Consumer confidence increased for the second straight month to the highest level since April, as solid job gains, declining gas prices and easing inflation contributed to more optimistic views of economy. However, spending plans were mixed. The purchasing intention to buy cars and major appliances increased, while the intention to buy homes fell due to the rising mortgage rates. Looking forward, consumer spending will continue to face headwinds from inflation and interest rate hikes.

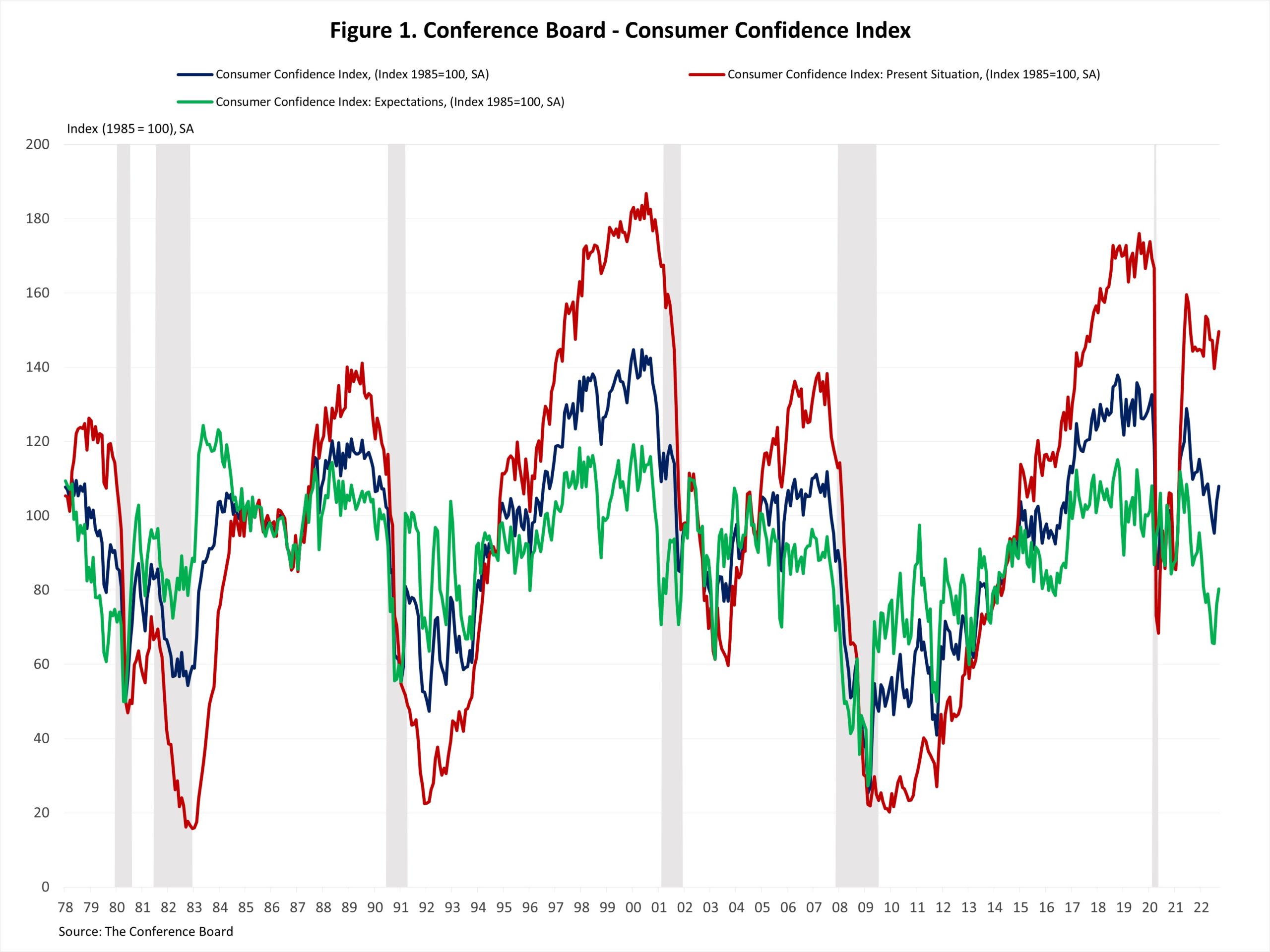

The Consumer Confidence Index, reported by the Conference Board, increased 4.4 points from 103.6 to 108.0 in September, the highest level since April 2022. The Present Situation Index increased 4.3 points from 145.3 to 149.6, and the Expectation Situation Index climbed 4.5 points from 75.8 to 80.3, the highest since February 2022.

Consumers’ assessment of current business conditions improved in September. The shares of respondents rating business conditions “good” rose by 1.8 percentage points to 20.8%, while those claiming business conditions “bad” fell by 1.4 percentage points to 21.2%. Meanwhile, consumers’ assessment of the labor market was more favorable. The share of respondents reporting that jobs were “plentiful” increased by 1.8 percentage points, while those saw jobs as “hard to get” declined by 0.2 percentage points.

Consumers were more optimistic about the short-term outlook. The share of respondents expecting business conditions to improve rose from 17.3% to 19.3%, while those expecting business conditions to deteriorate fell from 21.7% to 21.0%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 0.4 percentage points to 17.5%, and those anticipating “fewer jobs” decreased by 1.9 percentage points to 17.7%.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home stayed slightly fell to 5.3% in September, the lowest level since September 2021. The share of respondents planning to buy a newly constructed home remained at 0.6%, while for those who planning to buy an existing home rose to 2.3%.

Related