Good bye Denmark, hello Norway !!

As with previous series (Germany, Switzerland & Denmark) I will tackle the Norwegian shares in random order. The main reason for this is that I find this funnier compared to working down the list in Alphabetic order. The first batch of 15 stocks has resulted in two watch list candidates. Let’s go !

- Kahoot!

Kahoot! is 1,1 bn EUR market cap former “growth darling” that was part of many “naive Tech investor” portfolios. Kahoot! is an online learning platform that addresses both, private customers as well as the corporate learning market. As many other Tech companies the financial report is a gibberish of Non-GAAP adjusted numbers. On a GAAP level, the company is loss making and cash seems to be shrinking. At 7x P/S this still looks much to expensive. “Pass”.

2. AF Gruppen

AF Gruppen is a 1,5 bn EUR market cap construction and engineering company active in Norway and Sweden. They seem to be active in various areas, from home building, civil construction to demolition and off-shore. In 2022 they have seen already a decline in profitability. in Sweden they are actually already making losses. The growing and profitable offshore division is unfortunately relatively small.

Over the long term, the share price has performed very well until 2016 but since then went mostly sideways:

With a P/E of 15x, the stock is also not cheap. “Pass”.

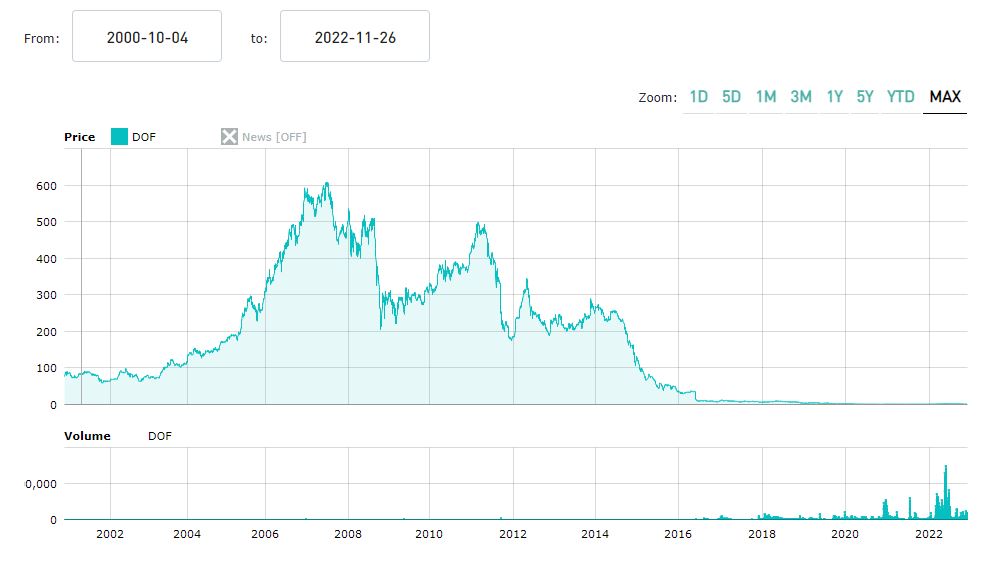

3. DOF

DOF is a 30 mn EUR market cap company operating a fleet of vessels for offshore and subsea services around the world.

Looking at the long term share price chart, one can see that there seem to be some issues here:

According to TIKR, the company carries 2 bn EUR of debt and the cash flow goes into debt repayments. With increasing interest rates, this doesn’t look promising. “Pass”.

4. Holand OG Setskog Sparebank

This is a local savings bank with a market cap according to TIKR of only 10 mn EUR. I am not sure however if there or other share classes that were not counted for this. I couldn’t even find the Investor Relations section on their website. Maybe it’s a hidden treasure but I’ll “pass”.

5. Cambi ASA

Cambi is a ~80 mn EUR market cap company that “provides thermal hydrolysis, advanced anaerobic digestion, and biogas solutions for sewage sludge and organic waste management in Europe, the United States, Asia, Africa, and Oceania. “

The company went public in the crazy days of 2021 and its share price tanked soon afterwards:

The treatment of waste is a quite interesting business and Cambi’s technology seems to have some merit. However I find the financials extremely hard to read. There is a lot of POC accounting and combining the two business models of manufacturing equipment as well as owning and running installations is not easy to understand. Nevertheless, I’ll put them on “watch”.

6. BEWI

BEWI is a 1,2 bn EUR market cap company that is manufacturing packaging and insulation based on Styrofoam, but most recently also based on biological inputs.

BEWI IPOed in August 2020 and is interestingly still above the IPO price. The chart shows that there was quite some movements over the last 2 years:

Fundamentally, the company has developed well since the IPO, although I am not 100% sure what happened before as TIKR shows some very strange numbers. Valuation wise, it doesn’t look cheap (P/E ~15) and the company has some debt, but the insulation aspect alone warrants a place on the “watch” list.

7. Huddly

Huddly is a 85 mn EUR market cap technology company that seems to offer camera systems for meeting rooms. The company has grown from nothing in 2016 to ~40 mn revenues for 2022. However, according to TIKR, they have made profits only in 2019 and 2020 which was good timing for their 2021 IPO. 2021 and 2022 however will again see a loss. According to their latest quarterly report. They are still growing at a 30% rate, however gross margins are contracting and GAAP results go even more negative.

They still have new cash but at the current burn rate, the cash is spent in 4 quarters. They also seem to capitalize R&D.

So maybe not the worst of all 2021 vintage IPOs but still a “pass”.

8. Atlantic Sapphire

Atlantic Sapphire is a 110 mn EUR market cap fish farming company that seems to farm Salmon in Denmark and the US, and despite it’s name not in the Ocean but with land based installations. Over the past 18 months, the stock lost ~-90% of its value, so not everything seems to go according to plan:

The company is loss making, which is not uncommon for a fish farm that is in the process of ramping up, as fish takes some time to grow and in between one has to feed and tend them.

Land based aquaculture seemed to have been a hype sector for some time. However it seems to be very capital intensive and in Atlantic’s case, there seem to be issues with the actual quality of the product. In general, i I find fish farming interesting and would want to learn more, but Atlantic Sapphire doesn’t seem to be a good place to start. “Pass”.

9. Norse Atlantic

Norse Atlantic is a 800 mn EUR market cap airline “Start-up” that was IPOes in 2021. It seems to be somehow related to bankrupt Norwegian Airlines and specializes on long haul flights. As many other 2021 IPOs, the stock is struggling and lost ~-90% from the IPO. Airlines are not my kind of thing, therefore I’ll “pass”.

10. Andfjord Salmon

Andfjord is a 160 mn Salmon farm located in Polar Waters that was IPOed in 2020. They also seem to use land based pools but with Seawater. On their website they talk a lot about sustainability and low energy intensity. However they seem to be in a build up face with the first harvest expected for 2023. I am not sure if they are hit by the extra tax on fish farming revealed by the Norwegian Government some months ago. The stock has been doing better than Atlantic Sapphire, but is still down ~-1/3. Overall, this also might not be the best place to understand more about fish farming, therefore I’ll “pass”.

11. Play Magnus

Play Magnus is a 75 mn EUR market cap company that is active in online chess, has Magnus Carlsen as a main investor and is well known to my readers as I owned the stock twice and made some money in total. However, as mentioned on the blog, competitor Chess.com made an offer of 13 NOK per share recently and it seems that this is the end of Play magnus as a stand-alone company. Nothing to see here anymore, “pass”.

12. Sikri Holding

Sikri Holding is a 107 mn EUR market cap company that was IPOed in 2020 and seems to provide software for the property sector and public authorities. The good news is that the company is profitable, the bad news is that they don#t seem to be able to grow organically in their main business line. The stock has done relatively well for a 2020 IPO, only losing around -1/3% which for a software company is not so bad:

The company has quite some debt (close to 100 mn EUR), so the valuation of around 20x EV/EBITDA is quite ambitious. Doesn’t look so interesting to me, “pass”.

13. Noram Drilling

Noram is a 230 mn EUR market cap company that just went public in October 2022. It seems to operate a fleet of 11 on shore drilling rigs active in the Permian basin in the US. Things currently look quite good, TIKR estimates a P/E of 9 for 2022. However I assume that this is a very cyclical business and I understand next to nothing about drilling, so I’ll “pass”.

14. Crayon Group

Crayon is a 920 mn EUR market cap B2B software/ services company that seems to mostly resell software and service. At first sight, the company grows nicely by around 30% p.a., but margins are razor thin, with EBITDA margins being between 1-2%. At 11,5x EV/EBITDA and 22x P/E, the company seems to be adequately valued. “Pass”.

15. Ultimovacs

Ultimovacs is a 355 mn EUR market cap Biotech that seems to develop a “universal cancer vaccine” and has one product at level II development stage. There are no revenues but increasing losses. However they seem to be able to raise capital. “Pass”.

16. Melhus Sparebank