On Tuesday night, the new Labor government will deliver its first federal budget and shine a light on one of the most talked about policies – stage three tax cuts.

Due in July 2024, the tax cuts are part of the federal government’s income tax package to update the tax bracket threshold for inflation.

With the next official cash rate announcement from the RBA only one week away, many Australians are wondering what impact the tax cuts might have on the property market and their borrowing capacity to get into the market.

Read next: RBA announces October cash rate call

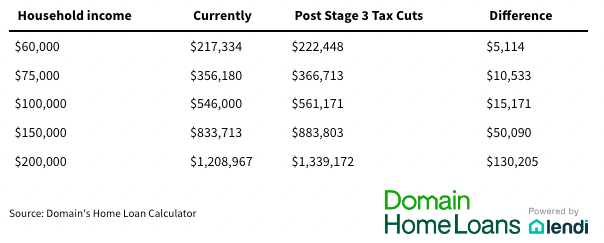

Domain, which has a partnership with online home loan platform Lendi, has crunched the numbers and found that higher-income earners will benefit more as the percentage increase equates to a larger amount of dollars as the income increases.

Those on lower incomes will still benefit from the tax cuts and increased borrowing capacity but won’t see borrowing capacity increase by as much in dollar terms.

“While the changes disproportionately benefit higher-income earners, the cuts level out the tax bracket system,” said Domain chief of research and economics Dr Nicola Powell (pictured above).

“With interest rates hitting household budgets, this is a positive as it helps to build back some of buyers’ eroded borrowing capacity. This should help more first home buyers get into the market by opening up more suburbs that fit within their borrowing capacity based on today’s median house prices.”

Powell said as interest rates rose at the fastest rate since 1994, the impact on Australia’s housing market had become glaringly evident.

“Based on the predictions from the big four banks, Domain is predicting the Reserve Bank of Australia to continue to ease the pace of interest rate hikes in the lead-up to Christmas,” she said.

“This eased approach also indicates that the RBA has more certainty that the risks to economic growth and rising inflation will soothe quickly, potentially showing that inflation could already be moving through a peak.”

Domain home loans general manager Kareene Koh said the rapid increase in interest rates since May had triggered a wave of refinancing as Australians on fixed rate home loans start to revisit their finances.

Read next: Mortgage prisoners are being locked up

“We’ll see this continue into 2023 as more Australians see their fixed rate expiring. The less than expected rate rise was welcome news to consumers last month, however, it does not take away from the fact that a household with a $1m has seen an increase in their monthly repayments well over $1,000 which is challenging to absorb,” Koh said.

“We are still seeing strong activity in pre-approvals suggesting that buyers are still in the market and potentially taking advantage of lower competition over properties and price decreases.”

Below is a table of what the change in borrowing capacity could look like after the state three tax cuts (Source: Domain).

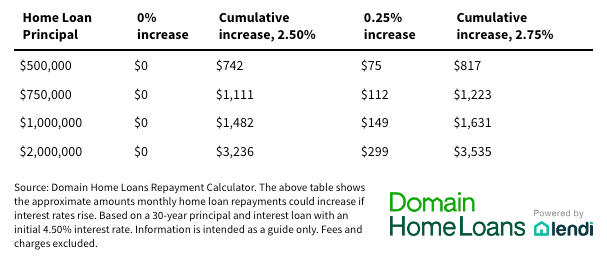

Below is a table of what mortgage repayments could look like after the November RBA cash rate call (Source: Domain)