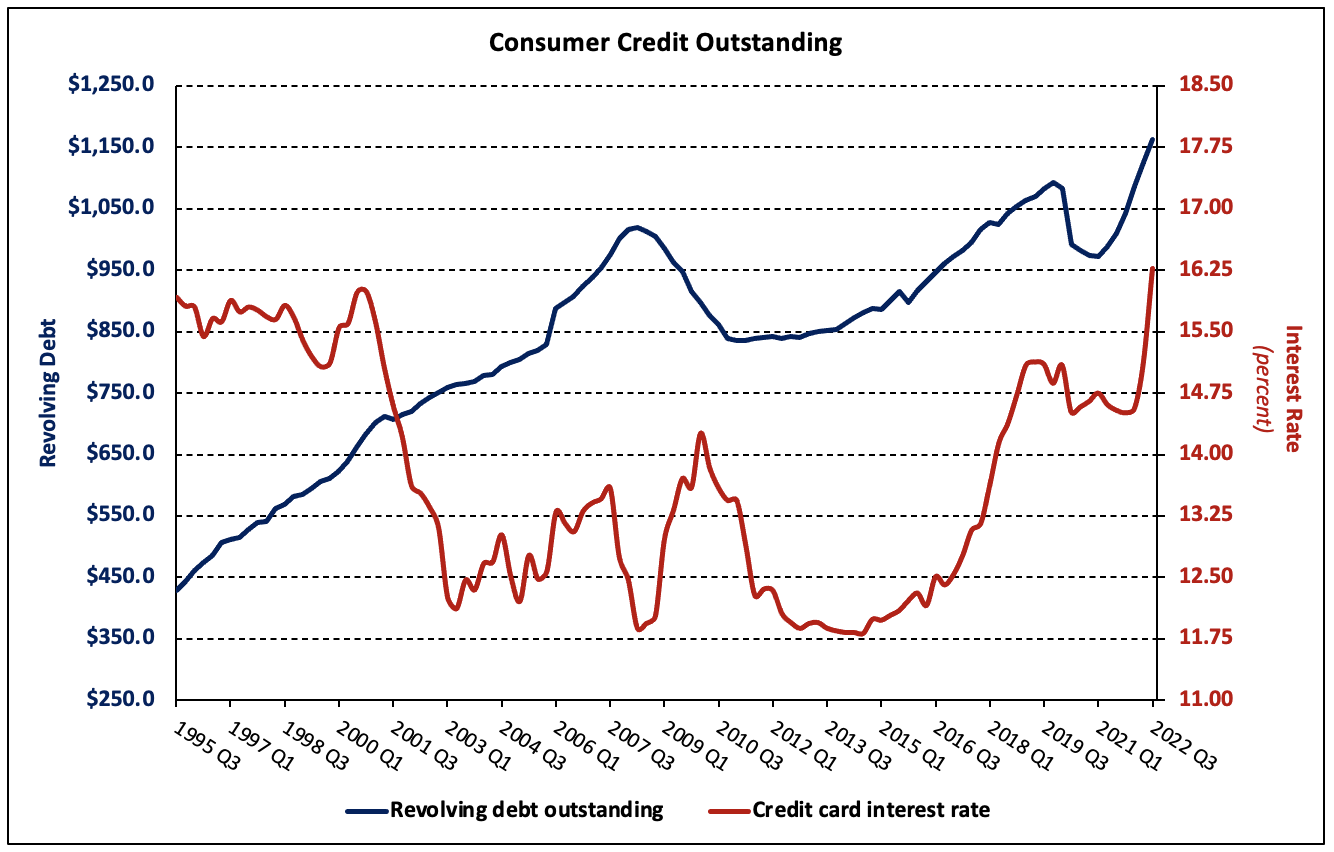

According to the Federal Reserve’s latest G.19 Consumer Credit report, consumer credit growth (ex-real estate) decelerated to a seasonal adjusted annual rate (SAAR) of 6.8% in the third quarter of 2022 after growing at an 8.7% pace in the prior quarter. Revolving debt increased at a 12.9% rate, more than double the pace of nonrevolving debt (+4.9%). Credit card interest rates reached 16.3%, the highest level since the inception of the data series in 1994.

Total consumer credit currently stands at $4.7 trillion, an increase of $100 billion over the second quarter. Revolving and nonrevolving debt accounted for 24.7% and 75.3%, respectively, of non-revolving debt. Nonevolving credit outstanding increased $42.6 billion while the level of revolving debt rose $36.3 billion over the quarter. Between Q2 2020 and Q2 2021, revolving consumer credit outstanding as a share of the total steeply declined as stimulus checks were used to pay down credit card debt. The share has increased each quarter since.

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding levels on a non-seasonally adjusted (NSA) basis. The most recent release shows that the balance of student loans was $1.8 trillion at the end of the third quarter while the amount of auto loan debt outstanding stood at $1.4 trillion. Together, these loans made up 88.9% of nonrevolving credit balances (NSA), down 0.1 percentage point from Q2 2022.

Related