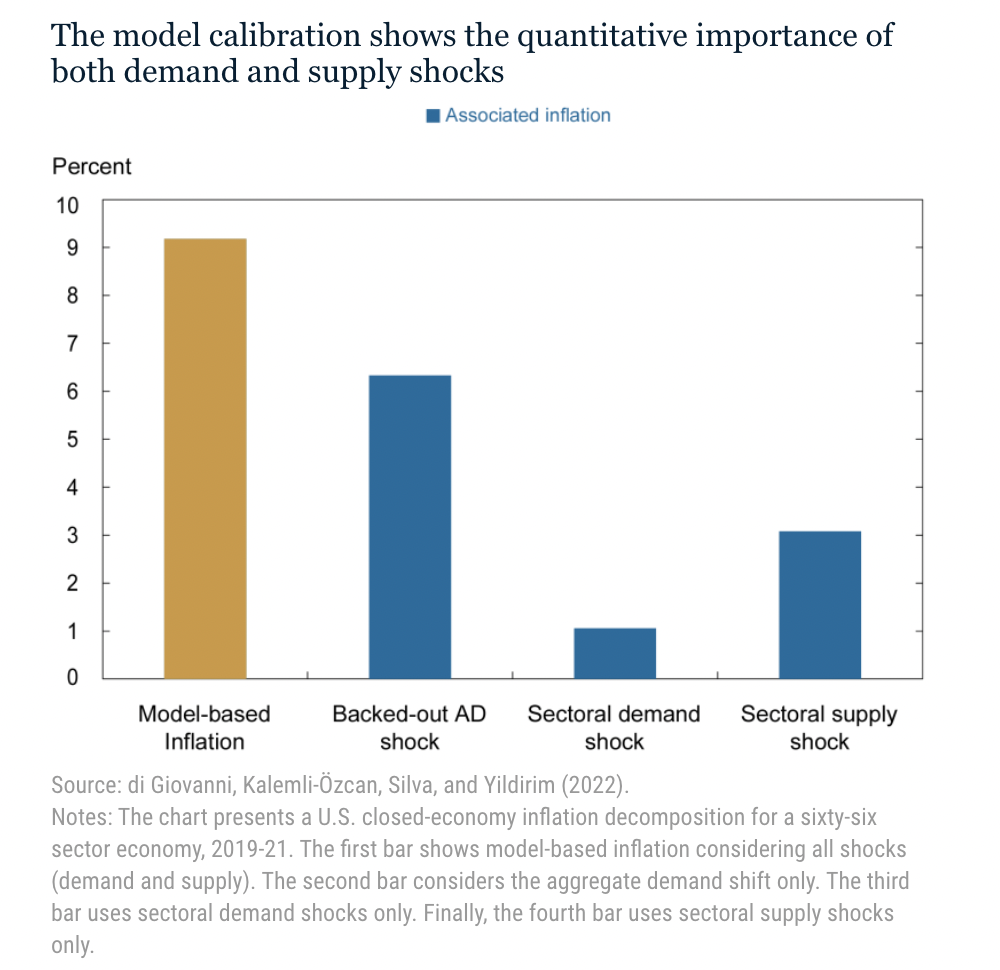

There is a new 60/40 in town, and it is the contribution to inflation from consumer demand for goods and the pandemic-broken supply chain.

That is according to a study by Julian di Giovanni, who publishes at the NY Fed’s blog Liberty Street Economics. Over the summer, he posed a fascinating question: How Much Did Supply Constraints Boost U.S. Inflation?

Short answer: 40%.

The longer answer is based on detailed research out of the FRBNY, ECB, and Harvard. Most observers of the economy assumed the answer to his question was “some amount,” but I believe di Giovanni and his co-authors are the first to quantify it:

“Our analysis of the relative importance of supply-side versus demand-side factors finds 60 percent of U.S. inflation over the 2019-21 period was due to the jump in demand for goods while 40 percent owed to supply-side issues that magnified the impact of this higher demand.”

This raises the obvious question as to what increasing FOMC rates are going to do to fix the 40% that is supply-chain-related problems. The honest answer: “Nothing, we are aiming at the 60% that is the goods demand side.”

My job is not to give policy advice to the Fed, but to interpret what they are doing and its most likely impact on our portfolios. To paraphrase Ray Dalio, it is the role of the investor to see embrace reality and deal with it as it is.

Still, I cannot help but observe that the FOMC response to pandemic-induced inflation is blunt, excessive and unnecessarily painful to the middle and lower economic earners.

The Fed could learn from the Hippocratic oath: “First, do no harm.”

They did harm by remaining on emergency footing of zero for way too long, and then missing the initial rise of inflation straight through their 2% target. Now, they are massively overcompensating by chocking off the economy to the point of recession.

Jerome Powell and the FOMC should ask themselves three questions:

1. How much of the supply chain issues are resolving by itself organically?

2. How much of the demand side is reverting back to prior balance between goods and services?

3. How much is the FOMC itself causing OER to rise by making housing purchases unaffordable?

Bloodletting, leeches, trepanation, and even Mercury were forms of “medicine” used by doctors who had little idea as to how the human body worked and did not know what was actually wrong with patients, but “did harm” anyway. The Fed should learn from those ancient medical mistakes.

Rant over.

See also:

Glenn Hubbard: Post-pandemic fiscal spending bears much of the blame for US inflation (FT, November 14, 2022)

Challenges for monetary policy in a rapidly changing world (ECB Forum, June 2022)

How Much Did Supply Constraints Boost U.S. Inflation? (Liberty Street Economics, August 24, 2022)

Previously:

What’s Driving Inflation: Labor or Capital? (November 7, 2022)

Behind the Curve, Part V (November 3, 2022)

When Your Only Tool is a Hammer (November 1, 2022)

How the Fed Causes (Model) Inflation (October 25, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)