1) SBF, FTX, WTF.

The big story of the week remains Sam Bankman-Fried and the collapse of crypto exchange FTX. I haven’t written much about this topic because, well, crypto is not nearly as important as the amount of airtime it gets. It’s 0.5% of the world’s financial assets, but seems to get 50%+ of the media airtime. Additionally, I don’t believe that 100+ volatility assets should be a large part of anyone’s savings so in the scope of my asset management approach crypto is a fringe speculative asset (like venture capital) and not a core part of common sense portfolio construction.

That said, billions of dollars were lost here so I don’t want to downplay the real losses involved. I suspect it’s especially important here because the majority of losses were incurred by people who couldn’t afford to lose. It’s rumored that there are millions of creditors here which would mean that the average account size for the losses was $10,000. If that’s even remotely close to true then it’s really sad because these were most likely novice investors or young investors who bought into the narrative that crypto was helping to build a whole new financial system.

Of course, we now know that this “new” financial system is essentially the old financial system except without any of the regulations that make the old system trustworthy. And that’s where I find the media coverage of this situation so odd. Sam Bankman Fried isn’t just being treated as if he’s innocent until proven guilty. He’s being treated as if he did nothing wrong. And like so much of the crypto space, it’s getting undeserved attention because it’s the current bright shiny object that gets attention, eyeballs and clicks. But in this particular case it looks like many media outlets are covering their butts because they helped build SBF up as this altruistic do-gooder when we now know he’s a fraudster at worst and a horrible risk manager at best.

So, should the media not be covering it? Of course they should. But I don’t understand why SBF is being given so much presumed innocence. After all, it’s clear that SBF is guilty of fraud at worst and extraordinary negligence at best. He should not be given the benefit of the doubt and the media should be treating him much more harshly than they are. So the whole situation comes down to a problem of trust. We can’t trust the most trustworthy operators in the crypto space. And we can’t trust the media to objectively cover the space. And people wonder why the “fake news” narrative was so powerful under the Trump administration….

2) Who can we trust about house prices?

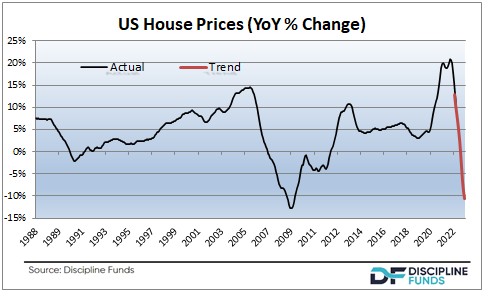

I posted an interesting chart the other day on Twitter showing that the current projected pace of house price declines is on pace to rival the financial crisis. The universal response to this was “you’re just fear mongering”. I found that to be interesting in the context of the broader house price boom. After all, we had a 40% increase in house prices in 2 years. So a 10% decline would take us back to levels last seen in late 2021. 10% is barely a flesh would.

But that’s the interesting thing about house prices here. First of all, people seem to think that house prices cannot fall substantially here. And second, they seem to think that house price declines wouldn’t be a big deal. I want to agree with both of these positions and my baseline projection actually calls for both, but I think it would be incredibly naive to not consider the potential scenario where prices fall much more than expected.

In fact, we are starting to see more and more analysts come around to that view. John Burns Real Estate, for instance, is now calling for 20% declines. Ivy Zelman says 20% is realistic. But even a 20% decline takes us back to just 2021. Again, we’re talking about prices that already appeared elevated in 2021 and now most baseline views say that prices cannot revert back to those levels. I don’t know. As I said, I want to be on the more optimistic side, but I definitely think there’s downside risk to my prior 10-15% projections….

3) Who can we trust about future employment?

There is a war raging in bull/bear camps about future employment. On the one hand we keep getting relatively strong employment reports. On the other hand, there is increasingly conflicted data under the surface. For instance, the household survey has been flat to negative all year while the establishment survey keeps showing strong readings. And even when you look at the establishment survey the rate of change is clearly slowing. Further, when you look at trends like wages it looks like labor has more power than was expected which would throw gasoline on the wage price spiral argument and the tight labor market argument.

But who can we trust? Well, I think this is a scenario where you can’t fight the Fed. After all, they want higher employment to snuff out inflation. And I doubt they’re going to fail in their mission. They’ve been brutally transparent about wanting lower asset price levels and higher unemployment. And I would be shocked if we don’t get that. So, even if labor remains strong for longer than expected I think the Fed will ultimately win that battle. Even if it means they have to wage another battle to get unemployment UP after they realize they’ve caused more unemployment than they desire….