Executive Summary

Welcome to the December 2022 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that Savvy Wealth has raised an $11M Series A round to compete in the new category of ‘tech-enabled RIA’ – where the firm will use the bulk of its capital to develop its own in-house fully-integrated advisor tech stack, in the hopes that a better technology experience will both attract advisors to work for the firm, attract consumers to want to be clients of the firm, and enable their advisors to service more clients (and be more productive) with the firm.

Notably, though, the reality is that while few would argue that today’s ‘best-of-breed’ approach of cobbling together independent advisor technology solutions is perfect, advisory firms on average have continued to run remarkably healthy 25% – 30% profit margins, suggesting that while the technology may not be perfect, it’s not that broken, either. With a select number of ‘all-in-one’ solutions that form a consistent hub (around which the rest of the advisor tech stack is at least reasonably integrated), and a subset of tasks that can be solved with just a little extra administrative support, it’s not clear whether firms like Savvy can build technology that really materially alters the productivity and profit margins of a tech-enabled RIA. Not to mention that for most firms, the biggest inhibitor to expanding reach and growing faster is not its back-office technology efficiencies, but the cost of attracting new clients in the first place… which raises the question of whether Savvy is bringing (or raising capital to fund) an operational solution to what is still first and foremost a marketing problem?

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- DPL Partners launches a new advisor-matching solution to solve for the inbound demand of consumers increasingly seeking out a new crop of no-commission annuity products

- InvestCloud launches a new Advisor Connect solution that will allow larger advisor enterprises to embed an advisor-matching system into their own websites (presuming that the enterprise has a steady supply of prospects to go through the matching process!?)

- IncomeLab’s LifeHub wins the ‘Best-In-Show’ award from the XYPN AdvisorTech Expo with an interface that consolidates the client’s entire financial life down to a single screen (that clients can then engage with to drill deeper)

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- eMoney Advisor launches a new Explore feature that helps clients move past just planning for their goals and instead have the opportunity to see what other goals might even be possible in the first place

- BlackCloak offers a new ‘concierge cybersecurity’ solution for the most affluent clients of financial advisors who may want to spend a little more to protect themselves as potential ‘high-value’ highly-visible targets for hackers.

In the meantime, we’re excited to announce several new updates to our new Kitces AdvisorTech Directory, including Advisor Satisfaction scores from our Kitces AdvisorTech Research, and the inclusion of WealthTech Integration scores from the Ezra Group!

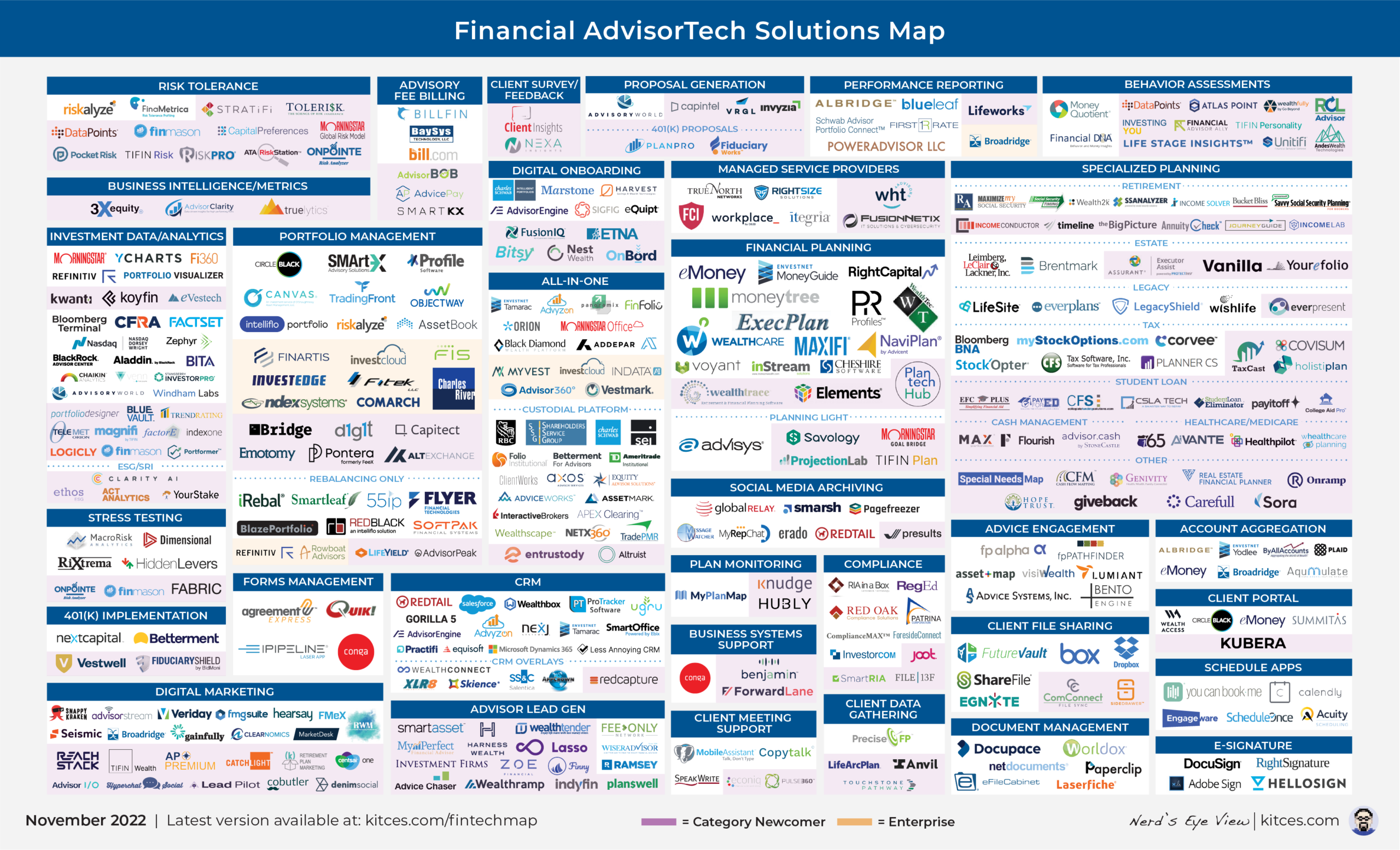

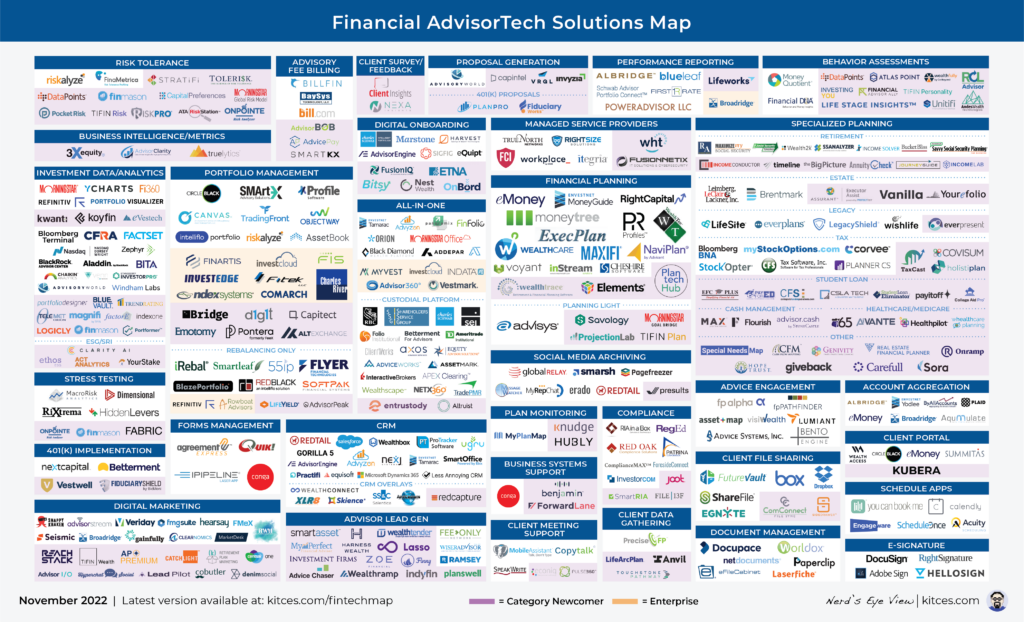

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

In the world of financial advisors, it’s common to value an advisory firm as a multiple of its revenue. But the reality is that, in the end, businesses are not typically valued based on their revenue; they’re valued based on profits, and bought for a multiple of those profits. As a result, the ‘traditional’ valuation of an advisory firm wasn’t really 2X revenue; it was 6-8X profits, and when advisory firms can run 25% to 30% profit margins, 7X profits at 28% margins came out to almost exactly 2X revenue. (In recent years, advisory firm valuations have crept higher, primarily because buyers are willing to pay more than 6-8X profits for larger, more stable, and more established advisory firms.)

When it comes to technology firms, revenue valuation multiples are often much higher. In part, that’s because tech firms can often support higher growth rates, because it’s “easier” to scale tech growth more quickly once it’s built (as the tech is the tech regardless of whether it supports 100 or 1,000 users, while a service business that wants to 10X its customers typically has to nearly-10X its staff to deliver those services to them). Though tech firms get higher revenue multiples primarily because the margins themselves are higher – where it’s not uncommon for tech firms at scale to run 50% – 60%+ profit margins. Which can lead tech firms to get margins of 5X to 7X revenue (or in some cases of very rapid growth, even higher).

This dichotomy has led to a drive in recent years to “tech-ify” wealth management, in the hopes of building faster-growth, more-scalable businesses that in turn can command higher valuation multiples. Which started a decade ago with the rise of the robo-advisors. Built around the presumption that tech could be so efficient that robos could charge 1/4th of the price of human advisors and still be more profitable, at least at scale… and, at the same time, grow rapidly by capturing a market of consumers that traditional advisors couldn’t even afford to serve (i.e., next-generation investors with smaller balances).

In recent years, the hunger to tech-ify wealth management has led to a new type of venture – the tech-enabled RIA, that builds its own technology to try to automate more of the back office and improve the tech experience of the front office (i.e., for the client), again in pursuit of either higher margins and/or the ability to grow with consumer segments that traditional advisors have struggled to serve. The most prominent of which is Facet Wealth, which has stated a goal of getting advisors up to 250 clients/advisor by leveraging their own proprietary technology to make their advisors maximally productive. Which attracted a similar tech-enabled RIA competitor “Compound” earlier this year.

And this month, a new entrant into the tech-enabled RIA domain appeared, with Savvy Wealth announcing an $11M Series A round of funding. Similar to other tech-enabled RIAs, Savvy makes the claim that existing AdvisorTech solutions are too inefficient given their limited integrations (noting one advisor Savvy recruited who was previously spending “40% to 50% of his time every week just syncing data over between different systems and making sure things are all synchronized”), and is aiming to leverage the development of its own in-house technology build to become a “one-stop shop” of onboarding, workflows, and client portal, to make its human advisors more efficient.

From the advisor perspective, there’s no question that the depth of integrations in the typical AdvisorTech stack is not where it ideally would be, and that advisors often still live in disparate systems more than they wish. Yet at the same time, the reality remains that advisory firms do still often drive 25% to 30% profit margins, which is hardly the profile of an industry that is struggling to execute due to the limitations of its tech stack. Or, viewed another way, how much more efficient could an advisory firm really realistically get from ‘better’ technology? It is, ultimately, still a service business that is never going to run tech margins, and advisory firms are already above-average in margins relative to service businesses in general. Or stated even more simply: what tech can really be built with an $11M capital raise to more-than-offset the cost of simply hiring one (not-very-margin-impacting) entry-level administrative staff member to manually do a few tasks that existing advisor technology hasn’t fully automated yet?

From the broader industry perspective, though, the ongoing drive of venture capital towards tech-enabled RIAs signals that investors increasingly see humans prevailing over ‘pure’ robo solutions, while at the same time still seeing a material opportunity to improve upon the existing AdvisorTech solutions for those human advisors… putting ongoing pressure on existing platforms to continue to step up and integrate better, or risk being displaced by an emergence of new all-in-one, internally-built solutions (which, if they are really more effective, will eventually lead those firms to attract advisor talent and acquire existing advisory firms into their home-built tech stack). Though in the end, when the advisor platform business is itself a hyper-competitive business of “who gives the highest payouts” – from independent broker-dealers to advisor networks to the new tech-enabled RIA platforms – the irony again is that there’s only ‘so much’ room for advisors to earn (and pay their platforms from the) better margins with that tech. In other words, if an advisory firm can only improve its margins by 3% to 5% with superior technology, then a platform might only be able to keep another 1% to 3% of the advisor’s revenue (in the form of lower payouts) as compensation for that benefit… which, again, makes it hard to drive profitability on an $11M Series A round?

Because, in the end, the reality is that the biggest inhibitor to better margins for advisory firms is arguably not the back-office efficiency of the firm, it’s the sheer difficulty of getting new clients in the first place, in a world where established advisors incur a client acquisition cost of more than $4,000 (including hard-dollar marketing expenses and the cost of their own time as an advisor) to get a single client. Which means the typical advisor spends more to get a client than they spend on all their back-office staff and technology costs combined in the first full year of servicing that client! As a result, the real question for Savvy and its prospective success is not really about whether it can build a better back-office-technology mousetrap, but whether it can improve upon the true cost-inhibitor for financial advisors, by coming up with a more cost-efficient way to get clients for its advisors in the first place?

Ken Fisher built an independent RIA with more than $100B of assets under management, driven in no small part by a multi-decade marketing campaign built around the phrase “I Hate Annuities”. In practice, though, Ken Fisher does not have the consumer reach to materially alter public opinion on annuities. Instead, annuities have unfortunately earned their bad reputation themselves, driven by the industry’s own multi-decade problem of selling often-high-cost products, often peddled by overly-aggressive commission-based salespeople. A challenge that has only amplified for the annuity industry over the past decade, as low interest rates have made it more challenging for annuities to price competitively, leading to increasingly opaque and complex products (that make it harder for consumers to understand how they work, or to even determine what the underlying costs actually are). Which means Ken Fisher was able to succeed by marketing “I Hate Annuities” simply because the message resonated with consumers who themselves already hated annuities due to their own prior bad experiences, and were attracted to an advisory firm that affirmed their experience.

However, two recent trends are beginning to upend the long-standing challenges – and negative perceptions – of the annuity marketplace.

The first is the advent of the commission-free annuity. As the Department of Labor’s 2016 fiduciary rule threatened to reduce (or eventually, to eliminate) commissions on annuity (and other) products sold into retirement plans, coupled with the ongoing rise of the fee-based RIA channel (that typically doesn’t even have a license to accept an annuity commission), forced the industry to begin to reinvent new forms of no-commission annuities that could be ‘sold’ (or at least, recommended and implemented) by no-commission fiduciary advisors. Which was further accelerated in 2019 when the IRS issued a series of Private Letter Rulings that permit RIAs to assess and collect advisory fees directly from the cash value of an annuity without triggering a taxable distribution for the annuity owner, ushering in a new wave of fee-based annuities.

The second shift, even more recently, is the emergence of inflation and the subsequent rise in interest rates that has followed. Which is extremely important from the annuity perspective, both because fixed annuities are often a fixed-income alternative to CDs and bonds (and tend to be attractive in rising rate environments because their yield offers tend to be very competitive very quickly, with A+ rated annuity carriers out-yielding similar-maturity Treasuries by upwards of 1% in yield), and because annuities with guarantees – from income/withdrawal guarantees to indexed annuity return guarantees – are priced in large part based on available yields, and higher yields makes it feasible to offer more generous (or at least, more competitive and compelling) annuity benefits.

And now the combination of the two – a rapid expansion of no-commission annuity products, which themselves are suddenly offering more appealing yields or guarantees – is leading to an emerging shift in consumer preferences towards annuities, as exemplified this month by the announcement that DPL Partners (a platform that provides independent RIAs access to no-commission annuity products) is rolling out an advisor matching service that will pair consumers who are interested in no-commission annuities with an advisor on the DPL Platform who can implement their no-commission annuity request.

Unlike other ‘advisor matching’ platforms that have launched in recent years, though, DPL didn’t simply launch the new lead generation solution as a (solicitor) business model unto itself; instead, the offering comes in response to the growth of the DPL brand as a no-commission annuity platform, which is generating its own inbound inquiries from consumers looking for such annuities, for whom DPL is simply trying to find an advisor within its existing network to help them get what they’re looking for. In other words, DPL isn’t trying to attract consumer leads for its advisors to grow its business; it’s attracting consumer leads for its advisors by growing its business, and in response to an emerging demand from consumers themselves who are seeking out a no-commission annuity. Which is a truly remarkable turn of events relative to Ken Fisher’s storied “I Hate Annuities” growth success.

From the advisor perspective, any source of new clients is appealing, and while it’s not clear that DPL is generating enough leads to materially impact all 1,200+ RIAs that are on its platform, there’s no question that it’s an incremental value-add to have the opportunity to receive leads from interested clients.

From the broader industry perspective, though, the real significance is that if no-commission annuities are becoming so compelling that consumers are actually seeking them out – and willing to show preference to a financial advisor who can implement one as part of their financial plan and investment portfolio, because of the more appealing yields and guarantees becoming available in no-commission products – it may further accelerate the ongoing shift towards fiduciary advisors incorporating annuities into their client recommendations, which impacts everything from no-commission platforms like DPL to the growth of annuity companies with a no-commission channel they historically ignored to the relative competitive pressure on traditional asset managers to come up with their own competing solutions (e.g., more breadth of structured notes to compete with indexed annuities, better yield products to compete with fixed annuities, etc.).

For nearly our entire history, advisors have sought out prospective clients in our local markets. After all, in a world where prospecting was almost entirely a function of networking and establishing relationships with Centers Of Influence who could refer the advisor, almost by definition the advisor’s marketing efforts would concentrate on the local market where they could engage in such in-person relationship-building. And of course, client meetings themselves were in-person engagements by definition, which meant the client had to be geographically local.

In turn, even in a more virtual world, most “Find An Advisor” platforms over the past two decades start first and foremost with the prospect’s zip code – finding the consumer a local advisor, or at least the opportunity to meet several local advisors and decide from there which one the prospect felt was the best personality fit to work with on an ongoing basis.

But the rise of the internet, video-based calling and collaborative screen-sharing tools, and more recently the COVID-19 pandemic that accelerated the adoption of these platforms, is suddenly making it feasible to have valuable meetings and a meaningful relationship with a professional who might not be local. Which, on the plus side, makes it possible for consumers to no longer just select the best advisor in the area, but the best advisor in the country for their particular needs and circumstances. And, on the downside, makes it almost impossible to sift through a seemingly infinite number of (or, at least, several hundred thousand) possible advisors to actually find that one best match.

To fill the void, a growing number of “advisor matching” platforms have begun to emerge, that pledge to help consumers navigate the overwhelming number of choices, often amongst seemingly undifferentiated advisors, to find the one right and best financial advisor for their needs and circumstances. In most cases, this involves asking the prospective client questions about both the technical needs of their situation (to ensure the advisor has an expertise match), along with questions about their communication and style preferences (to ensure the advisor has a relationship match). Recent entrants have included everything from third-party lead generation services like SmartAsset’s SmartAdvisor and Zoe Financial, to ‘internal’ solutions like Merrill Lynch’s recent Advisor Matching tool or the Edward Jones Match solution.

And now, InvestCloud has announced its own advisor-matching tool, dubbed Advisor Connect, that is being implemented with launch partner Huntington Bank. Similar to other advisor-matching tools, Advisor Connect will prompt consumers to answer a series of questions to express their advisor preferences, and then queue up a list of prospective advisors for the consumer to connect with (including both local in-person advisors and virtual remote options). Which Huntington intends to integrate into its existing online platform for its banking customers.

Notably, this means that InvestCloud’s Advisor Connect is fundamentally different from most other “Advisor Matching” platforms being launched, in that it is not a lead generation platform, per se – as InvestCloud is not taking on any responsibility to generate prospects for the matching solution, it’s simply an interface for consumers who have already come to the firm’s website to go through a questionnaire process and be matched to prospective advisors at that firm (by whatever algorithm Advisor Connect uses to do the matching). In other words, Advisor Connect will only generate results by being implemented into a platform that already has a source of prospects coming in (and/or an existing customer base that can be cross-sold). Which is distinct from alternatives like SmartAdvisor or Zoe, or more recent entrants like Lasso or WealthTender, where the primary value proposition that the advisor pays for (and why advisory firms have been willing to pay substantially higher fees for the solutions) is the origination of the lead (shifting the platform from a ‘technology’ expense to a marketing/client-acquisition expense, which has a far bigger budget).

As a result, solutions like Advisor Connect will likely only be appealing to the largest advisor enterprises, that either already have an existing brand and organic marketing systems (where Advisor Connect can help route prospects to the ‘right’ advisor at the firm), or to firms with a large consumer presence (e.g., banks or retail brokerage firms) who want to cross-sell deeper wealth management/advice relationships to their existing retail customers. Thus why such advisor matching platforms have thus far been primarily implemented at mega-firms like Merrill Lynch and Edward Jones (and now, as a cross-selling test at Huntington Bank with Advisor Connect).

The broader industry question, though, is simply “what are the best ways to match consumers to advisors” when local geography alone no longer has to be the primary driver? What actually leads to advisors having higher close rates, and/or higher long-term retention rates? Is it primarily about matching consumers based on the advisor’s expertise (e.g., pairing tech workers with advisors who have a niche with tech workers, and prospective retirees with advisors who specialize in retirees)? Or will the greater driver be ‘personality matching’ (e.g., pairing consumers who prefer virtual meetings with virtual-focused advisors, and directing consumers who prefer written communication over meetings to advisors who like to communicate via long, thorough emails)?

The fact that there is no clear consensus – nor, really, even any clear data – about what the best matching algorithm is, means there is arguably a great deal of room for innovation and development of the ‘best’ Advisor Matching tool. (At least, if advisors will allow themselves to be sorted into such ‘buckets’ based on their own expertise and communication style!?) Though in the end, the market for advisor matching tools that ‘just’ allocate an enterprise’s existing leads to the ‘right’ advisor will still likely be a more limited marketplace, at least relative to the harder (albeit more remunerative) challenge of originated leads for advisors in the first place?

From its very start, one of the fundamental purposes of producing and delivering a Financial Plan to clients was to help them make sense of their financial life. Dating back to an era where there was no internet (and computers were just emerging), the average consumer’s financial life was a splintered existence across multiple different financial institutions, and just getting a clear picture of where it all was and what it added up to was a meaningful value proposition. Especially when that was followed by an equally-challenging projection of where it was all going with growth over time (i.e., running retirement and other projections to determine whether the current plan was on track to achieve the client’s goals).

To substantiate those increasingly sophisticated analyses (as financial planning software got better), financial plans themselves grew increasingly long (as measured by the physical plan deliverable and its page count). The good news was that this allowed advisors to explain in great detail the basis for their recommendations and really ‘show their work’ to build trust and confidence with clients that it was the right recommendation. The bad news is that financial plans eventually became so long that they began to serve as the butt of jokes about financial tomes with unbroken spines that clients never referenced again and only used as a doorstop after the initial meeting.

As a result, in recent years a counter-trend has emerged, which is focused on how to consolidate the key information of a financial plan down into as few pages as possible… or in the logical extreme and ‘ideal’, to a single One-Page Financial Plan. Which has sparked the growth of tools from Asset-Map and its single-page ‘mind-map’ of the client’s financial picture, to RightCapital’s one-page Snapshot feature, to standalone One-Page Financial Plan templates for financial advisors.

And now, IncomeLab has rolled out its own version of a single-page financial plan visualization, dubbed LifeHub, which was selected by advisor attendees as the ‘Best In Show’ winner of the XYPN AdvisorTech Expo.

Similar to other one-page visualization tools, IncomeLab’s LifeHub aims to consolidate all of the client’s financial information into a single page, using an Asset-Map-style mind-mapping layout that covers the client’s financial life across four quadrants of the screen (Income, Expenses, Assets, and Liabilities), and a breakout of the key financial information in each domain. What’s unique about LifeHub, though, is that it’s not meant to be a static display of financial information, though; instead, advisors and/or clients can click into any financial element to see a drill-down of where those numbers are sourced from, and delve deeper into that segment of the financial plan analysis, which makes LifeHub less of a mere one-page summary and more of a true Hub – a singular source where clients can see their full financial picture and navigate from there into whatever part of their financial plan they want to explore further.

From the advisor perspective, the launch of IncomeLab’s LifeHub is significant not only to compete as another player in the increasingly popular domain of one-page financial plan visualizations, but also because it begins to reposition IncomeLab away from being ‘just’ a retirement planning distribution tool (where it was already becoming increasingly popular), to compete more directly with the likes of Asset-Map and even more head-to-head with other financial planning software tools as advisors shift away from lengthy financial plan software output and towards the kinds of one-page visualizations that IncomeLab built with LifeHub. Though obviously, LifeHub can also simply be used meaningfully as a financial dashboard for advisors serving retirees (more directly complementing IncomeHub’s retiree-centric distribution planning tools).

From the broader industry perspective, though, IncomeLab’s LifeHub is notable not merely because it positions IncomeLab as ‘yet another’ competitor for financial planning software tools, but the way it has developed its interface to be less of a one-page plan and more of a true one-page hub from which an entire financial plan presentation and interactive experience can be crafted. Or viewed another way, traditional financial planning software began with a physical plan and then put The Plan on screen, One-Page Financial Plans aimed to shorten and simplify the plan, but LifeHub appears to be taking an entirely different approach, where the single-page hub is the foundation on which an entire comprehensive financial plan is built and presented, but built with a digital-collaboration-first design approach. Which, if it takes hold, signals an entirely new pathway by which new competitors can aim to differentiate and take market share from incumbents?

In the end, though, the biggest blocking point to new competitors in the domain of financial planning software is not whether new entrants can offer incrementally features, but whether they can offer compelling enough features to persuade advisors to navigate the very high switching costs of adopting new planning software (given the lack of portability of client data and plans from existing tools). And it remains to be seen whether LifeHub’s dashboard-approach to financial planning is truly compelling enough to convince advisors to switch (for which their XYPN AdvisorTech Expo Best-In-Show win is a positive indicator but no guarantee)… or if it’s simply compelling enough to persuade other financial planning software companies to emulate their approach? Time will tell.

Financial planning software has gone through multiple eras, from the earliest days of operating as a ‘calculator’ to illustrate a client’s needs and gaps (into which advisors could sell their insurance and investment products as solutions), to a comprehensive analytical tool that evaluated all of a client’s current and future cash flows to project their financial situation and whether they were on track, to today’s environment where most financial planning software is built primarily to take input of a client’s prospective goals and then analyze what steps the client must take to achieve their goals.

The caveat, though, is that goals-based financial planning doesn’t really work unless clients know upfront what their goals are in the first place. Which in practice is often quite difficult for clients to articulate, and consequently has led in recent years to ‘goal identification’ interfaces that prompt clients with a series of goals that might be of interest, and invites them to select the particular goals they’d like to pursue. Allowing advisors to then craft recommendations about what clients need to do to reach the goals they selected.

However, it’s not entirely clear how clients actually choose from a list of “potential” goals that are presented to them. Do clients actually pick the goals they want to achieve, or do they simply select the ones that seem the most feasible to achieve? From the client’s perspective, this makes sense: what’s the point of pursuing a goal that isn’t possible in the first place? But from the advisor’s perspective, it’s very problematic, because it means clients will tend to simply pick the goals they’re already on track for, and not the ones that might be achieved by taking action (e.g., by implementing the advisor’s recommendations to reach better financial outcomes!). Because, again, most people don’t try to pursue goals that they don’t believe are possible in the first place… even if they’re wrong and the goal is possible (and they just didn’t realize it!).

Accordingly, it’s notable that at its recent Annual Conference and roadmap discussion, eMoney Advisor highlighted the expansion of its “Explore Mode”, where clients can “test how changes to their financial behaviors can impact their financial plan.” In other words, Explore Mode allows clients to see what might actually be possible – that they didn’t even realize would be feasible if they changed their behavior. As ultimately, very few human beings can effectively do compound math in their head, to figure out the cumulative impact of years or decades of a change in savings, investing, or other financial behaviors, on their long-term wealth. Which means most people literally don’t know the long-term implications of their own financial behaviors… until they Explore and see for themselves.

Notably, though, the eMoney Explore Mode is built directly into the Client’s side of the portal (on the Goals page), effectively making it a client-self-directed module for them to examine for themselves what’s possible. While arguably “exploring the possibilities” is better as an advisor-led engagement, as sometimes clients don’t even realize what they could explore as a possibility. For instance, if a prospective retiree is waiting until age 65 to retire because they need access to Medicare for retiree health care, they may ignore the possibility to change their behaviors to retire earlier because they need the advisor to explain to them the potential solutions to solve for ‘early’ retiree health insurance before Medicare at age 65). Or, alternatively, clients who have already resigned themselves to the path that they’re on may not realize it’s worth exploring possibilities and that they even could have a materially different and more favorable financial future.

Nonetheless, the significance of the introduction of tools like eMoney’s Explore Mode is that it highlights that financial planning is about more than ‘just’ inviting clients to articulate their long-term goals and then mapping a path to achieve those goals. The first step is to explore what’s possible in the first place, which requires a fundamentally different type of engagement (and financial planning software interface), as financial planning software itself continues to evolve.

When our money is held as physical cash, security – whether in the form of a safe or vault, or the most (physically) protected bank – is vital. It’s the physical security protections that ensure the money cannot be stolen by thieves. And the bigger the target – the more money the individual is known to have/hold, or the more money the bank is known to store in its vault – the more security matters.

In the modern digital world, cash isn’t physically stored in a vault, but the dynamics of security remain the same. Money still needs to be secured to prevent unauthorized access and potential stealing, thieves are still seeking vectors to get to the money, and the people and places with the most money are still the biggest targets. The only difference is that the protections aren’t about physical security, but cybersecurity.

Most financial advisors are already acutely aware of the need for good cybersecurity, as advisory firms themselves have been, similar to banks, deemed by many hackers to be a ‘high-value’ target, resulting in a growing trend of wire fraud attempts by trying to compromise advisory firms’ security, from hacking attempts to phishing attacks to breaching clients’ email addresses to submit fraudulent transfer requests.

In turn, affluent clients also continue to be increasingly direct targets. As while the reality is that for most people, their greatest cybersecurity risks are likely to be a result of a mass breach (e.g., an entire platform is compromised, and their password or other financial information is amongst those that are taken), or by unfortunate opportunism (e.g., a mass phishing email that goes out to thousands or more, and the client happens to be the one that falls for it). But for ultra-HNW clients and other more ‘visible’ targets (e.g., executives and prominent business owners), the risks are even more acute, as hackers and cyber thieves may target them by name and individually, either to reach their assets, compromise their identity, or potentially to seize private information and try to collect via ransomware.

In this context, a new solution has emerged: BlackCloak, which specifically aims to provide concierge cybersecurity protection and support for ‘high-value targets’ like executives, business owners, and ultra-HNW clientele.

At its core, BlackCloak is a combination of technology (anti-virus, anti-malware, and endpoint detection and response tools to install on the client’s computers and devices), support to enhance home network protections (e.g., firewalls to prevent intrusion, penetration testing, etc.), additional services to help provide privacy and protection (e.g., scanning the dark web for client information, regular removal of client information from data brokers), and additional ‘high-touch’ concierge services (to support everything from onboarding to incident response to ongoing cybersecurity education).

From the advisor perspective, BlackCloak is an interesting option to consider as a solution to offer to clients, either encouraging them to buy the service to protect themselves (and training on why it’s so important), or outright as a ‘perk’ provided to top-tier (e.g., A-level) clients, with a full platform cost of $6k/year for each client.

For most clients that would be at risk, BlackCloak would probably simply come across as a nice service and value-add from the advisory firm, though it may be perceived even more positively for any ‘VIP’ clients who really are concerned about being cyber-targets. And in the long run, the service could even save the advisory firm time, if they really work with clients who are more likely to be targeted, given the time-hassle and impact that could spill over to the advisory firm if they have to help their high-value client actually remediate a breach or other financial incident. Though notably, nothing is an iron-clad guarantee in the realm of cybersecurity, and advisors may still have to weigh offering BlackCloak against the risks that clients still fail to follow through and implement effectively (or get targeted by a social-engineering attack that bypasses the security), and get breached anyway. But still, additional cybersecurity protocols are still more likely helpful than not, and reduce the risk of client breaches.

At the least, BlackCloak is arguably a more differentiated service to offer clients as a value-add, beyond the ‘usual’ perks that advisors typically offer to their top clients.

Interested financial advisors can explore BlackCloak further for themselves by going here.

In the meantime, we’ve rolled out a beta version of our new AdvisorTech Directory, along with making updates to the latest version of our Financial AdvisorTech Solutions Map with several new companies (including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation)!

So what do you think? Will Savvy really be able to build a superior version of AdvisorTech that enhances its margins enough to make its Series A profitable? Do you see more value in the rise of no-commission annuities in a higher interest rate environment? Would you want to offer BlackCloak to your top ‘VIP’ clients to enhance their cybersecurity? Let us know your thoughts by sharing in the comments below!

Disclosure: Michael Kitces is the co-founder of XYPN which was mentioned in this article.