Lane Bryant pushes their Credit Card on customers at check-out, with promises of valuable reward points and exclusive member shopping perks. Our review found damaged credit scores, extremely high interest rates, and one of the worst rewards programs we have reviewed.

Choosing a more traditional card over the Lane Bryant Card could save your credit score and thousands of dollars in interest payments over your lifetime.

Lane Bryant Credit Card Review & Ratings

Lane Bryant pushes their Credit Card on customers at check-out, with promises of valuable reward points and exclusive member shopping perks. What we found in our review was damaged credit scores, extremely high interest rates, and one of the worst rewards programs we have reviewed.

Annual Fee: $0

APR: 28.49% Variable

Credit Needed: Fair/Good/Excellent

Pros

Reports To Major Credit Bureaus

The card has a very high variable APR rate and you have to earn a minimum of 3000 points to exchange for a small $10 credit.

You can only use the Lane Bryant Store Card at Lane Bryant stores.

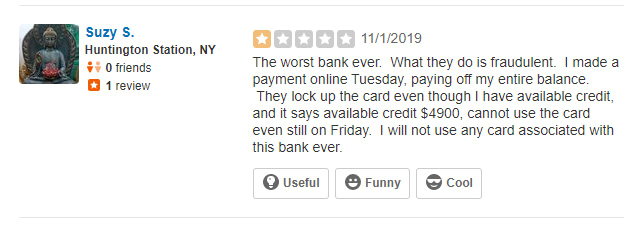

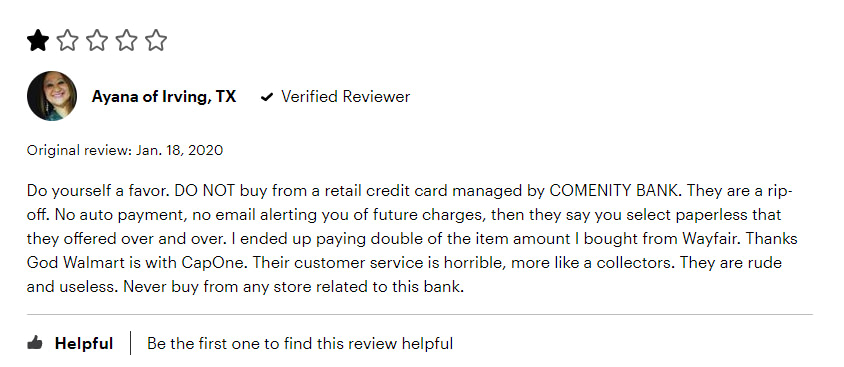

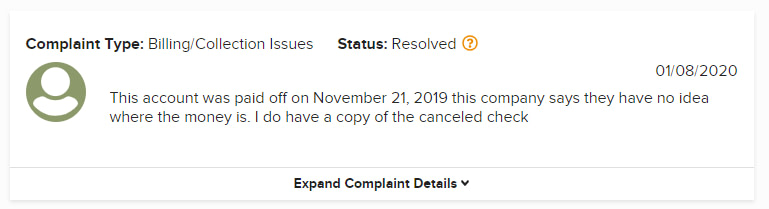

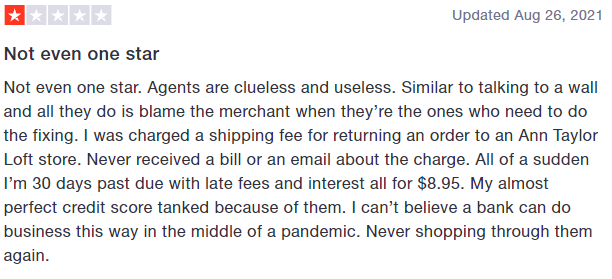

A major problem with this card is the issuer, Comenity Bank. Comenity Bank gets consistently terrible reviews on all the cards they issue. One recurring complaint is that they will cancel your card if you do not keep a balance and pay them interest.

Your credit score can be damaged if a revolving credit card account is closed by the issuer.

What Is The Lane Bryant Credit Card?

The Lane Bryant Credit Card accounts are issued by Comenity Bank for use only at the Lane Bryant family of stores.

You will not find a Visa, MasterCard, Discover, or American Express, logo on this card.

Who Is Comenity Bank?

Comenity Bank and Comenity Capital Bank are owned by Data Alliance. They manage multiple customer loyalty programs.

They work with retail locations and provide them with store credit cards, rewards programs and marketing information to retain customers.

Lane Bryant Credit Card Basics

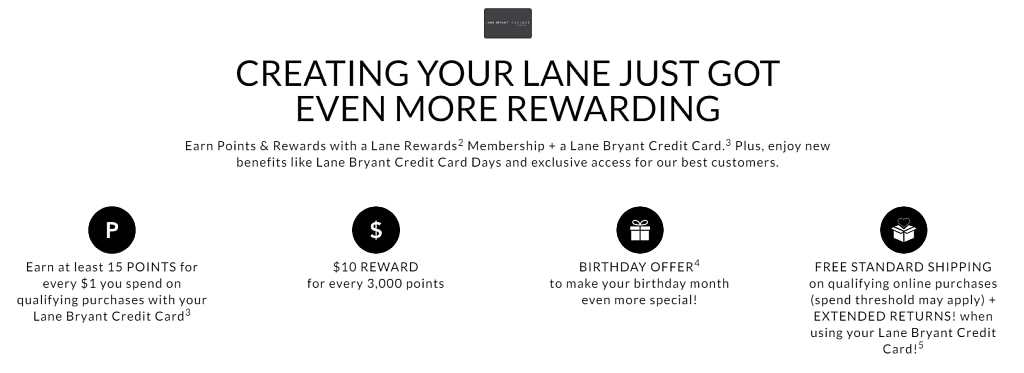

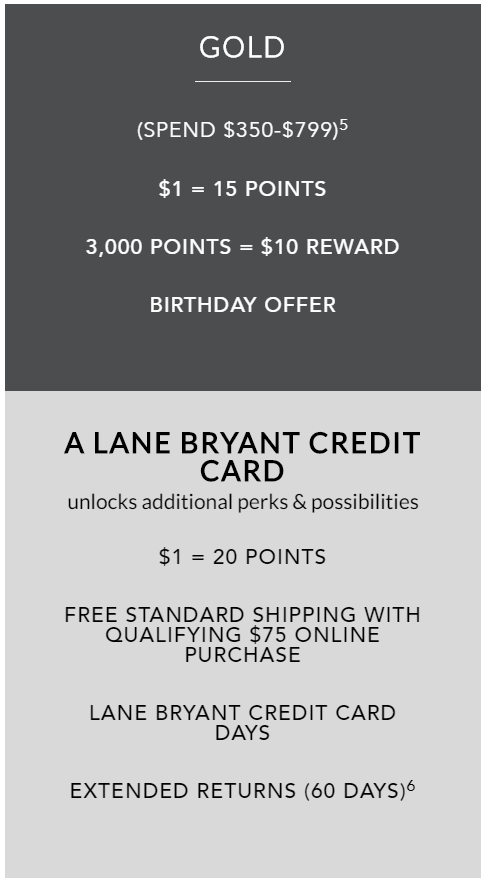

Below are some of the basic features of the Lane Bryant credit card:

- Card type: Unsecured

- Interest rate: 28.49% Variable

- Annual fee: $0

- Rewards: Earn 3,000 points to get a $10 discount

- Security deposit: None

- Foreign transaction fee: N/A

- Credit reporting: Reports payment history to all three credit bureaus.

- Cash advance fee: N/A

- Cash advance APR: N/A

- Late payment fee: Up to $39.00

- Returned payment fee: Up to $39.00

- Over The Credit Limit: None

Many Comenity Bank reviews describe late payments imposed for payments the user claimed to have made on time, or for failure to pay fees or charges they never knew existed.

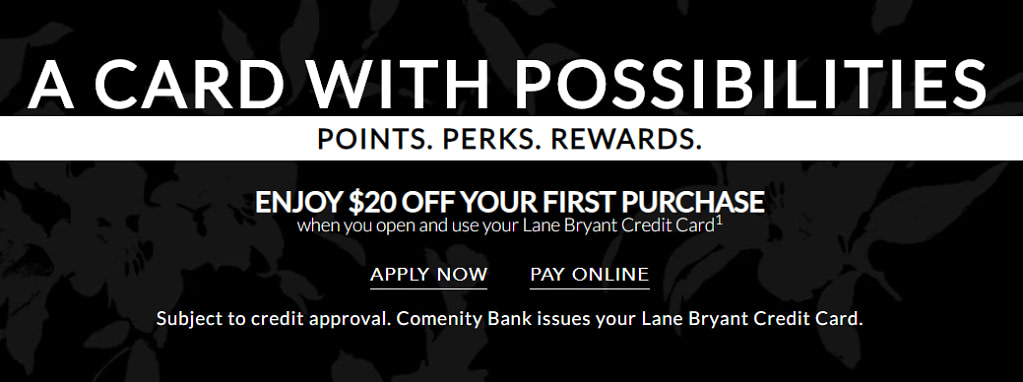

The Benefits

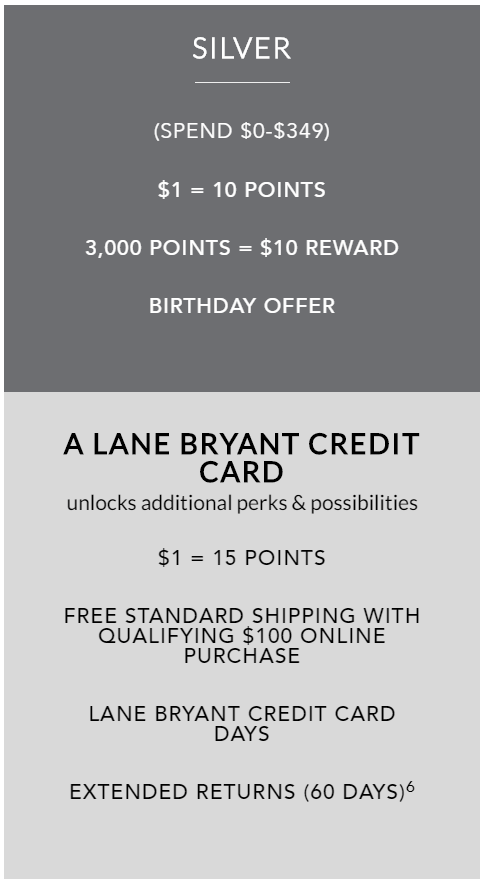

The Lane Bryant Comenity Card offers a few benefits that are also available to you if you just sign up to be a Lane Bryant Member without a credit card.

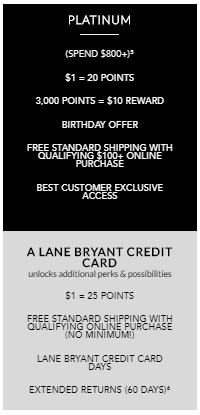

These Lane Bryant Rewards include:

- You can turn in every 3,000 points for a $10 discount

- Free shipping if you spend a set amount based on if you are at the Silver, Gold, or Platinum level

- Special birthday month deals

Customers who use the Lane Bryant Card to make purchases will receive rewards points. Once the points reach a set level you can exchange them for a small one-time discount on a future purchase.

The Lane Bryant credit card also offers free standard shipping if your cart total amount reaches certain thresholds. There are also Lane Bryant Card Days that include discount offers, and discounts during your birthday month.

All of these rewards can save you money, but the actual savings are very low compared to many other rewards programs. You can sign up to be a Lane Bryant Member without a credit card and receive almost the same benefits that you get from the card.

Where Can I Use My Lane Bryant Card?

The Comenity Bank Lane Bryant card can be used only at the Lane Bryant stores, Lane Bryant Outlet, and LaneBryant.com.

You can also use it at Lane Bryant’s other company-owned stores, Cacique and Catherines, along with their respective websites.

Can I Use My Lane Bryant Card At Torrid?

The Lane Bryant card is not backed by one of the major payment networks, like Visa or MasterCard, thus, it is only accepted at Lane Bryant-owned stores.

Torrid is not owned by Lane Bryant and you cannot use a Lane Bryant card there.

What Is The Starting Lane Bryant Credit Limit

Comenity Bank will assign a credit limit based on a number of factors, including your credit history and income.

There is no way of predicting the credit limit you will be given.

Lane Bryant Credit Limit Increase

Your card will periodically be reviewed for eligible credit limit increases.

If you make your payments on time, Comenity Bank will consider you for a credit limit increase.

You can also request a credit limit increase on your customer dashboard or by calling Comenity Bank directly.

The above is true for most credit cards.

Pros & Cons

PROS

- Reports to major credit bureaus

- Rewards program

- $0 Annual fee

CONS

- 28.49% Variable APR

- Limited use

- Bad customer service

- Low rewards value

Comenity Bank Card Customer Reviews

Comenity Bank is notorious for only caring about their profits with little concern for their customers. Comenity Bank-issued store credit cards tend to carry extremely high interest rates, even if your credit is good.

You can see more reviews of Comenity Bank and their store credit cards at the Better Business Bureau, Trustpilot, and Consumer Affairs.

How Do I Cancel My Lane Bryant Credit Card?

You can cancel your account at any time by contacting their Customer Service Department at the phone number listed on your billing statement or on the back of your credit card.

Is There A Fee For Closing My Account?

Outside of the fees associated with your remaining balance, there is no fee for closing your account.

I would recommend keeping the card active as long as you can, there really isn’t a reason to cancel the card any time soon.

Taking Action

Hopefully, you found this Lane Bryant Credit Card Review helpful because applying for this card could be a terrible mistake.

Today is a great day to apply for a new credit card that you can use anywhere and be charged a fair interest rate. The Lane Bryant Card is not that card.

Whatever credit card you choose, you’ll do your credit score a favor if you use it wisely!