Background:

Hypoport has been one of the sore points in my investing history. I have been looking at this company several times, quite intensively in 2013 but never “pulled the trigger”. Hypoport has been a “FinTech” before this expression has been used. The business is not so easy to explain and comprises 4 different segments with several companies within these segments.

Recently, the share price of the company has been hammered after they gave a profit warning, despite having decreased already -75% from their peak before that profit warning. Time to look at Hypoport again.

Business:

- Loan platform “Europace”

This is clearly the flagship product of Hypoport although it doesn’t seem to be well understood or known. Europace is a B2B market place that gathers different mortgage offerings and combines these offerings combined with other useful tools to professional advisers who then actually make the deal with retail customers.

In 2021, this platform grew by 22% to sales of 207 mn EUR, EBIT increased to 56,6 mn EUR (+44%), resulting in an EBIt margin of 27,3%. As far as I understand, Europace gets on average around 0,10% of the volume every transaction that runs via its platform. The current market share of German retail real estate financing was around 20%. so revenues clearly depend both, on real estate activity but also price levels.

What I find extremely remarkable is the fact, that Hypoport managed to penetrate both, the German Sparkassen as well as the Cooperative banks which own a very large share of the German retail market.

2. Private clients “Dr. Klein”

Dr. klein is a Franchise based retail client distribution company that focuses on mortgages and other financial products, including insurance. The Privat client segment managed to grow 10% in 2021 to 135 mn in sales and an EBIT of 23 mn EUR (+29%). Dr. Klein is also a client of Europace.

Dr. Klein seems to be the second largest mortgage distributor in Germany and almost forming a Duopoly with market leader Interhyp ( a subsidiary of ING).

As Europace, the revenue is a function of mortgage activity and size. to my knowledge, a mortgage distributor earns around 1% of the mortgage amount as a fee from the issuing bank.

3. Real estate platform

This platform is targeted towards real estate agents in order to help them performing their services as digital as possible. It comprises features such as valuation (for Mortgages) as well as other real estate related services.

This Segment grew 10% to sales of 58 mn in 2021, EBIT was a negative 8 mn EUR due to investments. Interestingly, Gross margins in this segment are >90%.

4. Insurance platform

Here they offer tools to manage portfolio of insurance contracts and to enable comparisons. The clients here are mostly independent brokers and banks. In this area, they compete with JDC and Netfonds.

This has been the segment with the weakest growth in 2021 (+7%), Overall this segment had sales of 48 mn EUR and an EBIT of -3 mn EUR.

Business model overall:

With regard to the business overall, I find it very interesting that in the public, Hypport is mostly referred to as a mortgage distributor, whereas in reality the main business is clearly the “back-end” platform.

What I really like about the business that it is clearly a powerful B2B platform. The core is clearly the back end solution Europace which is both, the basis for their retail business but also as a hub to add additional services for their clients, such as valuation services, real estate broker solutions etc.

In total, I really like the business model and think it is a very attractive one, especially with regard to the real estate sector.

The CEO Ronald Slabke

I am not sure if Ronald Slabke qualifies as the founder of Hypoport but he is/was clearly the driving force. Initially, he joined Dr. Klein as an assistant to an MD and later became responsible for digitizing Dr. klein’s operation. He then managed to do a management buyout and then merged Dr. Klein with Europace in 2001. In 2007, he took Hypoport public at 15,25 EUR per share. Slabke still owns 34,5% of the company and effectively controls it.

He is 49 years old and quite outspoken, especially on his Twitter account. There is a quite interesting Podcast with him from September 2021 when Slabke was still a Billionaire.

Overall, I am very impressed with what I have heard from him. He bootstrapped the company and seems to be relentlessly focusing on the company. Other Fintech founders are in parallel business angels, whereas he has all his money in Hypoport. he also had already the chance to manage through a crisis which most of the other Fintech founders have yet to achieve.

The willingness not to try to please the investment public but concentrating of building the company is something that one doesn’t see these days very often.

Share price

Hypoport went public on October 2007 at 15,25 EUR per share. 1 year later, the stock was down ~2/3 at 5 EUR. The stock then oscillated for a few years between 7-10 EUR per share before then increasing by more than 100x compared to its ATL to an ATH of ~600 EUR in 2021:

As we can see, the stock started to drop together with other tech stocks in the second half of 2021 and then got really hammered over the past few days.

Valuation – first attempt

Even despite that huge drop from 600 EUR to currently 90 EUR, Hypoport is not super cheap. With a market cap of 550 mn EUR and an EV of 680 mn EUR (~60 mn debt, 80 mn Leasing), based on 2021 earnings this translates into ~15-16x P/E and 13-14x EV/EBIT according to TIKR.

There are a few positive aspects: Hypoport invests a lot in growth, of which ~ 50% is directly expensed in the P&L. Also the first 6M really looked great, with top-line being up +23% and EBIT even up 38% (as EPS).#

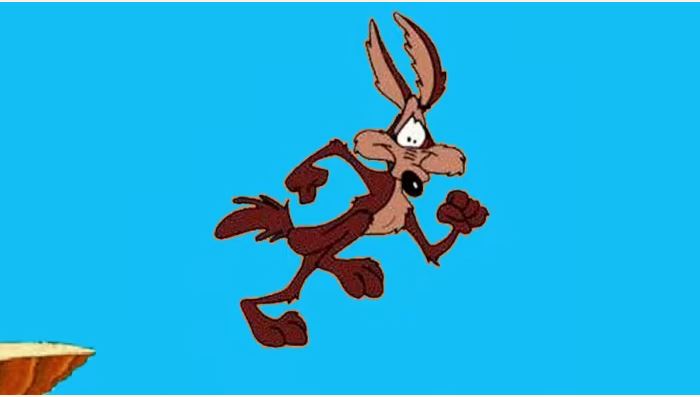

The Wile E. Coyote Moment

However in the last weeks, according to several sources and “scuttlebutt”, the German residential real estate market seems to have come to a complete stop. This is what these days is called the Wile E. Coyote moment:

So far, Hypoport expected 500-540 mn in sales and 51-58 mn in EBIT. After having achieved already 30 mn EBIT in the first 6M with the traditionally stronger second half in front of them, the announcement that they will be significantly below the guidance is clearly a big warning sign that very hard times are already here.

A quick look into TIKR estimates show that analysts seem to expect -20% in EBIT compared to 2021 for this year but that 2023 will already be at 2021 levels. To me that sounds a little bit too optimistic.

As shown above, Hypoport’s sales correlate directly both with the price level but especially with the activity in the German residential real estate sector. 2021 was clearly a boom year as well as the first 6M 2022. However I have currently no idea when the market will come back and at what level. With high interest rates, high energy costs and a looming recession it is not clear how the overall sector will develop in the next few years. Even the CEO seems to have been very surprised by this sudden drop.

Looking back at a share price of 600 EUR, it is easy to say that Hypoport was overvalued at a 100x Earnings and 75x EV/EBIT, but at that time (last year) anything that had good growth prospects was valued to perfection.

Overall, at this stage I find it hard to value Hypoport without having an opinion on where German/Residential real estate will go in the next years. I also have to be careful in managing exposure, as my (badly timed) “freedom insulation” basket already exposes me to that sector as well as investments into Thermador, Meier & Tobler and Solar.

Summary part 1:

Hypoport in my opinion is a very interesting company. It has a very attractive platform business model and seems to be led by a owner/operator who is very dedicated to the company and has a very good track record.

However, the company fully depends on the German residential real estate market which seems to have been frozen completely by the time of writing.

At the moment I would not feel confident to invest into Hypoport without knowing how far down Wile E. Coyote might fall.

To be continued…..