If you’re desperate to start saving some money – for any occasion – but your budget can’t stretch to £1 a week in the 52 week saving challenge, how about trying the Skint Dad 1p saving challenge instead?

First created at Skint Dad in 2015/2016, this is the original 1p challenge (updated for 2023).

£10 BONUS OFFER: Earn easy cash by watching videos, playing games, and entering surveys.

Get a £10 sign up bonus when you join today.

So many people have heard of the 52 week saving challenge. If you haven’t, it’s quite simple, so let me explain.

The idea behind the money saving challenge is that you save an increasing amount per week for each week of the year. In week one, you save £1; in week two, you save £2; in three, you save £3 until you’re saving £52 by the last week of the year.

The first few weeks are obviously easy as you’ll have to put away £10 from your budget.

However, by the end of the year, you’ll be down the total each week of £49, £50, £51, £52 (£202!!) – that’s a lot of money for any month, let alone December.

If you’re skint, this can get really hard!

For me, this target just seems a little bit too far out of my comfort zone.

Although we’d be able to make the savings initially within a few months, our budget just wouldn’t stretch anymore, and we’d fail.

If these are the kind of targets that you’ve been looking at but feel like you’re setting yourself up to fail, then think again!

The challenges can be easily adapted for the skinter people of the world, and the Skint Dad 1p Saving Challenges are even easier to do!

Happy saving – say goodbye to being skint!

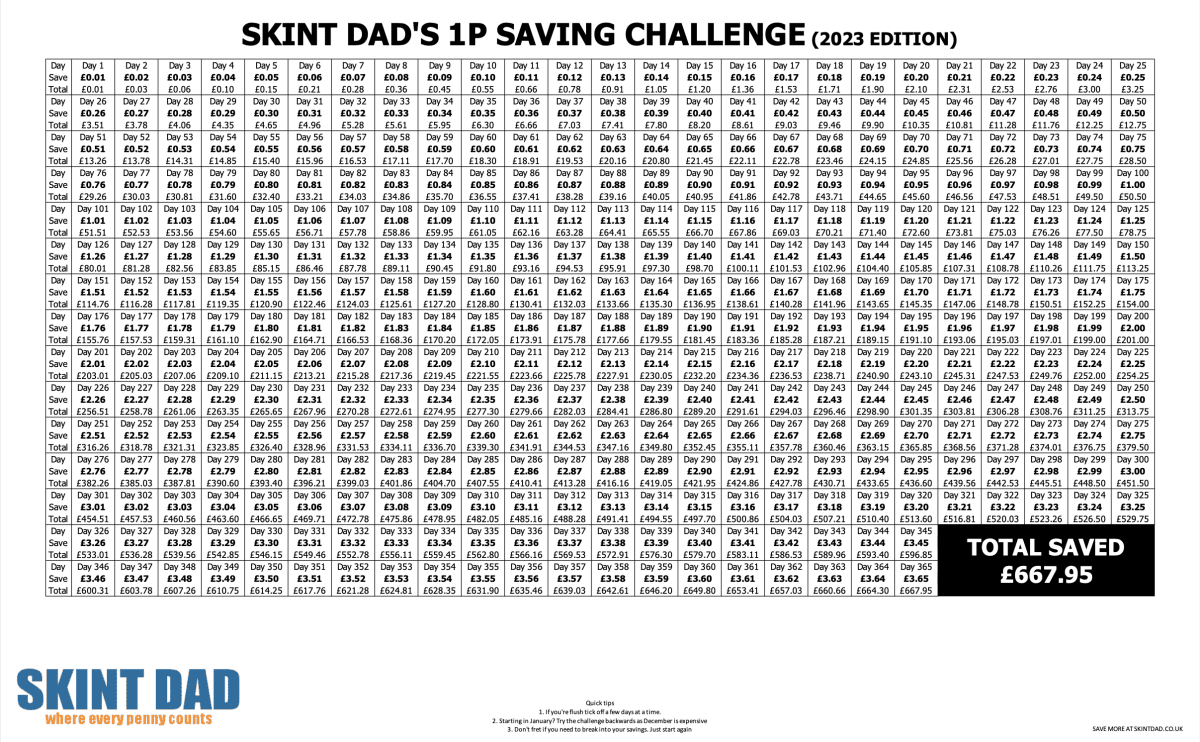

Skint Dad’s 1p saving challenge for 2023

Instead of trying to over-save, why not try a similar saving challenge by saving just a penny at a time (still increasing each and every day)?

So there are some of you saying, “Just a penny? Are you crazy? There’s no chance you’d save anything saving a penny a day!”

But could I?

Well, one penny adds up quickly.

In a year, you can save nearly £700 by putting just 1p away on day one, 2p on day two….you get the idea.

For a normal (365 day) year, you can save £667.95; in a leap year, you can save £671.61.

How much has been saved?

More than 16 million people in the UK have savings of less than £100, according to a study by the Money Advice Service.

Without even trying, the 1p saving challenge can easily see you hit £100 in savings!

This is a really popular challenge, and it’s changed how people are saving money.

In the last year alone, if everyone who accessed our free 1p saving challenge printable managed to save the full amount, there would be a collective savings total of…

…drum roll, please…

£36,837,442.50

£36 million pounds!

Now I’m not saying that everyone hit on the print button, or that everyone managed to save for the entire year, but just imagine if they did.

It just goes to show the potential amount of money we could collectively save – just by saving your pennies!

Plus, the Skint Dad 1p challenge has been so popular that it’s been picked up over the years by the press and loads of other money sites, who obviously think this way of saving rocks, which means even more people will be saving money.

2023 1p challenge – free printable

By popular demand, the Skint Dad 1p Challenge fits onto one A4 sheet.

Downloadable PDF: Skint Dad 1p Challenge 2023

Downloadable Excel doc: Skint Dad 1p Saving Challenge Excel doc 2023

This’ll help save your printer ink, paper use and will mean fewer things to lose.

We’ve still got all the best features that you’ve told us you love.

You’re able to tick off each of the 365 days as you go, and you’re able to track how much you’ve saved along the way.

In a leap year, while some people get to have a birthday for the first time in four years, others think it’s lucky for a woman to propose to a man. When it comes to a savings challenge, it means you can save more.

You can save an extra £3.66 in a leap year, meaning the total you can save is £671.61. We adjust the printable for an extra day for savings and will share the leap year chart again in 2024.

Need help with the 1p challenge?

Many people started the 1p saving challenge at the beginning of the year, but a few of you have started to struggle.

Don’t get put off!

We’ve got plenty of tips to keep you on track so you can still save £667.95 by the end of the year.

One way to give your saving journey some extra fire is to decide on a specific saving goal.

You’ll be extra motivated not only for the sake of spending less but also by being able to do or have things you didn’t think were attainable.

And, to help get your savings moving even faster, The Money Builders has plenty of ideas to help grow your money faster with tips around earning more from your career or finding the perfect side hustle.

For more inspiration, here are some bucket list adventures that will help you visualise what is possible, even when you’re starting with pennies!

Want to save differently? Try an alternative savings challenge

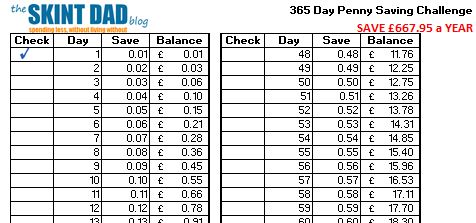

Undated 1p saving challenge – to use at any time of the year

If you’re a fan of our old formats, we’re not going to get rid of them – don’t worry.

Here are the previous versions:

Downloadable PDF: Skint Dad 1p Challenge

Downloadable Excel doc: Skint Dad 1p Challenge

Backwards 1p saving challenge

Do you think you’ll find it too hard to save the larger amount of money in December?

With Christmas looming having extra money to save could be a bit tough for some so, by popular demand, I have turned the whole savings template backwards.

This means you’ll start by saving £3.65 on day one, £3.64 on day two and by the last few days you’ll be putting away just pennies.

Undated to use at any time of the year

Downloadable PDF: 365 Backwards 1p Saving Challenge

Downloadable Excel doc: 365 Backwards 1p Challenge

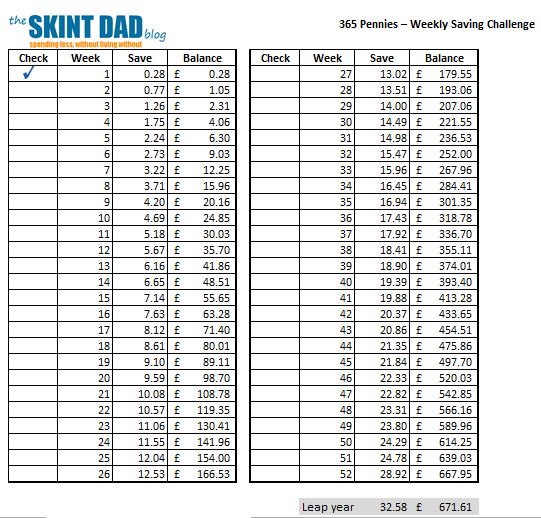

365 pennies – saving weekly

Saving daily will get harder as each day goes on (does anyone have that many coppers?!)

Instead, why not try this adapted version (plus this only takes one page to print). Depending on how much you’ve got spare each month, this may be a bit hard when you reach the final weeks. The last month you need to save £101.79 to hit the target.

Downloadable PDF: Penny Saving Challenge Weekly

Downloadable Excel doc: Penny Saving Challenge Weekly

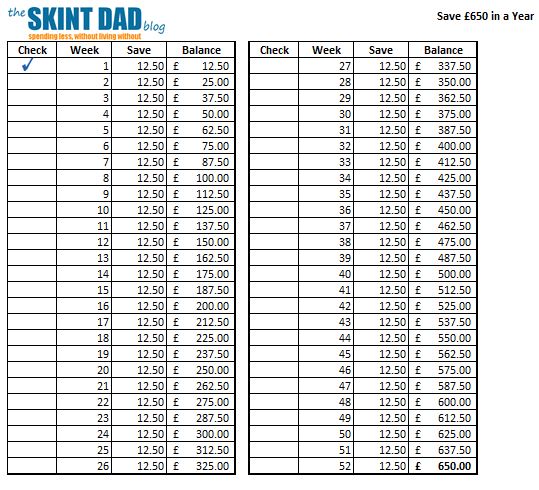

Save £650 – for the budget conscious

Saving money can be tough!

If you don’t have a ton of extra cash left after paying all the bills, putting anything away can seem like a real stretch.

If you have a tight budget I know just how difficult it is to have changing amounts coming out of my bank each week. As saving can prove difficult, how about just saving the same amount each week instead – you’ll still achieve a £600 saving!

I think this can be the easiest one to do. I know the idea of saving with a 52-week challenge looks quite fun, but saving the same amount is far easier in terms of budgeting and it’s easier to set up a standing order.

Downloadable PDF: Save £650 a year

Downloadable Excel doc: Save £650 a year

Blank template – 52 week saving challenge

If you want to save more or less each week then you don’t have to do the amounts I suggest. Instead, use this template 52 week saving challenge crib sheet and enter your own figure.

The balance will work out your annual savings amount for you.

Downloadable Excel doc: Template 52 week saving challenge

Easy money saving

The 1p savings challenge isn’t for everyone.

Instead, save your money with the Chip app.

Chip works out how much you can afford to save, without leaving you skint.

Find out more in our Chip review.

Remember, each image can be opened as a PDF for easy printing or you can download them for free as a spreadsheet. If you’re worried about downloading the documents please contact me and I’d be happy to email you the document instead.

£16 free after cashback

Get your savings off to a great start.

Join the Skint List newsletter where each week we’ll be sharing exclusive content, money-saving guides, extra income ideas and awesome competitions.

We’ve also managed to blag an exclusive £16 cashback offer from Quidco for our new subscribers.

Related articles:

Don’t just think of these saving goals as something you need to start on 1st January as a New Year resolution, or even on the first of any month.

There are no dates on some of the charts and they have been left off on purpose.

This then gives you the option to start them on any day, week or month that suits you.