Real estate investing can be intimidating to new investors – you must search for the right property, obtain financing, purchase the property, and then find tenants. A lot can go wrong, from buying a property with structural issues to challenges with finding the ideal tenants.

Real estate investing takes work and can be risky, and many don’t have the time or risk tolerance to commit.

Enter Roofstock, a real estate investing platform that helps you invest in single-family homes without leaving your home. Roofstock wants to help you become a real estate investor regardless of where you live.

About Roofstock

Roofstock is working on building the world’s best real estate investing marketplace. The company was founded in 2015 by Gregor Watson, Gary Beasley, and Rich Ford, all having years of real estate experience.

Roofstock’s primary service is a marketplace that allows you to buy and sell single-family homes. The marketplace is free, giving anyone access to explore and browse properties.

The Roofstock Marketplace allows real estate investors to find essential information in one place, making informed investment decisions easier. The company touts that its mission is to make investing in real estate accessible and simple.

Roofstock has passed over $5 billion in transactions in more than 70 real estate markets.

What Does Roofstock Offer?

Roofstock offers three main programs, each differing based on how much money you want to invest and your experience with real estate investing.

Roofstock Marketplace

This online marketplace is for buyers and sellers of investment properties and portfolios, and Roofstock vets its properties through a strict process.

This marketplace lists properties based on your preferred criteria, like location, neighborhood rating, listing price, and more. You can also find tenant-occupied investment properties here. It’s also worth noting that you can use the marketplace to sell your home and only pay a final 3% sale fee.

We go into detail on using the Roofstock Marketplace later in this review.

Roofstock One

Roofstock One is an option for accredited investors who don’t want to purchase an entire property. The minimum amount to get started is $5,000, and users can buy a 1/10th share of some of the properties on the marketplace. Roofstock One is ideal if you don’t want the burden of carrying the entire property loan alone.

Roofstock One provides two investment options:

- Tracking stock: Provides exposure to many properties and markets.

- Common stock: Gives you broad exposure to all homes in the Roofstock One REIT.

Both options will help you avoid the risks associated with home ownership, and you won’t have to worry about putting your name on a mortgage. Roofstock One allows investors to make personalized choices in their portfolio strategies, unlike traditional REIT investments.

It’s worth mentioning that these investments are highly illiquid, and there’s no secondary market for Roofstock One shares. It requires an investment horizon of at least five years, so you must be patient.

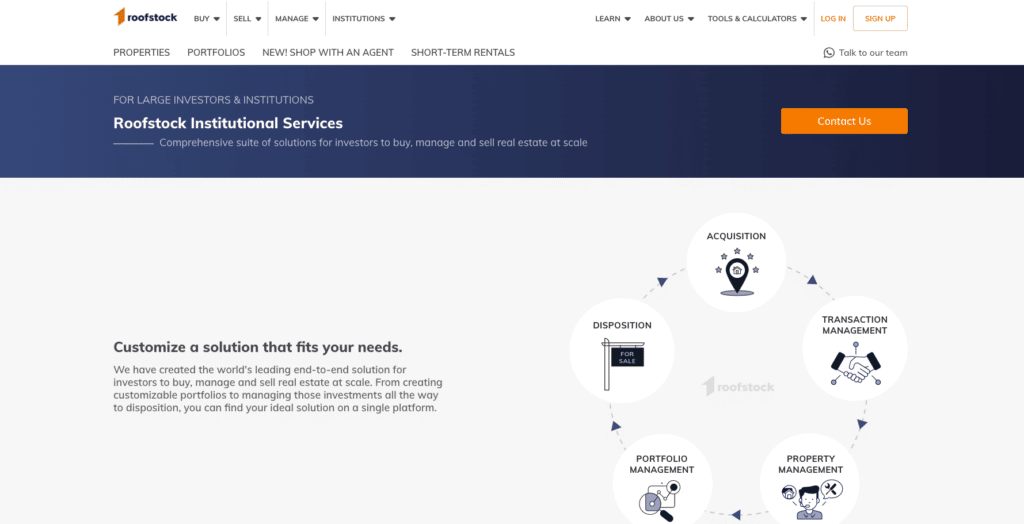

Roofstock Institutional Services

Roofstock Institutional Services is an end-to-end solution for investors with more capital who are looking to scale their portfolios. They offer these services for large investors and institutions and include the following benefits:

- Acquisition: This includes market analysis, underwriting, and rehab management.

- Transaction management: You can receive local market information, offer management, and complete transaction services.

- Property management: This covers marketing, tenant relations, repairs, maintenance, and construction management.

- Portfolio management: You get reporting, accounting, oversight, and recommendations.

- Disposition: This covers strategy recommendation, a multi-channel exit strategy, and portfolio disposition.

Lets’ take a closer look at some other noteworthy services Roofstock offers its users:

Retirement Accounts

You can invest in real estate through your retirement account with Roofstock’s partnership with New Direction Trust Company. Roofstock allows you to integrate your properties into a self-directed IRA. Once done, the IRA becomes the holder of your title report, meaning the income from your rental property becomes tax-deferred.

Roofstock Academy

Roofstock launched a course that teaches you everything you want to know about investing in real estate properties. The program’s goal is to have a one-stop resource for all real estate investors. There’s access to a private Slack group, coaching groups, and private coaching.

Roofstock claims that academy members have closed $45 million in real estate acquisitions on and off the Roofstock platform. There’s a money-back guarantee, but enrollment is presently closed.

While there’s no free academy tier, you can access the Roofstock blog for free. The blog covers topics ranging from inflation to REITs.

Shop with an Agent

Roofstock has a curated network of agents who closed more than $50 million in real estate transactions in 2021. The new Shop with an Agent feature connects you with a certified agent who will help you decide on which property to invest in and how to make an informed offer.

This tool is worth considering if you’re new to real estate investing and want someone to guide you through the process.

How Does Roofstock Work?

If you want to get into real estate investing, Roofstock simplifies the entire process. You can browse properties on the Roofstock Marketplace without registering on the website. Simply click on the “Properties” tab to see the available homes. From there, you can filter your research by

- Newly Listed

- Neighborhood rating

- Best schools

- Multiple units

- Pre-inspection

- Higher yield

When you click on a specific property, you get detailed information about the investment to make an informed offer.

You can also decide how many Roofstock services you want to use. You can tap into Roofstock for financing and property management, or you can use the platform to find tenant-occupied investment properties on the other side of the country. With so many services offered, most investors can benefit from using Roofstock.

Roofstock Pricing

There are no fees to signup with Roofstock and browse properties on the Roofstock Marketplace. As mentioned in this article, if you close on a property, you will pay 0.50% of the contract price or $500, whichever is greater. When you sell a property through Roofstock, you pay a listing fee of 3% or $2500, whichever is greater. Remember to obtain an accurate valuation of your home before you list.

Accredited investors will pay asset management fees of approximately 0.50% (and up) when they invest through Roofstock One.

How to Get Started With Roofstock Marketplace

Roofstock offers different options for property buyers and sellers. If you’re ready to invest with Roofstock, create your free account and begin your search.

Step 1: Search for your property.

Custom filters allow you to find a property based on the price, expected return, location, and more. You can even sign up for alerts when a property that fits your criteria comes on the market. With thousands of properties listed on its marketplace, Roofstock will likely have something for everyone.

Step 2: Analyze the property.

Roofstock provides enough detailed information about the property to answer most questions you may have. The platform shares the following:

- Floor plans and pictures: You can also get a 3D tour and curb view.

- Property inspection and valuation: This includes the title report and an insurance quote so that you know exactly what you’re signing up for.

- Tools for figuring out the numbers: You can see how much of an initial investment you have to make, along with the total return.

- Current lease and tenant information: You know what kind of tenants you inherit.

- School and neighborhood ratings: You can get an accurate picture of the community you’re investing in.

- Local options for property management services: You can use one of Roofstock’s property managers to handle everything and be a hands-off investor.

Step 3: Make an offer.

You can submit an offer on Roofstock for free and not get charged any commission until your offer is accepted. The marketplace fee is either 0.5% of the contract price or $500, whichever is higher.

Roofstock provides an Open House feature where you get an exclusive look at properties on the platform. You’re allowed to review and submit an offer within the first 24 hours.

Step 4: Close the property.

The service and transaction team from Roofstcok will work with you through escrow until the property is finally under your ownership. Once this process settles, you’re officially the rental property owner.

Looking for a low barrier to entry into real estate investing? Join a crowdfunded real estate investment platform.

Roofstock Advantages

Over the years, many competitors have popped up in the online real estate investment space. Investors have more options than ever before, making it difficult to choose one platform over another. Here are some benefits of choosing Roofstock over competitors in the real estate space.

Free to start

You can browse properties for free on the Roofstock Marketplace, including the full inspection report and analysis of potential properties. Users can access all the information they want about the report, from the current lease to the detailed financials (like the down payment and the expected annual return).

Eliminates the stress of finding tenants

Being a landlord can be stressful. Roofstock helps you find tenant-occupied properties, so you don’t have to worry about finding tenants. With tenant-occupied properties, you assume the lease agreement from the previous landlord, meaning you don’t have to worry about screening tenants or performing background checks.

The company also offers Vacancy Protection for single-family rentals operated by Roofstock-partnered property managers. This guarantee promises that if you cannot find a tenant within 45 days, the company will pay 75% of the market rental rate for up to six months or until a new tenant is found.

Offer detailed inspections and reports

There’s plenty of uncertainty that comes with investing in property. You either must spend the money on a full property inspection or purchase as-is if the real estate market is hot enough.

With Roofstock, you get detailed reports on the home’s standing, so you know what you’re getting yourself into, and you won’t have to fly out to see the property in person.

Simpler financing for rental properties

Roofstock makes it easy for investors to research financing options. You can have a list of quotes from numerous third-party lenders by providing a little information, like credit score, target property price, loan terms, and down payment percentages.

Roofstock Alternatives

At the moment, Roofstock is unique in allowing non-accredited investors to buy and sell tenant-occupied residential real estate properties for a fraction of the cost of going through regular channels. There are hundreds of homes listed on the Roofstock marketplace.

But Roofstock One, which lets investors buy into portfolios of single-dwelling residences, is only available to accredited investors. Fundrise and RealtyMogul are two Roofstock alternatives worth considering if you’re looking for a REIT-style investment option.

Fundrise

With Fundrise, you can invest in residential and commercial real estate portfolios, starting with a minimum investment of $10. Unlike publicly-traded REITs, Fundrise portfolios are privately held. While they’re not exposed to natural market volatility, they are less liquid than traditional REITs. Fundrise charges an annual fee of 1% of your overall portfolio value, which is reasonable for the asset class. Learn more in our Fundrise review.

RealtyMogul

Los Angeles-based RealtyMogul gives non-accredited investors access to a REIT portfolio with a minimum investment of $5000. At the time of this writing, you can invest in the RealtyMogul Income REIT or the RealtyMogul Apartment Growth REIT. In addition, RealtyMogul allows accredited investors to invest in private placements. RealtyMogul fees are similar to Fundrise, at 1 to 1.25%. For more information, check out our RealtyMogul review.

What Are The Pros and Cons of Roofstock?

Pros

- Roofstock does all of the research for you, saving time

- Investment properties often already have tenants

- Competitive transaction fees

- Roofstock Marketplace is available to non-accredited investors

Cons

- REIT option is limited to accredited investors (Roofstock One)

- Investment is illiquid. Buying a property will hold up your capital

- The Roofstock Marketplace can be competitive, mainly as more people use it

Is Roofstock For Me?

The Roofstock Marketplace is ideal for real estate investing beginners looking for a straightforward way to get started buying or selling individual real estate. Roofstock is affordable, easy to understand, and shares all the relevant property information with you.

On the flip side, if you’re interested in real estate crowdfunding options as a non-accredited investor, Fundrise or RealtyMogul will be more suitable than Roofstock One, which is open to accredited investors only.

Investing in real estate can be intimidating, especially when you’re doing it from a distance. It helps to use a trusted platform that does the vetting for you.