This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. We all have our petty dignities. Ours is refusal to write about Elon and Twitter. But there was plenty going in the market’s less absurd corners, including a job openings report that encouraged stocks, already primed to rise, to rise faster still. Is this rally a repeat of August’s false dawn? Let us know what you think: robert.armstrong@ft.com and ethan.wu@ft.com.

Cooling in the jobs market

Remember Fed governor Christopher Waller’s theory of a soft landing?

Here’s a refresher. Waller argues that the pandemic has changed the labour market. Specifically, job vacancies — a measure of labour demand — have been much higher relative to unemployment. This creates the possibility that tighter policy could lower vacancies — that is, labour demand — without raising unemployment. Wage growth, and therefore inflation, would fall too.

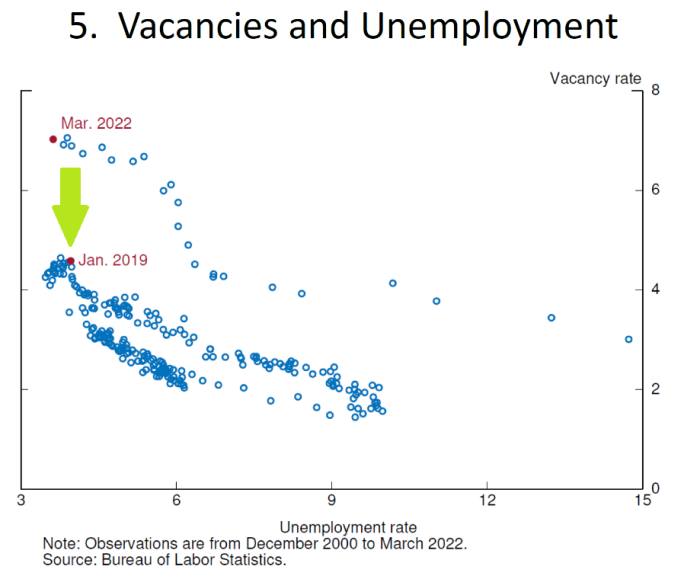

The graph below from Waller (which we’ve shown you before) plots the vacancy rate against unemployment, where each dot represents one month. The shift he envisions would track the green arrow below, snapping back to the pre-pandemic regime:

We’ve been sceptical of Waller’s theory. It’s hard for us to see why tighter monetary policy — which works by indiscriminately whacking demand — would narrowly lower job openings without also dragging up unemployment. Plus, as Skanda Amarnath of Employ America has noted, the vacancies data just might not be that reliable. It is, after all, cheaper and easier than ever to post a job listing online.

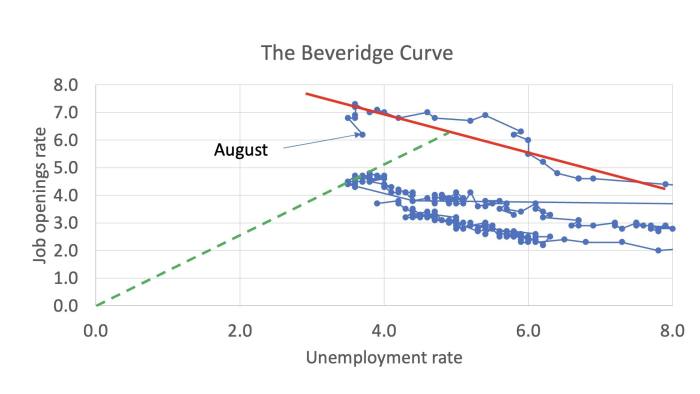

Yesterday brought data that made Waller look prescient. Job vacancies in the latest Jolts survey fell hard, with 10 per cent fewer openings in August than July. Add this to anecdata on hiring freezes and lay-offs in some sectors, and some are already spotting a cooling labour market. Paul Krugman of the New York Times tweeted out this updated version of Waller’s vacancies vs unemployment chart (called the Beveridge curve), with the latest data flagged:

Krugman writes:

Two more months like that (unlikely, but still) would restore the old [relationship between vacancies to unemployment]. This suggests that the disruptions in the labour market may be healing.

Yes, one month’s data, don’t count your chickens etc. But this was the best economic news I’ve seen for a long time.

This could impact Fed decision-making. Ian Shepherdson at Pantheon Macro called it a “potential Fed game-changer”, arguing:

The frequency with which Mr Powell refers to this number indicates that it is taken very seriously within the Fed . . . two more Jolts reports will be released before the December [Fed meeting], and if they look like August’s the Fed will not be hiking by 50bp or more at the final meeting of the year.

Maybe. We’d read the openings numbers more cautiously. Consider the big picture. Inflation is the real target here. It is edging down but still hot, and the Fed has set a high bar (“clear and convincing evidence”) for letting up on rate increases. And even just looking at labour market indicators, normalisation is a ways off. The quits rate, a more reliable measure of tightness than job openings, is still well above pre-pandemic levels. At the pace quits have fallen from their December 2021 peak, it would take 11 months to normalise:

From wage growth to hours worked, nearly all labour market charts look like the one above: off their peaks, but far from normal. Financial markets care chiefly about change at the margin, but the Fed has made clear that it will wait until the trend is obvious. Much still needs to go right. (Ethan Wu)

China’s property crisis, global disengagement and the return to low inflation

Everyone should read the big read on the Chinese property crisis by our colleagues James Kynge, Sun Yu and Thomas Hale. Here’s the core argument:

-

China’s introduction of the “three red lines” debt limits in 2020 left developers without the capital to complete pre-sold housing projects. These “hung” projects sparked a rout in the bubbly property market.

-

Broke or near-broke property developers, no longer able to contemplate new projects, have bought much less land from local governments.

-

This has left local government financing vehicles (LGFVs) short of funds and at risk of default. LGFVs are the main source of funds for infrastructure projects, from roads to power plants, and the LGFV debt stock is equivalent to half of China’s annual GDP. Yikes.

-

The underlying problem? Falling returns on debt-financed private and public projects. The killer quote, from a US investor: “The LGFVs took on debt at around 6 per cent and get returns on equity of maybe 1 per cent . . . Most of them rely on subsidies from local governments. But now that local government revenue from land sales are down, a lot of the subsidies are just stopping.”

-

The government has the means to stop this “slow motion crisis” from speeding up. But the debt-driven growth model of recent decades appears to be defunct.

-

This has global implications: “Between 2013 and 2018, according to a study by the IMF, China contributed some 28 per cent of GDP growth worldwide — more than twice the share of the US.” A contribution near that level seems unlikely in the future.

This final point fits into a debate we have aired in the space several times (most recently last week). Is the current economic moment an aberrant incident within the low inflation regime of recent decades, or an inflection point and a taste of a more inflationary world to come? If China’s growth phase is over, that supports the former position. A slow-growing China should be deflationary.

A point that seems crucial to Unhedged is that change being forced on China by the property crisis is reinforced by deliberate changes in Chinese policy — by the plan to create of what Kynge has called “fortress China”.

In this context, it is worth reading the latest position paper from the European Chamber of Commerce in China. It opens as follows: “Although Europe and China already sit at opposite ends of a shared continent, it seems they are drifting further and further apart.” A litany of complaints follows: regulations covering foreign forms are becoming more stringent and less predictable; barriers to new entrants to the China market are rising; efforts to reform China’s state-owned entities, which dominate key industries, have stalled.

The chamber’s report does not name specific companies. But this summer, for example, the head of carmaker Stellantis (the product of the Fiat Chrysler/Peugeot merger) warned “there is growing political interference in the way we do business as a western company in China”, after Stellantis dissolved a manufacturing joint venture with a Chinese partner.

Beijing’s zero-Covid policies make all this worse, but the chamber sees those policies as extension of, rather than an aberration from, business policy generally. Ideology is trumping economy. The reforms and opening up of the 1990s are a thing of the past. As a result, the chamber argues, European companies that were once intent on expanding in the country are increasingly focused on meeting the challenges facing their existing Chinese operations. European investment in China is declining, and is now dominated by just a few large companies. Businesses are actively exploring diversification of supply chains away from China.

The picture painted by the chamber’s report matters for the trajectory of global growth. It suggests that not only will China struggle to grow quickly as it transitions away from the borrow-and-build model, but that growth is no longer a top priority of China’s policymakers — at least not growth of the outward-facing sort that the rest of the world has gotten accustomed to.

One good read

How in tarnation do you archive the internet? Turns out it’s pretty hard.