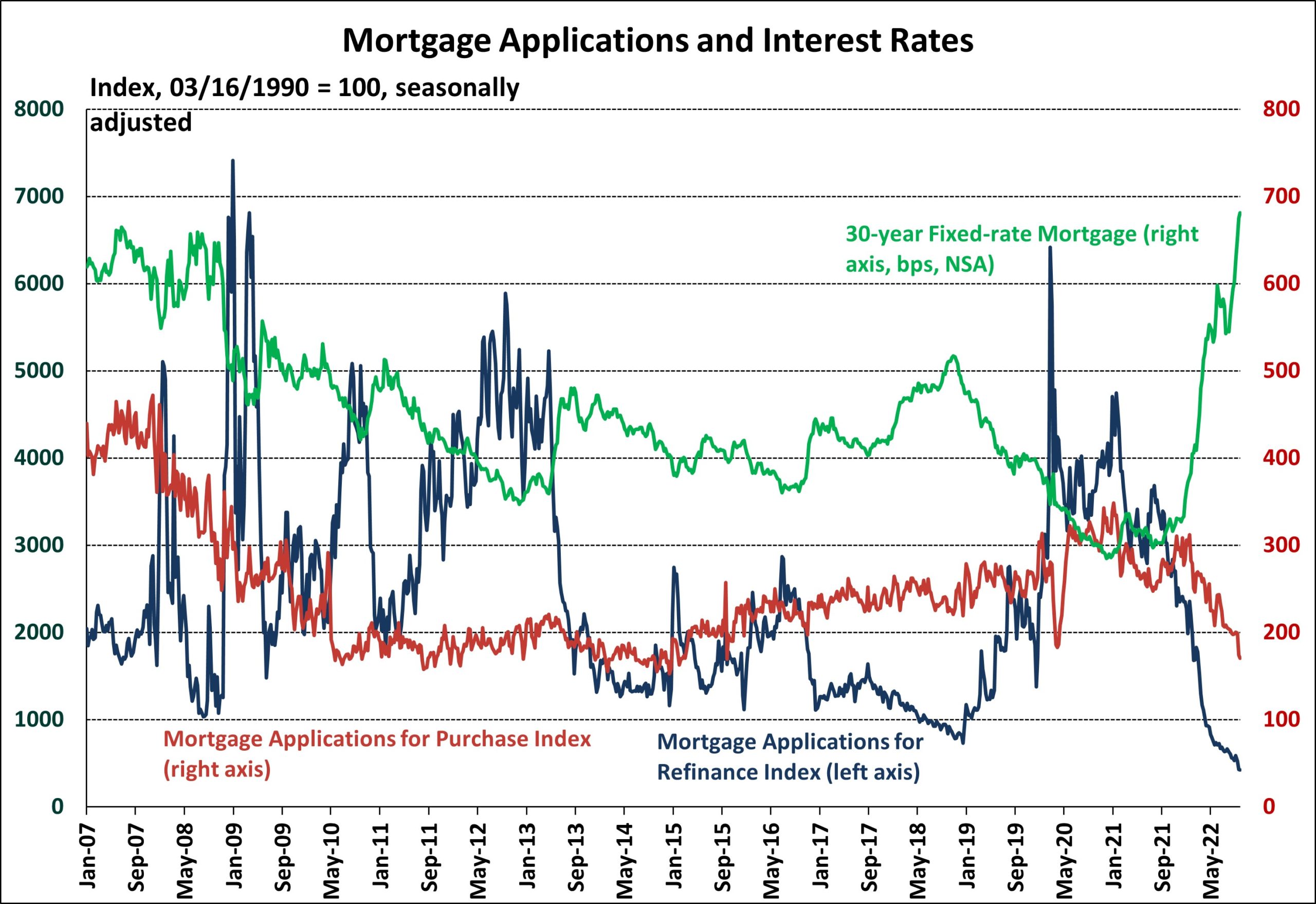

Per the Mortgage Bankers Association’s (MBA) survey through the week ending October 7th, total mortgage activity declined 2.0% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate rose six basis points to 6.81%. The FRM has risen 80 basis points over the past month, reaching its highest level since 2006.

The Market Composite Index, a measure of mortgage loan application volume, decreased by 2.0% on a seasonally adjusted (SA) basis from one week earlier. Purchasing and refinancing activity both decreased by 2.0% from one week earlier

Purchase application volume is down 39.1% from one year ago, the largest year-over-year decline in purchasing since September 2010. The refinancing activity index is down 86.0% from the same week one year ago, the largest year-over-year decrease since October 1999.

The refinance share of mortgage activity remained unchanged from one week prior at 29.0% while the adjustable-rate mortgage (ARM) share of activity slightly decreased from 11.8% to 11.7%. Due to higher FRM rates, the ARM share of mortgage activity has more than tripled from 3.4% one year ago.

Related