At the beginning of each quarter, I prepare a short but in-depth conference call for RWM clients. Our team puts together the most revealing and informative slides. In that half hour, I blow through ~40 slides that capture and explain what is going on.

About a quarter of the October 2022 slides were focused on real estate. The reason for this is that housing is very often where we see FOMC policy having its most immediate effect. Sure, RRE/CRE is a huge part of the economy, so its health is important. But for the purposes of our discussion about the stater of the economy and markets, Real Estate is where the rubber meets the road.

Rising Fed Funds Rates make capital and credit more expensive; the calculus around both debt and equity shifts. Nowhere is this easier to see than in mortgage rates and their impact on home purchases.1

The caveat these days is that a wicked combination of events — falling new home construction post-GFC, the pandemic purchase spree, and the low available inventory have made it more difficult to read into the usual home data.

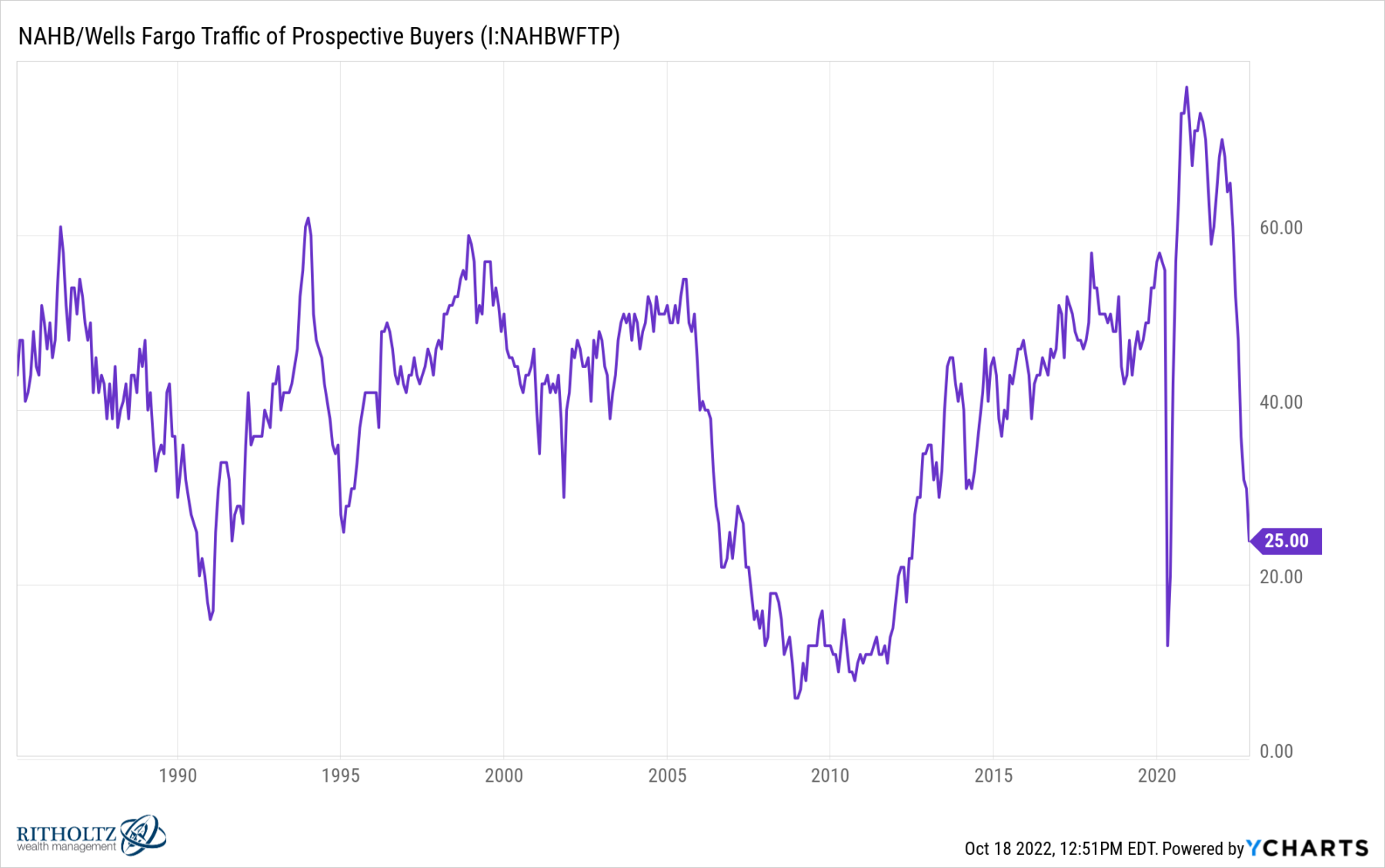

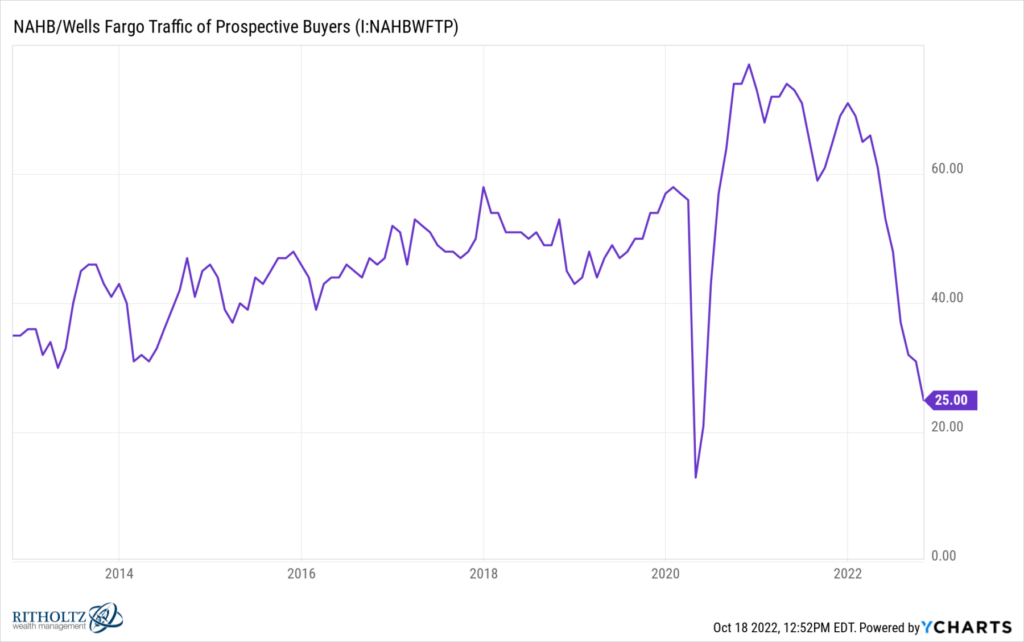

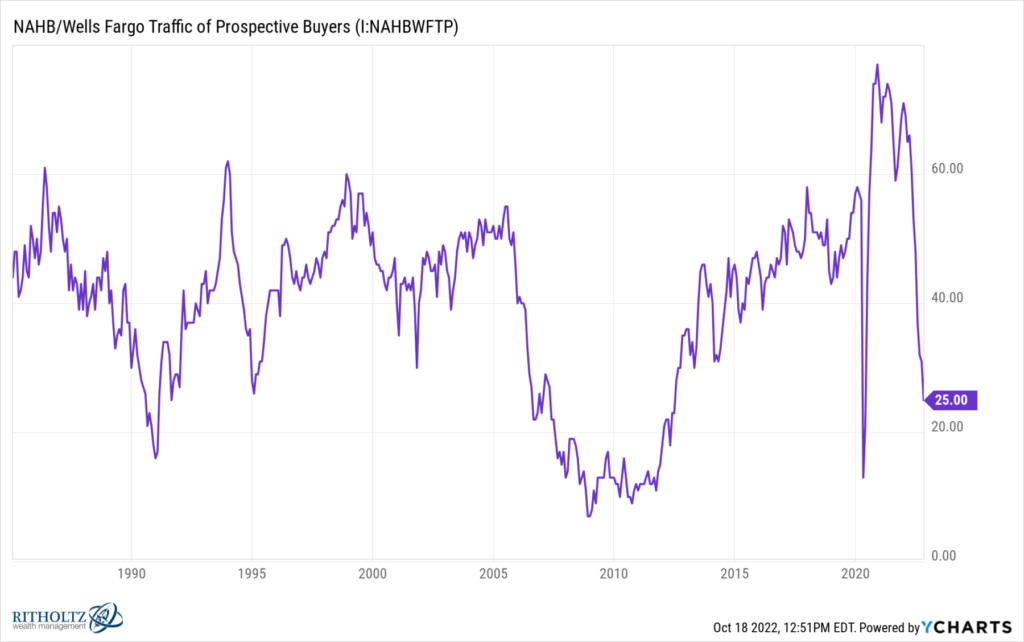

This brings us to the chart: The one above shows the traffic of prospective buyers looking at a new home (2014- 2022); the one below goes back to the 1980s.

The four largest drops occurred during distinct periods of economic distress: 1990 (recession), 2006-09 (GFC), 2020 (pandemic/recession), and today (FOMC 300 bp rate hike). The current collapse is to a measure of 25, from a November 2020 peak of 77; the pandemic saw a fall to 13 from 58, and the GFC saw a collapse from 55 to 7. That makes the degree of drop today as bad as any of those prior falls.

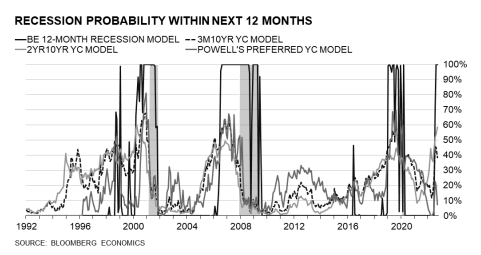

When recession probabilities tick up to nearly 100% for the next year, this is where those expectations begin.

Previously:

How Everybody Miscalculated Housing Demand (July 29, 2021)

Aspirational Pricing (May 25, 2022)

See also:

The Housing Market Correction (Wells Fargo, October 5, 2022)

__________

1. We have discussed in the past why the actual purchase price of a home matters less than the monthly carrying costs: The sale price is somewhat abstract while homeowners must pay their monthly mortgage, utilities, HOA, and taxes. For everyone who is not a cash buyer of a house — that is about 75% of the homes sold nationally (and about half in places like Manhattan) — those numbers can be budgeted.