Wall Street banks have slashed their expectations for third-quarter earnings of big US companies by $34bn over the past three months, with analysts now anticipating the most feeble rise in profits since the depths of the Covid crisis.

Analysts are expecting companies listed on the S&P 500 index to post earnings-per-share growth of 2.6 per cent in the July to September quarter, compared with the same period a year earlier, according to FactSet data. That figure has fallen from 9.8 per cent at the start of July, and if accurate would mark the weakest quarter since the July to September period in 2020, when the economy was still reeling from coronavirus lockdowns.

The darkening outlook highlights how worries over Federal Reserve rate increases and early signs of deterioration in the US economy have left investors more cautious on the prospects of listed companies. Wall Street’s S&P 500 has already fallen by about a fifth this year as fund managers adjust to this reality, but many analysts fear that current profit expectations are still overly optimistic.

“There are some positives in the mix . . . [but] there’s little incentive for companies to paint a particularly optimistic outlook when the market is going to discount that anyway,” said Chris Shipley, chief investment strategist for North America at Northern Trust Asset Management.

The Fed is in the midst of its most aggressive cycle of interest rate increases since the 1980s, and chair Jay Powell has made clear that it is willing to put up with causing economic pain to bring inflation down. The interest rate increases have sent borrowing costs for consumers and businesses soaring, weighed heavily on asset prices and are expected to reduce demand across the world’s biggest economy.

“[Estimates] are still higher than what I would rationally expect,” said Omar Aguilar, chief executive at Schwab Asset Management. “They don’t necessarily have to come down dramatically, but I think there is a high probability that if the [Fed] is successful in its journey to destroy demand, then that will be reflected in earnings numbers in the first half of next year.”

When earnings reporting season kicks off next week, investors will be watching closely for evidence of the impact inflation is having on costs and consumer demand, how hiring plans are changing and which companies did a better job of predicting appetite to avoid being left with warehouses full of unsold furniture or clothing.

The recent strength of the dollar will add an additional pressure point for many companies, since around a third of S&P 500 revenues are earned overseas.

If S&P 500 earnings meet expectations and rise 2.6 per cent, it would still represent a fall in inflation-adjusted terms, with annual US inflation running at more than 8 per cent. Even those results are flattered by the outperformance of a single sector — energy — which has benefited from surging commodity prices. Excluding energy, analysts forecast a 3.8 per cent decline.

Still, estimates for next year have so far been far more resilient, with consensus pointing to growth of 6.5 per cent in the first quarter and 5.5 per cent in the second.

There are some reasons to be optimistic. Retail spending data have been relatively resilient and a recent fall in petrol prices will provide an additional boost to consumers.

Recent high profile warnings from companies such as FedEx have drawn outsized attention, but the total number of negative trading updates over the past three months was actually less than in the previous two quarters, while the number of positive updates was above the five-year average.

Still, strategists at Morgan Stanley have argued that companies’ ability to predict demand has been damaged since the start of the coronavirus pandemic.

From an equity market perspective, there is disagreement over whether stocks have fallen enough to reflect the uncertain environment. Morgan Stanley has been particularly bearish this year, arguing last month that “there is still a long way to go before reality is fairly priced”.

However, Denise Chisholm, director of quantitative strategy at Fidelity, said that despite the fact “estimates for next year are not rational yet”, shares in some economically-sensitive sectors like consumer goods have already fallen so far that the worst of the news is priced in.

“There is a common belief that if earnings are weak, only ‘defensive’ stocks will outperform, but sometimes economically sensitive sectors price it in much faster . . . by the time earnings declines are in, sometimes the stocks have already bottomed.”

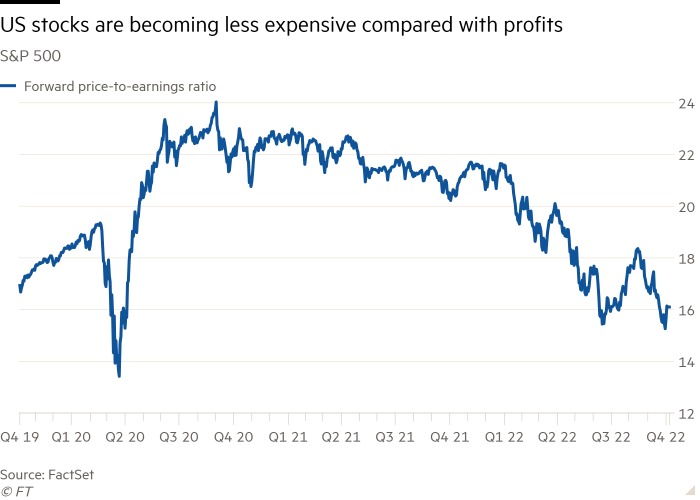

With average valuations of companies on the S&P 500 falling from 21 times expected earnings over the next year at the end of 2021 to 16, many investors and analysts said the next few weeks could provide an opportunity for businesses that are doing a better job of navigating the tough environment to differentiate themselves from underperforming rivals after an indiscriminate sell-off.

The potential for sharp rallies during the bear market was highlighted this week as the S&P enjoyed its biggest two-day rise in more than two years, but few expect strong earnings will be enough to lift the wider market for a sustained period unless the Fed changes its approach.

“A lot of securities are attractively priced,” said Charles Lemonides, chief investment officer at Valueworks, a New York-based hedge fund. “I think there will be differentiation between winners and losers . . . [but] when you look at the overall market, the Fed is still the be all and end all.”