Houses have among the highest price tags of anything you’ll ever purchase. When you add interest, the cost becomes unfathomable for some. Fortunately, even in today’s soaring interest rates, there are ways to decrease the punch to your bank account. One way is through applying a temporary buydown.

At MortgageDepot, we understand your desire to be a homeowner. We also know that the thought of spending that much money on anything might have you running in the other direction! Today we’re going to discuss how you might be able to ease the financial blow with a temporary buydown.

What Is a Temporary Buydown?

A temporary buydown allows the buyer to bring more money to closing in exchange for a lower interest rate for the first few years of their loan. The buyer will use this money to purchase “discount points” (sometimes called “mortgage points”). They can use these points to apply a set percent decrease in their interest rate, depending on the structure of their buydown program.

Are All Loans Eligible for a Temporary Buydown?

Through MortgageDepot, temporary buydowns are available for many loan types. Here are the ones that are eligible:

- Conventional primary and secondary residence purchases

- FHA primary residence purchases

- VA primary residence purchases

What Does a Temporary Buydown Look Like?

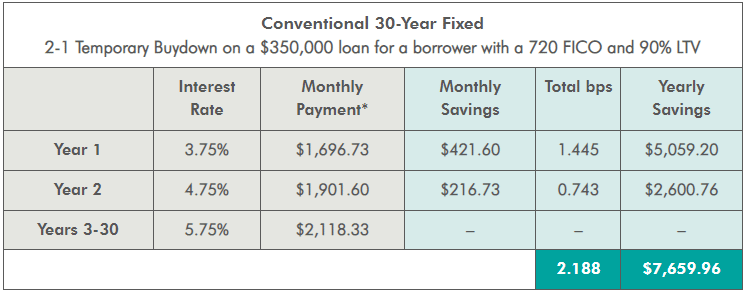

Temporary buydowns can be set up differently, depending on your needs. At MortgageDepot, our most common buydown program is a 2-1 Temporary Buydown on a Conventional 30-Year Fixed Mortgage. Here is a quick glimpse of what this structure looks like for a loan with a 5.75% interest rate:

- The borrower’s interest rate would be 2% lower in year one, making it 3.75%

- In year two, the borrower’s interest rate would 1% lower, making it 4.75%

- After the end of year two, the borrower would pay the full interest rate of 5.75% for the remainder of the loan.

One discount point does not always equal a 1% decrease in your interest rate. Talk you your loan officer to see how much your discount points are worth.

Contact Us Today!

Do you need a little time to get used to the demands of being a homeowner? A temporary buydown lets borrowers experience lower interest rates while juggling their new financial responsibilities. Contact us today to see if a temporary buydown program is right for you!

Connect with one of our loan consultants for more information.