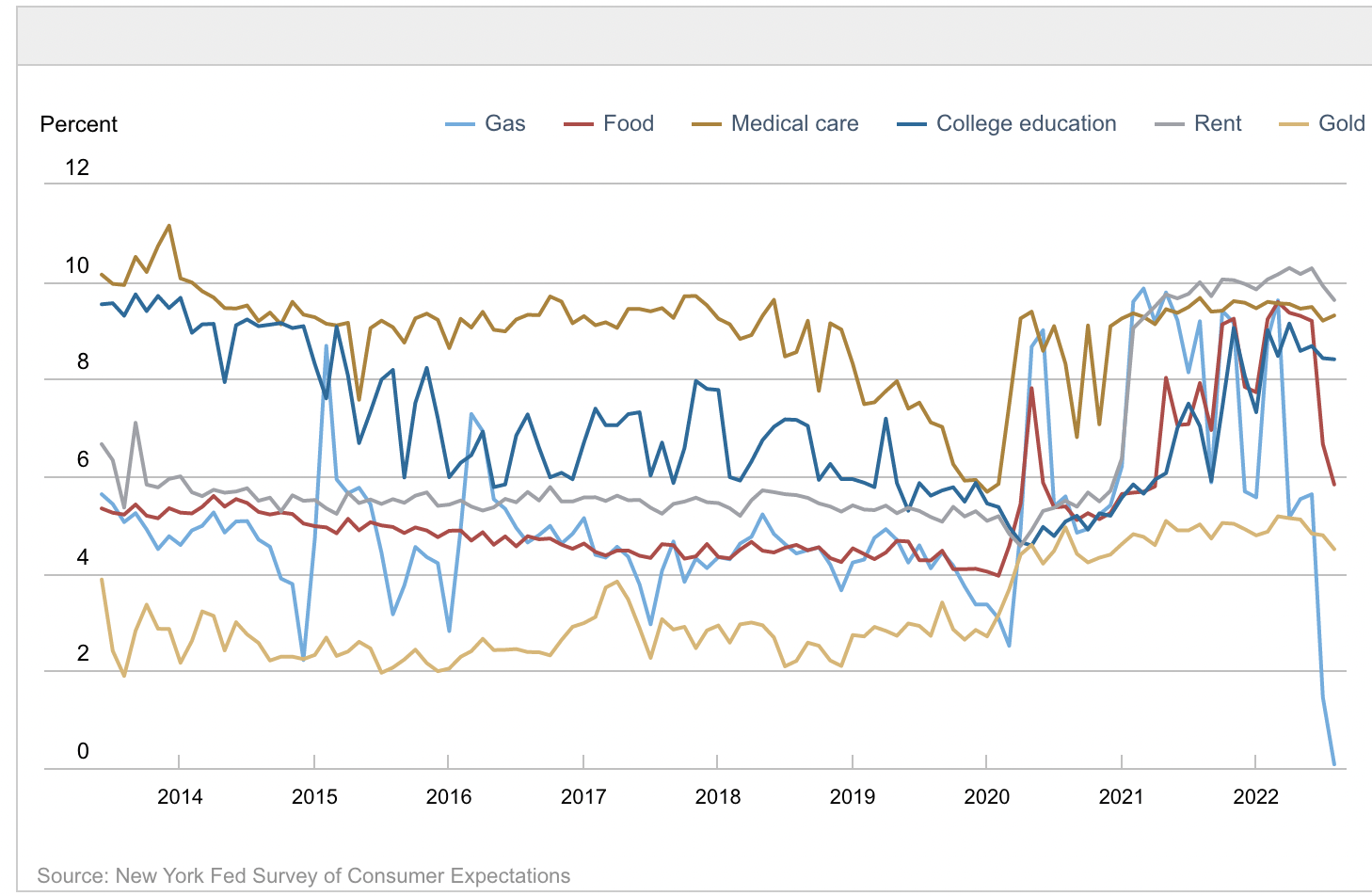

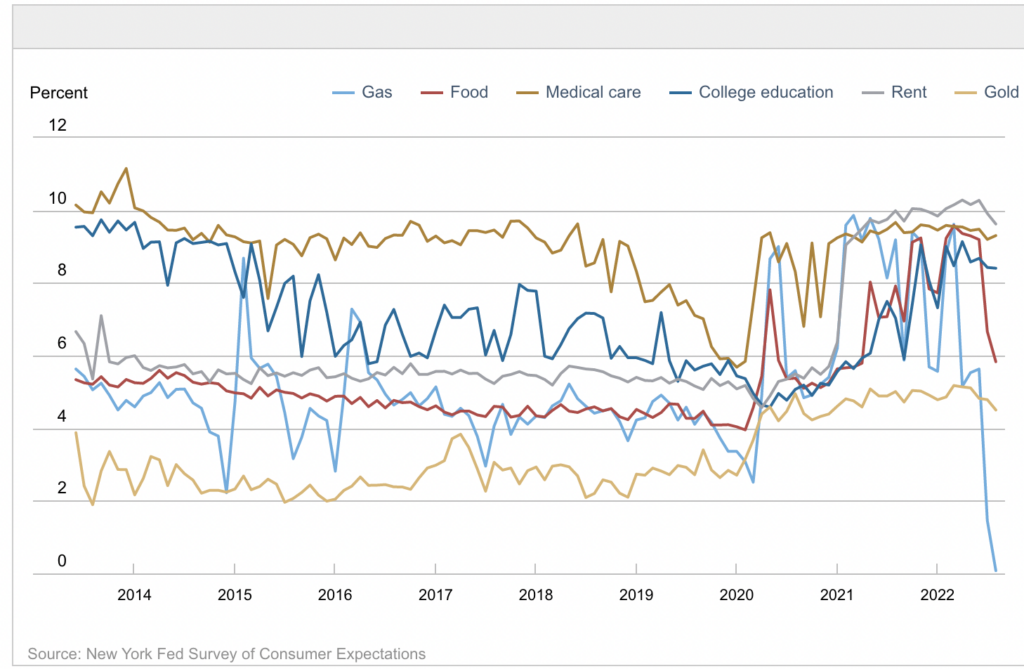

I have a sneaking suspicion that inflation expectations are overly dependent on 6-foot tall numbers posted nationwide adjacent to roadways showing the price of a commodity that used to be a very significant portion of the family budget but today is a much smaller part of consumer spending. With Gasoline prices falling for a near-record 98 consecutive days, no wonder inflation expectations have also fallen.

Anyway, here is the FRBNY:

Median one- and three-year-ahead inflation expectations both posted steep declines in August, from 6.2 percent and 3.2 percent in July to 5.7 percent and 2.8 percent, respectively. Median five-year-ahead inflation expectations, which have been elicited in the monthly SCE core survey on an ad-hoc basis since the beginning of this year and were first published in July, also declined to 2.0 percent from 2.3 percent. Expectations about year-ahead price increases for gas also continued to decline, with households now expecting gas prices to be roughly unchanged a year from now.

The good news is that expectations are coming down; the bad news is that it’s 3-6 months after real-world inflation likely peaked but before the FOMC has recognized as much. This presents a risk of the Federal Reserve raising rates too high and overtightening credit, leading to higher unemployment and potentially a recession, where neither is necessary.

Regardless, this is an area of research ripe for further exploration. I hope to address this in greater detail in the coming weeks…

Previously:

How Overrated is Sentiment in Economics? (November 22, 2009)

Source:

Inflation Expectations Continue Decline at the Short-, Medium-, and Long-Term Horizons

Survey of Consumer Expectations

FRBNY, Center for Microeconomic Data (August 2022 Data)

One-year ahead commodity price change expectations

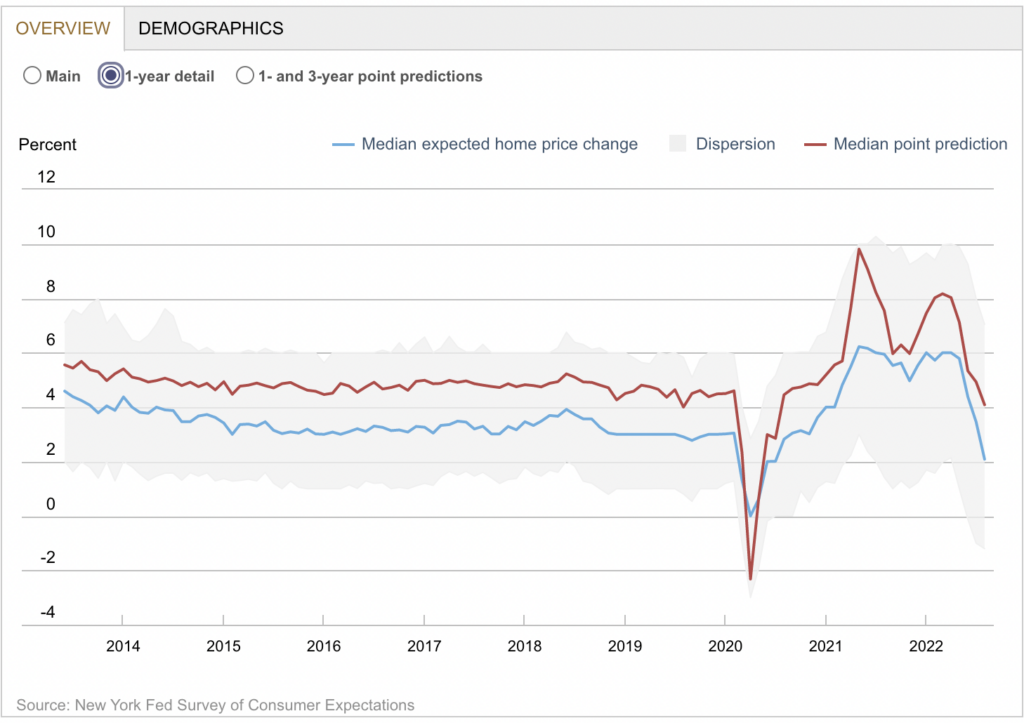

Home price change expectations