Consumer prices eased in September for the third-straight month as declines in energy prices partly offset increases in food and shelter indexes. Despite this slight improvement, inflation remains above an 8% year-over-year rate for the seven straight month. The food and shelter indexes continued to rise at an accelerated pace, with the owners’ equivalent rent index seeing the largest monthly increase since June 1990. Though it is likely that both core PCE and CPI measures of inflation have peaked, the Fed is expected to remain aggressive with respect to tightening monetary policy. It is also worth noting that higher interest rates will have limited effects on rising rent (a function of a lack of attainable housing) or the ongoing labor shortage.

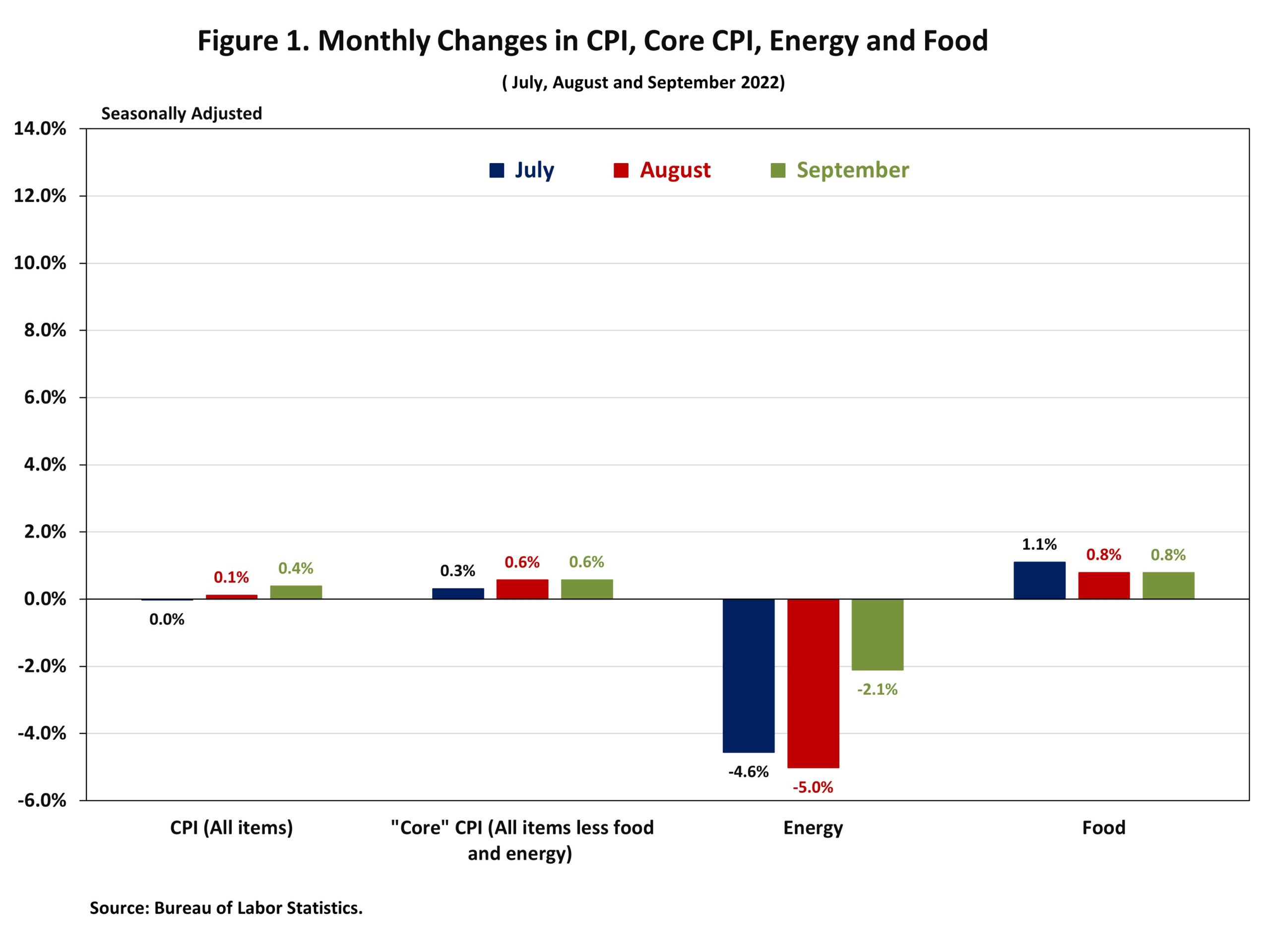

The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose by 0.4% in September on a seasonally adjusted basis, following an increase of 0.1% in August. The price index for a broad set of energy sources fell by 2.1% in September as a decline in gasoline (-4.9%) partly offset an increase in electricity (+0.4%) and natural gas index (+2.9%). Excluding the volatile food and energy components, the “core” CPI increased by 0.6% in September, as it did in August. Meanwhile, the food index increased by 0.8% in September, the same increase as August.

Most component indexes continued to increase in September. The indexes for shelter (+0.7%), medical care (+0.8%), motor vehicle insurance (+1.6%), household furnishings and operations (+0.5%) as well as education (+0.4%) showed sizeable monthly increases in September. Meanwhile, the indexes for used cars and trucks (-1.1%), apparel (-0.3%) and communication (-0.1%) declined in September.

The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.6% in September, following an identical increase in August. The indexes for owners’ equivalent rent (OER) and rent of primary residence (RPR) both increased by 0.8% over the month. Monthly increases in OER have averaged 0.7% over the last three months. More cost increases are coming from this category, which will add to inflationary forces in the months ahead. These higher costs are driven by lack of supply and higher development costs. Higher interest rates will not slow these costs, which means the Fed’s tools are limited in addressing shelter inflation.

During the past twelve months, on a not seasonally adjusted basis, the CPI rose by 8.2% in September, following an 8.3% increase in August. The “core” CPI increased by 6.6% over the past twelve months, following an 6.3% increase in August. The food index rose by 11.2% and the energy index climbed by 19.8% over the past twelve months.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than overall inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster (slower) than overall inflation, the real rent index rises (declines). The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

The Real Rent Index rose by 0.3% in September. Over the first nine months of 2022, the monthly change of the Real Rent Index increased by 0.1%, on average.

Related