When inflation hits and you’re seeing your expenses go up as a result, what do you do?

Do you:

- complain and fret over how it sucks to be living through inflationary times,

- start looking into how you can spend less, or

- take action to adapt to the new normal?

I’m the type of person who falls into the third category, and I hope that if you’re reading this blog, it means you are the sort to direct your energy towards actually taking action to improve your situation too…rather than just whine about circumstances that you cannot change.

None of us have any control over the price of electricity or mortgage interest rates, but we can certainly choose to reduce them; or if we can’t, then at least optimise what we have to spend anyway.

And now that it has become almost certain that inflation isn’t going away any time soon, it is time to take action, be it through:

- Cut back on expenses

- Get more rewards out of the money that you have to spend

- Earn more

If you can do all 3, that’ll be even better.

Here’s how.

REDUCE

During times of inflation, you can’t control how much more you have to pay, but you can certainly control (i) how much you use and (ii) going for lower-cost alternatives, wherever possible.

By now, I hope you’ve already switched to a low-cost electricity provider. Your mobile plan is also worth looking at, especially if you’re still on a tied contract because changing to a SIM-only plan can easily save you 30% to 50% in a single move.

Choose to eat at home more often, and you might just find that your dining expenses go down by an easy 20% – 30% each month.

If you have to eat out, choose the hawker centres or food courts wherever possible, as you’re paying less but also supporting local at the same time.

Another tip I’ve implemented for my own household is to switch to house brands, which can potentially reduce your grocery expenses by up to a further 30%.

OPTIMISE

Next, for the money that you have to spend anyway, look at how you can best optimise this spend. The most beneficial move you can make in this area is to make sure you’re using the right cards for your spending.

Being conscious about our expenses now also means that you don’t want to be bogged down by a card that requires you to clock a minimum spend, or gives you a low earn rate, or even worse – both,when you’re unable to meet their criteria.

Let me teach you how to do this easily with your POSB cards.

In case you haven’t heard, the POSB Everyday Card is a hidden gem that is hardly talked about, but the truth is, the card has been one of the top picks for people who seek rewards across their everyday spend effortlessly. And it’s not surprising – the card has no minimum spend and relatively higher earn rates on groceries, fuel, public transport (SimplyGo) and even your utilities.

Groceries

For instance, if you buy your groceries from Sheng Siong, the POSB Everyday Card gives you 7% cash rebates. But, if your weekly grocery runs are at Cold Storage or Giant instead, then you should be paying with your PAssion POSB Debit Card for 7% savings instead, which also earns you TapForMore points (a.k.a. PAssion card points)!

Unbeknownst to many, there is in fact a debit card that gives you cashback in Singapore – this being one of the few cards locally to do so.

Public Transport

When it comes to transport options, POSB has also catered for both the drivers and non-drivers.

For those taking public transport, you already know by now that you get 5% cash rebates for bus/MRT rides when you use your PAssion POSB Debit Card / POSB Everyday Card.

Whereas if you’re a driver, you’ll be familiar with how you can get 15% savings upfront when you swipe your POSB debit card together with your SPC&U card. But why not go for even more discount when you maximise it by using your POSB Everyday Card together with your SPC&U membership? That way, you can get >20% off your bill i.e. $21.80 off for a $100 fuel receipt!

Bills / Utilities

As for your bills, most Singaporeans make the mistake of not optimising this and paying via the traditional methods e.g. AXS machines, online bill payment, etc. Neither of which gives you any cashback or miles, unfortunately.

In that case, you should be using your POSB Everyday Card instead, which gives you 5%^ cash rebates on your recurring utilities bills and 3% for your telco payments.

^5% for electricity covers SP Group (recurring), Geneco, Sembcorp Power, Union Power, Tuas Power. 4% if your electricity provider is Keppel Electric and Senoko Energy.

Alternatively, you can also use your PAssion POSB Debit Card, which also gives you 5% cash rebates on your utilities bills.

Food / Dining Out

And now that you’ve taken to dining at hawkers instead of cafes or restaurants, you’ll soon find that you can’t use your cards to pay since most hawkers don’t accept credit cards as a payment mode. An easy way out is to pay with PayLah! at hawkers which will help to unlock more bonus interest for you too (more on this bonus interest later).

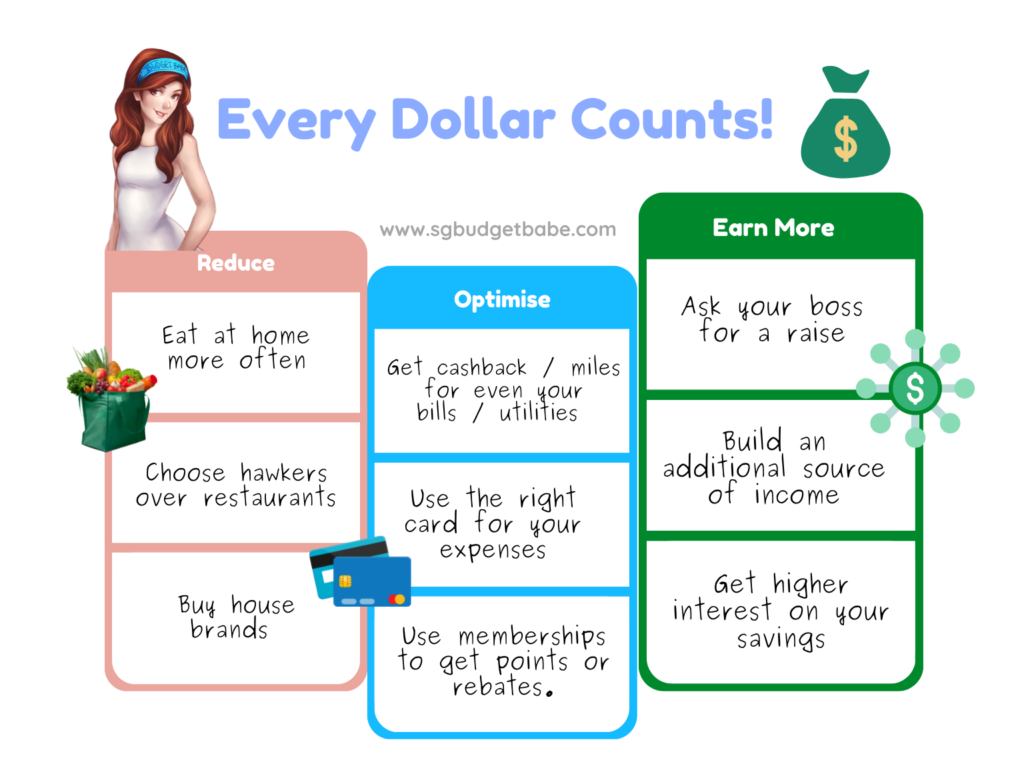

Mortgage Payments

In this case, POSB HomeSaver is one way to get the most out of your mortgage, because by taking up a new home loan with POSB and opening/having a SAYE account, you can get $500 (and a bonus $200 when you get MRTA).

SGD deposits are also insured up to S$75k by SDIC.

And the best part? Your home loan now contributes to the bonus interest rate you’ll get with Multiplier! It’s a win-win, since mortgage repayments are something that all of us homeowners have to pay off each month anyway.

EARN

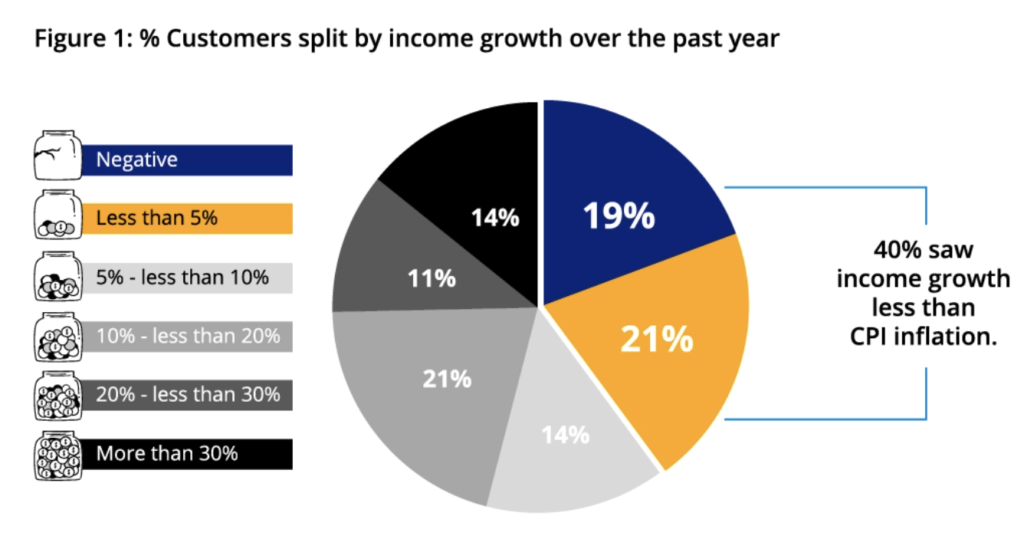

And finally, the most important thing to do if you want to come out stronger than inflationary cost pressures is to…earn more!

Can you ask your boss for a salary raise?

If not, then you can also look into building an additional source of income, such as starting a side hustle (check out my previous article here if you need some ideas) so that you can earn more outside of your job. In my case, I used to teach tuition on weekends and I’ve recently ventured into dropshipping earlier this year – both of which gave me an additional 5-figure annual income.

Next, review your cash savings – are you making the most out of this money? Where are you currently parking your cash in? Would it make sense to transfer it into fixed deposits or even the Singapore Savings Bonds for higher interest?

Multiplier is still one of the best savings accounts in Singapore

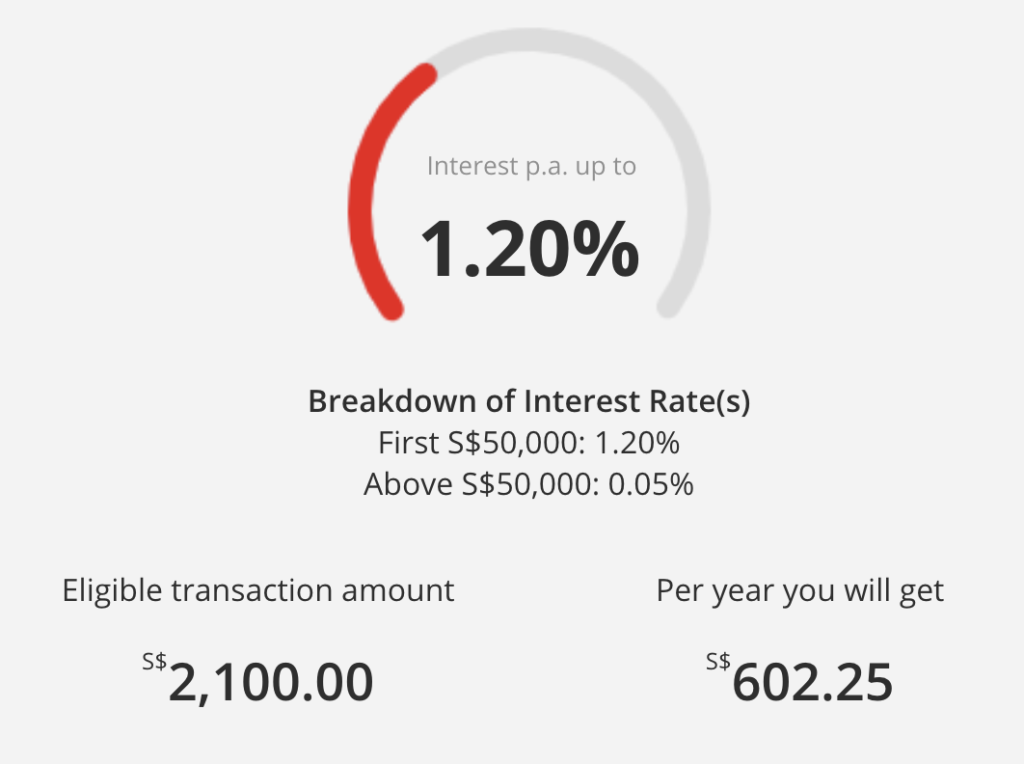

If you prefer to retain liquidity, then at least make sure you’re using a high-interest savings account like Multiplier, where you can earn up to 3.5%* p.a. This is where you need to spend at least 10 minutes to review which account would be best for you – based on the criteria that you can hit – before you go and open it.

If you want a fuss-free options, one of the easiest would definitely be Multiplier, because you can earn extra interest simply by doing the following (easy) steps:

- buy a kopi with PayLah!

- connect with SGFinDex (no need to do salary crediting)

And if you want to earn even more interest, my recommendation would be to:

- set up a $1,000 investment in digiPortfolio (psst, check out the newest SaveUp or Income portfolios which offer more stable growth / regular payouts)

- make use of your mortgage with DBS/POSB (the other 2 banks don’t reward mortgage repayments, and the best part is that DBS/POSB recognizes for the full amount for as long as your loan is still with them)

There’s absolutely no need to do the following if you don’t want to:

- credit your salary

- hit a minimum card spend

- sign up for insurance or investment

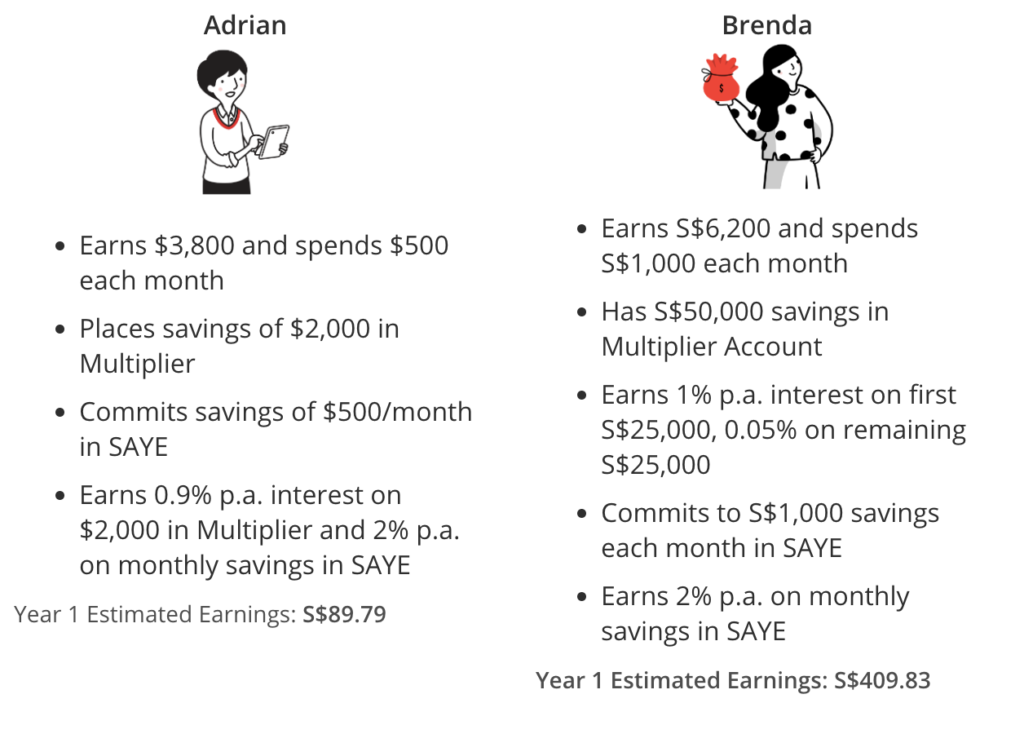

Inflation Hack: If you are already crediting your salary with POSB, you can earn an additional 2% p.a. on your monthly savings by depositing into the POSB SAYE Account.

This hack lets you double the ways to earn even more interest! Here’s how it might work for you:

Of course, you could also learn how to invest in dividend stocks which can pay you passive income, which is even better than you having to actively exchange your time and energy for money. Even with the bear market that we are currently in now, there are plenty of fundamentally strong companies which are continuing to pay out dividends to their shareholders like you and me. Last year, for instance, I earned >7% dividend yield on my DBS stocks!

Sponsored Message from POSB With the majority of Singaporeans banking with POSB, the bank has put together several offers to help its customers fight inflation in as many aspects as possible – be it by reducing spend through everyday merchant partners, giving cash rebates on your regular spend, raising interest rates on one’s cash, or even sharing more educational “hacks” like the ones presented in this article.

Conclusion

In summary, while we cannot control our cost of living and inflationary pressures, we can definitely take steps today so that it affects us less than it otherwise would.

And what you can do for yourself today with minimal effort is:

- Eat at home more often

- Choose hawkers over cafes or restaurants

- Switch to house brands

By researching a little, you can also:

- Get more cashback

- Take advantage of discounts or promotions

- Use the right card(s) or memberships to get rebates

- Get a higher interest rate on your savings

And as long as you’re willing to invest some time and energy, you can even earn more by:

- Buiding an extra source of income or a side hustle

- Get paid higher at your job

The possibilities are endless, but what matters more is – what are YOU going to do today to beat inflation?

Disclosure: This post was written in collaboration with POSB, with hacks and tips provided by yours truly.

*Notes for Multiplier bonus interest rates: 1. Higher interest rates are applicable to the S$ balance in your DBS Multiplier Account, up to the first S$100,000. Any amount over and above this will be accorded the prevailing interest rate for that month. Interest is credited in 2 parts: i. base interest at our prevailing interest rate, calculated on daily balances will be credited at month end, and ii. preferential interest at the preferential interest rate (which is the higher interest rate less the prevailing interest rate) based on the sum of your eligible transactions with us, calculated on daily balances, by the 7th working day of the following month. 2. If your transactions do not meet the criteria, the S$ balance in your DBS Multiplier Account will be accorded the prevailing interest rate for that month. 3. Foreign currency transactions are subject to exchange rate fluctuations, which may result in capital gains or losses; such accounts may also be subject to exchange controls imposed on the currency held. 4. Service charge is waived for DBS Multiplier Account holders up to 29 years old, effective from May 2018 onwards.