Josh Martin

Everyone likes a bonus – be it a bonus in pay, or a bonus episode for your favourite TV show. Everyone, that is, except statisticians. Bonuses are hard to define and measure and are often excluded from data on pay. But bonuses could be really important to understand labour market tightness – a topic of much interest at the moment. This blog takes a quick walk through some pay measures, highlighting the role of bonuses, and exploring what has happened to bonuses before, during and since the pandemic.

A frequently used measure of pay by the Bank of England is Average Weekly Earnings (AWE) regular pay for the private sector, published by the Office for National Statistics (ONS). AWE statistics are available for many industries and sectors, and with various inclusions and exclusions. ‘Regular pay’ statistics exclude bonuses and arrears (such as overtime).

Focusing on regular pay allows us to more clearly see the trend, since it avoids influence from often volatile components of total pay. That means regular pay is probably more appropriate as a measure of inflationary pressure over the medium term. However, since it omits bonuses, it may not fully reflect wage dynamics over the business cycle.

Businesses appear to be using bonuses to attract or retain talent in today’s tight labour market, allowing them to compete for talent without locking themselves into higher permanent salaries. As such, focusing only on regular pay (which excludes bonuses) may understate current pay pressure. Bonuses may also have a ‘special status’ with employees – they may be seen more directly as a ‘reward’ and therefore elicit effort in reciprocation (for instance, see Hossain and List (2012) for a behavioural economics view).

To see if bonuses help us understand labour market tightness, Chart 1 shows a simple wage-Phillips curve, with the short-term unemployment rate (a simple measure of excess unemployment) on the x-axis, and rolling-annual growth of nominal pay on the y-axis. Orange circles use ‘regular pay’, and blue circles use ‘total pay’ (including bonuses) – both from AWE. The slope of this simple wage-Phillips curve is steeper with total pay than with regular pay (although the fit is a little worse). That suggests that the wage response to labour market tightness (measured by the short-term unemployment rate) is more pronounced when including bonuses, than when excluding them.

Chart 1: Simple wage-Philips curves, short-term unemployment with regular and total pay, 2001 Q1 to 2019 Q4

Notes: Short-term unemployment refers to less than 12 months in duration. The trend line is still steeper for total pay if using alternative x-axis variables, including unemployment gap measures, adjusting for prices or productivity, and after excluding the outlier in blue (2009 Q1). I have not tested for significance of difference. I use a very simple scatter plot of short-term unemployment and wage growth for ease of visualisation, but more sophisticated models will have superior predictive and explanatory power. For more, see August 2013 Inflation Report, Weale (2014) and Cunliffe (2017).

Source: Author’s calculations using ONS Average Weekly Earnings and unemployment data.

What data is there on bonuses?

Bonuses are hard to define and measure, owing to their irregularity, seasonality, and variety. Bonuses can be individual, team-based, organisation-wide, performance-related, contractual, discretionary, hiring bonuses, retirement bonuses, and more besides. At my last job, some bonuses were paid via shopping vouchers!

Because bonuses are heterogeneous, data on them is quite limited. Average Weekly Earnings (AWE) from ONS identifies some bonuses but not all. The bonus question on the Monthly Wages and Salaries Survey (the survey that collects the data for AWE), asks respondents about ‘bonuses, commissions or annual profit from profit related pay schemes’.

This explicitly excludes signing-on bonuses, or ‘golden hellos’ as they are sometimes called. In a tight labour market like today’s, these signing-on bonuses might be especially important.

Bonuses are highly seasonal – they tend to be highest in March, and are elevated in December, January and February – reflecting typical payment at the end of the calendar and financial years. That makes seasonal adjustment especially important. One way around this is to compare the same month or quarter between years (eg using 12-month growth rates), since they will be affected by seasonality to a similar degree.

A recently launched ONS data series – Average Labour Compensation per Hour worked (ALCH) – captures all labour compensation, consistent with National Accounts definitions. This will include wages and salaries in cash and in kind (eg company cars), bonuses (including all the types listed previously), overtime pay, sick pay, maternity and paternity pay, and non-wage labour costs such as employer pension and National Insurance contributions. ALCH also accounts for self-employment labour income (taken as a share of mixed income). This should give us a better read on total pay than AWE, but bonuses cannot be separated out here. It is also less timely than AWE, as it is quarterly rather than monthly, and produced with a lag. Industry breakdowns are available, alongside data on Unit Labour Costs and the labour share of income.

External pay indicators, such as those from the REC Report on Jobs, usually do not explicitly include bonuses. The Bank’s Agents offer valuable qualitative information – for instance, they noted an increase in ‘one-off retention bonuses’ in their 2021 Q4 Summary, and ‘one-off bonuses to compensate workers for higher inflation and to retain staff’ in their 2022 Q2 Summary. But for quantitative measures on bonuses, AWE appears to be the best source for now.

Which industries pay bonuses?

The finance and insurance industry might have a reputation for big bonuses, but is not the only industry that pays them. Chart 2 shows industry contributions to average (weekly) bonuses across the whole economy, for Quarter 1 of each year (when most bonuses are paid). The finance and insurance industry (light blue bars) accounted for about 40% in 2021 Q1, down from almost half over the past decade, and about two thirds just before the financial crisis. There are also relatively large contributions from business services industries (professional and admin services), the retail and wholesale industry (partly reflecting its large size), and the ICT services industry. The manufacturing industry and other industries typically account for a pretty small share of total bonuses.

Chart 2: Industry contributions to average weekly bonuses, quarter 1 of each year

Notes: SIC 2007 sections of industry groups are: Finance, insurance = K; Business services = MN; retail, wholesale = G, ICT services = J; Manufacturing = C; Other industries = all others.

Source: Author’s calculations using ONS Average Weekly Earnings data.

What do the latest data on bonuses tell us?

Bonuses have grown far more than regular pay since the start of the pandemic. Chart 3 shows trends in AWE regular pay and AWE bonuses for the private sector since 2019. By July 2022, the latest data, bonuses had grown by about 40% on 2019 levels, compared to 14% for regular pay. Most of the growth in bonuses came during 2021.

The bonus data can be a little volatile given smaller numbers, but the variation also reflects economic conditions – bonuses fell much further than regular pay during the first national lockdown, before recovering more sharply; and bonuses took a further hit with the national lockdown in early 2021 before rebounding.

Chart 3: Regular pay and bonuses, private sector, seasonally adjusted, index 2019 = 100

Source: Author’s calculations using ONS Average Weekly Earnings data.

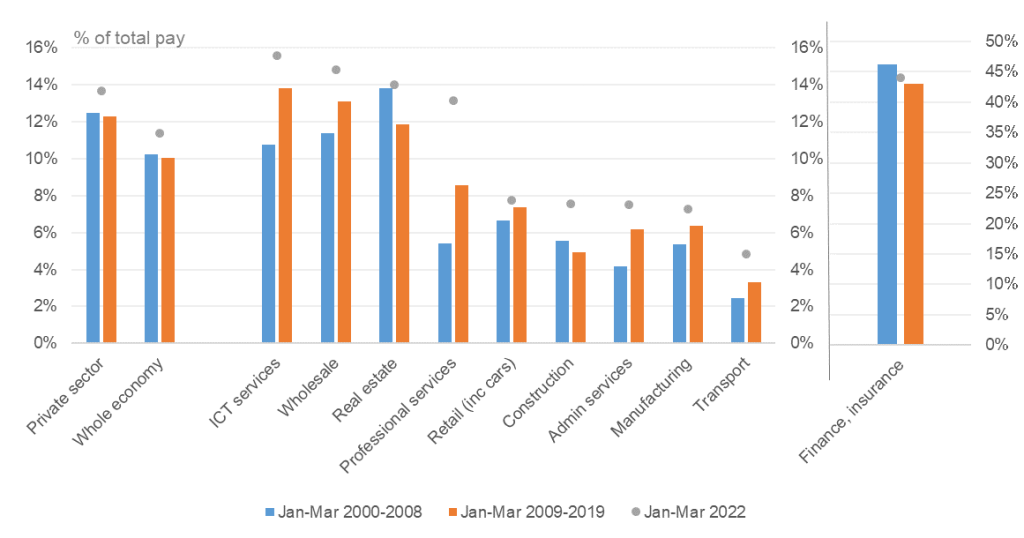

Given the growth of bonuses over the past year, they now account for a larger share of total pay than usual. Chart 4 shows the proportion of total pay accounted for by bonuses in the first quarter of the year, over different time periods. The finance industry is on a separate scale to the right hand side, since the figures are much larger than the rest of the economy.

In most industries, bonuses currently account for a much larger share of total pay than usual. The chart splits the period into before and after the financial crisis, because bonuses in the finance and real estate industries were even higher before the financial crisis, and took a hit afterwards. The current share of bonuses in total pay is above pre-financial crisis and post-financial crisis levels in most industries (although in finance it is not quite at pre-financial crisis levels).

The current bonus share is particularly high relative to pre-pandemic levels in professional services (includes legal and consulting), administrative services (includes employment agencies), transport and storage, and construction. This is line with anecdotal reports of marked competition for talent in these industries.

Chart 4: Bonuses as a share of total pay, January–March over different periods, not seasonally adjusted, selected industries and sectors

Source: Author’s calculations using ONS Average Weekly Earnings data.

Where next for bonuses?

So bonuses are an often overlooked, and potentially important, part of the total pay packet. However, bonuses are typically one-off in nature: they are not usually embedded into wage growth and employment contracts. That means businesses might be able to avoid paying high bonuses again next year if the labour market cools down, unlike increases in regular pay. That would usually make bonuses less directly relevant to monetary policy makers focused on medium term inflationary pressure.

This year, however, bonuses appear to be different – not used just for performance (as captured in AWE), but also for retention and recruitment, and in response to ‘cost of living’ increases. That might make them more persistent, but it is too early to know. In the meantime, bonuses offer another valuable way to assess the degree of labour market, tightness which is very important for policy-setting.

To understand labour market tightness, and potential inflationary pressure from wages, I will be keeping a close eye on multiple pay measures, especially those (like AWE total pay and ALCH) which include bonuses. Hopefully the current interest in bonuses sparks the collection of new data to shed more light on this feature of the labour market.

Josh Martin works in the Bank’s External MPC Unit.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.