One of the really strange things about watching Federal Reserve policy is the excess of deference that is given to the Fed’s judgment.

While the Fed deserves credit for when they get things right – e.g., rescuing the credit system from the great financial crisis (GFC) – they also deserve plenty of blame for the multitude of sins they commit.

I am not a Fed hater or part of the crew that wants to “End the Fed.” All too often, Fed criticism is thinly-veiled excuse-making for underperforming alpha chasers. “If only the Fed didn’t do X, our portfolio would have been much better” seems to be a terrible approach to managing assets for clients.

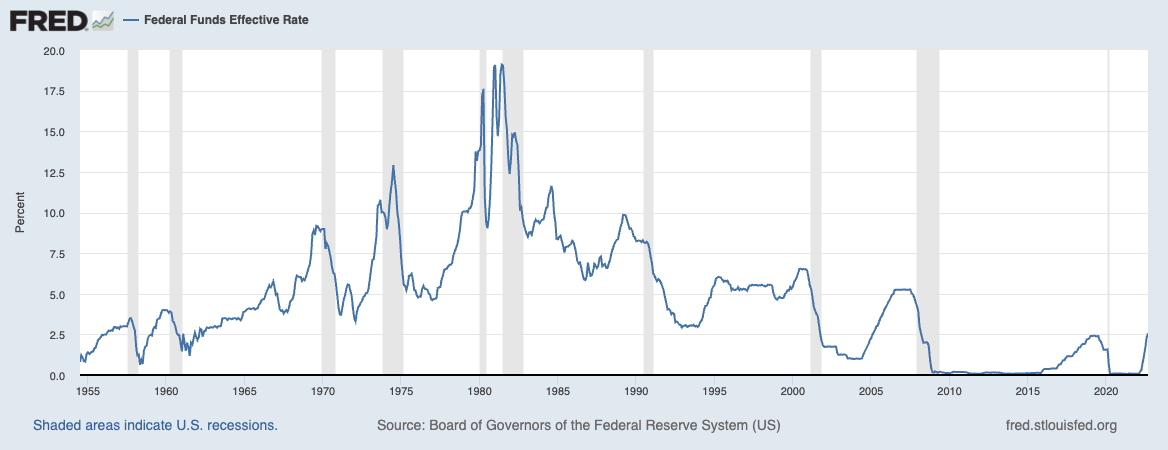

Still, as the Fed Funds chart above shows, if you want to critique America central bank, there is plenty of deserving criticism:

– They were a major factor (out of many) contributing to the GFC;

– Their forecasts are terrible (to be fair, so are everyone else’s);

– They hold fundamental beliefs which are misguided or wrong. (Wealth effect, Inflation expectations, etc.)

We can hold for a future date further criticism of how the Fed can improve, but for today let’s just stay focused on the FOMC’s interest rate policy.

Consider the errors of just the past few years and you can see the biggest mistake they make seems to be either arriving way too late to the party or once they are there, is overstaying their welcome.

2000s: Kept rates too low for too long following 9/11 and dotcom implosion – FOMC Rate did not get over 1% until 2004.

2010s: Remained on emergency footing post GFC for far too long – left rates at 0 until December 2015.

2020s: Remained on emergency footing post Covid, despite broad evidence of economic recovery. Following those March 2020 rate cuts, the Fed stayed at Zero until March 2022. During the same period of time, the S&P 500 rose 67.9% (2020) and 28.7% (2021).1

To sum up, the Fed was late to recognize post 9/11 the impact their ultra low rates were having; Post 2008-09 crisis, they kept rates at zero until 2015, post Covid, they kept rates at zero despite inflation and market signals. Despite myriad signs we are way past peak inflation, the FOMC is again late to recognize it.

Once again, the FOMC is the party guest who was late to arrive, and now, is wildly overstaying their welcome.

Previously:

Farewell, TINA (September 28, 2022)

Blame the Fed For Everything! (June 9, 2022)

Normalization vs Inflation (March 14, 2022)

How Greenspan Became the ex-Maestro (August 11, 2014)

Who is to Blame, 1-25 (June 29, 2009)

_____________

1. For the full calendar year 2020, the total return for the S&P 50 index was 18.4%; the 67.9% return is from the March 23, 2020 low