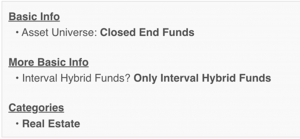

You cannot praise them enough. Don’t take my word. Look at the MFO Premium search engine:

Results sorted by AUM with Year-to-date Returns and other metrics:

Among these are Great Owls, Fund Alarm Ratings Honor Rolls, MFO 5 Rating, MFO 1-2 Risk, Sharpe Ratios that touch the sky, Max drawdowns of no more than a 2-3%, Year to Date Returns ALL POSITIVE!

The biggest fund, Bluerock Total Income (TIPRX), is up 16% on the year!! We are talking about 2022, my friends, not 2021. While the rest of planet earth’s financial markets burn, these funds have been having a moment in the sun. Their phenomenal performance begets questions:

- What do these funds do?

- How are they structured?

- Why are they doing so well?

- Will their good performance continue?

What do these funds do?

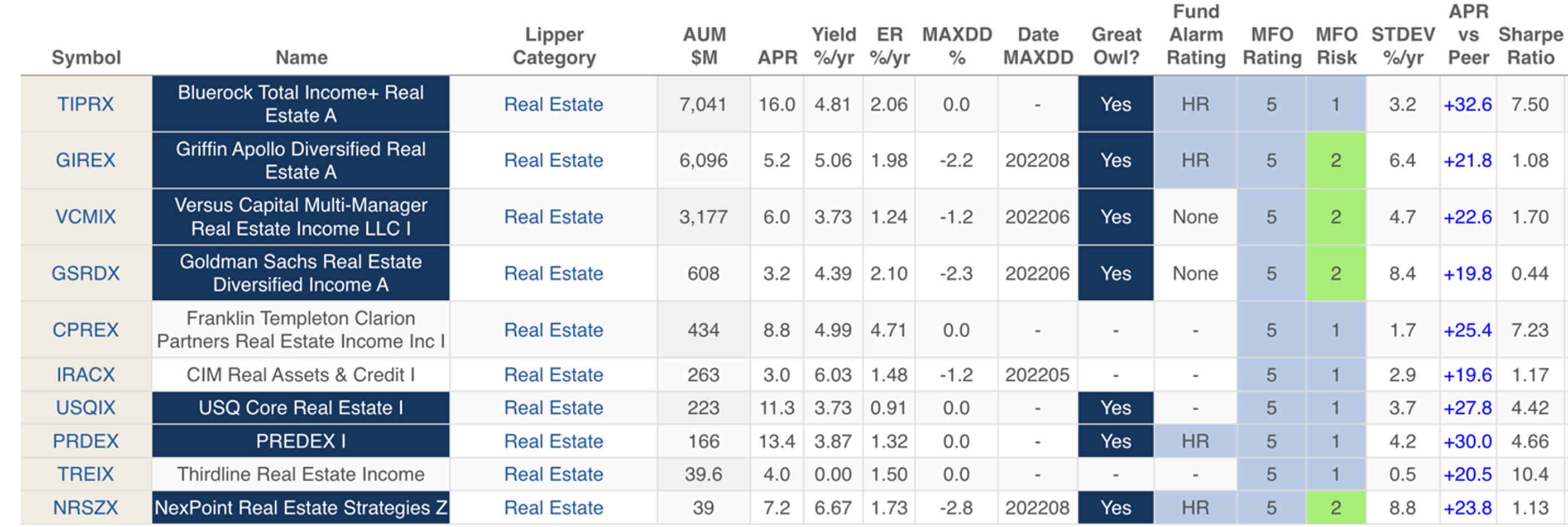

They are funds of funds. These funds are investors in institutional Private Real Estate funds. They may also invest in public REITs, public REIT ETFs, and the debt of REITs. They belong in the US Domestic Real Estate investment bucket. By picking best-in-class real estate managers and their funds in their portfolio, these closed-end funds hope to earn income and gain capital appreciation.

Bluerock’s online description of the fund’s strategy provides an intuitive understanding of their investment portfolio:

How are these funds structured?

Closed-end funds can be bought anytime but cannot be sold daily.

As these are also interval funds, they offer the unit holders an opportunity to redeem once a quarter, although this can differ from fund to fund.

No more than 5% of the fund can be redeemed in a quarter. These funds need liquidity gates because they are holding illiquid private real estate funds, which cannot be sold. Usually, the funds carry 5-10% in cash to facilitate redemptions.

They do not take leverage, but that says nothing about the leverage held by the underlying fund investments or the actual properties.

In the recent past, about 45-50% of shares submitted for redemption at Bluerock (as an example) have been accepted for redemption.

They charge about 2% fees on average. There are multiple share classes.

If the fund is held for less than 12 months, it may incur a 1% penalty to exit. A detailed reading of the prospectus is required to determine the loads for each share class.

Why are they doing so well?

This is a legitimate question in 2022. Compare these funds to the total return of broader asset classes to Sep 26th of this year:

- the S&P 500 Index ETF SPY: down 22.4%,

- iShares Core US Aggregate Bond ETF (AGG): down 14.7%

- the Vanguard Real Estate ETF (VNQ): down 28.5%

- the iShares US Real Estate ETF (IYR): down 27.5%

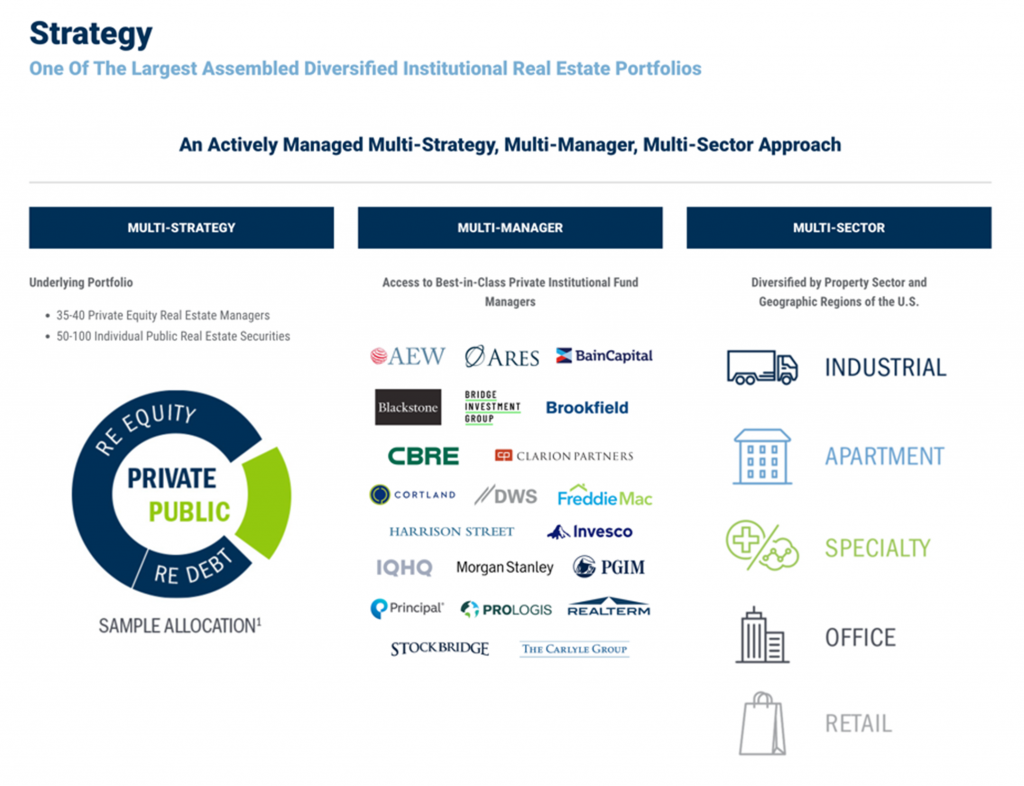

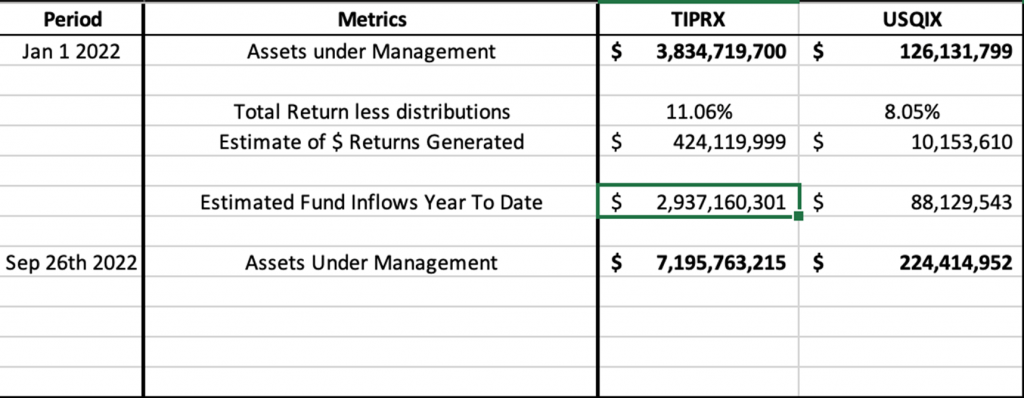

Contrary to the massive volatility seen in publicly marketable securities, these closed-end interval private real estate funds have performed beautifully over the past few years. Here are the numbers for two of the funds:

As a result, there has been little reason for investors to want to sell these funds. In fact, quite the opposite has been happening – these funds have been receiving substantial inflows this year. Take the above two funds as an example:

My back-of-the-envelope calculations show that Bluerock has gone from managing $3.8 billion in assets at the end of the year to $7.2 billion now. Of this change, almost $3 billion comes from new money. Combined, these funds of funds have received over $5.28 Billion in the last 1 year.

It thus appears that investors have tried to seek protection from rising interest rates, falling equities, rising real yields, and rising risk premiums by hiding in these funds standing tall.

Meanwhile, the big passive public REIT ETFs, Vanguard ETF (VNQ) and Ishares (IYR) have lost over $31 billion in Assets from Outflows, besides losing $30 Billions in market returns.

This still doesn’t explain why these fund of funds are doing well. I suspect it has to do with two features of these closed-end funds:

- Their private holdings have not yet been marked down.

- Their investors are gated and can sell very little of the fund each quarter in aggregate.

Intuitively, this makes sense, even though it is hard to get asset-level confirmation on private fund holdings. Nobody denies these have been great investments. I am not even questioning their institutional high-quality portfolio. The only question is if they have done their job a little too well and if it’s time for the savvy investor to say thank you and move on.

Will their good performance continue?

Lesson from Private Equity Secondary Market: Institutional Investor magazine’s Hannah Zhang penned an article in the August 2022 magazine, “Prices Are Dropping as Investors Sell Private Equity Stakes at a Record Pace”. She writes …According to Jefferies, the average winning bid of secondary private equity stakes was 86 percent of net asset value in the first half of 2022…

If Private equity assets are selling at a 14% discount, will private real estate assets meet a different outcome? I don’t think so. Real rates are much higher, and risk premiums much wider than even the first half of 2022. The private real estate portfolio, even if it is invested in the best of all assets, will go through a markdown.

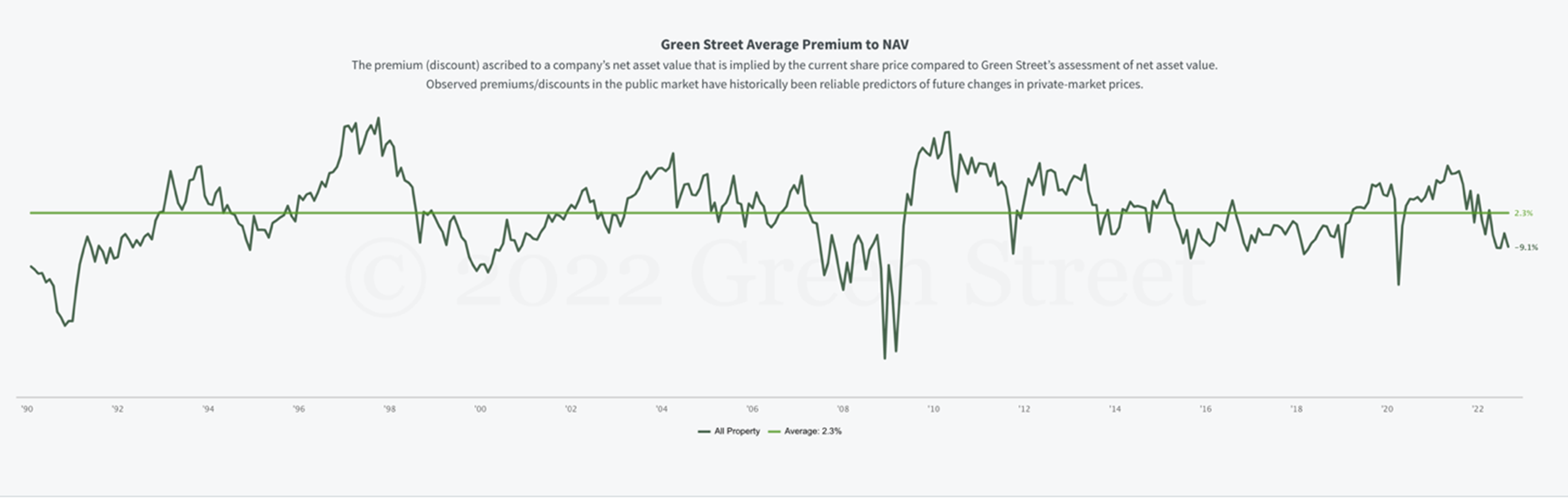

Green Street Advisors Public to Private REIT NAV Comparison:

Green Street Advisor is the preeminent independent research and advisory firm concentrating on the commercial real estate industry in North America and Europe. The firm maintains a measure of Public REITs Share Prices to Green Street calculated NAVs going back to 1990.

The chart reads that share prices trade at a 2.3% average premium to their NAVs in the 1990 to 2022 period. However, REIT shares prices are currently trading at a 9.1% discount to the NAV. One can see earlier periods of discounts and premiums. The chart will not too data friendly is intuitive to a market follower.

It’s unclear when, in 2022, the chart was updated, but things have only worsened in the last few months and weeks.

In addition, Green Street writes on the chart: “Observed premiums/discounts in the public market have historically been reliable predictors of future changes in private-market prices.”

In short, Private REIT prices are primed to head down. It is a matter of time.

In 2020, private REITs did not mark down because the share prices rebounded quickly enough. I am not sure if we will have that luxury this time.

Conclusion

Closed-end interval private real estate funds have done very well for their early and loyal investors. This is a tough year. There are many assets available at far cheaper prices than just 9- months ago. Some of them even deserve our attention. To buy cheap assets, sometimes we have to sell other assets that have done their job for now. We must say thank you and (try) to move on from these funds. It won’t be easy because of the redemption gates. The early bird will catch the worm. There will be a time in the future to come back to these funds, but for now, it’s time to say bye.