Private residential construction spending was virtually unchanged in September, with spending on single-family construction dropping just 2.6%. The value of September private residential construction put in place was at an annual pace of $918 billion, about 12.7% higher compared to a year ago.

The monthly decline is largely attributed to lower spending on single-family construction. Single-family construction spending dropped 2.6% in September, after a decline of 2.7% in August. Compared to a year ago, it was 2.7% lower. Rising mortgage rates, flagging housing demand, and supply-chain disruptions put a damper on the housing market. The weekly average for a 30-year fixed mortgage rate reached 7.08% last week for the first time in 20 years.

Multifamily construction spending edged up by 0.3% in September, after an increase of 0.33% in August. It was 1.9% over the September 2021 estimates. Private residential improvements rose by 2.9% in September and was a dramatic 40.8% higher over a year ago. Keep in mind that construction spending reports the value of property put-in-place, so it is a measure of property value placed in service at the end of the construction pipeline.

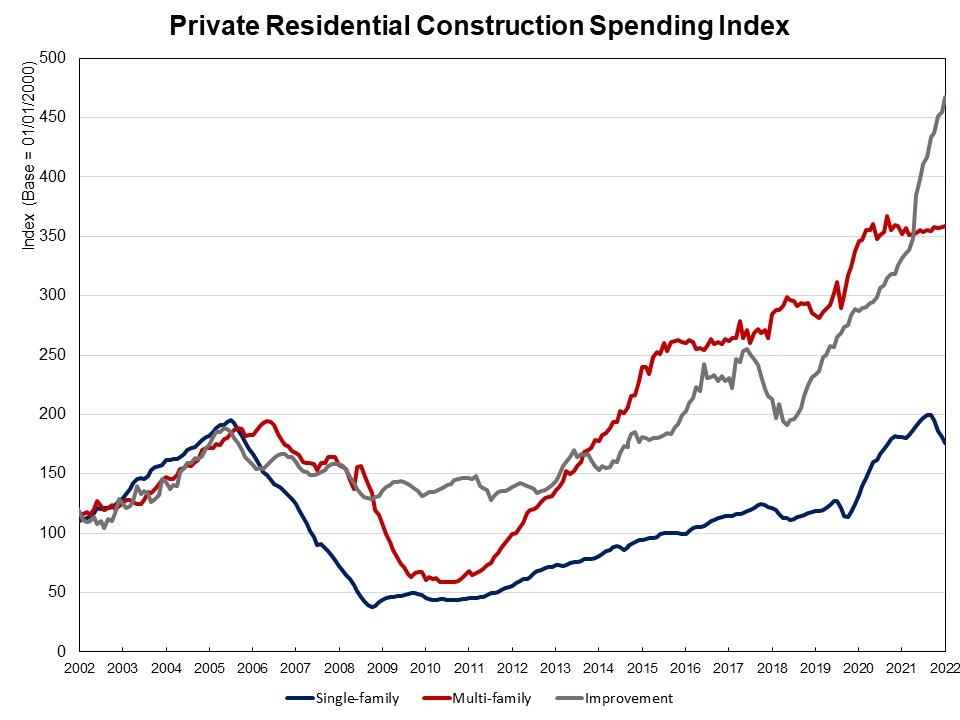

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates how construction spending on single-family has slowed since early 2022 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction held steady in recent months, while improvement spending has increased pace since early 2019. Before the COVID-19 crisis hit the U.S. economy, single-family and multifamily construction spending experienced solid growth from the second half of 2019 to February 2020, followed by a quick post-covid rebound since July 2020.

Spending on private nonresidential construction increased by 1% in September to a seasonally adjusted annual rate of $532.3 billion. The monthly private nonresidential spending increase was mainly due to more spending on the class of manufacturing category ($8.0 billion), followed by the lodging category ($0.12 billion), and the office property ($0.1 billion).

Related