Today’s Animal Spirits is brought to you by AcreTrader and Nasdaq:

See here for more information on AcreTrader and here for AcreTrader disclosures

See here for Nasdaq’s stock screener

On today’s show we discuss:

Listen here:

Recommendations:

Charts:

Tweets:

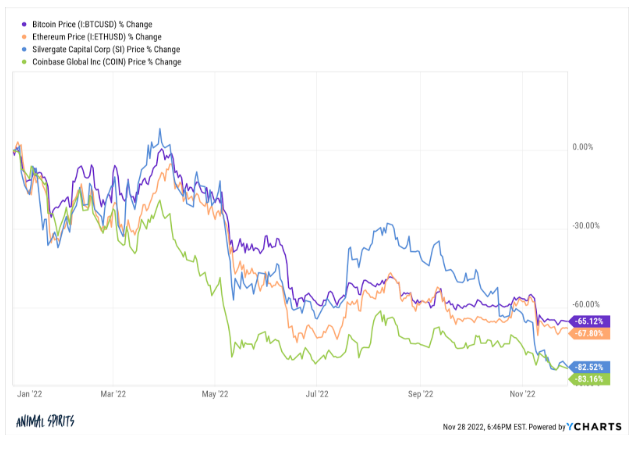

So far in 2022:

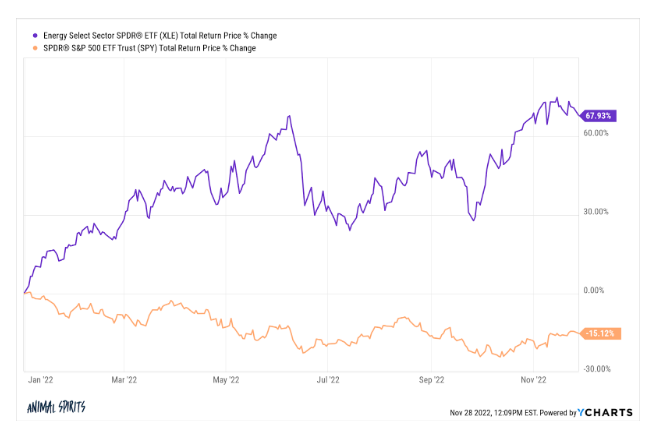

Energy Sector +39% vs S&P 500 -5%Three reasons we see the Energy rally continuing:

1: Energy Security Re-Rating,

2: Portfolio Diversification/Hedge, &

3: Momentum Rotation— Warren Pies (@WarrenPies) April 2, 2022

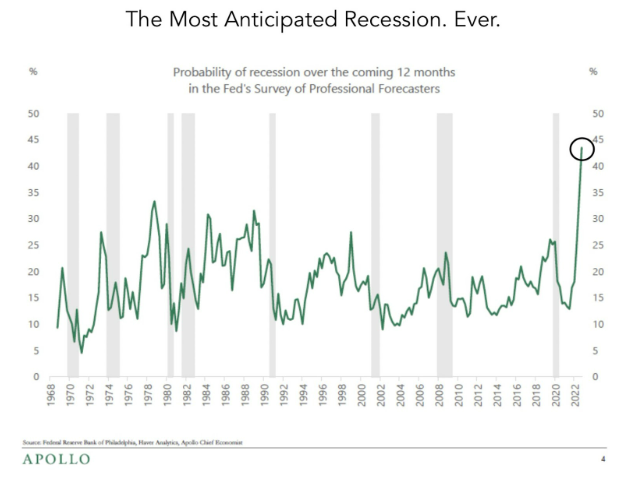

Two-year Treasuries now yield 0.7 points more than 10-years. You must go back to the early 1980s to find a wider spread for this closely watched indicator of future recession risk.$IEF $SPY pic.twitter.com/lbD29tOxIZ

— DataTrek Research (@DataTrekMB) November 22, 2022

FOMC Minutes: It seems like a growing consensus that it’s time to wait for data to reflect lagged impact of rapid tightening to date. Terminal rate debate is going on among the “various”. Reality is – Fed won’t know the terminal rate until its behind them.

— Kathy Jones (@KathyJones) November 23, 2022

Chart strongly suggests inflation in Germany was supply chain driven–not the result of monetary policy. So can ECB pause now with an eye towards continued improvement in supply chains? pic.twitter.com/ATRHyRlt0s

— Jeffrey Kleintop (@JeffreyKleintop) November 28, 2022

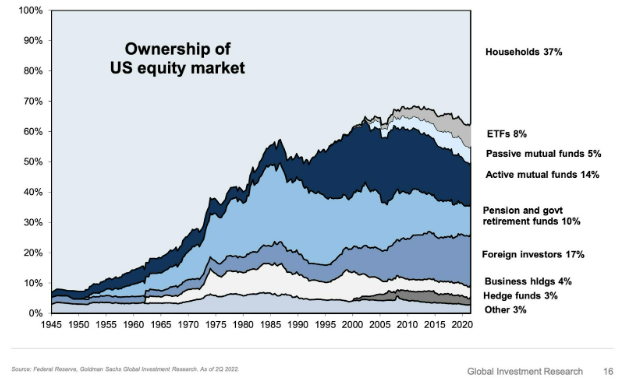

Active vs passive fund flows since 2000…

What a chart.

via @emmaboyde pic.twitter.com/4lXaYqh6kl

— Nate Geraci (@NateGeraci) November 23, 2022

From @MorningstarInc Direct: Trailing 12-month flows for Active/Passive Mutual Funds/ETFs.

Notable:

1.) Active mutual funds are the outlier ($797 Bil in net outflows over TTM)

2.) Passive ETFs have gotten way out ahead of index mutual funds ($541 Bil more in net flows over TTM) pic.twitter.com/Sm88oIpC9i— Ben Johnson, CFA (@MstarBenJohnson) November 22, 2022

Credit card debt is near pre-pandemic levels and this is the latest worry.

What they don’t tell you is consumers are using only 21% of their total credit, well beneath the 24% avg pre-pandemic.

Also, household debt payments relative to income is near historically low levels. pic.twitter.com/2vR3ImaiYF

— Ryan Detrick, CMT (@RyanDetrick) November 23, 2022

Exotic car market is getting decimated right now.

2021 Mercedes G-Wagon with 3,378 miles just sold for $187K at auction.

that’s nearly an $80K (or 30%) drop in under 12 months.

— CarDealershipGuy (@GuyDealership) November 22, 2022

The one year price chart of #Solana has stretched my imagination and made me rethink everything I thought I knew about investing and markets and venture capital. Exciting and humbling. pic.twitter.com/D314Ym4QBp

— Boring Howard Lindzon (@howardlindzon) November 4, 2021

5/ As you can see, the majority of the outflows happened in Q4 2021. Things noticeably cool down after that.

To us, this is a sign that they took a huge hit as markets contracted in Q4.

As mindblowing as this might be: it’s possible by the time Terra happened, they were broke.

— Lucas Nuzzi (@LucasNuzzi) November 22, 2022

Alameda’s massive losses in 2021 indicates that the insolvency didn’t just originate in the Luna blowup from

May of this year. https://t.co/Kt2RTBf9EO— Doug Colkitt (

,

) (@0xdoug) November 21, 2022

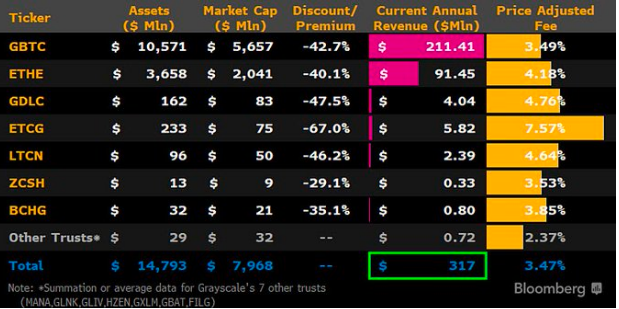

A LOT of people have asked me to do a thread on the $GBTC, Grayscale, DCG, Genesis situation but primarily with regard to GBTC. First off.. DCG & Genesis own a ton of GBTC. Almost 67 million shares as of 9/30/22. The bulk of that was added in the second quarter 2022. 1/X pic.twitter.com/4Vhccj4vkg

— James Seyffart (@JSeyff) November 23, 2022

Crypto companies currently in bankruptcy proceedings

3AC

Voyager

Celsius

FTX

BlockFiRestructuring lawyers up big

— db (@tier10k) November 28, 2022

BlockFi’s 4th largest creditor is the SEC, to whom the company owes $30m. I presume that’s left over from the $100m fine and settlement it agreed to in Feb. 2022. pic.twitter.com/WVmbXXFXsd

— Jacob Silverman (@SilvermanJacob) November 28, 2022

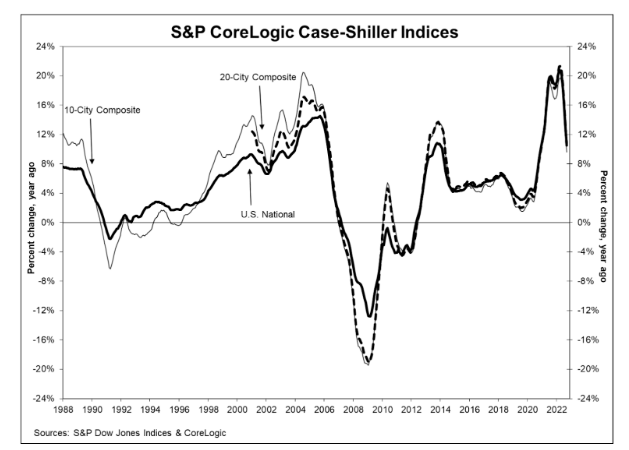

Case Shiller 20 City M/M: -1.24%, Exp. -1.20%, Last -1.30%

Case Shiller 20 City Y/Y: 10.43%, Exp. 10.55%, Last 13.06%— zerohedge (@zerohedge) November 29, 2022

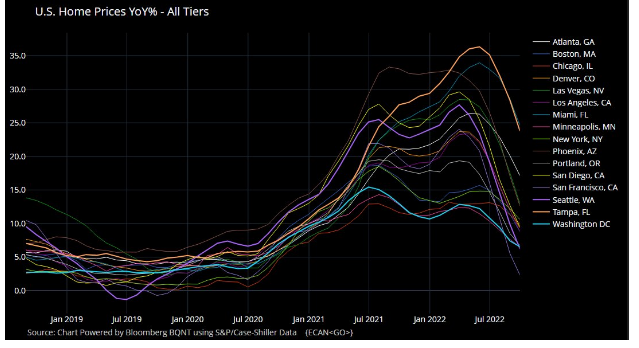

The housing market:

[H/t @jonathanmiller] pic.twitter.com/FQG1MqhRl5

— The Transcript (@TheTranscript_) November 28, 2022

Direct evidence of the decline in VC investment volumes: the unicorn birthrate has collapsed. pic.twitter.com/DcrbnzVJdH

— Brett Winton (@wintonARK) November 23, 2022

Here are six public companies that are now valued way below their total funding since inception

$ACAST $BRDS $ROO $RENT $GRAB $BGRY pic.twitter.com/tA8bjiQG16

— Quartr (@Quartr_App) November 23, 2022

IGER SAYS DISNEY PRIORITIES ARE PROFITABILITY AND TAKING HARD LOOK AT COST STRUCTURE — TOWN HALL MEETING$DIS

— *Walter Bloomberg (@DeItaone) November 28, 2022

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.