Having accurate accounting books is essential for making financial decisions, securing financing, and drafting financial statements. But sometimes, you find gaps in your records, either from making mistakes or carrying out transactions from one accounting period to another.

To combat discrepancies and get your records in order, you need to create adjusting entries. What are adjusting entries?

What are adjusting entries?

Adjusting entries are journal entries used to recognize income or expenses that occurred but are not accurately displayed in your records.

You create adjusting journal entries at the end of an accounting period to balance your debits and credits. They ensure your books are accurate so you can create financial statements.

In accrual accounting, you report transactions when your business incurs them, not when you physically spend or receive money. Adjusting journal entries are required to record transactions in the right accounting period.

You can create adjusting entries to record depreciation and amortization, an allowance for doubtful accounts, accrued revenue or expenses, and adjustments necessary after bank statement reconciliations.

Adjusting entries fall under one of three categories:

- Accruals: Revenues or expenses that have not been recorded, and have not been received or paid (e.g., accrued revenues and accrued expenses)

- Deferrals: Revenues or expenses that have been recorded but not yet earned or used (e.g., prepaid expenses and unearned revenues)

- Estimates: Non-cash items (e.g., allowance for doubtful accounts)

Adjusting entries can also refer to entries you need to make because you simply made a mistake in your general ledger. If your numbers don’t add up, refer back to your general ledger to determine where the mistake is. Then, create an adjusting entry to reverse or alter the record.

Creating adjusting entries is one of the steps in the accounting cycle. It occurs after you prepare a trial balance, which is an accounting report to determine whether your debits and credits are equal. If the debits and credits in your trial balance are unequal, you must create accounting adjustments to fix the discrepancy.

How to do adjusting entries

Prepare adjusting entries like you would any entry in accrual accounting: debit one account and credit another account.

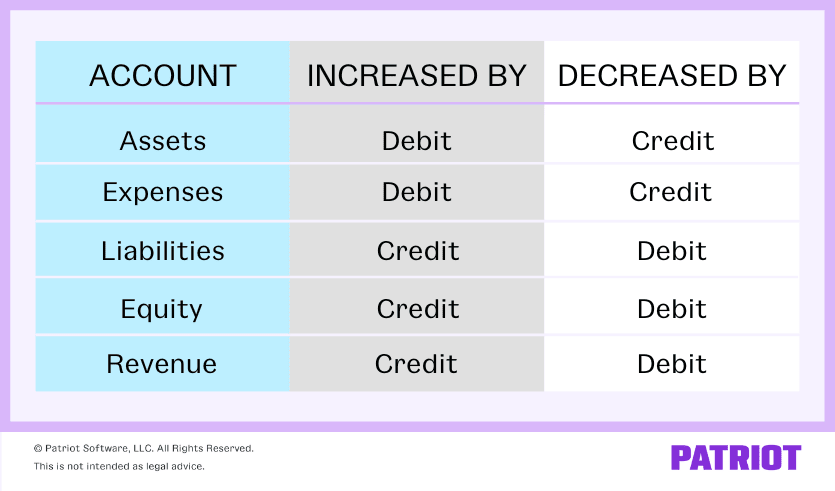

Some accounts are increased by debits while others are increased by credits. Take a look at the following chart to help you:

Adjusting entries deal mainly with revenue and expenses. When you need to increase a revenue account, credit it. And when you need to decrease a revenue account, debit it. Oppositely, debit an expense account to increase it, and credit an expense account to decrease it.

Adjusting entries examples

Take a look at these three adjusting entries examples and solutions to further clarify the topic.

Example #1: Accruals

Let’s say you operate a lawn mowing service. You mowed a customer’s lawn in one accounting period, but you will not bill the customer until the following accounting period. You performed a service worth $1,000.

Even though you won’t bill the customer until the following period, you still need to record the amount of your service in your books.

To record the amount of your services performed in one accounting period, you need to create the following adjusting entry. Debit your accounts receivable account and credit your service revenues account.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 6/30/2018 | Accounts Receivable | Lawn services | 1,000 | |

| Service Revenues | 1,000 |

Creating this adjusting entry will increase the amount of your accounts receivable account in your books.

Example #2: Deferrals

You run a jelly of the month subscription business. A customer pays you $300 for a 12-month supply of jelly. Because the customer pays you before they receive all their jelly, not all the revenue is earned. Instead, it is deferred revenue. However, your cash account increases because your business receives more cash.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 1/1/2018 | Cash | Payment for jelly subscription | 300 | |

| Deferred Revenue | 300 |

Each month, one-twelfth of the deferred revenue becomes earned revenue, which works out to $25 per month ($300 / 12). Create an adjusting entry to decrease your deferred revenue account by debiting it, and increase your revenue account by crediting it.

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 1/15/2018 | Deferred Revenue | One month of jelly subscription | 25 | |

| Revenue | 25 |

Example #3: Estimates

You set up an allowance for doubtful accounts. An allowance for doubtful accounts is a contra-asset account that decreases your accounts receivable. It estimates that some of your customers won’t pay you.

Let’s say you predict that you won’t receive $800 of your receivables. Because a debit increases expenses, you must debit your bad debts expense account. Take a look at your adjusting entry:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| 1/5/2018 | Bad Debts Expense | Estimated default payments | 800 | |

| Allowance for Doubtful Accounts | 800 |

Simplify your accounting responsibilities with online accounting software. Patriot’s small business accounting software makes it easy to add entries and view reports. Try it for free today!

This article is updated from its original publication date of May 29, 2018

This is not intended as legal advice; for more information, please click here.