DollarBreak is reader-supported, when you sign up through links on this post, we may receive compensation. Disclosure.

The content is for informational purposes only. Conduct your own research and seek advice of a licensed financial advisor. Terms.

M1 Finance is an app that combines brokerage services with robo advisory services. Despite being a relatively new app, it has already built a reputation for being easy to use. The platform has is beginner-friendly and offers both customizable and pre-built (by experts) investment portfolio that it calls “pies”. There is also a low $100 minimum deposit amount and no management or portfolio fees.

Pros

- No trading fees – the platform does not charge any trading fees. However, it offers an option $125 annual membership that comes with premium features.

- Get access to pre-built portfolios – the platform offers over 80 different Expert Pies, which are pre-built portfolios by experienced traders.

- Sign up bonus – get a bonus of $30 when you first join and deposit at least $1000 within the first 14 days. The more you deposit, the higher the bonus.

- Low minimum investment amount – the minimum deposit is just $100, making the platform suitable for novice investors to dip their toes in stocks.

Cons

- High interest rate for borrowing – to invest on credit, you must have at least $5000 in your balance and the platform charges a high fee of 3.5%.

- Inactivity – the platform charges an inactivity fee of $20 for accounts that have up to $20 in assets and have been inactive for more than 90 days.

Jump to: Full Review

Compare to Other Investment Apps

Fundrise

Invest in real estate properties with a $10 minimum initial investment

Historical annual return varies from 8.8% to 12.4% (2019 – 9.47%)

Low annual fees: advisory – 0.15%; management fee – 0.85%

How Does M1 Finance Work?

M1 Finance is an online platform that provides several different financial and investment services. The company has been around since 2015, and its headquarters are in Chicago.

M1 Finance specializes in providing Robo-advisory services to its members. You can use these services to manage your finances and investments with the help of a computer algorithm.

The company allows you to split your investment portfolio into pies. You can customize these pies to manage your investments based on your risk tolerance.

In addition, you can also specify the categories of assets where you want to invest your funds. Alternatively, you can also choose the specific stocks you want to buy. The company’s algorithm will then allocate and rebalance your investments based on your preferences.

How Much Can You Earn With M1 Finance?

Your earnings on M1 Finance will vary depending on the types of stocks you buy. For example, the assets on the S&P 500 have an average annual return of over 10%. Some could potentially help you earn more returns. However, these stocks tend to be riskier, and you may also make a loss on them.

Investing in the stock market comes with risks, and there is always a chance that you may lose money on your investments.

M1 Finance Reviews: Is M1 Finance Legit?

M1 Finance is a legitimate website you can use to invest in shares and ETFs. The company has received mostly positive reviews from users.

Many of the platform’s users have praised it for being easy to set up and use and having one of the best user interfaces. In addition, many users were also satisfied that the platform for its commission-free trading and automation.

However, some users of M1 Finance have complained that they were unable to turn off the automatic investing feature. Some reviewers were also unhappy that the platform required them to pay to access two separate trading intervals.

Who Is M1 Finance Best for?

M1 Finance is best for individuals who want to invest in the stock market or those who need help managing their finances. The company’s algorithm will help you buy and sell shares based on your preferences, saving you time and effort.

In addition, beginners in investing can benefit from using the platform due to its beginner-friendly interface.

M1 Finance Fees: How Much Does It Cost to Invest With M1 Finance?

M1 Finance offers commission-free trading, and you will not need to pay any trading fees when you buy or sell shares on the website. However, there are some regulatory and other fees that you may have to pay.

| Type of Fee | Fee Amount |

|---|---|

| M1 Plus Account (Optional) | $125 per year |

| Management Fee (Only for Portfolios Containing ETFs) | 0.06% to 0.2% per year, depending on the ETF |

| SEC Fees | Total price of transaction * $5.10 / 1,000,000 |

| TAF | $0.000119 per share for each sale of covered equity security with a maximum of $5.95 per trade. |

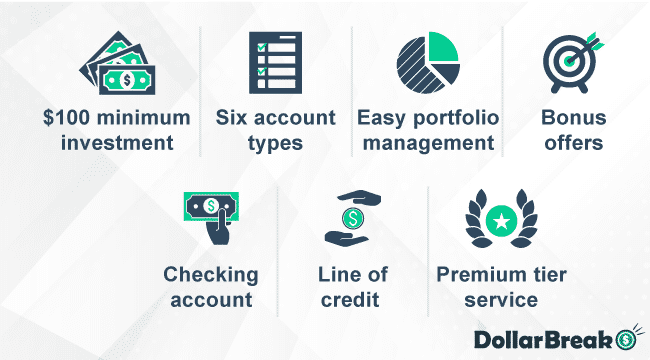

M1 Finance Features: What Does M1 Finance Offer?

Apart from its Robo-advisory feature, M1 Finance also offers a variety of other money-management features.

Some of these features include:

- Investing with Pies

- Fractional Investing

- Retirement account

- M1 Borrow

- M1 Spend

- Credit Card

- M1 Plus

Investing With Pies

M1 Finances allows users to split their portfolios into pies. Each slice of your pie represents a share of your portfolio, and you can choose a category or stock for each slice.

Investing with pies also gives users the added benefits of automation and customizability. Using the pie system, you can choose the exact stocks you want to buy. The M1 Finance algorithm will then automatically rebalance your portfolio based on your selections for the different slices in your pie.

In addition, if you are new to investing or are unsure of what stocks to include in your pie, you can also browse Expert Pies. Expert Pies are curated portfolios designed by experienced investors. If you find an Expert Pie that suits your preferences and risk tolerance, you can copy it into your pie.

Fractional Investing

M1 Finance also allows users to invest in stocks fractionally. Fractional investing involves buying and selling just a fraction of a share instead of the whole share. This feature is especially beneficial for new users who may not want to commit a large sum to buy an expensive stock.

With M1 Finance, you can buy as little as $1 worth of a share.

Retirement Account

M1 Finance also allows users to set up a retirement account with IRA or Roth IRA. You can set up an automatic investment schedule with your M1 Finance retirement account to grow your wealth for retirement.

M1 Borrow

If you have investments with M1 Finance, the company also allows you to borrow money against your investments. You can use M1 Borrow to access a line of credit and borrow up to 40% of your portfolio’s value.

The company also charges relatively low-interest rates of between 2.75% to 4.25%.

M1 Spend

M1 Finance also allows users to create a checking account.

An M1 Finance checking account comes with various benefits, including:

- 1% APY on your deposits

- 1% cashback on your M1 Spend Visa debit card

- Send paper checks using the M1 app

- Get your paycheck up to two days in advance

Credit Card

M1 Finance has a credit card program that you can take advantage of to earn up to 10% cashback on your spending. The rate of cashback you can enjoy will depend on the brands you hold in your M1 Finance portfolio.

However, there is a $95 annual fee for the credit card, although this fee is waived for M1 Plus members.

M1 Plus

M1 Plus is the company’s premium membership program. An M1 Plus membership costs just $125 per year, and you can enjoy a one-year free trial.

Some of the benefits that you can enjoy with the M1 Plus membership include:

- Two trading windows instead of one

- No application necessary for M1 Borrow

- Pay at your own pace with M1 Borrow

- 0 international fees

- M1 Spend credit card fees are waived

- And many more

M1 Finance Requirements

The only requirement that M1 Finance has for its users is a $100 minimum account balance ($500 for retirement accounts).

Apart from the minimum account balance, there are no other requirements to use M1 Finance. Thus, it is one of the best websites you can use to invest.

M1 Finance Payout Terms & Options?

You can withdraw money from your M1 Finance account to your linked bank account. It is free to withdraw funds from your M1 Finance account, although it takes two to three days.

M1 Finance Risks: Is M1 Finance Safe to Invest With?

M1 Finance is insured by the Securities and Investor Protection Corporation (SIPC). The SIPC insures M1 Finance accounts for up to $250,000 in cash and up to $500,000 in total. Thus, even if M1 Finance shuts down, you will still be able to recover a part of your investment.

In addition, M1 Spend and M1 Plus checking accounts are also insured for up to $250,000 by the FDIC.

How Does M1 Finance Protect Your Money?

M1 Finance helps you protect your finances and investments through two-factor authentication. This security measure requires anyone trying to access your account to also have access to your mobile phone.

In addition, M1 Finance also provides users with regular updates on their account security status. You should turn on notifications from M1 Finance and read your emails regularly to ensure that your account is not compromised.

The company also recommends using a unique password for your M1 Finance account that you do not use for other websites.

What Are the M1 Finance Pros & Cons?

M1 Finance Pros

- There are no trading fees, and you can enjoy commission-free trading.

- You can customize your portfolio or choose from one of over 60 different expert portfolios.

- The dashboard allows you to easily view and manage your portfolio.

- Your account is insured by the SPIC for up to $250,000 in cash and $500,000 in total.

M1 Finance Cons

- The app does not provide financial advisory services.

- You will need to pay $125 per year to access the features included in a Plus membership.

How Good Is M1 Finance Support and Knowledge Base?

M1 Finance provides a comprehensive support and knowledge base on its website. You can access this knowledge base by visiting the M1 Finance website and clicking on the Resources tab.

In the help center, you will find the answers to many frequently asked questions that M1 Finance users have. If you still have any questions about how to use the platform, you can contact M1 Finance customer support by creating a support ticket through the M1 Finance website.

M1 Finance Review Verdict: Is M1 Finance Worth It?

M1 Finance is one of the best websites that you can use to invest in shares and ETFs. The company specializes in providing Robo-advisory services, allowing users to automatically manage and rebalance their portfolios based on their risk tolerance. Moreover, you can also buy fractional shares and enjoy commission-free trading with M1 finance.

Apart from investment services, M1 Finance also offers users comprehensive financial management services. Some of these additional services include a line of credit and cashback on your spending. However, note that it costs $125 per year to access some of the bonus features.

Overall, if you are looking for a good platform to manage your investments and finances, M1 Finance is one of the best options to consider.

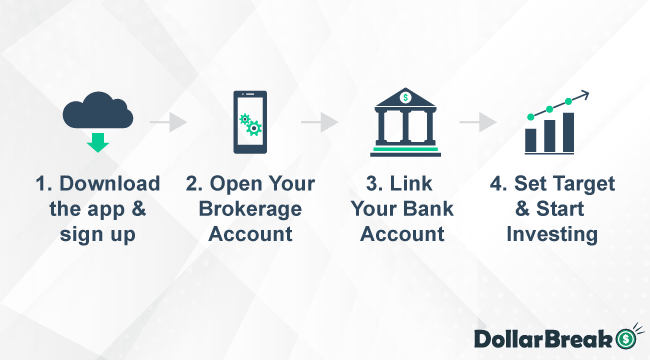

How to Sign Up With M1 Finance?

Step 1: Create an Account

To sign up with M1 Finance, download the M1 Finance app first. The app will then guide you through creating an account and setting up your pies. You will also need to provide a valid email address and your full name.

Step 2: Open a Brokerage Account

Once you have an M1 Finance account, you can open your brokerage account. This is where you can decide on the types of investment accounts you would like to open. You can also create multiple accounts, including investment accounts and IRA retirement accounts.

To open a brokerage account, you will need to provide information about your trading experience. M1 Finance is also required to report investment activities to the IRS and verify the identities of its investors. Thus, you will also need to provide your social security number and your address.

Step 3: Link Your Bank Account

After you have opened your brokerage account with M1 Finance, you will need to link your bank account. Linking your bank account allows you to fund your M1 Finance account.

Note that there is a minimum investment amount of $100. Whenever you deposit any money into your M1 Finance account, the platform will automatically invest it according to your allocations in your pies.

Sites Like M1 Finance

| Comparison | M1 Finance | Acorns | Fundrise | Public |

|---|---|---|---|---|

| Service Fees | No fees | From $3 per month | 1% | No fees |

| Min. Investment | $100 | $5 | $10 | $1 |

| Best For | Robo-investing | Spare change | Real estate | Stocks and ETFs |

M1 Finance vs Acorns

Both M1 Finance and Acorns provide automated investment services. However, unlike M1 Finance, Acorns specializes in helping users invest their loose change. Acorns will round up all your spending on a linked card to the nearest dollar, helping you save and invest any loose change.

You can invest in various stocks and ETFs with Acorns starting from just $5. The low minimum investment amount makes Acorns more suitable for beginners who are new to investing. However, if you want to invest larger sums, M1 Finance may be a more suitable app to use.

M1 Finance vs Fundrise

Fundrise is one of the best websites that you can use to invest in real estate. The company operates real-estate investment trusts (REITs). You can invest in Fundrise REITs to enjoy dividends and capital gains. The company has an average annual return of 5.42%, with returns in some years exceeding 22%.

Fundrise also pays dividends to shareholders in its REITs, based on the profits that the properties earn. Thus, buying shares in rental properties with Fundrise can allow you to create a source of passive income.

If you want to invest in a REIT that is not publicly traded, Fundrise can be a good alternative to M1 Finance.

M1 Finance vs Public

Like M1 Finance, Public offers fee-free trading with no commission. This platform specializes in offering self-directed trading services, meaning that you will have the ability to manage all your investments.

However, unlike M1 Finance, Public does not offer Robo-advisory services to help you automate the trading process. Thus, while Public may be ideal for experienced investors, M1 Finance is still the better option for beginners.

Other Sites Like M1 Finance

M1 Finance FAQ

What Is M1 Finance?

The platform is most well-known for its brokerage and Robo-advisory services. The brokerage services allow members to buy and sell shares on the stock market. In addition, the Robo-advisory services allow members automatically manage their finances with the help of a Robo-advisor.

The company currently has over 500,000 active members using its services.

Is M1 Finance a good investment?

M1 Finance is a good platform to invest with if you want to have control over your investments without having to actively rebalance your portfolio or manage your investments. The platform also offers commission-free trading services, making it a good investment.

However, note that all investments carry risk and there is always a chance that you might lose money on your investments.

Is M1 Finance good for beginners?

M1 Finance is a good investment platform for novice investors. You can choose from over 60 pre-designed investment portfolios created by experienced investors to copy for your portfolio. This can be beneficial for beginner investors who may not know how to choose stocks to invest in yet.

What banks work with M1 Finance?

You can use almost any US bank account to fund your M1 Finance account. However, there are some banks that the platform does not support. You can view the full list of unsupported banks here.

How does M1 Finance make money?

M1 Finance can provide commission-free trading services because it makes money from the other services it provides.

Some of the ways M1 Finance makes money include:

- Interest from loans

- Subscription fees for its Plus membership

- Interchange fees

- Fees for stock lending

- And many more

Is M1 Finance good for the long term?

If you are looking to invest your money for the long term, M1 Finance is one of the best platforms you can use. You can create a pie that caters to long-term investments. The platform also allows you to adjust your risk tolerance based on your preferences.

Moreover, M1 Finance also allows you to create a Roth IRA or IRA account to invest in for your retirement.