Do you know what is really hard? Deciding to walk away from a whole lot of money in your prime. If you decide to retire early or take a lower-paying job out of joy, you must accept the death of your maximum money potential.

Over the years, many readers looking to retire early or do something more fun but less lucrative have found it difficult to walk away from more money. After all, working for just one more year will boost your savings that much more!

Then ten years go by and they regret sacrificing so much time for money. Time lost with friends and family. Journeys not taken. Businesses not built. The list goes on.

If you don’t enjoy your job, this regret of pursuing more money will sting even worse. Therefore, make sure if you choose money, to make the most of your free time.

This post will share how you can quit the pursuit of always making more money to live a more fulfilling life. Because once you get to your target stretch income, the joy won’t last for more than a month. You’ll then naturally try and make even more money.

The cycle never ends until you learn how to break it.

Breaking The Golden Handcuffs Is Hard

At age 34, I was making a base salary of $250,000. Come year-end, my bonus would range between $0 to $500,000. Instead of suffering from the one more year syndrome for one more year, I decided to quit the money by negotiating a severance instead.

If I hadn’t left my job and averaged a realistic $500,000 a year in total compensation since 2012, I would have made $5 million by now. And if I had gotten regular raises and promotions, maybe I would have made more than $7 million after ten years.

Damn, perhaps I should have stayed in finance after all!

The more you make, the harder it is to walk away. Conversely, the less you make, the easier it is to take more chances.

I told myself back in 2011 that if I didn’t leave soon, I probably never would break free from the golden handcuffs. Many people who dislike working in finance, management consulting, and big tech after a while have this same problem. It’s hard to drop your maximum money potential.

However, if you’re unhappy with your current situation, as I was, you must find a solution to overcome the desire for more money. Once you make enough to have your basics covered, more money truly doesn’t bring more happiness unless you enjoy what you do.

How To Be OK With No Longer Making Maximum Money

Everybody has the ability to make a certain amount of money. Income has a range that usually increases the older you get.

Rational people are also realistic with how much money they can potentially make. If you decide to work for the government, you know your pay will be within a very tight band. Alternatively, if you decide to become an entrepreneur, your income upside is unlimited.

Let me share with you the steps I took to be at peace with no longer trying to make maximum money. In the process of walking away, I also lost my title and became a nobody. For some, walking away from status and prestige is even more difficult than walking away from money. We all want to stay relevant somehow.

To clarify, this post is not so much about early retirement. It’s more about saying no to a promotion or a job transfer that requires more work for more money. It’s also about taking a new job that brings you more meaning, but doesn’t pay as well. Early retirement is an extreme example that isn’t for everybody.

1) Envision What Your Life Would Be Like Making More

The easiest way to imagine how your life would be different if you made maximum money is to analyze the life of your boss.

The two most observable things include their house and car. The type of car your boss drives may be misleading given they may drive their dough car to work and leave their show car at home.

However, when you make a lot of money, the one thing you tend to splurge on is your home. After all, we’re spending a lot more time at home post-pandemic.

Find the address of your boss’s home and ask yourself whether this is the type of home you aspire to own. Just be aware your boss may be a Financial Samurai reader and purposefully downgrade the features of their home to stay more stealth.

The next step to discover what life would be like making more money is guessing whether your boss has a happy home life.

Is s/he single, happily married, or bitterly divorced? Are his or her kids well-adjusted or in rehab? Do his or her kids attend good schools? Are they still living at home as adults because they were neglected by workaholic parents? Obviously, these are judgement calls you must make.

The final step to deciding whether you want to make maximum money is to rate your boss’s overall happiness at work. Use a scale of 1 – 10 after deciding what your rating is.

Is she coming into work and leaving at a reasonable hour? Or is she constantly burning the midnight oil? Or maybe she’s living the dream working from her vacation home in Hawaii while commanding you to work in the office. If your boss is making big bucks while hardly working, then you will certainly be more motivated to stay on!

After several years of working together, you should be able to get a good idea of what your boss’s lifestyle is like. You must then make a calculated decision as to whether your pursuit of more money is worth it.

Not An Exact Science Analyzing Your Boss’s Lifestyle

Of course, you won’t necessarily replicate your boss’s lifestyle. Maybe he is generally a moody and miserable person. And maybe you are a jovial person who takes a more optimistic outlook on things. However, a lot of stress in life comes from your responsibilities at work and the activities you do to make money. Therefore, be realistic with your comparisons.

Personally, I liked my immediate supervisor. She was the most hard-working and optimistic person in the office. Go Kathryn! However, she didn’t have jurisdiction over my pay or promotion. She was more of a figurehead given we worked in a satellite office. My career was determined by my bosses in New York City and Hong Kong.

My boss in NYC was actually the same level as me, Executive Director, but five years older. I knew he had to get promoted to Managing Director first before I could. Therefore, at minimum, I had to wait another three years. That was too much time to waste.

My NY-based boss was an OK guy. But he was not charismatic or inspiring. He also looked very unhealthy, which is something that disturbed me. I was paranoid that if I worked as long and as hard as him, I might one day look and feel like him.

There are many stories of relatively young people dying from heart attacks in high-stress work environments. Further, I was already suffering from plenty of chronic health issues due to all the stress.

I had the belief the richer you are, the fitter you should be because you can afford to eat healthier foods, hire trainers, and so forth. Therefore, his poor health made me wonder whether our work was somehow taking years off his life. If I worked until his age, would my health also disintegrate? I became a little paranoid.

There is no point having a lot more money if you are unhealthy or die young. Having to work for 5 to 10 more years to potentially make 100% more was no longer worth it to me.

2) Calculate The Minimal Amount Necessary To Be Happy

The minimal amount of money necessary to be happy equals being able to cover your core living expenses: food, clothing, shelter, healthcare, and children (if any).

Some researchers believe once you make over $75,000 a year, your happiness no longer increases. Inflation adjusted, that figure is about $100,000 today. $100,000 might be great for someone living in Des Moines Iowa, but it’s not that great for someone living in an expensive coastal city. Adjusting for the cost of living is important.

In 2012, after carefully analyzing my income since graduating college in 1999, I decided that making $200,000 a year was the ideal income for maximum happiness living in San Francisco or Honolulu.

My investment income was generating about $80,000 a year, my wife was making about $120,000 a year, and I was earning some supplemental online income as well. Thus, I felt taking a risk and leaving work behind was OK in 2012. Worst case, I would go back to work after a couple of years.

By the time my wife retired in 2015, we were able to generate closer to $150,000 a year in passive income. Although we were $50,000 a year short, I had confidence that we’d eventually get to $200,000 and beyond if I regularly reinvested my growing online income.

Analyze your budget for the previous three months to calculate your core living expenses. Treat your analysis like a pop quiz since. For the next three months, observe whether your core living expenses truly are enough to make you satisfied. If not, keep spending a little more each month until you find that perfect minimum monthly expenditure.

Now work backward and see whether your existing capital and supplemental income activities can cover this annual lifestyle expense. If it can, then you can take things easierl. If it can’t, then keep on saving away until you can get there.

Be Careful Not To Overestimate How Much You Need

Since leaving work, I realized we overestimated how much we actually need to be happy by about 30% for the first five years before we had children. It’s as if we forgot that after we retire, we no longer need to save for retirement. But we calculate a savings rate into our retirement income anyway since we’re so used to the habit.

If you have a net worth equal to 15-20X your average annual household income for the last three years, you can probably retire comfortably. If your net worth is equal to at least 40X your average annual expenses, you should be able to retire as well.

I wouldn’t use 25X your average annual expenses as a multiple to declare financial independence anymore given how low interest rates are today. The proper safe withdrawal rate is lower today than in the 1990s. Further, unexpected expenses pop up all the time, not to mention the occasional bear market!

However, these multiples are used for those who want to retire and not make ANY active income ever again. This article is about how to walk away from making your maximum money potential, not all money.

Therefore, if you have enough passive income or capital to cover your core living expenses, you should better be able to overcome the pursuit of maximum money. In other words, we’re talking more Barista FIRE or Coast FIRE where work is more flexible.

3) Find More Joy And Purpose In Something New

If you find something you’d be willing to do for free, it is much easier to shun making maximum money. If you’re making a lot of money, but not helping anyone, you’ll eventually lose interest. Your soul might start hollowing out as well.

Let’s say you’re making millions as a senior executive at The Coca-Cola Company. Your company is producing artificial products with excessive amounts of sugar that are hurting the health of billions. The ingredients in the products are creating more diabetics and creating a larger burden on the healthcare system. Clearly, you’re not helping the world.

However, you may trick yourself into thinking you’re doing good due to a charitable foundation Coca-Cola or you have created. You can tell yourself the means justify the ends in order to take care of your family. But deep down, you know that greed is what’s driving you to get more people hooked on sugar. The same goes for working at tobacco companies and maybe some social media companies too.

At the end of the day, you want to feel good about the product or service your company is producing. Once you’ve accumulated enough capital to cover your core living expenses, it’s worth trying to switch jobs if you don’t feel proud of what you do.

Experiencing A Wake-Up Call In 2008

Once the Global Financial Crisis hit, I no longer felt good about working in finance. Even though my job had nothing to do with the housing crisis since I worked in international equities, it still felt bad to be part of the system.

Yes, there is good in helping pension funds and retirement funds grow so that people don’t have to work forever. However, after 13 years, a career in making money from money wasn’t satisfying. So I left. I wanted to produce something instead.

Financial Samurai made very little money during its first couple of years. But I kept writing for several hours before and after work because I was having fun. Making money online wasn’t the primary goal. Expressing myself and connecting with others was and still is.

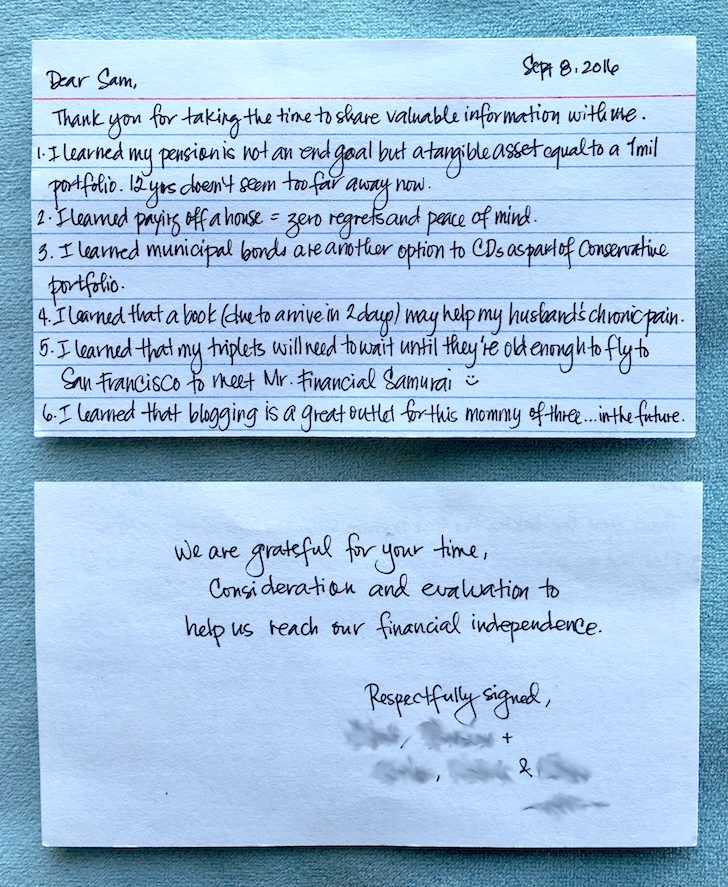

As the site grew, I could see the reward in helping people solve their financial dilemmas. Empowering people gave me purpose, therefore I have continued until this day. The kind comments and supportive notes are supremely rewarding, way more than any amount of money can provide.

4) Make Sure You Actually Win Back Some Time

If you choose to walk away from maximum money, make sure you gain back more time in your day. Not only should you gain back more time, you should also make sure you’re less stressed. Don’t just go through the same motions with your new occupation. Be very purposeful about how to utilize your extra time.

One of my friends left banking to become a pastry chef. She went to baking school for a year and got a job as a junior baker at a restaurant. She went from making ~$300,000 a year to $15/hour standing on her feet for eight hours a day. The joy of baking the yummiest desserts quickly disappeared.

She told me, “If I’m going to constantly be yelled at, then I might as well go back to banking!” Two years after quitting banking, my friend returned. She’s been back ever since.

Giving up 80% – 90% of my income was painful at first. However, being able to have 100% control over my free time made me incredibly happy.

More importantly, my chronic back pain, TMJ, and allergies started going away as well. My TMJ was so uncomfortable, I once paid a dentist $700 out of pocket to drill divots in my rear molars to provide jaw relief.

The health benefits of early retirement are priceless. The recovery in my health made walking away from maximum money much easier. More time is already more valuable than more money. The combination of more time and better health made quitting the money that much more of a no brainier. However, I didn’t really appreciate the health benefits until about a year after leaving my job.

And once again, it was the noticeable deterioration in my mental and physical health during the pandemic that necessitated a need for a sabbatical.

I discovered what it was like to make more money online because I tried, but it didn’t make me happier. Instead, it sucked me back into the never-ending cycle for more, more, more.

5) Try To Escape With A Win

Leaving a high-paying job with a severance package is a must. It is very common for high-paying jobs to come with some type of stock compensation or deferred compensation to keep you locked in.

A severance package helps pad your new lower compensation so the transition isn’t as jolting. With a smoother income transition, it will also be easier to accept making less money.

By negotiating a severance package, I was able to make the same amount of money had I stayed for the rest of the year working. This felt like a huge win.

The severance package kept paying out a livable income for five years total. As a result, I wasn’t as stressed as I should have been in my mid-30s. Further, I didn’t feel rushed to make money online.

Three years later, my wife also walked away with a severance package in 2015. She had a lot of doubt she could negotiate one, even after I negotiated mine. But after much coaching, we were able to come up with a win-win scenario. She felt like she had won the lottery!

Other wins may include having your company pay for your MBA, parental leave, or a sabbatical before you leave. If you like your company, another win may include getting reassigned to an easier role with less of a drop in pay as you would have expected.

It’s easier to walk away from maximum money when you are winning than when you are losing. Think about an NFL player retiring after winning a Super Bowl or a tennis player after winning a major. When you’re losing, there’s an inherent desire to prove to yourself and to your detractors that you can still succeed.

Knowing when to quit is as important as knowing when to keep on going. If you keep on grinding at something that is no longer worthwhile, you’re robbing yourself of a better life.

Making Lots Of Money Will Not Make You Happier

One of the goals I have from posts like the ones below is to make you question your pursuit of making maximum money.

In big cities such as New York and San Francisco, where I have lived since 1999, I meet people all the time who are miserable making multiple six-figures.

They went to good schools and feel like they have to follow traditional industries that pay the most. If not, what will their friends and family think of them? I’m assuming many of you reading this article fit the profile as well.

After I started focusing more on entrepreneurship, I began meeting people making millions a year. But they seem to have even more issues than the six-figure crowd!

One went through his third divorce. Another is constantly annoyed at dealing with HR issues given he’s the big boss. Yet another is dealing with a lawsuit that wouldn’t have happened if he wasn’t so rich. And another has been so stressed out by the markets he hasn’t been able to play tennis for six months due to a psychosomatic injury.

As you climb up the income stratosphere you simply start comparing yourself to a new set of highly-accomplished people. Just like making more money, the comparison never ends.

Make The Effort If You Feel Like Something Is Wrong

I know it’s hard to quit the money, but you must try if you are not happy. No matter how much money you make, if you don’t do something meaningful, you will eventually fall into a pit of despair. You might find yourself becoming more irritable, more moody, and more cynical.

Please calculate the minimum amount required to cover your living expenses to get understand your base income need. Then pursue something else that brings you joy. Stop moving the goalpost by appreciating more of what you have.

Although I left behind millions of dollars in finance, I gained back time. And if time truly is priceless, then giving up lots of money is no sacrifice at all.

Readers, are you pursuing your maximum money potential at a cost to your health and happiness? If you have been able to quit the money by taking a lower paying job, retiring early, or changing fields, I’d love to hear how you did it.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009

Manage Your Finances Like A Hawk

Being able to walk away from maximum money is easier if you are on top of your finances. Sign up for Personal Capital, the web’s #1 free financial app enables you to track your net worth and cash flow like a hawk.

My favorite features are the Retirement Planner and Portfolio Fee Analyzer. I’ve used Personal Capital since 2012 and have seen my net worth skyrocket partially thanks to better money management.