Investors can help your business get off the ground. But, finding investors is easier said than done. One reason is that there’s a lot of competition out there. In 2021 alone, there were 5.4 million new business applications in the U.S. Cutting through the competition may seem daunting. But with the right investment proposal, you can catch the attention of investors and get the influx of cash your business needs.

What is an investment proposal?

An investment proposal is a document or presentation created to convince potential investors to invest in your small business. The proposal can cover operational funds in general or specific projects or goals.

A successful investment proposal must:

- Be supported by the proper research

- Have a convincing argument

- Showcase the importance of potential investors and their ROI (return on investment)

Investment proposal vs. business plan

While they may seem similar at first, investment proposals and business plans are different. The main differences between an investment proposal and a business plan are purpose and audience.

An investment proposal helps find potential investors. A business plan helps define the goals of a business and determine how well it’s doing. You can secure funding with only a business plan. But if you want to raise a large sum of money, an investment proposal is the best way to catch the attention of angel investors, venture capitalists, and other heavy hitters.

Generally, a strong business plan will come before an investment proposal. The business plan organizes the vital information about your business you’ll use in your investment proposal.

Preparing your investment request

An investment proposal isn’t as simple as asking for some extra cash. You’ll want to set aside some time to draft and rework your investment proposal to make sure that everything is perfect. But how do you prepare the proposal?

Before you start your investment proposal, you should:

- Conduct a discovery phase (e.g., market research)

- Know your product

- Know your financials

Conduct a discovery phase

During a discovery phase, research and discover what your market looks like. Some key questions to answer are:

- Who’s my competition?

- What are their strengths and weaknesses?

- What makes my company or product unique in comparison?

- What does a customer’s journey look like for my product or company?

- Who is my ideal customer?

A discovery phase doesn’t only help you know what the landscape looks like; it’s a time to find and meet the needs of potential customers.

Know your product

After the discovery phase, you should take a closer look at your product and answer these questions:

- Does my product meet the needs of my potential customers?

- How does it stack up to the competition (e.g., price point, potential uses, design, etc.)?

- What’s my profit margin for each product sold?

Know your financials

Be honest with yourself and think about the big picture. What’s the best-case scenario for funding, and what’s the worst? If you know exactly what you need, and when you’ll leave the table empty-handed, you’ll have a better argument when delivering your investment proposal.

Research potential investors

You can’t just ask anyone on the street to help boost your business. Make sure to talk to the right people and know exactly what they can and can’t offer. Some investors may be more willing (or able) to help than others.

Here are a few investors to keep on your radar.

- Angel investors: Angel investors are often accredited investors that use their own money to invest in small businesses. In return for their investment, angel investors often become part owners of the company. Remember that angel investors typically invest in a company or a product they believe in. In other words, you’ll want to look for angel investors that align with your company’s ideals.

- Corporate investors: Depending on what your company offers, you may find some corporations interested in funding your company. Why? Corporations may support startups to help find new technology and acquire new assets (e.g., tools or software). Keep an eye out for corporations with special needs for your product.

- Personal investors: Personal investors can include friends, relatives, and crowdfunding platforms. Crowdfunding platforms are a great way to connect directly with customers at the very beginning of your business. If you use crowdfunding, you can offer gifts to crowdfunding investors when you reach certain milestones. If you’re thinking about friends and relatives as potential investors, make sure they know the risks before they commit.

- Venture capitalists: Venture capitalists make capital investments for an ownership share and role in your company. Venture capitalists typically invest in businesses with a high potential for growth. If you’re trying to woo venture capitalists, you should highlight your company’s potential for growth and offer a timeline for their ROI.

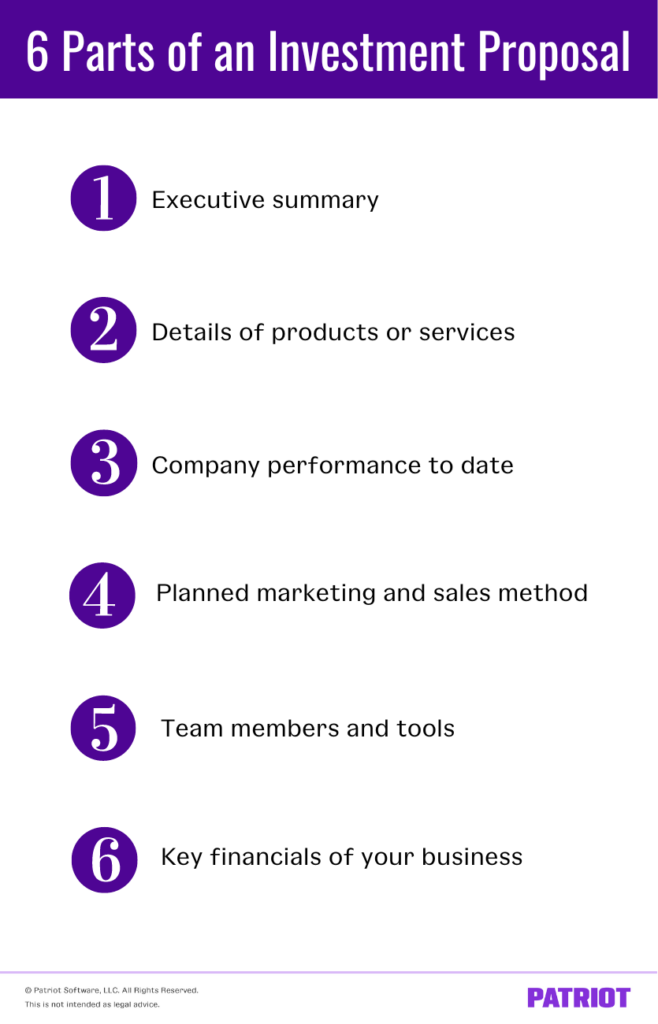

6 Parts of your investment proposal

Remember that your investors want to make (and not lose) money when they invest in your company. The sole purpose of your investment proposal is to convince investors they can make money if they back your company.

Think of your investment proposal as a good story. You want to keep your investors interested and informed while they read your story. And, you want the story to convince investors they must invest in your company. No matter how you tell your story or sell your investment proposal, always keep in mind the most important question to the investor: What’s in it for me?

So what goes into telling the perfect story to investors? Here’s what you should include in your investor proposal:

- Executive summary

- Details of products or services

- Company performance

- Planned marketing and sales method

- Team members and tools

- Key financials

1. Executive summary

Your executive summary tells the story of your business and answers questions like:

- Who are your ideal customers?

- What is the customer problem your business or product solves?

- What’s the expected return on investment?

Be specific when answering these questions by describing how your product meets the customer’s needs in a new way. Does your product offer the investor a unique chance to invest in the next big thing? If so, it’s worth mentioning.

When telling the story of your business, don’t worry about getting personal. Your personal story of leading your company, or your company’s story in general, can go a long way in convincing investors to work with you.

2. Project details

The project details section explains your product or services and how you plan to bring them to life. In this section, cover all the questions that might come up about your minimum viable product (MVP).

Here are some questions to think about:

- What’s my minimum viable product?

- What are the cost of goods of my MVP?

- What are the projected production volumes, unit prices, and market share of my product/company?

- Who are my future competitors?

When answering these questions, get as detailed as possible. Laying out the numbers in eye-catching infographics can help. Make sure to let your investors know you have what it takes to bring your small business goals to life.

3. Company performance

If you’re starting out and don’t have a long financial history, focus on the wins you’ve had in the past. What products or companies have you worked with? What about other team members in your current business? Focus on what you and your team have already accomplished and present market statistics to show the potential of your new business.

If your company is already up and running, include a business description and showcase historical and current financial data.

Include key financial reports for your business, like your:

- Profit and loss statement. Your profit and loss statement is an overview of your business’s financial performance. It summarizes your revenue, total expenses, and your profit (or loss) for a specific period. The profit and loss statement lets you know how your company has done in the past.

- Balance sheet. Your balance sheet lets you know what your business owns and owes for a set period. A balance sheet also shows your assets (e.g., property and equipment). What else is on a balance sheet? You’ll also find information on your liabilities (e.g., money you own) and shareholder’s equity.

- Cash flow statement. A cash flow statement details cash inflow and outflow every month and can be a great way to project into the future. When looking at your cash flow statement, go over several periods (e.g., months, quarters, years) so you and potential investors have a good sense of how cash healthy your company is now and can be in the future.

4. Planned marketing and sales method

It’s time to switch to the competition and your plans to come out on top. Present your research on the market, your competitors, and their products. The focus of this section of your investment proposal is to explain how you’ll stand out from the competition.

Include your:

5. Team members and tools

A company is only as good as its team members and the tools they have at their disposal. Make sure to show off your current team. They are the ones that are going to help the company achieve its goals after all. For this section, it’s good to be both holistic and specific.

So, think about answering some of these questions:

- Where’s the company located?

- What’s the layout of your office or storefront?

- How many employees do you have on staff?

- How long have they been with your business?

- What are your hiring plans for the future (e.g., positions to fill as you grow)?

- What equipment or technology do you have to meet your goals?

6. Key financials

Now that we’ve made it to the ask, make sure your numbers are both precise and necessary. Don’t just include numbers because you have them. Remember, the investment proposal should convince investors to back your company. Only include the numbers that give a realistic look into your company’s health.

Make sure that you specify:

- The funding you’ve already secured

- Forecasts for future funding

- Timeframes for production, sales, and ROI for investors

- An exit plan for investors when they fulfill their investment objectives or your company can’t meet profit expectations

Don’t let your business’s accounting needs get in the way of what you love, like running your business. Patriot’s online accounting software makes small business accounting a breeze. Create invoices, pay bills, and generate financial documents with just a click. Try it for free today.

This is not intended as legal advice; for more information, please click here.