When you manage your accounting books by hand, you are responsible for a lot of nitty-gritty details. One of your responsibilities is creating closing entries at the end of each accounting period.

What are closing entries?

Closing entries are entries used to shift balances from temporary to permanent accounts at the end of an accounting period. These journal entries condense your accounts so you can determine your retained earnings, or the amount your business has after paying expenses and dividends. Creating closing entries is one of the last steps of the accounting cycle.

Create closing entries to reflect when your accounting period ends. For example, if your accounting periods last one month, use month-end closing entries. However, businesses generally handle closing entries annually. Whatever accounting period you select, make sure to be consistent and not jump between frequencies.

Temporary vs. permanent accounts

In accounting, some of your accounts are temporary and must reset when a new period starts. These accounts track your funds during a specific accounting period. Temporary accounts include:

- Revenues

- Expenses

- Dividends

You also need to use permanent accounts to track your business’s financial health from period to period. Permanent accounts include:

Purpose of closing entries accounting

Without closing revenue accounts, you wouldn’t be able to compare how much your business earns each period because the amount would build up. And without closing expense accounts, you couldn’t compare your business expenses from period to period.

You need to use closing entries to reduce the value of your temporary accounts to zero. That way, your next accounting period does not have a balance in your revenue or expense account from the previous period.

Transferring funds from temporary to permanent accounts also updates your small business retained earnings account. You can report retained earnings either on your balance sheet or income statement. Without transferring funds, your financial statements will be inaccurate.

How to create closing entries

Accounting software automatically handles closing entries for you. If you don’t have accounting software, you must manually create closing entries each accounting period.

You can create a closing entry by closing your revenue and expense accounts and transferring the balances into an account called “income summary account.”

The income summary account is only used in closing process accounting. Basically, the income summary account is the amount of your revenues minus expenses. You will close the income summary account after you transfer the amount into the retained earnings account, which is a permanent account.

Here are the steps to creating closing entries:

- Close revenue accounts by transferring funds to income summary account

- Close expense accounts by transferring funds to income summary account

- Close income summary account by transferring funds to retained earnings account

- Close dividends by transferring funds to retained earnings account (if applicable)

So how exactly do you close the accounts?

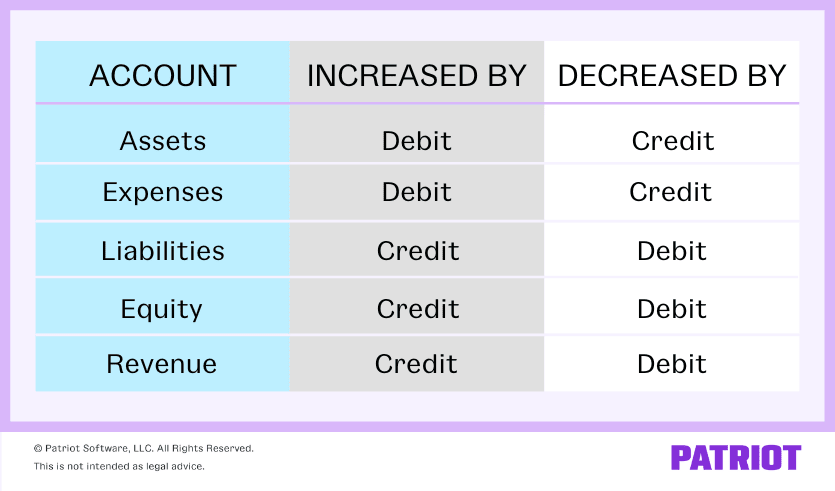

You need to create closing journal entries by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits.

Close revenue accounts

As you can see, revenue accounts are decreased by debits. You must debit your revenue accounts to decrease it, which means you must also credit your income summary account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Revenue | Closing journal entries | X | |

| Income Summary | X |

Close expense accounts

Because expenses are decreased by credits, you must credit the account and debit the income summary account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Income Summary | Closing journal entries | X | |

| Expense | X |

Close income summary account

Whether you credit or debit your income summary account will depend on whether your revenue is more than your expenses.

If your revenues are greater than your expenses, you will debit your income summary account and credit your retained earnings account. This increases your retained earnings account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Income Summary | Closing journal entries | X | |

| Retained Earnings | X |

If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account. This decreases your retained earnings account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Retained Earnings | Closing journal entries | X | |

| Income Summary | X |

Close dividend accounts

If you paid out dividends during the accounting period, you must close your dividend account. Now that the income summary account is closed, you can close your dividend account directly with your retained earnings account.

Debit your retained earnings account and credit your dividends expense. This reduces your retained earnings account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Retained Earnings | Closing journal entries | X | |

| Dividends | X |

Closing journal entries example

Let’s say your business wants to create month-end closing entries. During the accounting period, you earned $5,000 in revenue and had $2,500 in expenses. You did not pay any dividends.

First, transfer the $5,000 in your revenue account to your income summary account. Debit revenue and credit income summary.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Revenue | Closing journal entries | 5,000 | |

| Income Summary | 5,000 |

Next, transfer the $2,500 in your expense account to your income summary account. Debit the income summary account and credit expense account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Income Summary | Closing journal entries | 2,500 | |

| Expense | 2,500 |

Finally, you are ready to close the income summary account and transfer the funds to the retained earnings account.

After crediting your income summary account $5,000 and debiting it $2,500, you are left with $2,500 ($5,000 – $2,500). Because this is a positive number, you will debit your income summary account and credit your retained earnings account. This adds the $2,500 to your retained earnings account.

| Date | Account | Notes | Debit | Credit |

| XX/XX/XXXX | Income Summary | Closing journal entries | 2,500 | |

| Retained Earnings | 2,500 |

Interested in automating this process? With Patriot’s accounting software, you can handle closing entries with the touch of a button. And, you can choose an accounting period that works best for your business. Try it for free today!

This article is updated from its original publication date of March 15, 2018.

This is not intended as legal advice; for more information, please click here.