As a small business owner, it’s your responsibility to know who’s the best person to hire for a job. Sometimes that means adding an employee to your roster. Other times, it means hiring a contractor. Hiring a contractor can help fill temporary or project-oriented positions.

Read on to get the scoop on hiring independent contractors for your small business.

Independent contractor classification

Independent contractors are different than full- or part-time employees. Contractors are self-employed and provide a good or service to your business based on a contractual agreement.

Unlike employees, you do not have to do the following when you work with contractors:

- Provide healthcare or benefits

- Pay for unemployment and workers’ comp insurance

- Withhold and pay taxes on contractors’ wages (unless they’re subject to backup withholding)

You can find independent contractors with a variety of expertise, such as:

- HVAC

- Roofing

- Landscaping

- Masonry

- Plumbing

But before you bring on a “contractor,” you must classify a worker correctly. Thirty percent of employers have misclassified workers as independent contractors, depriving employees of worker protection laws, unemployment benefits, and workers’ compensation. Misclassification is also bad news for you. There are heavy penalties if you misclassify a worker as a contractor. Criminal penalties can include a $1,000 fine for each misclassified worker and up to a year in prison.

You’ll need to look over three regulatory groups with separate classification guidelines. These groups include:

- IRS

- Department of Labor

- State governments

If you’re unsure how to classify a worker, you can submit Form SS-8 and the IRS will determine the worker’s status for you. This process can take up to six months.

1. IRS classifications

According to the common law rules of the IRS, a worker’s classification as a contractor depends on how much control you have over them. Generally, employers have more control over their employees and far less control over an independent contractor.

The IRS divides the degree of control between an employer and an independent contractor into three categories:

- Behavioral. Who decides how the contractor behaves (e.g., how they dress, the hours they work, or the tools they use)? If you control the worker’s behavior, you may have an employee and not an independent contractor.

- Financial. Who controls the contractor’s financials? Do you supply the contractor with tools? Do you have the ability to control their profits and losses? Workers begin to move into employee territory if you offer supplies and control their profits and losses.

- Relationship. What benefits do you offer the worker? If you provide benefits like health insurance and paid time off, your worker may be an employee.

Again, the more independence your worker has, the more likely they may be an independent contractor.

Let’s look at an example of someone that doesn’t qualify as an independent contractor using these guidelines.

A magazine company hired a freelance writer for an article in an upcoming edition. At first, the writer appeared to fall under the category of an independent contractor. They set their own hours and supplied their own computer, keyboard, and desk. But, over time, the writer published more articles for the magazine, was reimbursed for supplies, and was offered health insurance.

In this case, the worker was an employee, not an independent contractor.

2. Department of Labor classification

Heads up! How the Department of Labor classifies independent contractors is changing. Check in with the DOL for any updates.

As of March 8, 2021, the Independent Contractor Final Rule (ICFR) simplified requirements by reducing classification factors from six to just two. The ICFR states that the most important factors are 1) who has control over the work and 2) the worker’s opportunity for profit or loss.

For instance, under the ICFR, a worker who controls their work and has a greater opportunity for profit or loss is classified as an independent contractor regardless of the other requirements.

But if these two factors are too difficult to answer, three other factors come into play.

The three additional factors include:

- The skill or expertise required to perform the work

- The permanency of the work relationship, AND

- Whether or not the work is integral to the employer’s business

Let’s look at an example of a worker that does qualify as an independent contractor under the ICFR.

The heating and cooling system of a local bakery recently broke down. The owners searched for an HVAC professional to install a new system. The HVAC professional was entirely self-employed and controlled every aspect of their business. They also controlled their profit and loss. They could lose money if they don’t secure contracts for their HVAC business. The bakery had no say in whether the HVAC business succeeded or failed.

In this case, the HVAC professional is an independent contractor under the ICFR.

3. State classification

State labor departments have more restrictive requirements to determine whether a worker is an independent contractor. More than 20 states have adopted the ABC test. How does the ABC test work? The test assumes that a worker providing services for an employer is already an employee, not an independent contractor. It’s up to the employer to prove otherwise through three interlocking factors (e.g., A, B, and C).

To pass the ABC test and qualify for independent contractor status, the worker must:

- Be free from the control or direction of their employer under the terms of the contract and in reality

- Perform work that is different than the primary work the employer’s business does for their customers

- Have an ongoing business with multiple customers and engage in the same type of work for those customers

So, what does this look like in action? Let’s look at an example of a worker that does qualify as an independent worker under the ABC test.

A coffee shop needed to install new windows, so they hired a glazier for the job. The owner of the coffee shop used the ABC test to prove that the glazier was an independent contractor and not an employee. The glazier was an independent contractor because the:

- Coffee shop did not control how the glass installer did their job in any way

- Coffee shop didn’t also have a business installing glass

- Glass installer operated their own business installing glass for multiple customers

What states use the ABC test?

The following states use the ABC test to determine if a worker is an independent contractor or an employee:

- Alaska

- California

- Connecticut

- Delaware

- District of Columbia

- Hawaii

- Illinois

- Indiana

- Louisiana

- Maine

- Maryland

- Massachusetts

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- Vermont

- Washington

- West Virginia

Hiring a contractor

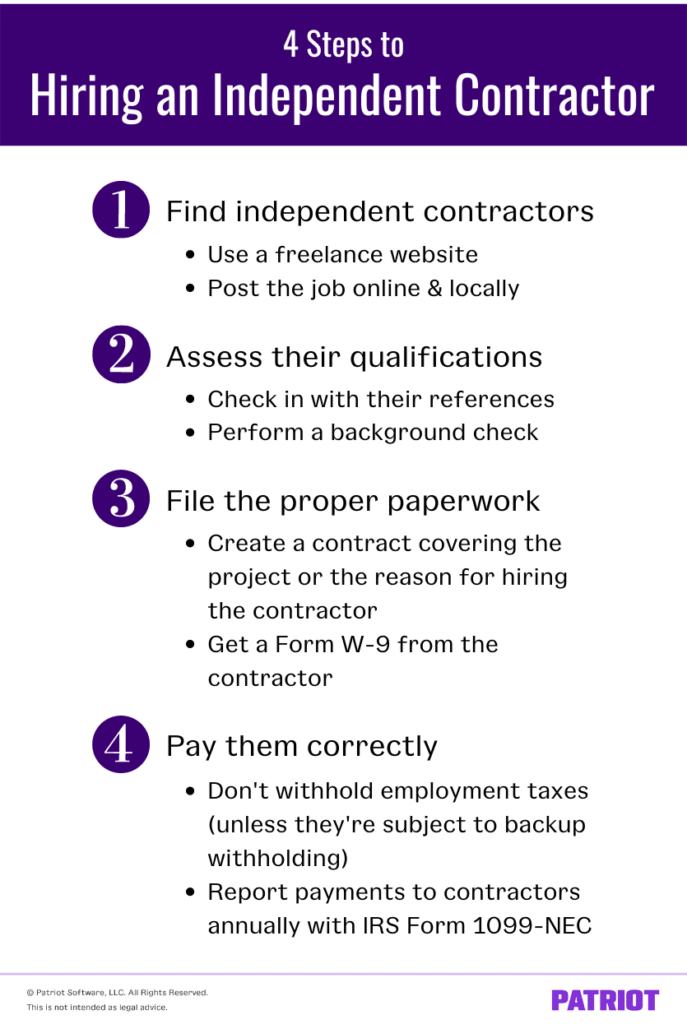

Rest assured, there is an independent contractor to tackle your next project. But to do that, you need to know how to hire independent contractors for your business.

Here are four things to consider:

- Where to find independent contractors

- How to assess their qualifications

- What paperwork to file

- How to pay them

1. Where to find independent contractors

Before you hire an independent contractor, you’ll have to find them first. Here are a few things to try to find the perfect independent contractor for your next project:

- Use a freelance website to get the word out. Freelance websites help you find contractors in your area, compare rates, and read reviews.

- Post the job listing on a job search website. Independent contractors in your area are looking for work. A job search website can help you find them.

- Post the job listing locally. “Help Wanted” signs and local job postings still work, especially for contractors.

2. How to assess their qualifications

So, you’ve found a few possible candidates. But, you still have a nagging question: What to look for when hiring a contractor?

Before bringing on an independent contractor, make sure they represent themselves accurately. Here’s what you should do:

- Look over their qualifications

- Look for online reviews

- Perform a background check

Look over their qualifications

Qualifications can include industry-specific licensing or education requirements. For instance, an HVAC technician will receive an HVAC certification once they’ve undergone the necessary training.

Do some research before you talk to any contractors so you know what qualifications to ask for.

Look for online reviews

Online reviews are a quick way to learn how good a contractor is at their work. Look for the contractor’s business website. If they don’t post user-generated content (e.g., customer reviews), you may want to do some more research. Check other business review sites to see how the contractor is doing.

Perform a background check

Background checks can help make sure that you aren’t contracting with someone who may harm your business or other people. For instance, you may not want to hire an independent contractor known for theft if they’ll be alone in your business after hours.

3. What paperwork to file

Hiring independent contractors requires paperwork. Here’s what you’ll need to get from your independent contractor before they start work for you.

New hire paperwork for a contractor includes:

- A contract that covers the extent of the project or reason you’ve hired the contractor

- The contractor’s Form W-9

Independent contractors must include their tax identification number (TIN) on their Form W-9 (e.g., their Social Security number).

4. How to pay them

If you have employees, you’re used to withholding income and FICA taxes and paying unemployment taxes on their wages.

But, you generally don’t need to withhold or pay taxes when paying a contractor. You only need to withhold taxes from a contractor’s wages if their earnings are subject to backup withholding.

Report payments to contractors annually using IRS Form 1099-NEC, Nonemployee Compensation.

Independent contractors may be perfect for your next project. Make sure to pay them correctly. With Patriot’s Full Service payroll, you can run payroll for employees and contractors at the same time. And, Patriot will e-File 1099s for Full Service Payroll customers at no additional charge. Start your free trial now!

This is not intended as legal advice; for more information, please click here.