Sponsored by

How do your advisors recognize an opportunity to rebalance?

A common and accepted practice among wealth managers and their advisors is to use a target asset allocation, based on some measure of risk appetite, as a benchmark for client portfolios. As markets change and the values of specific holdings fluctuate, the asset allocation within client portfolios may deviate from intended targets, resulting in over- or under-exposure to certain risks. Rebalancing on a specific cadence (e.g. quarterly or annually) is a method many advisors use to bring portfolios back in line.

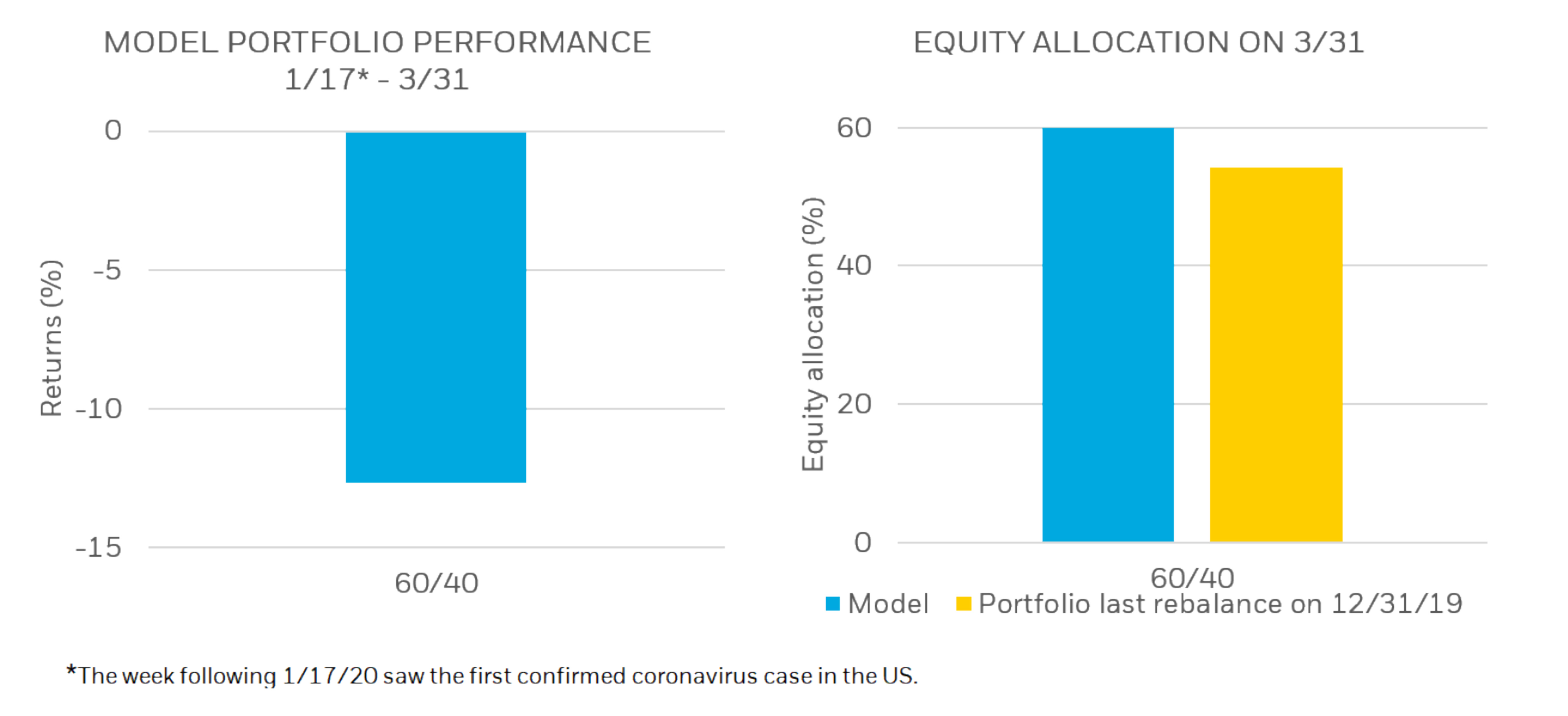

But when markets make big moves, portfolios can drift meaningfully in a short period of time. This drift can quickly result in client portfolios going off track and steering away from client goals. Take the recent market downturn and subsequent recovery of Spring 2020 as an example. These shifts surprised many investors, and a 60/40 portfolio on December 31, 2019 could easily have looked more like a 55/45 portfolio by the end of March 2020.

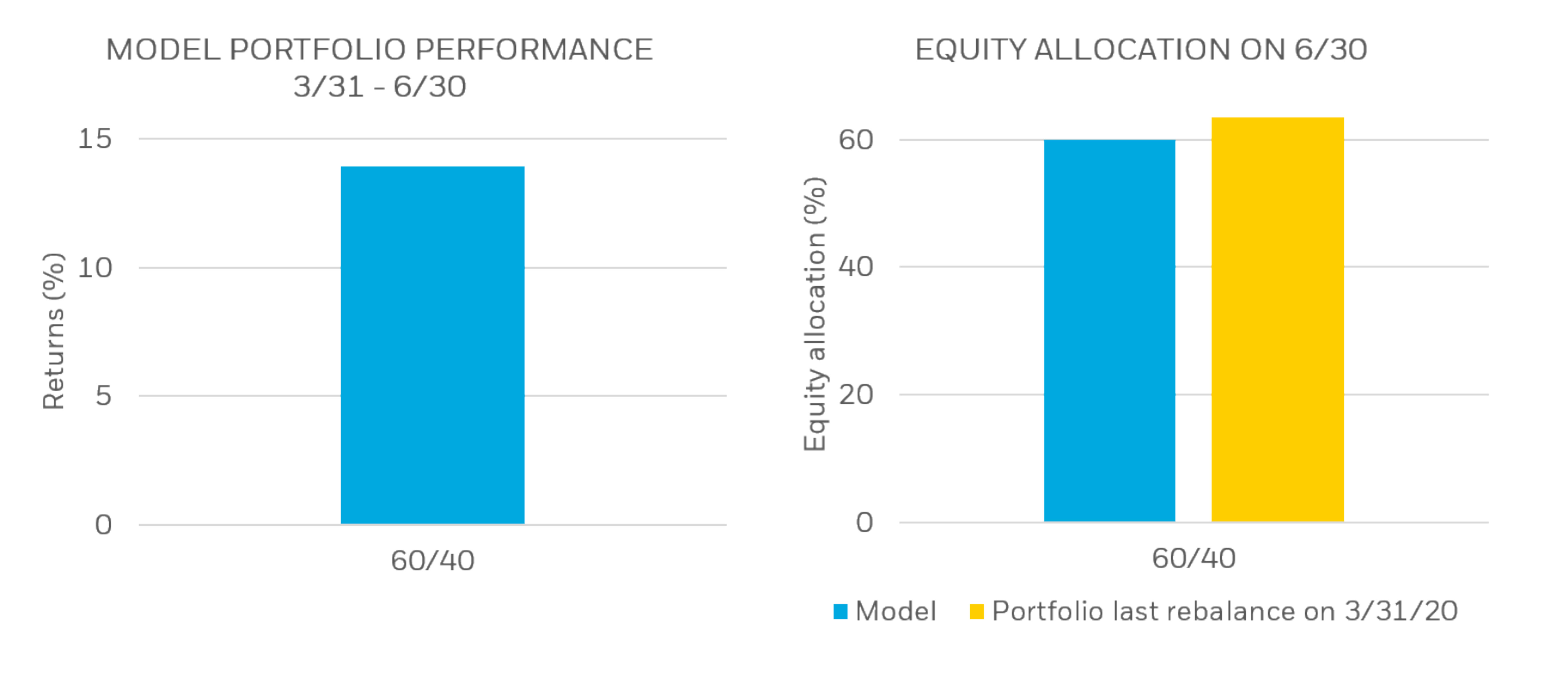

And when markets recovered, a 60/40 portfolio on March 31, 2020 could easily have looked more like a 65/35 portfolio by the end of the following June.

Advisors who can stay on top of asset allocation drift can do a better job at keeping clients aligned with their goals. Identifying which portfolios to rebalance and proactively communicating that can deepen relationships and grow wallet share, particularly in troubling times.

Alert your advisors when portfolios may need attention

The Aladdin Wealth™ platform offers an efficient mechanism to provide advisors with greater transparency when portfolio allocations drift due to market volatility and other reasons. Firms can create rules and alerts to systematically identify portfolio deviation across their entire book of business in order to help advisors bring outliers back in line with intended goals and investment guidelines.

This makes it easy for advisors to target the right households and accounts, implement timely changes, improve their conversations with clients and ultimately drive new revenue.

Show clients their portfolios and goals are aligned

Using the Aladdin Wealth™ platform, advisors can generate portfolio and risk insights that easily show clients the impact of proposed adjustments to their portfolios and reinforce how advisors are keeping each client’s financial future on track. Ensuring that risks taken are intended and appropriate helps build better portfolios and better client engagements.

Catch the drift

Some risks and opportunities are easy to spot, but others are not. If you’d like to talk through our most recent market and portfolio observations, or how Aladdin Wealth could work for your business needs, please reach out. We’re here to help.

© 2022 BlackRock, Inc. All rights reserved.

This material is provided for informational purposes only and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are subject to change at any time without notice. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Performance and risk calculations, including those incorporated into Aladdin Wealth technology, are based on assumptions, historical correlations, and other factors (such as inputs provided by the Aladdin Wealth users) and are not assured to predict future results. All graphs and screenshots are for illustrative purposes only. BlackRock’s Aladdin Wealth platform is a financial technology platform designed for institutional, wholesale, qualified, and professional investor/client use only and is not intended for end investor use. Aladdin Wealth users undertake sole responsibility and liability for investment or other decisions related to the technology’s calculations and for compliance with applicable laws and regulations. The technology should not be viewed or construed by any Aladdin Wealth users, or their customers or clients, as providing investment advice or investment recommendations to any parties. This material should not be construed as a representation or guarantee that use of Aladdin Wealth technology will satisfy your legal or regulatory obligations. BlackRock, as provider of the technology, does not assume any responsibility or liability for your compliance with applicable regulations or laws. For additional information on any of the descriptions contained herein, please contact your Aladdin Wealth Relationship Management representative. BlackRock may modify or discontinue any functionality or service component described herein at any time without prior advance notice to you.

In the U.S. and Canada, this material is intended for public distribution. In the UK, this material is for professional clients (as defined by the Financial Conduct Authority or MiFID Rules) and qualified investors only and should not be relied upon by any other persons. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. In the EEA, this material is for professional clients, professional investors, qualified clients and qualified investors. For qualified investors in Switzerland: This information is marketing material. This material shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa. In Singapore, this advertisement or publication is intended for public distribution and has not been reviewed by the Monetary Authority of Singapore. In Hong Kong, this material is intended for public distribution. The technology and the material have not been reviewed by the Securities and Futures Commission of Hong Kong. In Japan, this is for Professional Investors only (Professional Investor is defined in Financial Instruments and Exchange Act). In Australia, issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975 AFSL 230 523 (BIMAL). The material provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. In Brunei, Indonesia, Philippines and Malaysia, this material is issued for Institutional Investors only. In Latin America, for institutional investors and financial intermediaries only (not for public distribution). No securities regulator within Latin America has confirmed the accuracy of any information contained herein. Please note that IN MEXICO, the provision of investment management and investment advisory services (“Investment Services”) is a regulated activity, subject to strict rules, and performed under the supervision of the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores, the “CNBV”). BlackRock does not provide, and it shall not be deemed that it provides through Aladdin Wealth technology, any personalized investment advice to the recipient of this document, by reason of its use or otherwise. These materials are shared for information purposes only, do not constitute investment advice, and are being shared in the understanding that the addressee is an Institutional or Qualified investor as defined under Mexican Securities (Ley del Mercado de Valores). Each potential investor shall make its own investment decision based on their own analysis of the available information. Please note that by receiving these materials, it shall be construed as a representation by the receiver that it is an Institutional or Qualified investor as defined under Mexican law. BlackRock México Operadora, S.A. de C.V., Sociedad Operadora de Fondos de Inversión (“BlackRock México Operadora”) is a Mexican subsidiary of BlackRock, Inc., authorized by the CNBV as a Mutual Fund Manager (Operadora de Fondos), and as such, authorized to manage Mexican mutual funds, ETFs and provide Investment Services. For more information on the Investment Services offered by BlackRock Mexico, please review our Investment Services Guide available in https://www.blackrock.com/mx.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK and ALADDIN WEALTH are trademarks of BlackRock, Inc., or its subsidiaries. All other marks are the property of their respective owner.