The market didn’t like what it heard yesterday. It hasn’t liked much of anything this year.

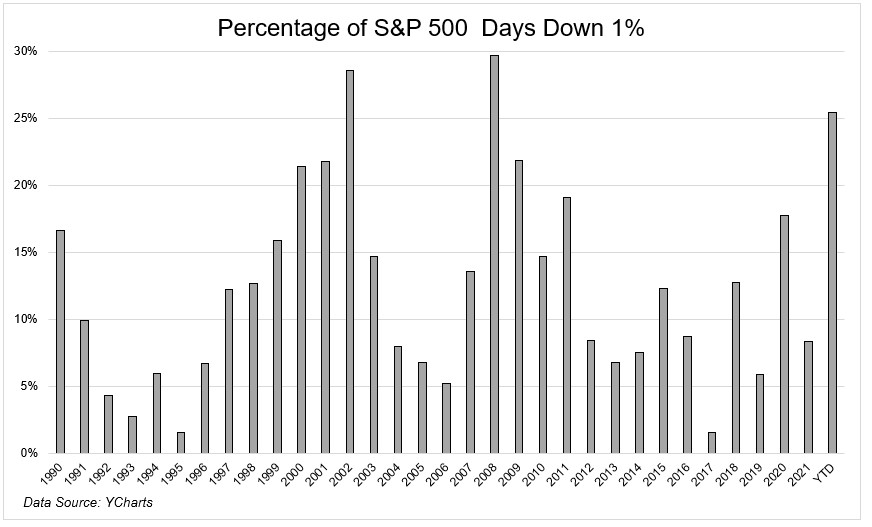

The S&P 500 has declined more than 1% in one out of four days so far in 2022. The only other years with a higher reading since 1990 were 2008 when the S&P fell 38%, and 2002, when it fell 23%.

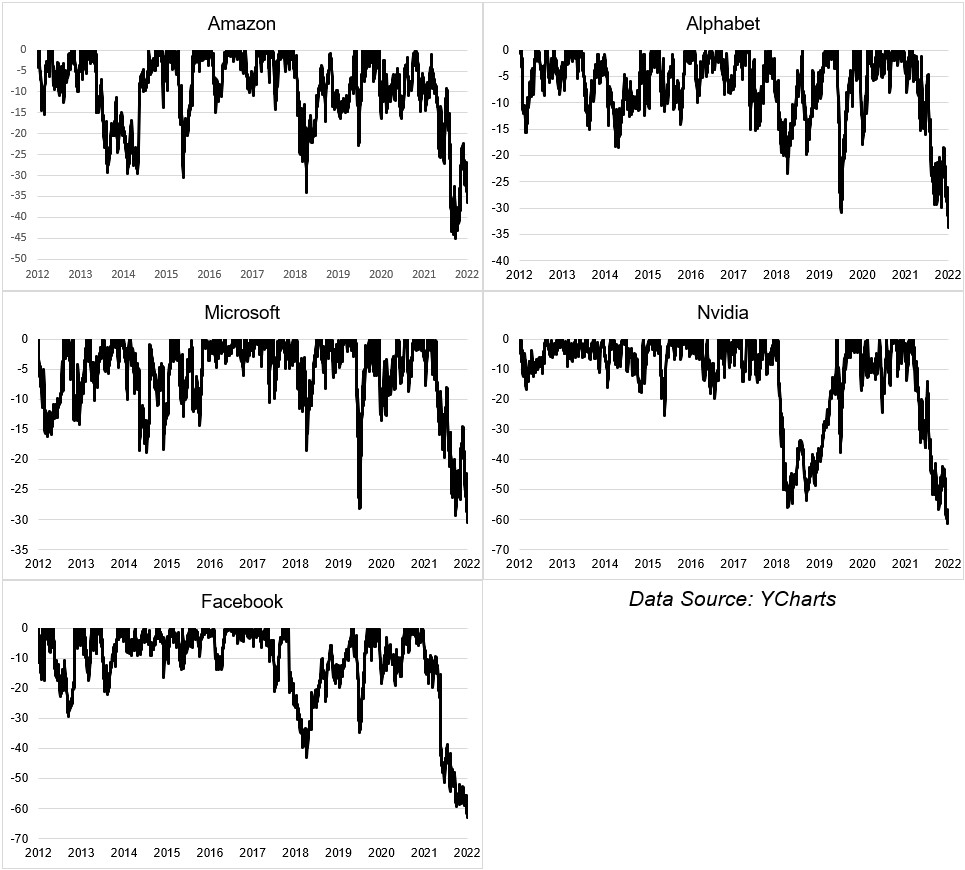

Mega cap tech stocks have been the best performing stocks for the last decade. That tailwind has now reversed. Live by the FAANG, die by the FAANG. With the exception of Apple, the others are in their deepest drawdown of the last decade.

These six stocks went from 10% of the S&P 500 to ~30% last year. The longer-term trend is still in tact, but it sure looks like this is going lower.

Buy low sell high. Be fearful when others are greedy. Etc, etc. It’s easy to be brave when stocks are going up. But putting money on the line when nobody else wants to takes actual courage and intestinal fortitude. You’re never going to buy the bottom, and you’re almost always going to regret it in the short term, but if you can stomach the pain, you’re usually rewarded over the long term.