Though there are other options now, the Extra Debit Card was the first debit card designed to help build credit. Extra reports the purchases you make on their card to the credit bureaus like a lender would, which helps you build your score by improving your payment history.

In most other respects, the Extra Debit Card functions like any other debit card. There’s no credit check to apply, you can connect it to your existing bank account, and there’s never interest on your purchases.

Here’s our comprehensive Extra Debit Card review to help you decide whether it’s your best option for building credit.

Extra Debit Card Review and Ratings

The Extra Debit Card lets you build credit without hurdling most of the traditional obstacles. There’s no credit check to apply, you don’t need to put down a security deposit, and it’s much harder to hurt your credit by misusing the account.

On the downside, you have to pay a monthly or annual subscription fee, and some customer reviews suggest that the customer support systems might need improvement.

Pros

Build credit with two credit bureaus

Cons

High monthly or annual fees

Questionable customer support

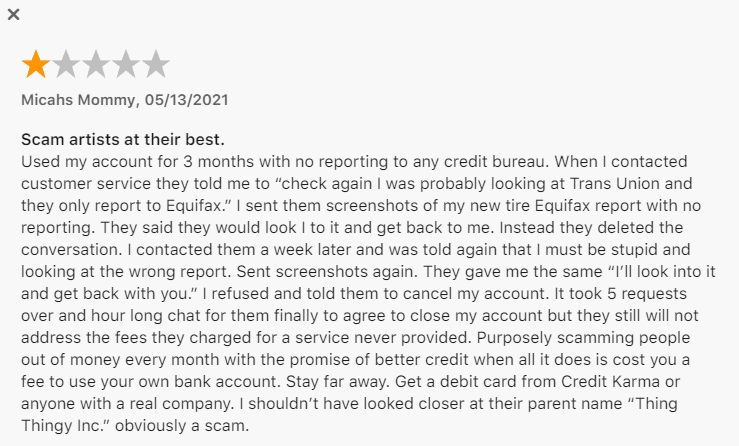

Doesn’t report to TransUnion

To build your credit score, you usually have to apply for a credit account and use it responsibly. Making timely payments and keeping your debt balances low are the most reliable ways to demonstrate your creditworthiness.

There are a few issues with that approach:

- Having no credit score makes it hard to qualify for most credit accounts.

- Applying for a credit account hurts your score by adding a hard inquiry to your credit report.

- If you don’t manage a credit account well, you’ll damage your score, and you may incur additional interest or fees.

The Extra Debit Card lets you sidestep these issues and still build your credit. Most debit cards do nothing for your credit score, but Extra reports the purchases you make on their card to credit bureaus as creditworthy payments.

Because it’s not a credit account, you don’t need a score to qualify.

There’s no credit check when you apply, which means you don’t have to add a hard inquiry to your file.

You’ll have to assess your spending habits and check the available products to decide whether the rewards are worth the extra cost.

From a user’s perspective, the Extra Debit Card works almost the same way as any other debit card. Extra reports your payments automatically, and there’s nothing special you have to do to build your credit with the account.

Here’s an in-depth guide to Extra’s card, including everything from signing up for the account to canceling it.

How to Sign Up for the Extra Debit Card

Signing up for the extra debit card is a relatively simple process. There’s no credit check involved. To qualify, you must:

- Be 18 years of age or older.

- Have a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Live in the United States with an address where you can receive your physical card (they don’t accept P.O. boxes).

- Have a bank account in the United States.

If Extra can’t verify your identity, they may try alternative methods that require you to provide additional personal details.

How to Use the Extra Debit Card

Once you qualify for the Extra Debit Card, you have to connect it to your bank account before using it. Extra can connect to over 10,000 banks, so you shouldn’t have to open a new account just for the card.

Once you’ve connected to your funding source, Extra assigns you a spending limit. It will always be at least slightly below your real-time checking account balance.

Whenever you buy something with the card, Extra “spots you” and pays for the transaction. Within a few days, they pay themselves back using the cash in your funding source.

The mechanism is similar to a credit transaction. It’s as though Extra gives you a credit line equal to each purchase amount and then has you pay off the balance using the cash in the bank account they monitor.

That’s why Extra can report the purchases as credit-worthy transactions. It also means that using the Extra Debit Card doesn’t raise your credit utilization since they wipe out your debt balance after each transaction.

If you pay extra for their rewards program, your purchases generate points you can spend in the Extra store. They’re not transparent about what you can buy in the store, but they mention gift cards and Airpods as examples.

How to Cancel the Extra Debit Card

Unfortunately, you can’t cancel the Extra Debit Card online. You’ll have to call them at 833-984-2291 or the number on the back of your debit card to close your account and end your subscription.

| Credit Building Only | Credit Building and Rewards | |

|---|---|---|

| Monthly Price | $16.60 per month (works out to $200 per year) | $22.08 per month (works out to $265 per year) |

| Annual Price | $200 per year (works out to $16.60 per month) | $265 per year (works out to $22.08 per month) |

Extra has two plans for purchase, and you can pay for them in either monthly or annual installments. There’s a discount if you pay annually ($149/year for Credit Building Only and $199/year for Credit Building & Rewards).

Extra was founded in 2019, so it’s a relatively new company. As a result, there aren’t many sources for customer reviews online.

The platform with the most reviews for the card is the App Store, and most of the comments are positive. Extra gets an average rating of 4.5 out of 5 stars on 3.8K ratings.

Online reviews have to be taken with some caution. Some companies do seed positive reviews. Customers with bad experiences are more likely to post reviews than those with good experiences. It’s still worth a look.

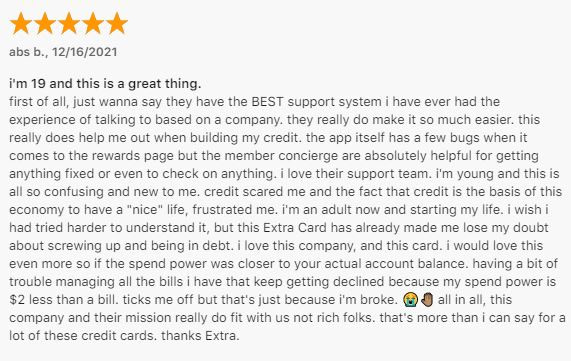

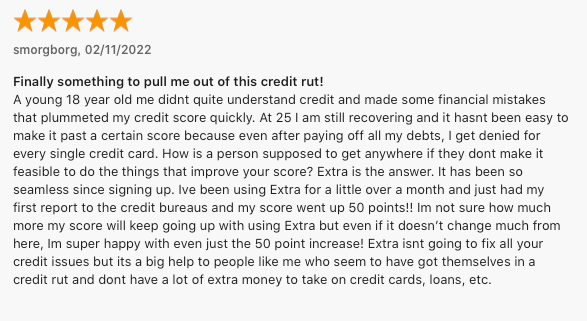

The positive reviews generally state that the app is easy to use and achieves the desired results. For example:

There are also negative reviews, most citing issues with function or service. They are a small minority, but you should be aware that some users report problems. For example:

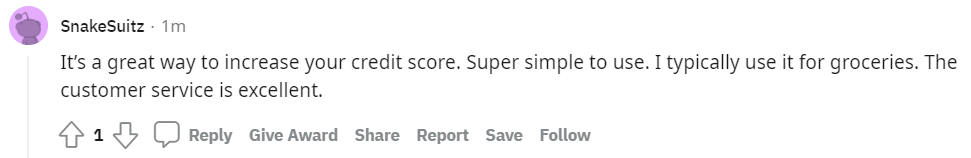

There is some discussion of the Extra Debit Card on Reddit, with opinions mixed between supporters and detractors. Unfortunately, some of these posts are suspicious. For example, the profile that posted the comment below was created that same day, and it hasn’t had any activity since.

Again, the large majority of positive reviews on the App Store suggests that most users are satisfied. The presence of negative and potentially inauthentic reviews is still a cause for caution.

Extra claims that their debit card is the first of its kind, but there are plenty of alternatives on the market today. Sequin and Credit Sesame also offer debit cards that build credit.

Sequin’s card follows the same model as Extra’s. It connects to your bank account, and then they report all your purchases to the credit bureaus. The most significant difference between the two is that Sequin only reports to Experian.

Credit Sesame’s card, the Sesame Cash debit card, works a little differently. You allocate a portion of your cash to the card each month, which they use to create a virtual secured credit card.

You then set a credit utilization limit for the virtual credit card. When you make purchases with the debit card, Sesame charges the virtual secured card until you hit your desired utilization ratio, then uses your cash to pay off the balance.

In some ways, the Extra Debit Card is more convenient than a credit card for building credit. You don’t have to undergo a credit check when you apply or put down a deposit to qualify like you would with a secured card.

The Extra Debit Card also reduces the risk of overspending and hurting your score. Because you can’t carry over a balance, you’ll never face interest charges, either.

That said, it’s not without its drawbacks. Most significantly, you have to pay a monthly or annual fee. I’ve always disliked the idea of paying money to build credit. The point of building credit is to save money, and there are so many ways to build your score for free.

Even if you take Extra’s cheapest option, you’d pay $200 per year. For comparison, the popular Discover it® secured card has no fee at all, though you will pay a refundable deposit. The card carries a substantial interest rate, but if you make your payments in full in every statement period you’ll never pay it.

You can get the OpenSky secured card without a credit check or even a bank account, and pay only $35/year.

Both of these cards report to all three credit bureaus.

There are risks to using a credit card. If you don’t have the discipline to keep your balance low and pay every bill on time and in full you can run up interest and late fees and do more harm than good to your credit. If you are confident in your ability to manage a credit card, a secured card could be a more cost-effective option.

There are other free or very cheap ways to build credit.

- Experian BOOST™ will report your utility payments (to Experian only) for free.

- Sesame Cash Credit Builder offers a credit-building debit card with no fees, and reports to all three credit bureaus.

- SeedFi offers credit-builder loans for as little as $10/month and reports to all three credit bureaus.

- Chime offers a free credit-building visa card that reports to all three credit bureaus, but you’ll need to have a Chime account.

If you choose to spend on a credit-building program, the Extra debit card is a low-risk way to do it. For some people, $200 per year may be an acceptable cost for building credit without the risk of mismanaging a credit card.

If you do make this choice, though, it should be an informed choice. Be sure to familiarize yourself with other lower-cost options and make an informed decision on what will suit you best.

How We Rated the Extra Debit Card

We rate credit-building products by comparing their key features with those of similar products. These products are rarely identical, so you’ll need to compare closely to determine what best fits your needs.

These are the criteria we used here.

Effectiveness

It’s never possible to accurately predict the impact of a new account on your credit score. A person with a thin credit file will see a greater impact than a person with an extensive credit record.

We dropped some points here for the Extra Debit Card because it reports to only two credit bureaus.

Ease of Use

Different users often have different experiences with a product. New products may have glitches that mar some users’ experiences. Some other users may have difficulty with products they don’t fully understand. We rank ease of use with an assessment of procedures and a cross-section of reported user reviews.

Reviews indicate a generally smooth user experience with the Extra Debit Card (with a few exceptions), hence the relatively high score.

Cost

Cost is a key element in assessing any credit-building product: after all, the point of the exercise is to save money!

The cost of the Extra Debit Card is not excessive, but we dropped points here because several similar products are substantially cheaper.

Support

Nothing works perfectly all the time, and when things go wrong you want to know you can get them made right. Support scores are based on reported user experiences.

FAQ:

To activate your card, simply connect your bank account with Extra. After that, they offer you a spending limit (Spend Power) based on your bank balance and other factors with no credit check.

There are no hard inquiries when applying for the Extra Card as it doesn’t check your credit during the application process.

Extra reports every purchase you make on the card to Experian and Equifax like a lender would, which helps you build your score by improving your payment history.

At this time you cannot use the Extra debit card outside of the United States as they do not support international transactions.

Extra charges a flat monthly subscription, with plans ranging from $16.60 to $22.08 a month. When you upgrade to their rewards + credit building plan, you earn points that can be used in their rewards store.