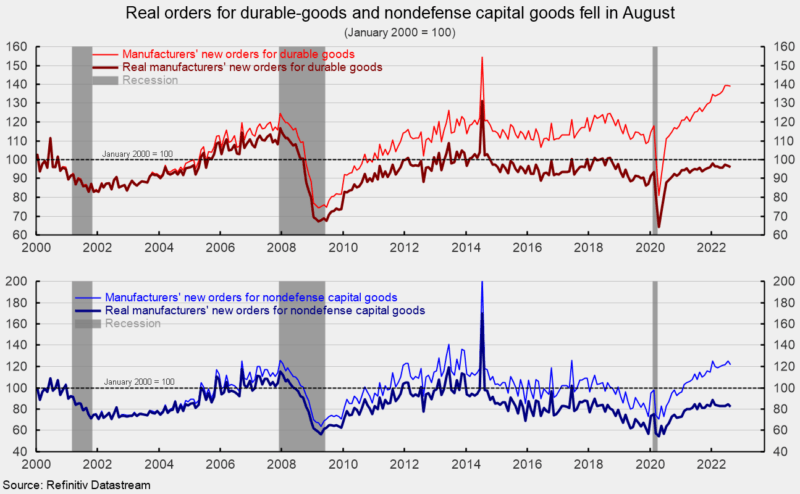

New orders for durable goods fell 0.2 percent in August, following a 0.1 percent fall in July and a 2.3 percent jump in June. Total durable-goods orders are up 9.2 percent from a year ago. The August decline puts the level of total durable-goods orders at $272.7 billion, a still-high result by historical comparison (see top of first chart).

New orders for nondefense capital goods excluding aircraft, or core capital goods, a proxy for business equipment investment, jumped 1.3 percent in August after increasing 0.7 percent in July and 1.0 percent in June. Orders are up 7.3 percent from a year ago, with the level at $75.6 billion, a new record high.

However, rapid price increases have had an impact on capital goods orders. In real terms, after adjusting for inflation, real new orders for durable goods fell 0.6 percent in August following a 0.7 percent decline in July. Real new orders for nondefense capital goods – one of AIERs leading indicators – sank 3.2 percent after a 2.0 percent gain in July (see bottom of first chart). Real new orders for capital goods are trending flat over the past year with the August level about equal to the mid-2021 level. Furthermore, real new orders for durable goods and real new orders for nondefense capital goods remain below their January 2000 level (see first chart again).

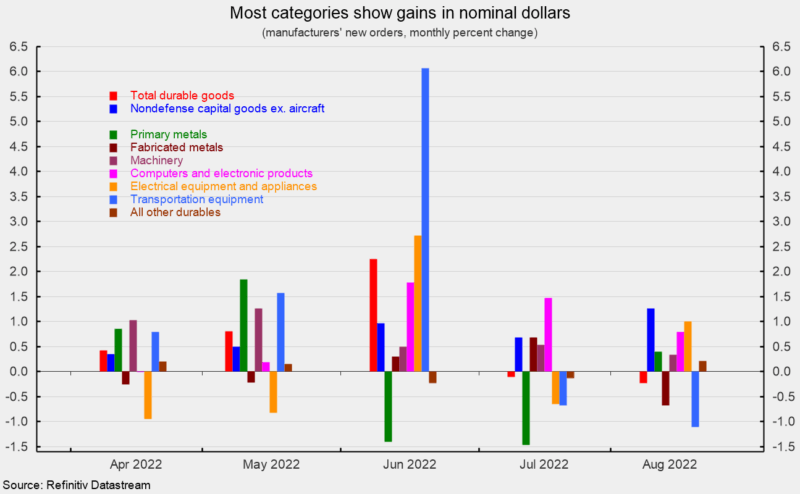

Five of the seven major categories shown in the durable-goods report posted a gain in August, in nominal terms. Among the individual categories, electrical equipment and appliances led with a 1.0 percent increase, followed by computers and electronic products with an 0.8 percent rise, primary metals orders with a 0.4 percent gain, machinery orders up 0.3 percent, and all other durables adding 0.2, percent.

On the downside for the major categories, transportation equipment fell 1.1 percent, and fabricated metals orders declined by 0.7 percent (see second chart). Within the transportation equipment category, nondefense aircraft sank 18.5 percent following a 12.1 percent jump in July, defense aircraft jumped 31.2 percent, and motor vehicles and parts were up 0.3 percent. Every major category shows a gain in nominal dollars from a year ago.

Durable-goods orders have posted a strong recovery from the lockdown recession measured in nominal-dollars. However, after adjusting for price increases, real orders for durable goods are rising at a very slow trend growth rate. Nominal new orders for capital goods are also growing briskly but in real terms, the trend is flat. The outlook remains highly uncertain as sustained upward pressure on prices distorts activity and impacts decision making. Despite substantial progress, labor and materials shortages continue to challenge businesses. Furthermore, the fallout from the Russian invasion of Ukraine and periodic lockdowns in China continue to disrupt global supply chains. Finally, the Federal Reserve has intensified the current interest rate tightening cycle, boosting the probability of a policy mistake. Caution is warranted.