If you have an employee in Ohio, you need to include the Ohio school district number on Form W-2. The Ohio Department of Taxation is requiring this change to help reduce the number of reporting errors on individual income tax returns. Read on to learn more about this requirement.

Form W-2 reporting requirement in Ohio

In Ohio, many locations have a local income tax and a school district income tax. Local income taxes go toward cities, counties, or local governments. School district income taxes go toward public school districts.

Employers must list the local and school district income taxes on Form W-2, including the name of the locality or school and the amount withheld for each tax.

In some locations, the city and the school district have a similar name. This has caused many Ohioans problems when filing their tax returns. Some people will mix up the taxes and report the wrong withholding amounts for each. Other people think the taxes are the same and will add the withholding amounts together, also reporting the wrong amount on their tax returns.

To help prevent further confusion, employers must now include the Ohio school district identification number with the school district name. This requirement started with the 2016 tax year.

How to report an Ohio school district number on Form W-2

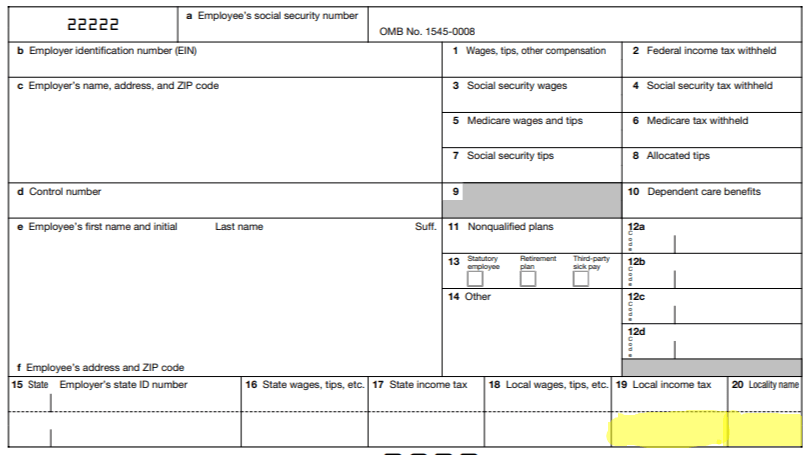

To report local and school district income tax on Form W-2, you need to focus on boxes 19 and 20.

W-2 Box 19

In W-2 box 19, you will enter the total local income tax withheld and the total school district income tax withheld. Make sure you enter the amounts on different lines; do not combine the tax withholdings.

W-2 Box 20

In box 20, enter the name of the locality or school district that you withheld taxes for. Make sure the locality and the school district match up with the correct tax withholding amounts.

You need to use the four-digit Ohio school district number with the school district name in W-2 box 20. You can look up school district identification numbers using The Finder on the Ohio Department of Taxation (ODT) website.

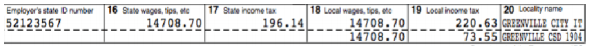

The ODT created an example of what boxes 19 and 20 should look like. As you can see, the local income tax is on the first line of boxes 19 and 20, and the school district income tax is on the second line.

Box 20 might not be big enough to enter the full school district name and identification number. The ODT will accept the school district number with an abbreviation of the school district name.

Here are some examples of acceptable methods of abbreviating the information in box 20:

- SD 1904 (SD is an abbreviation for school district)

- 1904 SD

- GREEN 1904

- 1904 GREEN

- GRE 1904

- 1904 GRE

For more information on Ohio school district income taxes and reporting on Form W-2, visit the Ohio Department of Taxation website.

Don’t worry about Ohio school district income tax. Let Patriot Software take care of it for you! Patriot’s Full Service Payroll correctly reports boxes 19 and 20 on Form W-2. Simplify your payroll process by getting a free trial now!

This article has been updated from its original publication date of 12/12/16.