I feel like investors are reaching a point of losing faith…and maybe that’s good.

But how is that measured? How do we gain insight into the way people are FEELING about the market?

Well, you will hear a ton about “consumer sentiment” this week because two reports used to measure how people are feeling are due this week.

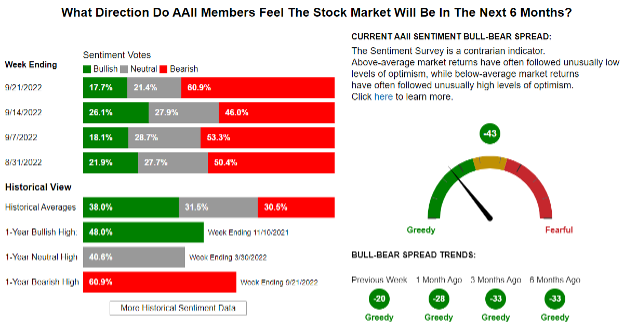

On Tuesday, we will get the Consumer Confidence Index report, and on Friday, we will get the University of Michigan Consumer Sentiment Index report. These two upcoming reports come on the heels of last week’s American Association of Individual Investors Sentiment Survey (the AAII Survey) – more on that below.

Look, I don’t think anyone expects a ton of gleeful bullishness from the upcoming reports, but what do they help us understand?

Here are some of my thoughts, perspectives, and opinions.

According to the AAII, the Sentiment Survey “offers insight into the opinions of individual investors by asking them their thoughts on where the market is heading in the next six months and has been doing so since 1987.” More can be found here.

So, by looking at the last AAII Survey, you’ll see as of 9/212022, almost 61% of those surveyed are bearish about the upcoming six months in the market.

That’s a lot of investor fear and worry.

But…let’s put that into some historical context by looking back in time.

This is the fifth time since 1987 that the survey has hit a 60% bearish reading.

It’s also the highest level of bearish sentiment since the very first week in March of 2009 when the percentage of bearish votes hit 70.3%.

BTDubs (By the way), that date should ring familiar as the bottom of the Great Financial Crisis bear market. But what does that actually tell us?

While nothing will accurately predict the future no matter how high someone’s conviction is, let’s at least look at what happened the four other times the votes hit a 60% bearish level.

In 1999, the survey hit the 60% bear mark on 8/31/1990 and again on 10/19/1990…that was the Gulf War and oil price spike. I would have felt bearish, too. (In fact, talk about bearish, I was in infantry training as a Marine Corps Second Lieutenant.)

Anyway, 12 months after each of those two dates, the S&P 500 was up 23% and 26%, respectively.

After that, the reading didn’t hit the 60% mark again until 10/9/2008.

That should be a time most everyone remembers feeling pretty shitty…Lehman Brothers had just collapsed, JP Morgan bought Bear Stearns for what amounted to pennies on the dollar, and Merrill Lynch almost went out of business over a weekend and had to be rescued by Bank of America in the 11th hour.

It was when another advisor friend of mine said, and I’m not making this up, “I think we could see the S&P 500 literally go to zero.”

Twelve months later, the S&P 500 was up 18%.

The 4th time the survey hit a reading of 60% or higher was on March 5th, 2009.

The percentage of bearish voters got to 70.3%, the highest bearish reading in survey history.

Twelve months later, the S&P 500 was up 67%.

What will happen this time is something that no one can forecast. However, I will offer that it is a seemingly decent signal that we are much closer to the market bottoming out that an indication that things will continue to get much worse.

Could things get worse?

Of course they could. However, let’s look at the S&P 500 afterward:

- 30 days after the date the survey hit a 60% reading, only ONE of those four instances posted a negative return…at – 2.3%.

- Ninety days later, two of the four instances were negative, and those losses were -0.01% (so let’s be optimistic here and call it zero) and -2.2%.

- Six months later, there was one instance where the S&P 500 was negative. And that loss was -5.6%…but that was six months after the 10/9/2008 survey, so that makes sense as the market was climbing out of a deep hole.

It’s also worth mentioning that of the four previous times the threshold crossed 60%, it was clumped into the calendar year of 1990 and essentially a six-month window between 2008 and 2009.

To be clear, I’m not suggesting there aren’t legitimate concerns – I will write more about those in the coming days.

I’m just suggesting that a lot of people aren’t expecting the market to get better,

And frankly, that may just be one of the most significant risks facing investors right now. People should keep owing the stocks of good companies that are still doing good business. If you don’t need the money today but are selling those companies simply because you don’t like seeing them trading at the same level as March of 2021, that’s a mistake.

Be sure to listen to our most recent episode of our Off The Wall Podcast, where Erin, Jessica, and I discuss this in further detail—it’ll be posted by close of business today (9/27/2022).

Keep looking forward.