The renminbi’s sharp fall over the past week started after regulators told traders they were relaxing informal foreign exchange trading limits, according to people familiar with the matter.

The State Administration of Foreign Exchange frequently uses informal “window guidance” to manage the exchange rate, sometimes discouraging participation in renminbi-dollar trading in order to slow depreciation of the Chinese currency.

But two people familiar with the matter said SAFE officials privately communicated an easing of the informal limits on transactions in China’s interbank market to foreign exchange brokers on Wednesday last week, in the wake of the US Federal Reserve’s 0.75 percentage point interest rate rise.

The move to relax curbs on transactions was made because policymakers “believed it was the proper time to let the renminbi depreciate a bit”, one of the people said.

SAFE did not immediately respond to a request for comment.

The easing of informal trading limits marks an inflection point for the tightly managed renminbi. The currency is subject to extensive capital controls and its dollar exchange rate cannot swing more than 2 per cent in either direction of a daily trading band midpoint set by the People’s Bank of China.

Less than a week after the move by SAFE, however, top officials began making public statements that pushed back against sharp falls for the renminbi. This about-face reflected what traders and strategists said was Beijing’s focus on preventing runaway depreciation that could threaten financial stability and spur more capital outflows, as Chinese policymakers attempt to boost lagging economic growth.

In the highest-profile comments from a government official since the currency dropped below Rmb7 against the dollar last week, Liu Guoqiang, vice-governor of the People’s Bank of China, struck out on Wednesday at traders betting on losses for China’s currency.

“Do not bet on either one-way depreciation or appreciation of the exchange rate,” he warned, at a meeting held by the industry body responsible for self-regulating China’s foreign exchange markets. “The longer you bet, the bigger the chance you’ll lose.”

The comments helped bolster the renminbi, which rose 1.1 per cent against the dollar after the PBoC also released a statement late on Thursday afternoon vowing to “strengthen expectation management and maintain the basic stability of the renminbi exchange rate at a reasonable and balanced level”.

But foreign exchange traders, economists and markets strategists said Liu’s warning was unlikely to turn the tide in favour of the renminbi, which is down almost 11 per cent against the dollar this year at about Rmb7.13 and on course for a record yearly fall.

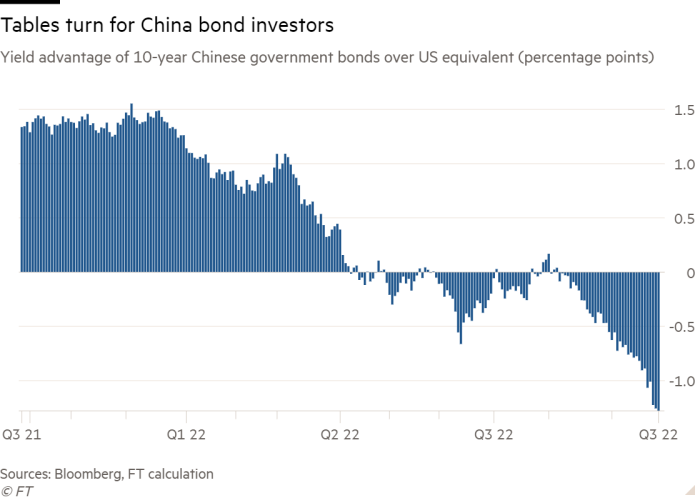

Traders in Shanghai said losses for the renminbi were primarily driven by a widening policy divergence between a hawkish Fed and a dovish PBoC working to shore up flagging growth.

The upshot is that the longstanding interest rate advantage of Chinese government debt has been reversed, removing a critical driver of global investor inflows. Data from Hong Kong’s Bond Connect programme show foreign outflows of almost Rmb530bn ($74bn) from China’s renminbi bond market during the first eight months of 2022.

Another reason Beijing has taken a relaxed attitude towards the renminbi’s depreciation is that exchange rates have remained relatively stable against a broader basket of global peers. The CFETS Renminbi index measuring the currency against China’s biggest trading partners is down less than 5 per cent from its most recent peak in March.

“I would say this time the PBoC won’t have to sell a lot of foreign reserves,” said Wei He, an analyst at consultancy Gavekal Economics in Beijing, who pointed to the capacity of domestic financial institutions to step in when called upon by the state.

With rate rises by the Fed boosting returns on dollar debt, and as Chinese policymakers continue easing to support growth, analyst expectations are growing that the most likely reason for a halt in the renminbi’s fall may be a US recession.

“If the US goes into recession, the Fed might actually pivot and start lowering interest rates — that would help the renminbi because the interest rate spread [between the two countries’ bonds] would narrow,” said Steve Cochrane, chief economist for Asia-Pacific at Moody’s.

But he added that while this would help stabilise the renminbi’s exchange rate, “from the point of view of exports, a US recession would weaken the Chinese economy” as external demand for goods from China waned.

Until the Fed stops raising rates, the PBoC is unlikely to burn through the country’s foreign exchange reserves trying to defend any specific level for the renminbi’s dollar exchange rate, according to analysts.

Instead, many expect China to continue a drip feed of measures such as those seen this week. On Monday, the PBoC introduced measures to discourage bets against the renminbi through the country’s derivatives markets. Such moves are typically introduced in China during periods of currency depreciation.

One Shanghai-based foreign exchange trader with a European bank said the move on Monday “can be counted as a gesture, instead of really a game changer for the market’s direction”.

Another major factor in the renminbi’s trajectory is how China manages its anticipated loosening of strict zero-Covid policies over the coming quarters. Some strategists expect that a swift and comprehensive opening that allows for outbound tourism would be negative for the renminbi — but others warn that this scenario is unlikely.

“If China’s opening is staggered in the way we expect, without any outbound tourism, that will be risk-on and good for the domestic economy, which will send the renminbi higher against the dollar,” said Danny Suwanapruti, head of Asia emerging markets foreign exchange and rates strategy at Goldman Sachs.

However, Suwanapruti added that because of low liquidity in the offshore market for the renminbi in Hong Kong, traders would focus on other currencies in the region that often serve as proxies for the renminbi’s exchange rate, following the Chinese currency higher when it rallies.

“The South Korean won is just cleaner than trying to play the dollar-offshore renminbi,” he said.