Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!

The company:

Royal Unibrew is a Danish Beverage company that I “discovered” during my journey through all Danish shares some weeks ago (too expensive back then but “watch”). I had also seen them some months ago in the Profitlich&Schmidlin portfolio.

The company is mostly active in Scandinavia and the Baltics where they have offerings in all areas (including a contribution agreement with Pepsi), whereas in some countries (France, Germany, Italy), they are running a focused niche strategy. Despite the name, Beer is only around 35% of their offerings (as of 2021), the other 65% are mostly non-alcoholic drinks from soft drinks to water and energy drinks.

Compared to their large competitors (Heineken, Carlsberg & Co), they don’t have any dominating brands but seem to focus on local brands in each category.

A short overview of the beverage industry

I am not an expert in the beverage industry, but at a high level I think one can see some relatively obvious trends:

- Beer is not a growth story in aggregate, however craft beer still seem to be “hot” as well as alcohol free beer

- Spirits, especially Whisky, Tequilla, Gin etc. are still growing

- Classic Softdrinks with sugar have an issue

- the growth stars are energy drinks, flavored water and other specialties

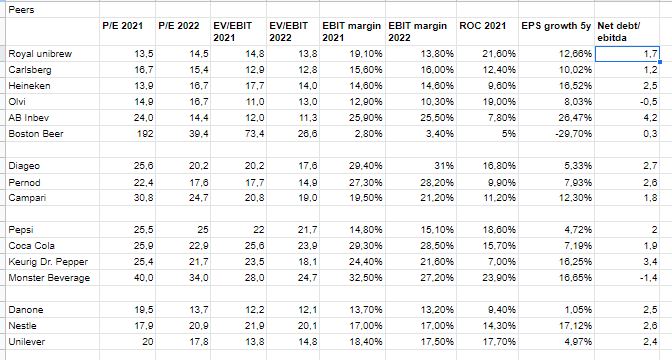

Just out of interest, I have compiled a small overview over the main players in the categories Beer, spirits, Soft drink and for comparison reasons, diversified food (numbers from TIKR):

As a general remark one can see that the the Beer players are generally significantly lower valued compared, both, to the spirits and the soft drink players, despite showing historically the same or better growth rates and profitability.

Overall, all categories look in general quite attractive which is reflected in the quite high valuations compared to more cyclical business models. I assume that investors overall consider beverage companies as quite stable businesses with decent growth opportunities.

Royal Unibrew – the history

Looking at the share price, it is not to easy to see in this long-term chart, but Royal Unibrew had a “near death experience” in 2008:

The problem back then was that their initial international expansion plans (Caribbean, Poland) didn’t work out and that they more or less ran out of money during the GFC. I found this interesting valuation exercise from 2009 with a lot of background information.

For anyone who bought back when they had an emergency capital increase, could experience a 100 bagger from 2009 to end of 2021.

Since then however, Royal Unibrew managed to increase sales and earnings at a very decent rate. Even if we use EPS at pre crisis year 2007 as a basis (5,24 DKK), Royal Unibrew increased EPS by 12,3% p.a. over these 14 years.

This was achieved by increasing the top line by “only” ~6% p.a. but especially EBIT margins more than tripled from 6% in 2007 to 19% in 2021. Also returns on capital increased from ~8% to around 22%.

Evolution of business model

For increasing the top line, Royal Unibrew made a couple of smaller acquisitions and one larger one, the acquisition of Hartwall (from Heineken) in 2013. The increase in profitability is a combination of the disposal of less profitable units after the 2008 crisis (Poland, Caribbean) and an evolution in the business model: In it’s core markets, Royal Unibrew not only acted as a brewer/manufacturer but also as a distributor. Owning the distribution in the beverage business seems to be a game change, as it allows much better control over where and at what price the products are sold.

It also allows to “plug in” smaller acquisitions and then distribute them across the existing network (network effect). Interestingly, they also distribute other brands, most notably Pepsi in some of the markets where they are active.

There is even a nice BCG case study on Royal Unibrew and its turnaround to be found here. Interestingly, the deal was not seen that favorable by sell side analysts when it happened.

2021/2022:

The year 2021 ended and 2022 started with 2 significant acquisitions: First, they bought a company called Solera which is a leading distributor/importer of beverage in Norway and Sweden. Secondly, they were able to buy the remaining 75% of Hansa Borg, the second largest brewery in Norway. Solera, with 700 mn DKK was the smaller acquisition, Hansa Borg with ~2,5 bn DKK much bigger. Interestingly, Royal Unibrew was able to pay 90% of the Hansa Borg purchase price with its own shares at a very high valuation (759 DKK/share).

Both acquisitions are strategically very interesting, as this opens up two relatively large and attractive markets (Norway and Sweden) for them and will allow them to execute their tested business model.

These acquisitions would would have resulted in lower EBIT margins as usually it takes some time until they get acquired companies up to their standards.

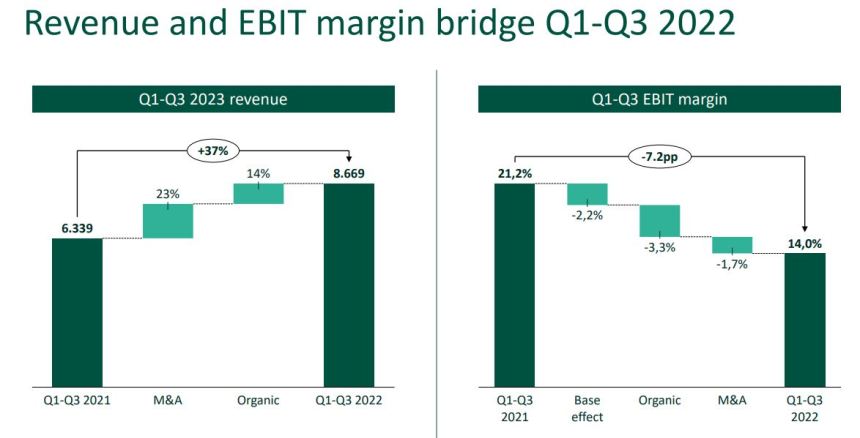

So far so good, but during 2022 the were also faced with fast rising costs, both, with inputs, but also as a distributor with transport costs, which they couldn’t fully pass through to customers yet. As a result, EBIT margins decreased significantly from ~20% to “only” 14% in the first 9M 2022.

As a consequence, they had to lower their profit outlook for 2022 2 times. Form the Q3 presetnation, they show these 2 bridges which explain how sales have increased significantly but EBIT margins decreased:

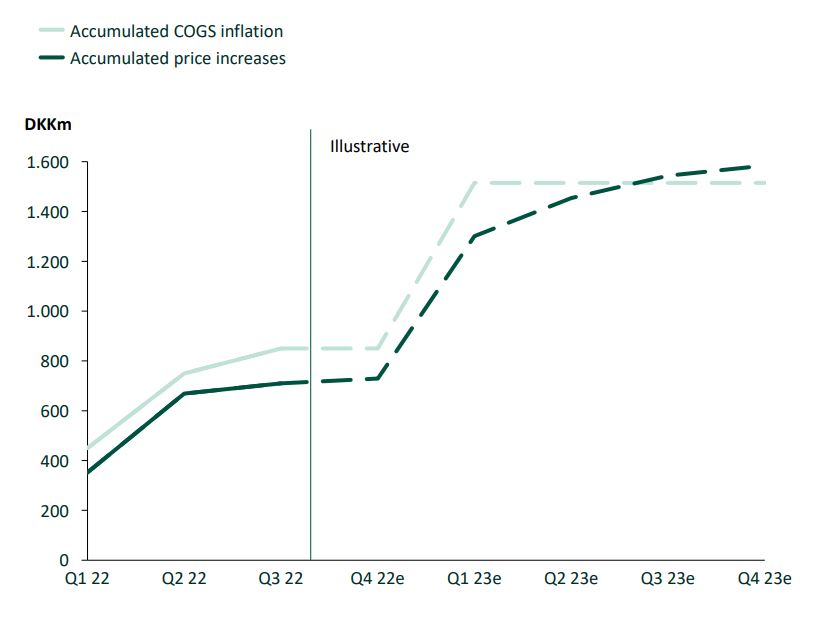

A really interesting chart form the presentation is how they plan to catch up with price increases:

So clearly, within the next 4 quarters, their profitability will most likely stay at the current lower levels and then hopefully go back up to the old levels.

In addition, for the first 9M 2022, cash flow generation was significantly below previous years,

Management, incentives & Capital allocation

The current management came into service in 2020, but both, CEO and CFO are company veterans despite being relatively young (below 50). The CEO own shares in a value of 6 mn EUR. The CFO has only a relatively small stake.

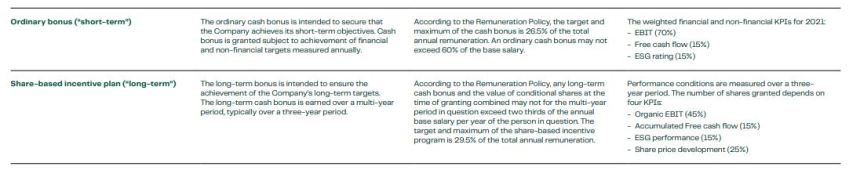

So this is not an owner/operator company, therefore it is important to understand the incentive scheme. This is how their incentives looked like for 2021:

It is a quite unique scheme, especially the long term scheme that focuses on Organice EBIT and accumulated Free Cashflow is quite interesting. Personally, I would have preferred a slightly more “per share” orientation but overall I think it is a good incentive scheme and aligns Management and share holders well.

Capital allocation in my opinion is one of the big strengths of Royal Unibrew at least since the turnaround 2008/2009. They do have a very clear acquisition strategy nicely summarized in this chart:

They also communicate clear targets for distribution to shareholders. Paying for Hansa Borg with exepnsive own shares also turned out to be good capital allocation.

Other aspects

One qualitative aspect that I like a lot at Royal Unibrew is the very clear and easy to understand reporting. I have shared already a few pages out of their reports, but in general, I would call it “best in class” reporting and shareholder communication. For instance, they show ROIC excluding Goodwill and including Goodwill. This is something I have never seen before. They also show 5 year numbers for most relevant items of the P&L and Balance sheet.

Another interesting feature is that the company seems to be quite decentralized. According to what I heard, the Headquarter in Faxe only employs 10 people and seems to focus mostly on capital allocation. Operational decisions are made at local subsidiary level. This is how the HQ at 1 Faxe Alle in Faxe looks from Google street view (not very fancy):

Pros & Cons

As always, I’ll try to collect the major Pro’s and con’s at this stage which looks as follows:

+ resilient underlying business in attractive markets

+ high margin / high return on capital

+ good growth record

+ very cash generative business

+ good capital allocation (clear targets, dividend/share buy back, structured M&A)

+ 100% cash conversion EBIT to FCF on average

+ decentralized structure with a very lean HQ

+ very good reporting (ROIC, cash flow etc, annual reports online since 1999)

+ Royal Unibrew itself could be an acquisition target for a large player

+ They also started early to decarbonize by developing a large solar plant at their Danish production site

+/- No owners but Management incentives reasonably aligned

+/- leverage in line with peers

- still energy intensive at the moment (switch from gas to oil already happened)

- limited pass through pricing power at the moment

- High share of intangible (>equity)

- no single powerful Global brand

Valuation/Investment case:

With a valuation of around 15 EV/EBIT for 2022 (based on 1.600 mn DKK EBIT), Royal Unibrew does’t look cheap. So why should it be an attractive investment nevertheless ?

The reason is relatively simple: If one assumes that at some point in time in the future, they will again reach ~20% EBIT margins (from the 14% expected in 2022), then there might be a decent upside in the current stock price.

If for instance EBIT margins would reach 19% in 2027 (increasing by 1% every year), 5% top line growth and a 50% payout ratio, one would underwrite a 13% p.a. return on a 14xEV/EBIT exit multiple over the next 5 years.

A slightly more aggressive case with 20% Margins in 2027 and a 15 EV/EBIT exit multiple would result in a ~16% p.a. return.

Looking at the company, the Management, the business model I do think that this is realistic and attractive as a “boring high quality GARP” stock. It is clearly not a “dirt cheap” company but I do think it could turn out to be a very attractive “GARP” investment.

Why the Company might be undervalued & Game plan

Existing Investors were clearly spooked about the profit warning. After this long run of very predictable growth, maybe some more recent investors got cold feet and wanted to take profits. Or they are nervous that this becomes another 2008 episode when they bungled the Polish market entry. Personally, I do think hat the market entry in Norway and Sweden is less risky, as especially in Norway they owned the 25% in Hansa Borg for quite some time and will know the market quite well.

I have also the impression that many investors consider breweries to be in general decline, not knowing that Royal Unibrew is only 35% beer and there it occupies the most interesting parts of the markets.

In addition, many “consumer staples” investors clearly prefer the big global brands like Carlsberg or Pepsi, believing that these companies do better over a downturn/recession which needs to be seen over the full cycle.

For many “value investors”, the stock is most likely still too expensive, there are many stocks out there who are technically much cheaper with single digit P/Es.

Game plan

However, as for the game plan, I think it is not realistic to assume that the share price will go back quickly to previous ATHs either. The company clearly needs to prove that they can bring costs under control, raise prices and successfully integrate the new acquisitions. They have clearly indicated, that the first half of 2023 will be still difficult. So patience will be very important for this investment. For me, the time horizon is at least 5 years unless the really don’t manage to reach previous profitability levels.

Summary:

In my opinion, Royal Unibrew is a very high quality company that has the potential to compound profits for some time to come. They have a stellar track record over the last 12-13 years, however 2022 is clearly challenging.

If one believes that 2022 and maybe the first half of 2023 are negative exceptions and Royal Unibrew manages to achieve its targets of 20% margins in the next few years, then the current valuation would be a very interesting entry point.

Therefore I am “underwriting” an expected 13-15% return p.a. over the next 5 years with a 4% position in my portfolio at an average entry price of 415 DKK/share.

Disclaimer: This is not investment advice. PLEASE DO YOUR OWN RESEARCH !!!!