If you’ve always wondered why we, as consumers have to jump through so many hoops just to earn a high interest rate on our savings, you aren’t alone. In fact, I know of many friends who just let their cash lie idle in their bank earning a paltry 0.05% p.a. simply because they are too lazy have no time or cannot be bothered to do all the necessary steps just to get a few hundred dollars more in interest each year.

While 2.5% to 3% p.a. high-yield interest savings accounts are a great move – and one that we consumers have benefited from in recent years – the reality remains that NOT everyone can meet the criteria needed.

What if a bank could create a savings account option that will allow us to earn higher interest without having to stress about meeting multiple conditions? One that doesn’t require us to do any salary crediting, clock credit card spend, purchase insurance or investment products that we don’t want, etc.

What if we just want to deposit our savings and watch them grow?

It is about time that a bank made it easier for folks to earn higher interest on our savings, and with minimal effort too.

So imagine my joy when a reader introduced me to CIMB StarSaver – one that gives higher interest without you needing to jump through any of the usual hoops in today’s market.

For those of you who find it a hassle to have to manage each of your high-yield savings accounts every month (just to make sure you have met the criteria for additional interest)…you’re gonna love this.

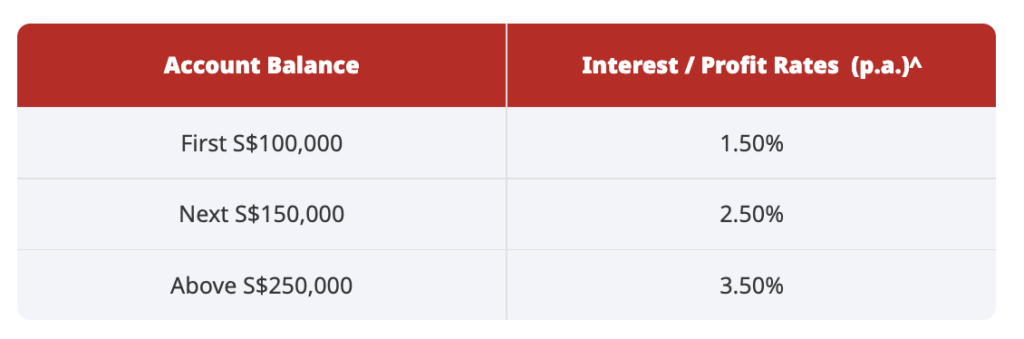

You can now earn up to 3.50% p.a. savings interest with CIMB StarSaver

Psst, read on to find out about their latest bonus 1% promotion!

Wanna know how to earn an easy 1.50% to 3.50% p.a interest rate with CIMB StarSaver?

- Step 1: Open an account online

- Step 2: Deposit >S$1,000

And…that’s it!

I kid you not.

It really is that simple. You no longer have to worry about fulfilling salary deposit / credit card spend / buying insurance products that you aren’t really keen on…when you open a CIMB StarSaver account.

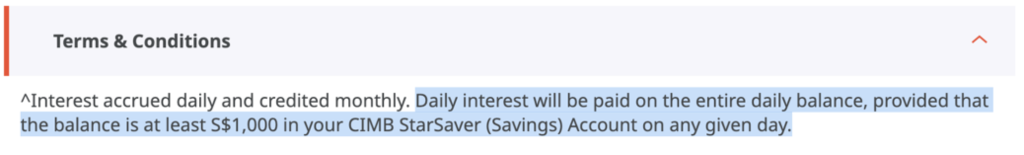

Don’t believe me? Go check out how refreshingly short and sweet their T&Cs are .

One of the only accounts that allows you to earn interest beyond your first S$100k

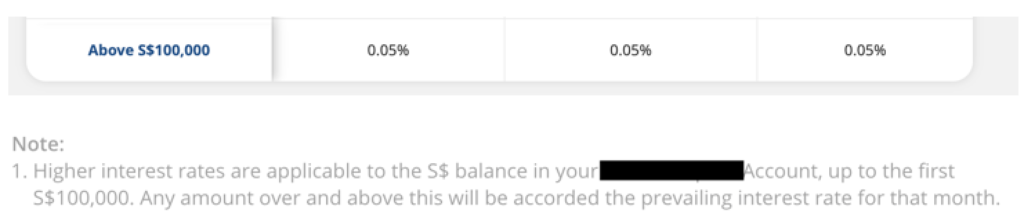

If you’ve ever wondered why most Singaporeans own more than 1 high-yield savings account, that’s because typically, the high interest rate only applies on our first S$100,000. Here’s a screenshot from 2 other banks:

Beyond your first S$100k, you earn a meagre 0.05% p.a. on the same account. Sad but true.

Which is why in contrast, CIMB StarSaver is more awesome, because it has no limit on how much you want to deposit to earn the full 1.50% p.a. to 3.50% p.a. interest rate.

(The only other exception I found was BOC, where you earn up to a maximum of 0.60% on S$80k – S$1M when you fulfil their card spend / salary credit / bill payment requirements.)

P.S. If you want to earn up to 3% p.a. and without locking your money up in a fixed deposit or a short-term bond, read till the end of the article to find out about CIMB’s bonus 1% p.a. offer.

No fall-below fees

The last thing you’d want is to open another savings account, deposit your money, and then leave it aside without realising the bank is deducting money from it each month for various fees, right?

Well, that’s what happened to me several years ago when I opened a savings account specifically for my overseas exchange. I kept the remaining S$1,000 in the account and left it untouched upon my return to Singapore, but shortly after, the bank started to impose fall-below fees. Because I wasn’t actively monitoring the account, I was left in the dark! You can bet that I terminated my account in a fit of anger when I found out (and after kicking myself for overlooking this in the first place), lol.

So I’m now more appreciative of banks who do NOT charge any fall-below fees or monthly fees, and CIMB StarSaver gets my vote for that.

Here’s the proof, in their fees schedule here.

What if I want more?

At this point you must be wondering, CIMB StarSaver is THAT good? What about CIMB’s other savings accounts then?

Of course, there’s an account for every need:

Here’s what I would suggest, based on your age and life stage:

If you’re in your 30s – 50s, then CIMB StarSaver would be great because you can easily earn 1.50% p.a.- 3.50% p.a., and without having to surrender your liquidity (such as to fixed deposits).

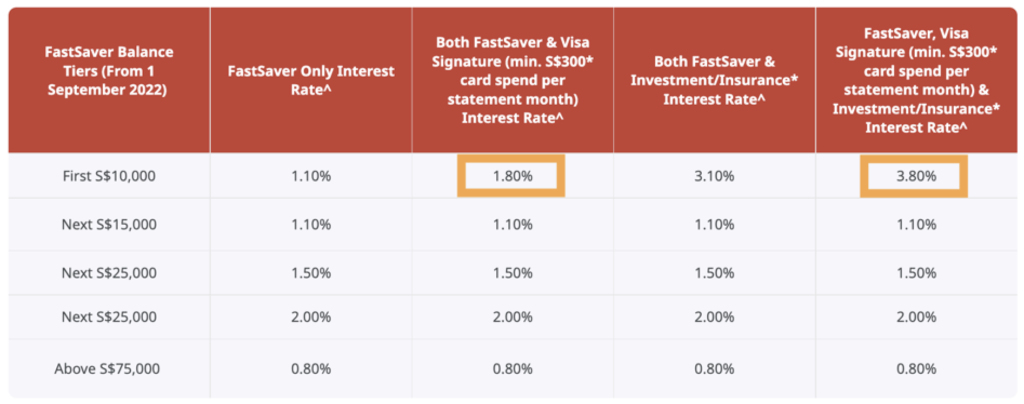

FastSaver would be better for the younger folks who are just entering the workforce and have lesser cash savings, as simply spending an easy S$300 on your CIMB Visa Signature will give you 1.8% p.a. straightaway on your first S$10k:

And of course, for parents , there’s even an account for your little ones. Check out the specially created CIMB Junior Saver Account just for those under 12 years of age with interest rates of 1.50% p.a. – 3.50% p.a., also with no other criteria needed.

Summary

CIMB StarSaver stands out for its refreshing simplicity, as one of the only few savings accounts where we can now earn an easy 1.50% p.a. – 3.50% p.a. simply by depositing our money.

I can think of 2 groups of people who will love this:

- Those who have gotten tired of jumping through hoops

- Those who have more than S$100k and are not able to earn higher interest on this on their primary high-yield savings account due to the bank’s limits

What’s more, there’s no lock-up period, so we get to retain full flexibility over our cash as well. This is really important in today’s climate, where the market could present us with investment opportunities anytime.

I hope this article helps you understand more about CIMB StarSaver now. It may not be talked about as often, so most people aren’t aware of its benefits, but hopefully, this article will start changing that.

Sponsored Message from CIMB New to CIMB? Earn an extra 1% bonus interest and cash credit when you deposit into StarSaver today. Find out how here. Simply deposit fresh funds of S$250K or more to be a part of CIMB Preferred, and enjoy sign up gifts up to S$12,460! Here’s how that works:

TLDR: Stop working so hard just for extra interest – open a CIMB StarSaver Account here today.

Disclosure: This article is written in collaboration with CIMB Singapore. I have also personally been a CIMB customer since pre-COVID. This advertisement has not been approved by the Monetary Authority of Singapore.