In the spring of 2020 I wrote a piece about how the Fed’s actions during financial crises could make stock market returns lower in the future.

This was the gist of it:

If the stock market during the worst economic contraction in 90 years can be smoothed out by government spending and Fed actions, does this change the risk-return framework in the stock market going forward?

Said another way — if stocks don’t have the risk of a Great Depression-like crash on the table, does that mean expected returns should be lower going forward?

This idea seemed counterintuitive at the time since so many people assumed the Federal Reserve was actively trying to prop up the stock market.

That is certainly not the case anymore.

Fed members are now actively rooting for the stock market to go down to soften financial conditions so inflation will fall. And it’s working. We’re in a bear market. Stocks and bonds have both crashed.

I’m not a fan of the Fed using the stock market as a barometer of their policies but I see where they’re coming from.

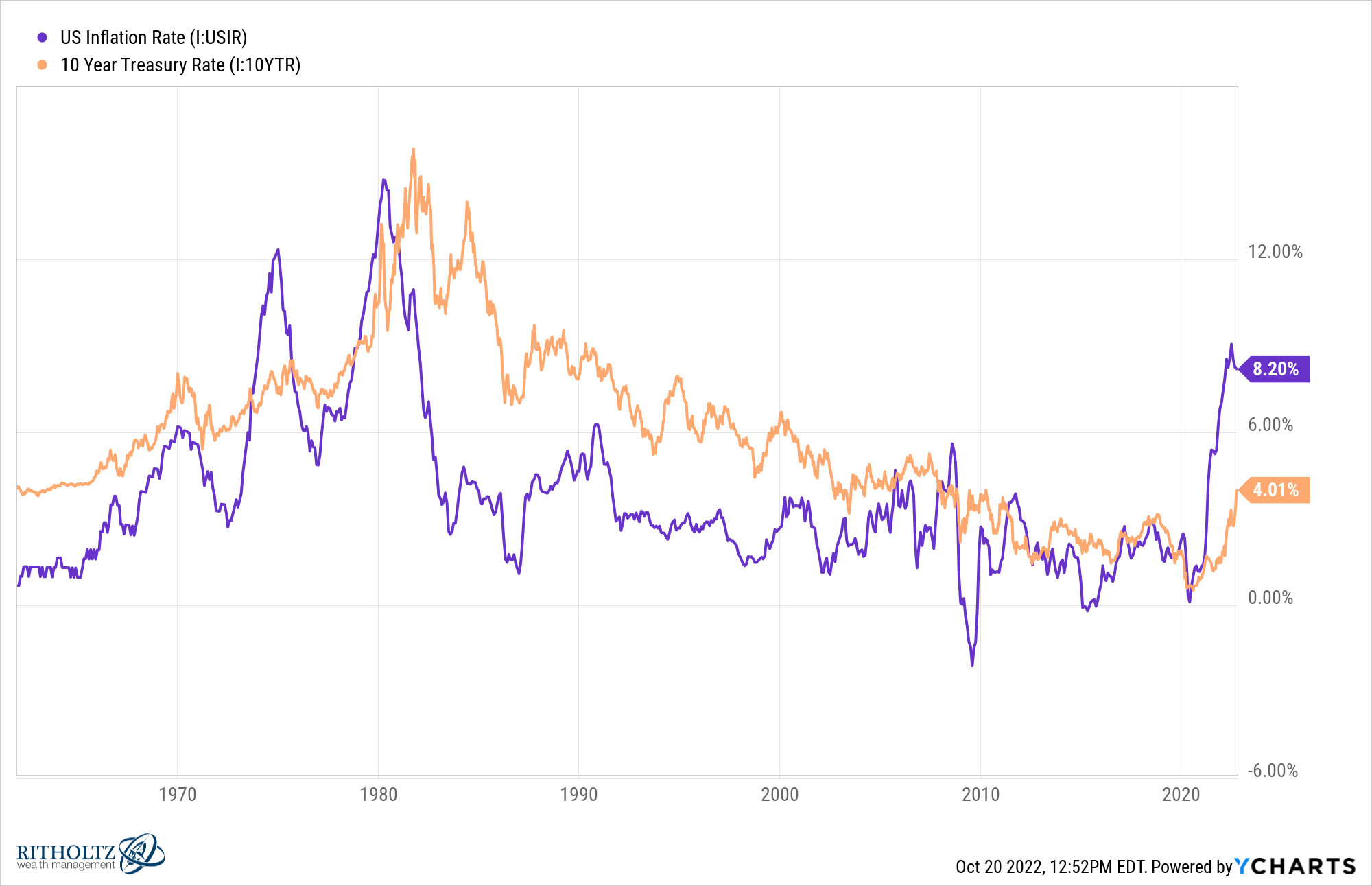

But I don’t agree with everything they’re trying to do right now. Interest rates obviously had to come up to deal with inflation, which remains far above the benchmark 10 year treasury yield:

My problem with the Fed’s current stance is not necessarily the magnitude of the interest rate move but the speed of that move. Just look at how quickly mortgage rates have risen this year:

They’ve more than doubled in 10 months.

Forget about the stock and bond markets. It’s never fun to lose money but that’s the contract we’ve signed up for in risk assets. Making money in the long-term sometimes requires losing money in the short-term.

I don’t really have a problem with that.

My problem is with the potential impact on important segments of the economy.

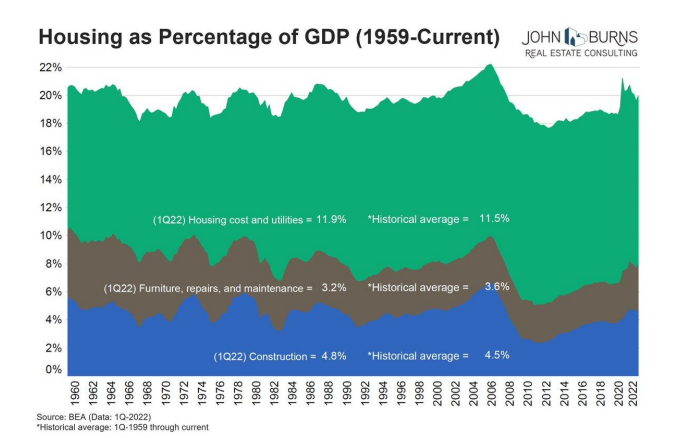

John Burns Real Estate Consulting estimates the housing market makes up roughly one-fifth of the U.S. economy:

Just think about all of the jobs and businesses involved in the housing market.

Building new houses requires homebuilders, architects, construction workers, inspectors and suppliers for building materials.

When you buy or sell a house there are realtors, loan officers, title companies, appraisers and moving companies involved.

And when people move to a new place, you invariably spend a lot of money on ancillary items such as furniture, lawn equipment, maintenance and renovations.

The impact on the housing market is one of the biggest reasons the 2008 crash was so severe. It impacts people personally, but it’s also an important piece of the economy.

Luckily, today’s housing market is different in many ways that what caused the boom and bust of the early-2000s.

Homebuyers have much better credit scores this time around. Most people were able to lock in low borrowing costs before they rose this year. There aren’t a bunch of no-income loans being given out with adjustable rates like the last time.

So the housing market is in a much better place.

The problem is it’s possible for the housing market as a driver of the economy to get much worse from here.

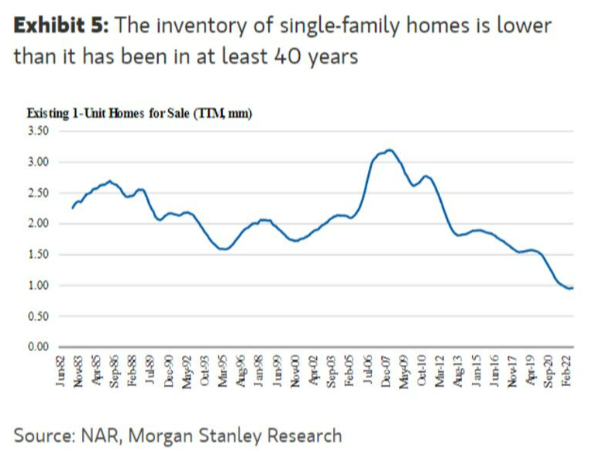

Morgan Stanley shows the inventory of single-family homes for sale is lower than it’s been in at least 40 years:

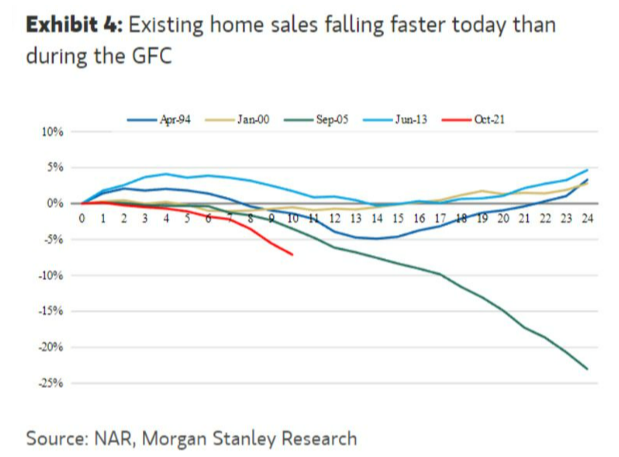

And home sale transactions are now falling off a cliff at an even faster pace than they did during the last housing crash:

Housing prices have some room to fall considering the massive gains homeowners have been gifted since the start of the pandemic.

I’m not worried about housing prices as much as I am worried about what this could do to the housing industry.

If the number of homes sold remains stagnant it could have ripple effects for years to come in the U.S. economy.

If homebuilders decide it’s not worth it to build more housing stock we could see a shortage of housing availability at a time of increased household formation for young people if there are no incentives for them to add more supply to the market.

Listen, I don’t envy policymakers. It’s not an easy job. The Fed didn’t single-handily cause this inflation so it seems unfair they are the ones tasked with getting it under control.

I’m glad I’m not running the Fed right now.

But if I was Fed Chair Carlson, here’s what I would do:

Take a little breather and see how things shake out for a couple of months. You can’t expect a $23 trillion economy to stop on a dime and change course.

It’s like turning a battleship. The economy typically reacts to new policy measures on a lag.

And the fact that interest rates have risen so much in such a short time frame means the market has already done a lot of the heavy lifting for them.

I understand why the Fed wanted to cool the housing, stock and bond markets.

I am just surprised they are willing they are trying to kick these markets while they are down without considering the potential ramifications of taking things too far and leaving lasting problems in the economy going forward.

We had my favorite Fed expert Cullen Roche on this week’s Portfolio Rescue to discuss the some lingering questions I have about their latest policies:

You can listen to the podcast version of the show here:

Further Reading:

What is the Fed Doing?