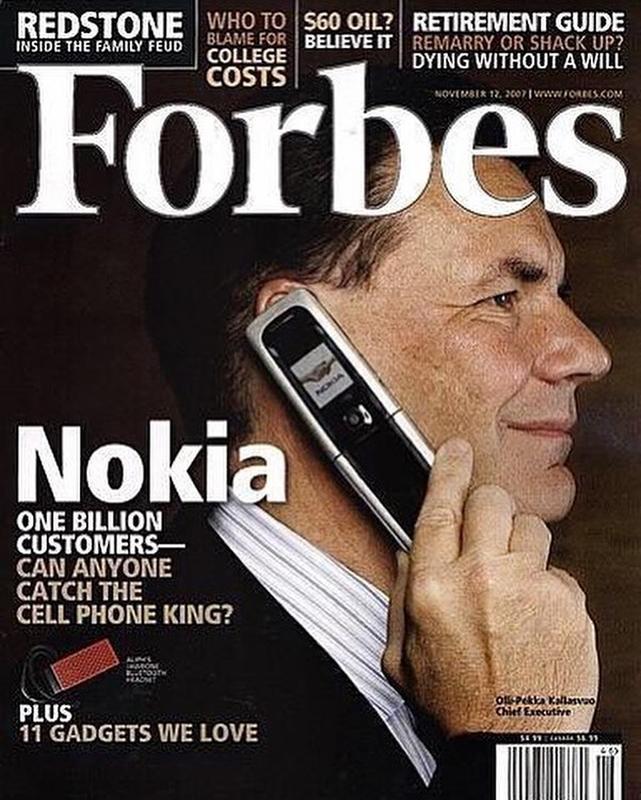

Today’s edition of “Nobody Knows Anything” is about a once-dominant mobile phone maker. Exactly 15 years ago, Forbes’s new cover story lauded Olli-Pekka Kallasvuo, Nokia’s CEO. The headline trumpeted:

“Nokia, one billion customers – can anyone catch the cell phone king?”

It was posted online October 26, 2007 — 15 years ago today.

In a classic version of the innovator’s dilemma, Nokia was unwilling to cannibalize its already very successful handset business. Perhaps they failed to recognize the shift toward more powerful smartphones that gave greater mobile computing capabilities to consumers. Or, they were simply unable to make the turn.

Regardless, Apple had already been working on a touchscreen mobile computing device for several years. In 2007, the very same year of the Nokia Forbes cover, Apple rolled out the iPhone; not long after, the decline of Nokia’s mobile phone business began. A mere 5 years later (2013), Nokia sold its entire phone business to Microsoft.

It’s yet another reminder of what we tend to overlook:

1. The future is unknown and unknowable: Ignore anyone who pretends they know with certainty what is coming next — they don’t, because they can’t. Instead, its better to think about the world in probabilistic terms: What is more likely or less likely to occur. You will still get this wrong (and often), but your mistakes will be smaller and you can be more flexible in your thinking.

2. This too, shall pass: There are lots of reasons why companies sometimes crash and burn from great success: Advantages achieved may not be long-lasting; the skills that led to greatness may not be the same as what it takes to maintain those advantages. Sometimes, the world changes before we recognize it. But its easy to forget this, and simply assume domiannt companies will remain that way. BlackBerry, Lucent, Nokia, NT were the dominant telecom players in the 1990s/2000s, and soon faded. Which dominant companies in the 2020s will suffer similar fates?

3. We fail to properly evaluate content we consume: Everything you read, listen ot or watch should to be analyzed for its integrity and accuracy. Every piece of information needs to be evaluated on its own merits. Investors cannot simply accept (or reject) something because it’s in a magazine or on television. My experience has been its better to rely on the individual writers you know than publications. Do not assume anything is right or wrong without understanding the source’s track record.

4. We underappreciate cycles: Trends feel like they are permanent, especially as they reach turning points: Nokia looked unbeatable in 2007 but the seeds of its destruction were planted years prior. We have a hard time looking beyond the here and now, as we live at the intersection of the past and the future. This often prevents us from understanding the long term life cycles of the economy, markets and companies.

5. Change is Constant: It is east to miss incremental shifts over time. The universe is dyanamic and ever changing. We are experts in the way the world used to be. Flux is a persistent state of affairs. This means we must constantly check our own knowledge base as it ages out of currency and decays over time.

If you pay attention to history, you will see this sort of thing regularly. Grand pronouncements about why a new service or product will be great or will fail miserably; forecasts about what will happen. Our own priors are so built in that it’s easy to miss when something — or everything — has changed.

Recognizing how little you actually know is a superpower. If we were less certain of ourselves and possessed more humility, we could all become better investors.

Previously:

Don’t Read This Blog Post! (May 18, 2022)

Gradually, Then Suddenly (October 1, 2021).

Why the Apple Store Will Fail (May 20, 2021)

Nobody Knows Nuthin’ (May 5, 2016)

How News Looks When Its Old (October 29, 2021)

Source:

The Next Billion

by Bruce Upbin

Forbes, Oct 26, 2007

https://www.forbes.com/forbes/2007/1112/048.html?sh=7e94dc6639e4