The last few years were all about growth. Aggresive hiring? +3% Burning cash on unprofitable investments? +10%! When money cost nothing, there were no consequences to wasting it.

Stock prices are the standings and as the great Bill Parcells once said, “You are what your record says you are.”

Companies are well aware of their stock price. It plays a big part of employee morale, it’s the currency in which they pay their employers, and it ultimately reflects investor’s belief, or lacktherof, in what they’re doing.

Dara Khosrowshahi was one of the first CEOs to recognize that the earth was shifting beneath his feet. Back in May he sent a memo to employees that said:

After earnings, I spent several days meeting investors in New York and Boston. It’s clear that the market is experiencing a seismic shift and we need to react accordingly….“We have made a ton of progress in terms of profitability, setting a target for $5 billion in Adjusted EBITDA in 2024, but the goalposts have changed. Now it’s about free cash flow. We can (and should) get there fast.

Uber had burned through $25 billion in cash since its founding in 2009, but in August, for the first time ever, the company reported positive free cash flow. The stock popped 19% that day, and has outperformed the Nasdaq by 30% since that earnings report.

The rest of the market has now gotten the memo that the bill for all that growth has come due, and they’re taking aggressive actions to pay fot it.

In an email to Lyft employees, they said,

We worked hard to bring down costs this summer: we slowed, then froze hiring; cut spending; and paused less-critical initiatives. Still, Lyft has to become leaner, which requires us to part with incredible team members,

In the most recent earnings call, PayPal said:

Our efforts to reduce our cost structure and drive productivity gains are yielding strong results. We remain on track to drive over $900 million in cost savings across our operating and transaction expenses this year and at least $1.3 billion in cost savings next year

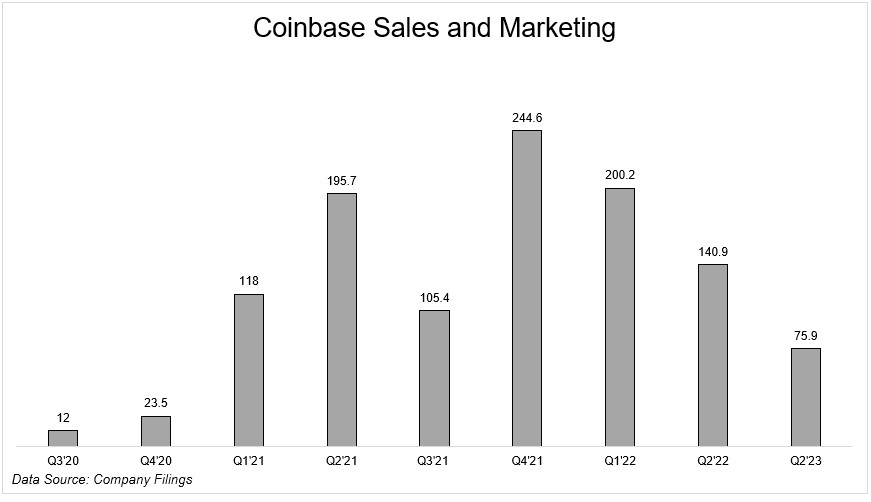

One of the biggest growth markets over the past few years was crypto. Coinabse quadrupled headcount over the past year and a half, and are now taking corrective actions. On the call last week, the CFO of Coinbase said

I just want to let everyone know that we’re committed to managing our expenses prudently

and watching the macro conditions and the business performance closely and that we’ll continue to update all of our scenarios as conditions evolve and we would take additional actions to further manage our expenses if we deemed that warranted.

Their sales and marketing expense is down ~70% from the highs in the fourth quarter of last year.

It took a while, but companies are reacting to the new world we live in. A 400 basis point increase in interest rates fundamentally changes how people feel about stocks. Investors went from only caring about growth to only caring about profitability, and companies are reacting accordingly.

Stocks want to be treated well, and the leaders of these businesses will do everything in their power to give investors what they want. Not all of them will be able to, of course, but they know they’re not in Kansas anymore.