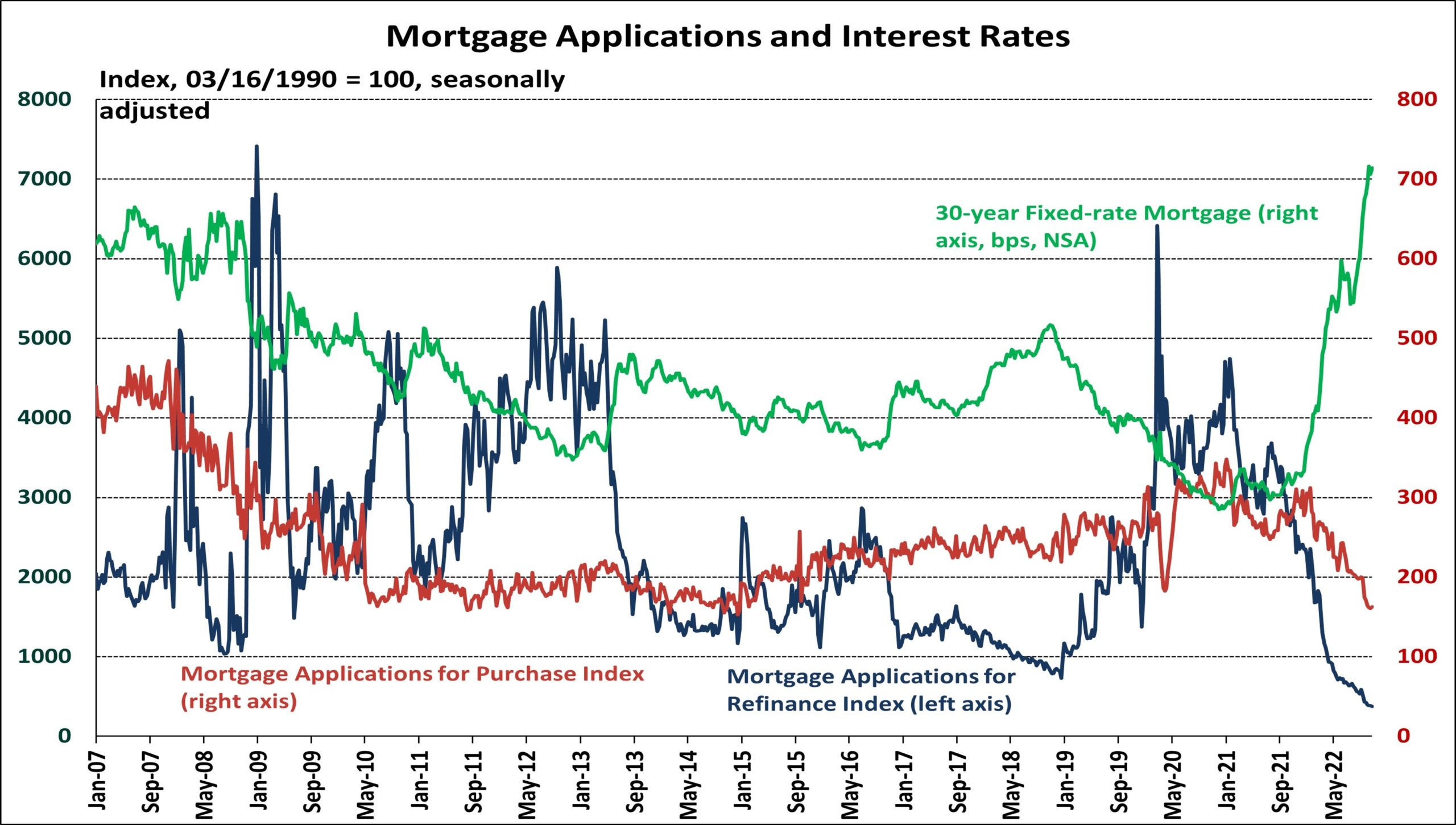

Per the Mortgage Bankers Association’s (MBA) survey through the week ending November 4th, total mortgage activity declined 0.1% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate rose eight basis points to 7.14%. The FRM rate has risen 33 basis points over the past month and has been above 7% for the past three weeks.

The Market Composite Index, a measure of mortgage loan application volume, decreased by 0.1% on a seasonally adjusted (SA) basis from one week earlier. Purchasing activity increased 1.3%, while refinancing activity decreased 3.5% week-over-week.

The 1.3% increase in purchasing activity was the first increase in the past six weeks even though purchasing activity has decreased 41.6% on a year-over-year basis. The refinancing activity index is down 86.9% from the same week one year ago, the index has hit its lowest point since August 2000.

The refinance share of mortgage activity declined from 28.6% to 28.1% over the week, while the adjustable-rate mortgage (ARM) share of activity slightly increased from 11.8% to 12.0%. With continued increases in FRM rates, buyers are looking for ways to save when purchasing. ARMs offer lower rates than FRMs which has led to an increase in activity with buyers more likely to use an ARM to purchase a home. According to Freddie Mac, the current 5/1-ARM rate is at 5.95%.

Related