Few things are more dangerous to investors than getting a big thing right.

Once you’ve tasted the sweet nectars of massive returns, average just won’t move your internal needle. Instead of trying to get on base, you go for the grand slam walk-off home run. Such is the story of many famous investors who got rich and famous at one specific moment in time.

John Paulson is one of these people. Gregory Zuckerman does a wonderful job telling the story of how Paulson made $20 billion shorting the housing market in The Greatest Trade Ever. Since then, he’s had a tough time trying to make a few more big calls along the way. I’m not throwing shade, I think the desire to recapture that feeling is very human. Who wouldn’t want that?

So I have to give him a lot of credit for some recent remarks he made about the housing market. It would be easy for him to capitalize on “the big short 2.0.” I’m sure he could raise billions of dollars in a week if he wanted to take another crack at the housing market.

When asked to compare and contrast now versus then, this was his response:

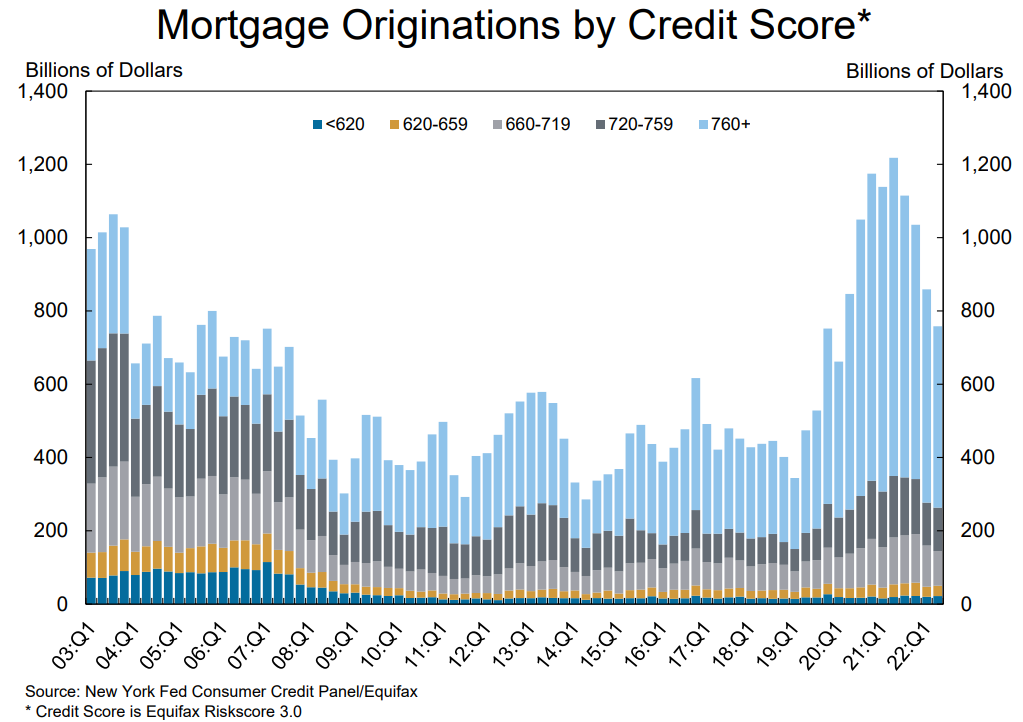

Well the financial market, the banking system and the housing market are much different today than in ‘06 and ‘07. The underlying quality of the mortgages today is far superior. You don’t even have any subprime mortgages in the market … And the FICO scores are very, very high. The average is like 760. And the subprime, they were averaging 580-620 with no down payment. So in that period, there was no down payments, no credit checks, very high leverage. And it’s just the opposite of what’s happening today. So you don’t have the degree of poor credit quality in mortgages that you did at that time.

At the live taping of TCAF last week at a MarketWatch event, Josh and I spoke about this exact topic. Look at the credit quality today versus pre-GFC. In the third quarter of 2007, 26% of mortgage origination went to people with credit scores below 660. That number has averaged 5% over the last eight quarters.

After talking about the consumer, Paulson turns his attention to the banks:

The average capital in your major banks was about 3%. And then they had a lot of off-balance sheet exposure as well. So, you know, it doesn’t take a lot to fail if you have, let’s say, a hundred dollars in assets, and then on the liability side you only have $3 in equity and $97 in various types of borrowing. If you’re not really careful on the asset side, all the assets have to do is fall 3% and your equity is wiped out. You go into default. So the problem, in that period of time, the banks were very speculative about what they were investing in. They had a lot of risky subprime, high yield, levered loans. And when the market started to fall, the equity quickly came under pressure.

And it caused the failure, very quickly, of major financial institutions in the US … The banks have recovered. But as a condition going forward, they really raise the equity. Today, the average bank is probably 9% equity, the systemically important banks are 11%-12% equity. So almost between three and four times as much equity as before. So we’re not at risk of a collapse today in the financial system like we were before. Yeah, it’s true, housing may be a little frothy. So housing prices may come down or they may plateau, but not to the extent it happened.

The housing market is not in great shape. Home prices are going to have to come down in order to reflect the new reality of ~7% mortgages. The math just doesn’t work anymore. But people who already are in a home are more than fine. Loans are not going bad. Banks are not hemorrhaging money. Yes this is a tough environment, but it’s not 2008. Credit to John Paulsen for telling it like it is.